Embarking on a journey with Fidelcrest.Fidelcrest Payout, a prop trading firm that's carving a niche in the competitive trading landscape, can be both exhilarating and lucrative. As a leading prop trading firm, Fidelcrest offers traders a path to funded accounts and a share of trading profits through its evaluation program.

However, understanding the details around payouts is key to maximizing earnings. This comprehensive guide will walk you through Fidelcrest's account types, passing the firm's rigorous multi-phase evaluation, securing funding, and most importantly – how the profit splits and payout structure works. Learn exactly when and how you get paid, what withdrawal options are available, and considerations around account termination.

With up to 90% profit splits for Pro Trader accounts, and funding levels from $1k to over $100k, Fidelcrest presents an exciting opportunity for skilled traders seeking capital and buying power. By detailing fee structures, referral programs, and scaling options, this article provides everything you need to know to evaluate if, Fidelcrest is the right fit for your trading goals, and how to optimize your payouts as a funded trader. Get ready to unlock the secrets to Fidelcrest's payout process and propel your trading career to new heights.

📌 Fidelcrest Payout (Understanding the Platform)

Fidelcrest Payout, established in 2018, is a prop trading firm that offers a unique platform for traders to showcase their skills and earn substantial profits. The platform is designed with user-friendliness at its core, providing an intuitive and straightforward interface that is optimized for mobile devices. Fidelcrest offers a smart and technically advanced system, setting up everything for successful trading by clients.

The firm provides traders with the opportunity to manage accounts ranging from $10,000 to $2 million, depending on their chosen trading mode. The platform offers a range of features and benefits, including the Funded Trader Program, which allows skilled traders to become funded traders after passing a rigorous trading challenge and verification stage.

According to Trustpilot, the most popular review portal, Fidelcrest's rating is 4.5 out of 5. With over 6,000 traders from more than 170 countries, Fidelcrest is a global platform that offers excellent training support and some of the highest profit-sharing schemes in the prop trading space.

What is the Fidelcrest Payout Challenge?

The Fidelcrest Payout Challenge is a two-part evaluation process designed for traders to demonstrate their trading skills and discipline in order to qualify for a funded trading account. It is a crucial gateway for traders aspiring to manage significant capital and earn a share of the profits.

Fidelcrest Payout offers traders the opportunity to prove their expertise through a structured two-part evaluation process. The challenge serves as a vetting mechanism, ensuring that only those with the requisite skills and risk management capabilities are entrusted with the firm's capital.

The Two-Part Evaluation Process Includes:

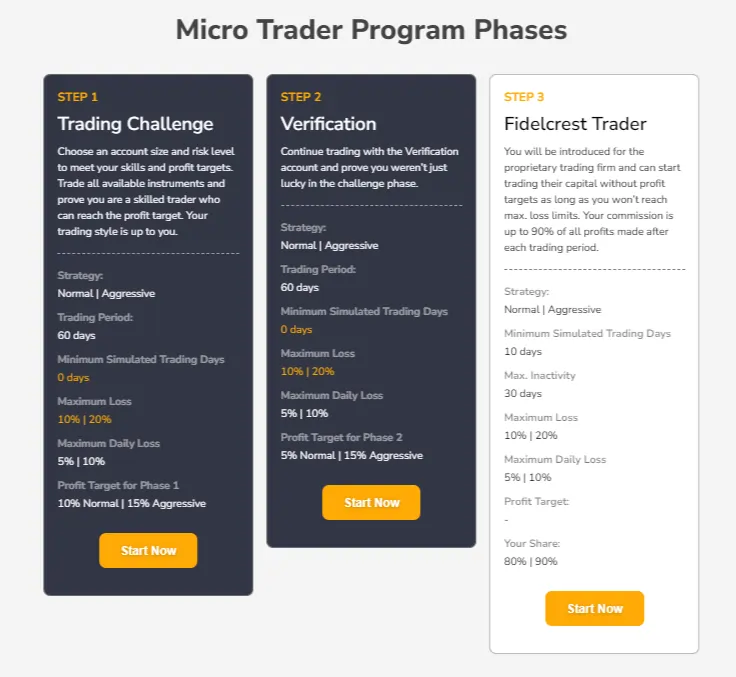

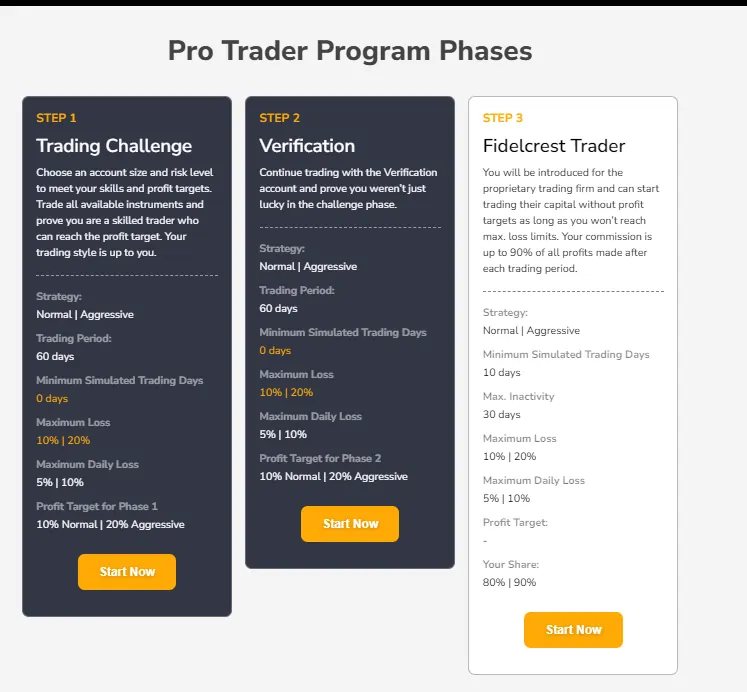

Phase 1: The Trading Challenge

- Traders are required to trade on a demo account under specific rules and targets.

- The objective is to meet a set profit target within a defined time frame while limiting maximum loss.

Phase 2: The Verification

- Successful traders from Phase 1 move to this stage, where they must demonstrate consistent trading performance under tighter conditions.

- Upon completion, traders are eligible for a bonus payout and can qualify for a funded account.

The purpose of this evaluation is to identify traders who can generate consistent profits while effectively managing risk, aligning with Fidelcrest's goal of fostering a community of successful traders managing up to $2 million in capital.

Fidelcrest Account Types

Fidelcrest Payout offers a range of account types and funding options for traders, with account balances ranging from $10,000 to $2,000,000. The two main account types are the Micro Trader and Pro Trader accounts, each with Normal and Aggressive risk strategies.

Micro Trader Accounts

Micro Trader accounts are designed for traders who are starting out or prefer to trade with smaller amounts. The starting capital for these accounts can be as low as $10,000. The costs associated with these accounts vary depending on the account balance:

- $10,000 balance costs €99

- $25,000 balance costs €249

- $50,000 balance costs €449

Fidelcrest Pro Trader Accounts

Pro Trader accounts are designed for more experienced traders and have higher starting capitals, beginning at $150,000 and going up to $1,000,000. The costs associated with these accounts also vary depending on the account balance:

- $150,000 balance costs €649

- $250,000 balance costs €999

- $500,000 balance costs €1,599

- $1,000,000 balance costs €2,699

Risk Strategies

The Normal risk strategy has a maximum daily loss of 5% and a maximum total loss of 10%. The profit target for both phases is 10%. The Aggressive risk strategy, on the other hand, has a maximum daily loss of 10% and a maximum total loss of 20%. The profit target for both phases is 20%. Both risk strategies are available for both account types.

Fidelcrest Payout Structure

Fidelcrest Payout offers a profit split model for its traders, with the percentage varying based on the trading strategy employed. Normal Strategy accounts receive an 80% profit split, while Aggressive Strategy accounts can earn up to a 90% profit split. This profit split is applied to all profits made after each trading period.

The payout process at Fidelcrest Payout is straightforward. After each 30-day trading period, any profit will be transferred to the trader's wallet. Traders can request a withdrawal at any point, with no minimum payment required. The withdrawal request is typically processed within three business days.

Fidelcrest Payout offers various withdrawal methods, including bank transfer, PayPal, credit cards, and debit cards. It's also possible to withdraw funds once a month via bank transfer or in Bitcoins to a crypto wallet. There are no minimum payment charges for withdrawals, but transfers to bank accounts outside of the SEPA area have a €50 fee, which can be avoided by using Bitcoin.

In terms of fees, Fidelcrest charges a one-time evaluation fee, which varies depending on the account size. However, it does charge a monthly platform fee for using its trading platform.

Fidelcrest Payout Process

Requirements and Conditions for Payouts:

To receive payouts from Fidelcrest, traders must first pass a rigorous multi-phase evaluation consisting of a trading challenge and verification stage. Key requirements include:

- Meet specified profit targets, such as 10% for Normal accounts and 20% for Aggressive accounts, within set time frames, usually 30 days.

- Adhere to strict risk rules regarding maximum daily and total losses, such as a 5% daily loss for Normal accounts.

- Trade a minimum number of days, typically 10 calendar days.

Only once a trader passes both evaluation phases are they eligible to trade with Fidelcrest's capital and receive payouts based on generated profits.

Funding Levels Available on Fidelcrest Payout

If traders meet all requirements, Fidelcrest Payout provides funding for live trading accounts ranging from $10,000 up to $2,000,000:

- Micro Trader: Starting at $10,000 and going up to $50,000

- Pro Trader: From $150,000 to $1,000,000.

Higher funding requires passing evaluations with larger account sizes. Traders can also increase buying power through Fidelcrest's scaling program.

Potential Issues and Complications

Some potential issues traders may encounter include:

- Strict evaluation rules lead to failure.

- Delays for withdrawals made via bank transfer.

- Fees from third-party withdrawal services.

- Losing access to the account if maximum loss limits are violated.

While Fidelcrest offers an appealing payout structure, traders should weigh these considerations before opening an account.

Fidelcrest Affiliate Program

Fidelcrest offers an affiliate program that allows individuals to earn commissions by referring new traders to their platform.

How Does Fidelcrest Affiliate Program Work?

- Easy Sign-Up: Signing up for the affiliate program is straightforward and can be done in as little as five minutes.

- No Joining Fee: There is no charge to join Fidelcrest's Affiliate Program.

- Commission Rates: Affiliates can earn up to 15% commission on every trader they refer to Fidelcrest who purchases one of their trading programs.

- Long Cookie Duration: The program offers a 60-day cookie duration, which means that if a referred trader makes a purchase within 60 days of clicking the affiliate link, the referring affiliate earns a commission.

- High Conversion Rates: Fidelcrest claims to have one of the highest conversion rates in the proprietary trading industry, which can potentially lead to more successful referrals and higher earnings for affiliates.

Commission Withdrawal

- Monthly Withdrawals: Traders can request commission withdrawals once per month.

- Payment Methods: The specific payment methods for commission withdrawals are not detailed in the provided search results, but they typically include options like bank transfer and online payment systems.

FAQs Regarding Fidelcrest Payout

When are payouts issued by Fidelcrest?

Payouts are issued after each 30-day trading period, once all positions are closed and profits or losses are calculated.

What is the timeframe for payout processing?

Withdrawal requests are typically processed within 1-3 business days.

Are there any minimum withdrawal amounts?

There is no minimum withdrawal amount for Fidelcrest payouts.

What are the requirements to qualify for a payout?

Traders must first pass a two-phase evaluation process, which includes the Trading Challenge and Verification phases, to qualify for a payout.

Can traders start receiving profit split payouts during the verification stage?

Yes, Fidelcrest is the only firm where traders can start receiving profit-split payouts during the verification stage.

How does Fidelcrest handle disputes over profit calculations?

In the event of a dispute, Fidelcrest may review the trader's performance and trading history to ensure compliance with their rules.

End Note

In wrapping up, the Fidelcrest payout process stands out as a beacon for traders seeking to leverage their skills for maximum earnings. With up to 90% profit splits, the platform not only incentivizes top-notch trading performance but also fosters a supportive environment for growth conditions.

Whether you're a cautious strategist or an aggressive risk-taker, Fidelcrest caters to your style with tailored account options. The swift and flexible withdrawal system adds to the allure, making it a solid choice for traders aiming to reach new financial heights. Ultimately, Fidelcrest's payout process is a testament to its commitment to empowering traders in the dynamic world of proprietary trading.