Traders with Edge is a platform that has caught the attention of traders and active investors. Whether you're into CFDs, stocks, options, futures, forex, or commodities, Traders with Edge offers insights and strategies to help you gain an edge in the market. This platform has been the subject of reviews and discussions, with users sharing their experiences and ratings.

From a savvy and streetwise book on trading to real user reports and ratings, the buzz around Traders with Edge is evident. With over 1000 tradeable stocks and a 4.3-star rating on Trustpilot, the platform has piqued the interest of many in the trading community. In this Traders with Edge review, we will delve into what makes Traders with Edge stand out and how it can potentially benefit traders and investors alike.

What Is Traders With Edge?

Traders With Edge is not your average trading platform. It's a proprietary trading firm that educates and funds traders, providing them with the tools and knowledge needed to navigate the complex world of trading. Whether you're a seasoned trader or just starting out, Traders With Edge offers a gateway to the thrilling world of prop trading.

With a focus on CFDs, stocks, options, futures, forex, and commodities, this platform equips users with insights and strategies to gain an edge in the market. From a “savvy and streetwise” book on trading to real user reports and ratings, the buzz around Traders With Edge is evident. With a 4.3-star rating on Trustpilot, it has piqued the interest of many in the trading community. So, if you're looking to elevate your trading game, Traders With Edge might just be the edge you've been searching for.

What Can You Trade With Traders With Edge?

- Traders With Edge is a proprietary trading firm that educates and funds traders in various markets, including CFDs, stocks, options, futures, forex, and commodities

- It provides insights and strategies to help traders gain a competitive edge in the market

- The platform offers a “savvy and streetwise” book on trading, known as The Trader's Edge, which provides valuable insights for traders

- Traders With Edge focuses on helping traders define and develop their trading edge, which is a technique or approach that creates a cash advantage over other market players

- Your Trading Edge Magazine, a publication covering CFDs, stocks, options, futures, forex, and commodities, is also associated with the concept of trading edge

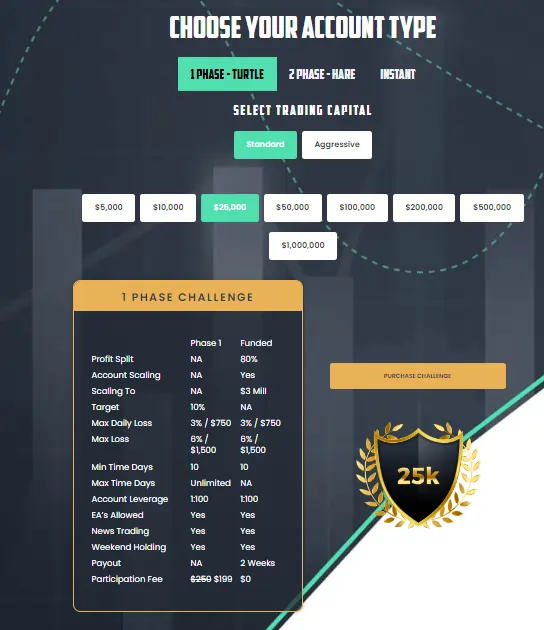

What Are The Traders With Edge Account Sizes?

Traders With Edge offers a range of account sizes for traders, providing funding and support based on their trading performance. The account sizes and features include:

- Phase 1 Challenge: Account sizes range from $5,000 to $1,000,000, with the potential to scale up to $3,000,000 based on trading performance

- Account Leverage: The leverage provided by the firm depends on the account type, with standard leverage at 1:20 and up to 1:100 through customizations

These account sizes and features reflect the platform's commitment to catering to traders with varying levels of experience and trading goals.

What Is The Traders With Edge Leverage?

| Account Sizes | Leverage |

|---|---|

| Phase 1 Challenge | 1:100 |

| Account Scaling | Up to 1:100 |

| Standard Leverage | 1:20, up to 1:40 |

| Aggressive Leverage | 1:50 |

The account sizes for the Phase 1 Challenge range from $5,000 to $1,000,000, with the potential to scale up to $3,000,000 based on trading performance. The leverage provided by the platform depends on the account type, with standard leverage at 1:100 and the ability to customize it up to 1:100. Aggressive leverage is set at 1:50. The prices of the smaller funded account start at $55 and go up to $15,000 for the bigger account

How Much Is The Traders With Edge Payout?

The Traders With Edge payout varies based on the account type and the profit split. Here are the details:

- The minimum payout is $100 for traders who wish to receive their payout through Crypto/Rise or Paypal

- The profit split is 80% for the Turtle and Hare programs, which are the ones that have 1-step or 2-step evaluations

- For the instant funding accounts, the profit split is 50%

- Traders With Edge covers all losses, and traders are eligible to keep up to 80% of their profits

These details provide an overview of the payout structure at Traders With Edge, highlighting the potential earnings for traders participating in the various programs offered by the platform.

Traders With Edge Turtle Accounts

The Traders With Edge Turtle Accounts offer two different challenge levels: the Standard and Aggressive accounts. Here are the details for each:

Turtle Standard Accounts

- Minimum days to trade: 10 days.

- Challenge duration: 365 days.

- Maximum daily loss: 2.5%.

- Maximum loss: 5%.

- Profit target: 10%

Turtle Aggressive Accounts

- Minimum days to trade: 10 days.

- Challenge duration: 365 days.

- Maximum daily loss: 5%.

- Maximum loss: 10%.

- Profit target: 20%

Traders With Edge provides these accounts as part of its evaluation and funding programs, allowing traders to choose the challenge level that aligns with their trading goals and risk tolerance.

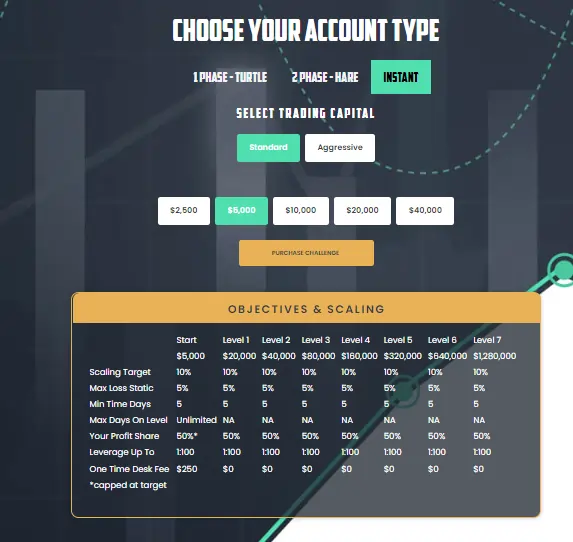

Traders With Edge Instant Accounts

Traders With Edge offers Instant Accounts, which are designed for traders seeking immediate funding. These accounts come with a profit target to achieve and provide leverage up to 1:100, allowing traders to amplify their positions. The one-time desk fee for an Instant Standard Account is $125. The profit split for Instant Accounts is 50%

Traders With Edge Instant Accounts

Standard Account

- Account Balance: $2,500 to $20,000.

- Leverage: Up to 1:100.

- Profit Target: 10%.

- Maximum Drawdown: 5% of the starting account balance.

- Payout: Traders can request a payout after trading for at least 5 different trading days. The minimum profit required for different payout methods can be found in the Funding & Payouts section

Aggressive Account

- Account Balance: $2,500 to $20,000.

- Leverage: 1:50.

- Profit Target: 20%.

- Maximum Drawdown: 10% of the starting account balance.

- Payout: Traders can request a payout after trading for at least 5 different trading days. The minimum profit required for different payout methods can be found in the Funding & Payouts section

These accounts are designed for traders who want to get funded immediately and come with a profit target to achieve

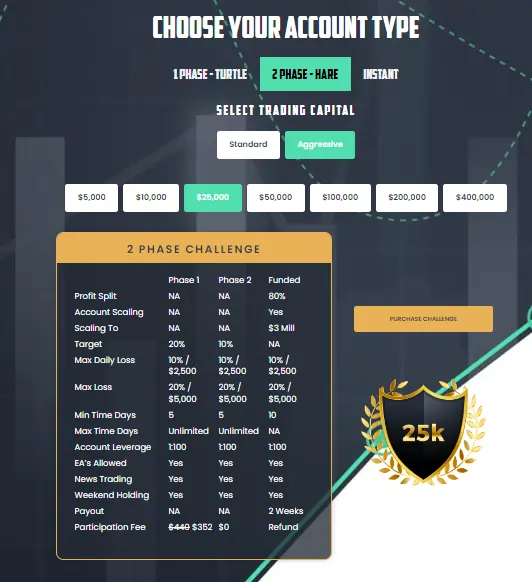

Traders With Edge Hare Accounts

The Hare Accounts at Traders With Edge are part of the 2-step challenge program. Here are the key details:

- The Hare Accounts involve a 2-step challenge, with a profit target to achieve in a minimum of 5 days per phase, and up to 60 days per phase

- The Hare challenge comprises two parts, and there is no charge to take part in the second part

- The profit split for the Hare program is 80% for the trader

- The Hare challenge has a higher potential payoff, and the cost is somewhat higher. The challenge is designed for traders who can manage a higher level of risk and aim for a more significant profit target

These accounts are designed to provide traders with an opportunity to demonstrate their trading skills and potentially secure funding from Traders With Edge

The Hare Accounts at Traders With Edge are part of the 2-step challenge program. Here are the details for the Standard and Aggressive Hare Accounts:

Hare Standard Accounts

- Minimum days to trade: 5 days/phase.

- Maximum trading days: 60 days/phase.

- Maximum daily loss: 5%/phase.

- Maximum loss: 10%/phase.

- Profit target: 10% at phase 1 and 5% at phase 2

Hare Aggressive Accounts

- Minimum days to trade: 5 days/phase.

- Maximum trading days: 60 days/phase.

- Maximum daily loss: 10%/phase.

- Maximum loss: 20%/phase.

- Profit target: 20% at Phase 1 and 10% at Phase 2

These accounts are designed to provide traders with an opportunity to demonstrate their trading skills and potentially secure funding from Traders With Edge.

Traders With Edge EAs (Expert Advisors)

Traders With Edge is a prop trading firm that allows the use of Expert Advisors (EAs) for trading. An EA is an automated trading system that can execute predefined trading strategies. Traders With Edge permits the use of EAs, but users are responsible for any trading violations that may occur due to their usage

EAs can be added to popular trading platforms like MetaTrader 5 and are written in a special programming language called MQL5. The use of EAs can provide traders with automation, efficiency, and a competitive edge in the financial markets

Traders With Edge Platforms

- EDGE TE Platform: An advanced online trading platform used by traders worldwide. It offers features such as paper trading, and smart and fast trading, and is available through Compositedge

- Traders With Edge App: A social media platform designed for traders of all levels of experience, available on the App Store

- Expert Advisors (EAs): Traders With Edge allows the use of EAs for trading. Users are responsible for any trading violations that may occur due to their usage. The firm advises using your own EA, as copy trading is not allowed

Traders With Edge Trading Hours

Traders With Edge trading hours are from 00:00 GMT +2 (+3 depending on daylight savings) to 23:59 GMT +2 (+3). The firm allows holding trades overnight on all programs, and traders can have their positions open for as long as they want according to their own trading style. There are no specific restrictions on news trading, but traders are advised to be cautious with volatility and trade management

Traders With Edge News Trading

Traders With Edge allows news trading, which means there are no specific restrictions on trading during news events. Traders can hold positions over the weekend, and Expert Advisors (EAs) are permitted for trading. However, users are responsible for any trading violations that may occur due to the usage of EAs

Is Traders With Edge Legit?

Yes, Traders With Edge is a legitimate company. It is classified as “excellent” on Trustpilot, scoring 4.4/5.0 after 36 reviews from users. The firm is a prop trading company located in the US, and it provides funding to traders to trade Forex and other CFDs trading assets, including major and minor currency pairs, indices, commodities, metals, cryptocurrencies, and stocks. Additionally, Traders With Edge has a social media platform designed for traders of all levels of experience

Conclusion:- Traders With Edge is a prop trading firm that provides funding to experienced investors, allowing them to retain 80% of their gains. The company is rapidly gaining recognition in the prop trading market and aims to onboard 25,000 new traders by 2025. Traders With Edge offers a variety of account sizes, leverages, and profit split arrangements.

It allows the use of Expert Advisors (EAs) for trading and provides a 14-day free trial. The firm is noted for its active investor community and flexible withdrawal system. While it is a relatively new company, it has received positive feedback and is classified as “excellent” on Trustpilot, scoring 4.4/5.0 after 36 reviews from users

FAQs on Traders with Edge Review

How can I develop an edge in trading?

Developing an edge in trading requires a combination of factors including deep market knowledge, robust risk management strategies, technical analysis skills, access to relevant data and information, and possibly unique insights or methodologies that give you an advantage over other market participants.

What are some common strategies used by traders with an edge?

Common strategies employed by traders with an edge include trend following, mean reversion, statistical arbitrage, quantitative trading, algorithmic trading, options trading, and macroeconomic analysis, among others.

How important is risk management for traders with an edge?

Risk management is paramount for traders with an edge. Even with a winning strategy, improper risk management can lead to significant losses. Traders should employ techniques such as position sizing, stop-loss orders, diversification, and monitoring of portfolio exposure to manage risk effectively.

Is it necessary to have a deep understanding of market psychology to be a trader with an edge?

Yes, understanding market psychology is often crucial for traders with an edge. Being able to recognize and interpret market sentiment, investor behavior, and crowd dynamics can provide valuable insights for making trading decisions.

Can traders with an edge still experience losses?

Yes, even traders with an edge can experience losses. Markets are inherently unpredictable, and no strategy is foolproof. However, traders with a genuine edge should have a higher probability of success over the long term compared to those without one.