AquaFunded

AquaFunded is a proprietary trading firm dedicated to empowering traders by providing a platform that combines talent and technology, enabling them to thrive in dynamic financial markets. Use Code :”SUMMER“

Are you tired of the same old prop trading firms and looking for something new and exciting? Well, you're in luck because we've got the scoop on the top 10 alternatives to Super Funded that are shaking up the industry.

Did you know that the prop trading market is expected to reach a whopping $12.3 billion by 2028? That's a lot of dough up for grabs! But with so many firms out there, it can be tough to know where to start. That's where we come in.

We've done the research and found the best of the best when it comes to Super Funded alternatives. These firms offer unique features, competitive profit splits, and a user experience that'll make you wonder why you didn't switch sooner. Whether you're a seasoned pro or just starting out, these alternatives have something for everyone.

So, what are you waiting for? Join the 43% of traders who are already exploring prop trading alternatives and take your trading game to the next level. Keep reading to discover the top 10 Super Funded alternatives that are changing the game.

✔ Super Funded Overview ✔

Let's talk about Super Funded, a relatively new prop trading firm that's been turning heads in the industry. Founded in 2020 by a group of experienced Australian traders, Super Funded is on a mission to make trading more accessible and affordable for everyone.

One of the coolest things about Super Funded is its partnership with Eightcap, a well-respected broker. This means you get access to top-notch trading platforms and a wide range of assets, including forex, crypto, CFD, and more.

Once you're a funded trader, you get to keep a whopping 90% of your profits. That's a pretty sweet deal if you ask me. Plus, they've got a user-friendly dashboard where you can track your progress and manage your account.

Now, keep in mind that Super Funded is still a young company, so there aren't a ton of reviews out there yet. But from what I can tell, they're definitely worth checking out if you're a skilled trader looking for a solid funding opportunity.

They offer funded accounts with balances ranging from $25,000 to $200,000, allowing you to trade with serious capital. Plus, with their 90% profit split and no hidden fees, you get to keep more of what you earn. Pretty sweet deal, right?

15% Off on all Super Funded Challenges

exclusive

Get Up To 15% OFF On Super Funded Challenges Using Our Exclusive Coupon Code “SF15”.

SAVE UP TO 15%

Why Look for Super Funded Alternatives?

Now, you might be wondering, “If Super Funded is so great, why should I bother looking for alternatives?” Well, here are a few reasons:

So, while Super Funded is a solid choice, it never hurts to explore your options. Who knows? You might just find your perfect match among the top Super Funded alternatives out there.

Top 10 Super Funded Alternatives– Quick Analysis

| Name | Profit Split | Account Sizes | Location | Rating |

|---|---|---|---|---|

| Funded Next | 95% | $6,000- 200,000 | United Arab Emirates | 4.6/5 |

| Toptier Trader | 80% up to 90% | $25,000 to $300,000 | Miami, Florida | 4.6/5 |

| AquaFunded | 90% | $10,000- 200,000 | Nassau City (Bahamas) | 4.5/5 |

| Audacity Capital | 50/50 | $15,000 to $480,000 | London, England | 4.6/5 |

| Blue Guardian | 85% | $10,000 to $200,000 | West Midlands, UK | 4.6/5 |

| Traders With Edge | 80% | $2,500 to $20,000 | Hong Kong Island, Hong Kong | 3.9/5 |

| Topstep | 100%, 80% | $50,000 to $150,000 | Chicago, US | 4.6/5 |

| Funded Trading Plus | 90% | $5,000 up to $200,000 | London, UK | 4.8/5 |

| E8 | 80% | $25,000 to $250,000 | Seattle, Washington | 4.8/5 |

| FTUK | 80% | $14,000 to $90,000 | London, UK | 4/5 |

1. Funded Next

When it comes to prop trading firms, Funded Next is emerging as a standout alternative to Super Funded. With its competitive offerings and trader-centric features, Funded Next is quickly becoming a favorite among traders looking for a firm that aligns with their ambitions and trading strategies.

Funded Next is a prop trading firm that empowers traders worldwide by providing them with the capital they need to maximize their trading success. The firm offers a unique set of features that cater to both novice and experienced traders, aiming to create an environment where traders can thrive without the constraints of limited capital.

Funded Next sets itself apart with a range of account sizes and profit-sharing models that are designed to suit various trading styles and preferences. The firm's commitment to providing a supportive trading environment is evident in its flexible challenge phases and profit-sharing structures.

Funded Next has garnered an “Excellent” rating on Trustpilot, with a score of 4.6 out of 5. Users have praised the firm for its good payment options and overall experience. As the firm celebrates its second anniversary, it continues to receive recommendations from its users, reflecting a positive community sentiment.

Key Features of Funded Next

2. Toptier Trader

In the competitive world of proprietary trading, finding a firm that aligns with your trading goals and style is crucial. Toptier Trader emerges as a compelling alternative to Super Funded Trading Firm, offering a suite of features designed to support traders in their quest for financial success.

Toptier Trader is a proprietary trading firm that has quickly made a name for itself in the prop trading community. With a focus on providing traders with the tools and support they need to succeed, Toptier Trader stands out for its commitment to helping traders achieve their full potential.

What sets Toptier Trader apart is its trader-centric approach. The firm offers a range of benefits designed to enhance the trading experience, from flexible trading conditions to robust support services. Here's a closer look at what Toptier Trader has to offer:

Toptier Trader has earned an “Excellent” rating on Trustpilot, with a score of 4.6 out of 5. Users have praised the firm for its comprehensive support, user-friendly platform, and the flexibility it offers traders. The positive feedback highlights Toptier Trader's effectiveness in providing a conducive environment for trading success.

Key Features of Toptier Trader

3. AquaFunded

AquaFunded is making a splash as a noteworthy alternative to Super Funded Trading Firm, offering traders a unique platform to grow their careers. With a focus on simplicity and trader success, AquaFunded has crafted an environment that appeals to both new and experienced traders.

AquaFunded is a proprietary trading firm that has positioned itself as a supportive partner for traders looking to leverage additional capital. Launched to transform the trader funding landscape, AquaFunded provides a straightforward path to trading larger account sizes while maintaining a clear focus on risk management and profitability.

AquaFunded distinguishes itself with a commitment to trader success, underscored by its flexible funding options and a supportive team. The firm offers a range of account sizes, allowing traders to choose the level of capital they feel comfortable managing.

AquaFunded boasts an “Excellent” rating on Trustpilot with a score of 4.5 out of 5. Users have expressed gratitude for the firm's responsive customer service and the opportunities provided by the platform. The positive testimonials reflect a community of traders who feel valued and supported throughout their trading journey with AquaFunded.

Key Features of AquaFunded

4. AudaCity Capital

AudaCity Capital stands out as a solid alternative to Super Funded Trading Firm, offering a comprehensive funded trader program that caters to a wide range of traders. With its roots in the UK, AudaCity Capital has built a reputation for supporting traders through a combination of funding options and educational resources.

Founded in 2012, AudaCity Capital is a London-based proprietary trading firm that provides funded accounts to traders who demonstrate profitability and sound risk management. The firm has established itself as a significant player in the prop trading industry, offering services to traders in over 140 countries.

Audacity Capital is known for its competitive scaling plan and straightforward evaluation process. The firm offers six funded profiles, with account sizes ranging from $15,000 to $480,000, catering to both novice and seasoned traders. With a focus on Forex and CFDs, AudaCity Capital provides a platform for traders to leverage their skills and potentially scale their accounts to impressive levels.

Audacity Capital has received an “Excellent” rating on Trustpilot, scoring 4.6 out of 5. Users have commended the firm for its supportive staff and the motivational environment it provides. One particular review praises a staff member for encouraging the trader to continue their journey, leading to a successful payout.

Key Features of AudaCity Capital

5. Blue Guardian

Blue Guardian is quickly establishing itself as a formidable alternative to Super Funded Trading Firm, offering a unique blend of features that cater to both novice and seasoned traders. With its transparent approach and a partnership with a regulated broker, Blue Guardian is carving out a niche in the competitive prop trading landscape.

Founded in 2019 and based in the West Midlands, UK, Blue Guardian has made significant strides in providing funded trading accounts to a global audience. The firm prides itself on its straightforward evaluation process, competitive fee structure, and a wide range of trading account sizes.

Blue Guardian distinguishes itself with a focus on simplicity, transparency, and trader support. The firm offers a variety of account sizes and a clear path to trading success, backed by a partnership with reputable brokers.

Blue Guardian has earned an “Excellent” rating on Trustpilot, with a score of 4.6 out of 5. Users have praised the firm for its active and supportive customer service, simple and flexible trading rules, and overall positive experience. The firm's commitment to trader success is reflected in the positive feedback from its community.

Key Features of Blue Guardian

6. Traders With Edge

Traders With Edge is carving out a significant presence as an alternative to Super Funded Trading Firm, offering a comprehensive suite of features that cater to a diverse range of traders. With a focus on flexibility and trader development, Traders With Edge is quickly becoming a go-to platform for those looking to leverage additional capital in their trading careers.

Launched in 2021 by Samuel Junghenn, Traders With Edge is a proprietary trading firm that has garnered attention for its commitment to supporting traders. The firm is backed by multiple equity firms and managed by a team of experts, aiming to provide a flexible trading environment and comprehensive product offerings that stand out in the crowded prop trading market.

Traders With Edge offers a competitive edge in the prop trading industry with its single-phase and double-phase challenge systems, instant funding options, and a focus on educational resources and mentorship. The firm's dedication to creating a conducive atmosphere for skill improvement is evident in its approach to trader growth.

Traders With Edge has a “Great” rating on Trustpilot with a score of 3.9 out of 5. Users have praised the platform for its exceptional customer support and the supportive response from the team, highlighting the firm's dedication to customer satisfaction. Testimonials from traders reflect a positive experience with timely payouts and favorable trading conditions.

Key Features of Traders With Edge

7. Topstep

Topstep stands out as a compelling alternative to Super Funded Trading Firm, offering a unique blend of features that cater to traders seeking to leverage additional capital without risking their own funds. With its roots firmly planted since 2012, Topstep has established itself as a pioneer in the funded trader program space, providing a platform for traders to prove their skills and earn a funded trading account.

Topstep is a Chicago-based proprietary trading firm that champions the growth and development of traders worldwide. By offering a simulated trading environment where traders can showcase their prowess without financial risk, Topstep aims to cultivate disciplined and profitable trading habits. The firm's mission is to support traders' development, regardless of their skill level or background, by providing a risk-free pathway to trading success.

Topstep's funded trader program is designed with the trader's growth in mind, offering a step-wise progression to a funded account. Traders start in a simulated environment, where they must meet specific targets and adhere to risk management rules. Successful traders are then awarded a funded account, where they can trade real money and retain a significant portion of their profits.

Topstep has garnered an “Excellent” rating on Trustpilot, with a score of 4.6 out of 5. However, it's important to note that while many users praise the platform for its comprehensive support and educational resources, there have been criticisms regarding customer support responsiveness and issues with payout processes. Despite these concerns, the positive feedback highlights Topstep's commitment to fostering a supportive environment for traders to learn and grow.

Key Features of Topstep

8. Funded Trading Plus

Funded Trading Plus is quickly emerging as a standout alternative to Super Funded Trading Firm, offering a robust platform that caters to traders seeking to leverage their skills without the financial risk typically associated with trading. With its foundation built on transparency, trader support, and a commitment to excellence, Funded Trading Plus is redefining what it means to be a prop trading firm.

Launched in late 2021, Funded Trading Plus set out with a clear mission: to be the best prop firm in the funded trading business by 2022. Based in London, UK, the firm has focused on delivering exceptional programs complemented by outstanding customer service. Their approach is simple yet effective—listen to the traders, adapt continuously, and ensure every participant feels valued and supported.

Funded Trading Plus distinguishes itself through a combination of competitive program pricing, a wide range of trading instruments, and a trader-centric model that prioritizes the success and growth of its participants. The firm offers a seamless journey from evaluation to live trading, with a variety of account sizes and fast scaling options designed to suit diverse trading strategies and goals.

Funded Trading Plus enjoys a high level of acclaim on Trustpilot, with a rating of 4.8 out of 5. Traders have praised the firm for its fast response times, diverse plan options, and reliability. The overwhelmingly positive feedback underscores the firm's commitment to doing what it claims—supporting traders in achieving their goals. The firm's proactive approach to customer service and its ability to deliver on promises has made it a preferred choice for traders looking for a reliable prop firm.

Key Features of Funded Trading Plus

9. E8

E8 emerges as a standout alternative to Super Funded Trading Firm, offering a unique proposition for traders seeking to leverage their skills in a supportive and rewarding environment. With its foundation laid in 2021, E8 has quickly ascended to prominence within the prop trading community, distinguishing itself through a blend of trader-friendly features and a commitment to fostering trading excellence.

E8 is a prop trading firm that has carved a niche for itself by providing traders with the opportunity to manage substantial virtual funds based on their trading prowess. The firm is built on the principle of empowering traders through a structured evaluation process, leading to access to funded accounts where traders can earn significant profits.

At the heart of E8's offering is a comprehensive evaluation plan that is tailored to match a trader's unique strategy, coupled with the potential to earn up to 100% of the profits generated. E8's approach is characterized by its flexibility, allowing traders to select or customize their evaluation plan, thereby catering to a wide spectrum of trading styles and preferences.

E8 boasts an “Excellent” rating on Trustpilot, with a score of 4.8 out of 5. Traders have lauded the firm for its innovative approach to prop trading, highlighting the flexibility of the evaluation plans and the potential for high-profit shares. Reviews also commend E8 for providing a fresh start with each payout, which is seen as a significant advantage. While it's still early days for E8, the positive feedback from traders underscores the firm's potential to lead in the prop trading space.

Key Features of E8

10. FTUK

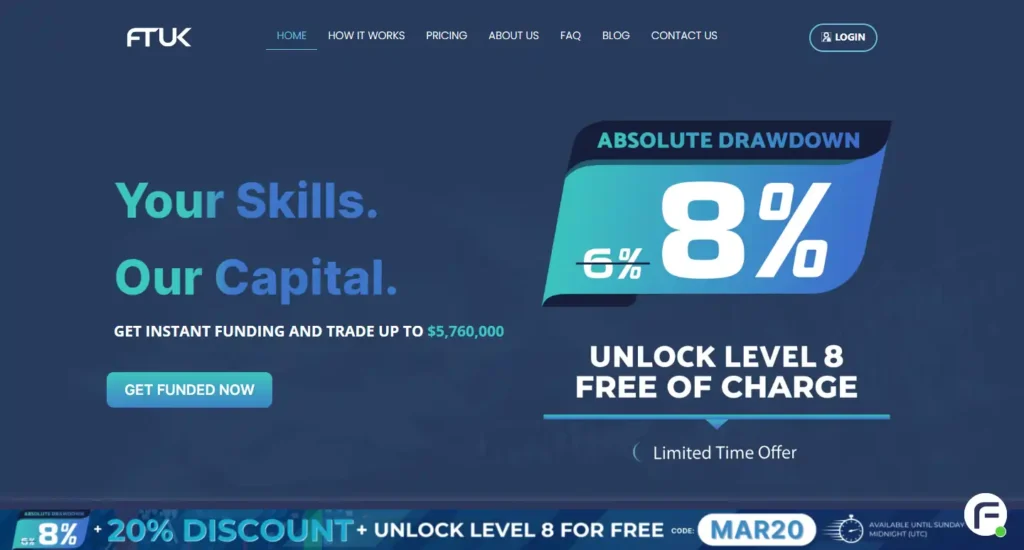

FTUK, also known as Forex Traders UK, is gaining traction as a viable alternative to Super Funded Trading Firm, offering traders a platform to grow their careers with funded accounts. Established in 2021 and based in London, FTUK has been providing prop trading opportunities on a variety of instruments, including currencies, indices, commodities, and metals.

FTUK is a proprietary trading firm that extends funding to traders who can demonstrate their ability to trade successfully and manage risk effectively. The firm has been operational since 2021, and it has developed a reputation for its supportive environment and clear trading rules.

FTUK offers traders the chance to trade with account balances ranging from $14,000 to $90,000, with the potential to scale up to $5,760,000 for consistent performers. The firm provides a range of trading instruments and has a structured evaluation program to assess traders' skills.

FTUK has received mixed reviews from users. On Trustpilot, the firm is rated “Great” with a score of 4 out of 5. However, some users have reported issues with rule changes not reflected in the FAQs, difficulties with customer support responsiveness, and concerns over the calculation of drawdowns. Despite these criticisms, many traders have found the support team helpful and the trading environment conducive to success.

Key Features of FTUK

FAQs on Best Super Funded Trader Alternatives

What is a Proprietary Trading Firm (prop firm)?

Prop firms are entities that trade stocks, currencies, commodities, and other assets using their own capital rather than client funds. They hire traders to trade the firm’s capital and share profits with these traders.

What should I look for in a Super Funded Trader Alternative?

Look for firms with high-profit splits, flexible evaluation processes, a wide range of trading instruments, supportive educational resources, and a strong reputation among traders.

Are there any Super Funded Trader Alternatives that offer Instant Funding?

Yes, some alternatives offer instant funding options, allowing traders to bypass or simplify the evaluation process and start trading with real capital more quickly.

What Trading Platforms are commonly offered by Super Funded Trader Alternatives?

Most prop firms support popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their robust charting tools, technical indicators, and support for automated trading strategies.

What types of Trading Strategies are allowed?

Most prop firms permit a wide range of strategies, including day trading, swing trading, and scalping. However, always check the specific rules as some strategies like copy trading may be restricted.

Are Super Funded Trader Alternatives available globally?

While many prop firms offer their services worldwide, some countries may be restricted due to regulatory conditions. Always check the firm's policy on international traders.

What happens if I violate the Trading rules of a Prop Firm?

Violating trading rules can lead to termination of your account or forfeiture of profits. It's crucial to understand and adhere to all trading guidelines.

How is drawdown calculated at these Prop Firms?

Drawdown is typically calculated as a percentage of the starting or peak balance, indicating the maximum allowable loss. Specific calculations can vary, so review each firm's policy.

🔗 Conclusion

Alright, we've journeyed through the landscape of Super Funded alternatives, and it's clear there's a lot to consider. From profit splits that let you keep a hefty slice of the pie, to account sizes that match your ambition, and platforms that feel just right under your fingertips.

Remember, the devil's in the details—like whether you can trade your favorite instruments or if the firm's available in your corner of the globe. And let's not forget the importance of a supportive environment that helps you grow, not just as a trader but as a savvy investor.

So, what's next? Dive in, explore your options, and don't be shy to ask the hard questions. Each firm has its unique flavor, and finding the one that tastes just right for you could be the game-changer in your trading career.

And hey, the world of trading evolves faster than a viral dance move, so keep your finger on the pulse and be ready to pivot when the time's right. Your future self, lounging on that dream vacation or enjoying early retirement, will thank you for making smart, informed choices today.