When it comes to prop trading firms, TradingFunds has been making waves with its streamlined one-step evaluation process and competitive profit splits of up to 90%.

However, there are several compelling alternatives to TradingFunds worth exploring, each with its own unique strengths and offerings.

In this article, we'll take a closer look at 9 of the best TradingFunds alternatives for traders seeking funding and support.

From established players like FTMO and Audacity Capital to newer entrants like Blue Guardian, these prop firms provide a range of options to suit different trading styles and preferences.

Whether you're looking for higher profit splits, more relaxed trading rules, or access to advanced tools and education, these TradingFunds alternatives have something to offer.

So let's dive in and explore some of the top prop trading firms that can help take your trading to the next level!

Top 9+ TradingFunds Alternatives 2025

| Prop Firm | Max Account Size | Price | Max Profit Split | Instruments | Platform | Rating |

|---|---|---|---|---|---|---|

| Audacity Capital | 480,000 | $1,559 | 85% | Forex, Currencies, Indices, Commodities | MetaTrader4 and MetaTrader5 | 4.6/5.0 |

| Toptier Trader | $300,000 | $1,681.25 | 80% | Forex pairs, indices, commodities, metals, and cryptocurrencies | MetaTrader4 | 4.5/5.0 |

| Blue Guardian | $200,000 | $999 | 85% | Forex, commodities, indices, stocks, and cryptocurrencies | MetaTrader4/5 | 4.8/5.0 |

| Leveled up society | $200,000 | $989 | 80% | Forex, real estate, stocks, and cryptocurrencies | MetaTrader4/5 | 3.4/5.0 |

| FundedNext | $200,000 | $999 | 95% | Forex pairs, commodities, indices, and cryptocurrencies | MetaTrader4/5 | 4.8/5.0 |

| FTUK | $90,000 | $1,200 | 80% | Forex pairs, indices, metals, commodities, and cryptocurrencies | MetaTrader 4/5, TradingView | 4.1/5.0 |

| E8 Trading | $200,000 | $661 | 80% | Forex pairs, commodities, indices, and cryptocurrencies | MetaTrader4/5 | 4.8/5.0 |

| FTMO | $200,000 | €1,080 | 80% | Forex, commodities, indices, stocks, and cryptocurrencies | MetaTrader4/5, DXTrade | 4.8/5.0 |

| SmartPropTrader | $100,000 | $497 | 90% | Forex pairs, commodities, indices, and cryptocurrencies | DXtrade | 4.7/5.0 |

| Funding Pips | $100,000 | $399 | 90% | Forex pairs, commodities, indices, and cryptocurrencies | MetaTrader4/5 | 4.6/5.0 |

| Lux Trading Firm | $1,000,000 | £1,499 | 75% | Forex pairs, commodities, and indices | MetaTrader 4/5, TradingView | 4.3/5.0 |

| Funded Trading Plus | $200,000 | $949 | 90%-100% | Forex pairs, commodities, indices, and cryptocurrencies | MetaTrader 4/5, TradingView | 4.8/5.0 |

🔗 Starting with TradingFunds | Why Look for Alternatives

TradingFunds is an innovative proprietary trading firm based in Dubai that is shaking up the industry with its unique approach. Launched in February 2023, the firm offers traders the opportunity to access up to $2 million in funding through a streamlined one-step evaluation process.

What sets TradingFunds apart is its focus on simplicity and flexibility. The firm provides clear and comfortable trading rules, no daily drawdown limits, and a rapid scaling plan that allows traders to grow their accounts quickly. With competitive profit splits ranging from 80% to 90% and no restrictions on trading styles, TradingFunds empowers traders to maximize their potential.

However, while TradingFunds has its merits, it's always wise to explore alternatives to find the best fit for your trading style and goals.

It's important to diversify your options and not put all your eggs in one basket! By researching and comparing different prop firms, you can find the one that aligns best with your needs and maximizes your potential for success as a funded trader.

1. Audacity Capital

Audacity Capital is a leading proprietary trading firm based in London, UK that empowers profitable traders by providing them with funded forex accounts. Founded in 2012, the firm has supported traders in over 140 countries, offering a transparent and fair partnership to help them monetize their trading talent.

Key Features

- Audacity Capital offers the Funded Trader Program for experienced traders and the Ability Challenge for traders of all levels, with account sizes ranging from $10,000 to $240,000.

- Traders can double their account size every time they reach the 10% profit target, with the potential to scale up to $2,000,000.

- Audacity Capital provides a profit split of up to 85%, rewarding successful traders for their performance.

- Traders can hold positions over weekends, trade during news events, and use EAs, with no restrictions on lot sizes.

Ability Challenge

| Account Sizes | Pricing |

|---|---|

| $10,000 | $129 |

| $15,000 | $189 |

| $30,000 | $339 |

| $60,000 | $459 |

| $120,000 | $779 |

| $240,000 | $1,559 |

2. TopTier Trader

TopTier Trader is a proprietary trading firm established in 2021 that offers funding to experienced traders. Through a two-tier evaluation process, traders can manage accounts ranging from $5,000 to $300,000 and receive up to 90% of the profits they generate. TopTier Trader provides a user-friendly platform with advanced tools and customizable dashboards.

Key Features

- Traders can access a wide range of assets, including forex, indices, commodities, metals, and cryptocurrencies, allowing for a versatile trading experience.

- Generous profit splits: TopTier Trader offers profit splits starting at 80% and increasing to 90% for consistent success, providing traders with a substantial share of their earnings.

- The firm allows news trading, weekend holding (except on Regular TopTier Challenge), and the use of EAs, giving traders the freedom to implement their preferred strategies.

- TopTier Trader provides 24/7 customer support, educational resources, and a professional trader dashboard to assist traders in their journey.

| Account Sizes | Pricing |

|---|---|

| $5,000 | $81.25 |

| $10,000 | $161.25 |

| $25,000 | $286.25 |

| $50,000 | $418.75 |

| $100,000 | $623.75 |

| $200,000 | $1,218.25 |

| $300,000 | $1,681.25 |

3. Blue Guardian

Blue Guardian is a reputable proprietary trading firm that empowers skilled traders to reach their full potential. With a transparent approach and competitive trading conditions, Blue Guardian offers funded accounts ranging from $10,000 to $200,000.

Key Features

- Realistic profit targets of 8% and 4%, are among the lowest in the industry, providing traders a fair chance at success.

- The innovative Guardian Protector is a built-in equity protection feature that helps traders confidently navigate markets with a 2% stop loss, shielding investments against unexpected fluctuations.

- A wide range of tradable instruments, including forex, indices, commodities, and cryptocurrencies, along with leverage up to 1:100, allowing for diverse trading strategies.

- Exceptional customer support, with quick response times, an extensive FAQ section, and a commitment to trader success through educational resources like weekly podcasts.

Unlimited Guardian

| Account Sizes | Pricing |

|---|---|

| $10,000 | $87 |

| $25,000 | $187 |

| $50,000 | $297 |

| $100,000 | $497 |

| $200,000 | $947 |

Elite Guardian

| Account Sizes | Pricing |

|---|---|

| $10,000 | $99 |

| $25,000 | $199 |

| $50,000 | $319 |

| $100,000 | $519 |

| $200,000 | $999 |

Rapid Guardian

| Account Sizes | Pricing |

|---|---|

| $10,000 | $97 |

| $25,000 | $197 |

| $50,000 | $297 |

| $100,000 | $497 |

| $200,000 | $947 |

4. Leveled up society

Leveled Up Society is a proprietary trading firm that offers aspiring traders the opportunity to trade with company capital. The firm provides a two-phase evaluation challenge, with the initial fee being refundable upon successful completion of the first phase. Traders can choose from account sizes ranging from $25,000 to $200,000, with the potential to scale up to $1,000,000.

Key Features

- Competitive trading conditions, such as tight spreads and high leverage, along with an 80% profit split for traders.

- A diverse range of tradable instruments, including forex pairs, commodities, indices, and cryptocurrencies.

- Relaxed trading rules compared to some competitors, allow traders to hold positions overnight and during weekends.

- A partnership with Eightcap, an ASIC-regulated broker known for its reputable services and global presence.

Fast-Track

| Account Sizes | Pricing |

|---|---|

| $10,000 | $139 |

| $25,000 | $249 |

| $50,000 | $349 |

| $100,000 | $549 |

| $150,000 | $749 |

| $200,000 | $989 |

Day Trading

| Account Sizes | Pricing |

|---|---|

| $10,000 | $139 |

| $25,000 | $249 |

| $50,000 | $349 |

| $100,000 | $549 |

| $150,000 | $749 |

| $200,000 | $989 |

Swing Trading

| Account Sizes | Pricing |

|---|---|

| $10,000 | $149 |

| $25,000 | $269 |

| $50,000 | $379 |

| $100,000 | $599 |

| $150,000 | $819 |

| $200,000 | $1079 |

5. FundedNext

FundedNext is a proprietary trading firm that provides traders with substantial capital, ranging from $6,000 to $200,000, and the potential to scale up to $4 million based on performance. Established in March 2022, the firm offers a unique 15% profit share during the evaluation phase and up to 90% profit split for funded accounts.

Key Features

- Traders can start trading within seconds of completing the sign-up process, without waiting for hours or days to access their funded account.

- FundedNext accommodates various trading styles, including scalping, swing trading, and news trading, with competitive spreads, low commissions, and leverage up to 1:100.

- The firm fosters a thriving Discord community where traders can network, exchange ideas, and receive support from experienced professionals.

- FundedNext provides educational resources, economic updates, and dedicated account managers to support traders in their journey.

2-Step Stellar Challenge

| Account Sizes | Pricing (Swap) | Pricing (Swap-Free) |

|---|---|---|

| $6,000 | $59 | $65 |

| $15,000 | $119 | $131 |

| $25,000 | $199 | $219 |

| $50,000 | $299 | $329 |

| $100,000 | $519 | $571 |

| $200,000 | $999 | $1,099 |

1-Step Stellar Challenge

| Account Sizes | Pricing (Swap) | Pricing (Swap-Free) |

|---|---|---|

| $6,000 | $59 | $65 |

| $15,000 | $119 | $131 |

| $25,000 | $199 | $219 |

| $50,000 | $299 | $329 |

| $100,000 | $519 | $571 |

| $200,000 | $999 | $1,099 |

Evaluation Model

| Account Sizes | Pricing (Swap) | Pricing (Swap-Free) |

|---|---|---|

| $6,000 | $49 | $54 |

| $15,000 | $99 | $109 |

| $25,000 | $199 | $219 |

| $50,000 | $299 | $329 |

| $100,000 | $549 | $604 |

| $200,000 | $999 | $1,099 |

Express Model

| Account Sizes | Pricing (Swap) | Pricing (Swap-Free) |

|---|---|---|

| $6,000 | $49 | $54 |

| $15,000 | $99 | $109 |

| $25,000 | $199 | $219 |

| $50,000 | $299 | $329 |

| $100,000 | $549 | $604 |

| $200,000 | $999 | $1,099 |

Non-Consistency Express Model

| Account Sizes | Pricing (Swap) | Pricing (Swap-Free) |

|---|---|---|

| $6,000 | $59 | $65 |

| $15,000 | $119 | $131 |

| $25,000 | $229 | $252 |

| $50,000 | $379 | $417 |

| $100,000 | $699 | $769 |

6. FTUK

FTUK is a London-based proprietary trading firm that provides traders with the opportunity to manage funded accounts. The firm offers two main programs: the Evaluation Program, which consists of a single-phase evaluation process, and the Instant Funding Program, which allows traders to bypass the evaluation and receive immediate funding.

Key Features

- FTUK offers huge account balances, allowing traders to significantly increase their earning potential.

- Traders can choose between the Evaluation Program, which requires meeting profit targets without exceeding loss thresholds, or the Instant Funding Program.

- FTUK offers profit splits of up to 80%, rewarding successful traders for their performance.

- FTUK collaborates with Eightcap, a reputable broker, to provide a wide range of tradable instruments, including forex, cryptocurrencies, indices, commodities, and precious metals.

Evaluation Program

| Account Sizes | Pricing |

|---|---|

| $14,000 | $149 |

| $40,000 | $349 |

| $60,000 | $449 |

| $90,000 | $599 |

Instant Funding

| Account Sizes | Pricing |

|---|---|

| $14,000 | $200 |

| $40,000 | $550 |

| $60,000 | $750 |

| $90,000 | $1200 |

7. E8 Trading

E8 Trading, formerly known as E8 Funding, is a leading proprietary trading firm that offers traders the opportunity to manage up to $1 million in trading capital. With a commitment to transparency and user-friendly trading conditions, E8 Trading provides an innovative platform for traders to showcase their skills and earn up to 80% of their profits.

Key Features

- E8 Trading offers a range of account types with no minimum trading days and the ability to use various trading strategies, including EAs and automated trading.

- As traders withdraw profits, their account balance and overall drawdown limit increase, allowing for more flexibility and risk tolerance.

- The E8X Dashboard provides traders with a comprehensive and intuitive interface for account management, trading analytics, and performance tracking.

- E8 Trading sets realistic profit targets for its evaluation process, and successful traders can request their first payout in just 8 days.

2-Step Evaluation

| Account Sizes | Pricing |

|---|---|

| $5,000 | $71 |

| $10,000 | $132 |

| $15,000 | $185 |

| $20,000 | $232 |

| $25,000 | $273 |

| $30,000 | $306 |

| $35,000 | $335 |

| $40,000 | $361 |

| $45,000 | $384 |

| $50,000 | $405 |

| $55,000 | $439 |

| $60,000 | $471 |

| $65,000 | $503 |

| $70,000 | $534 |

| $75,000 | $565 |

| $80,000 | $594 |

| $85,000 | $623 |

| $90,000 | $650 |

| $95,000 | $677 |

| $100,000 | $704 |

3-Step Evaluation

| Account Sizes | Pricing |

|---|---|

| $10,000 | $66 |

| $15,000 | $96 |

| $20,000 | $125 |

| $25,000 | $153 |

| $30,000 | $172 |

| $35,000 | $189 |

| $40,000 | $204 |

| $45,000 | $218 |

| $50,000 | $230 |

| $55,000 | $249 |

| $60,000 | $267 |

| $65,000 | $285 |

| $70,000 | $302 |

| $75,000 | $319 |

| $80,000 | $335 |

| $85,000 | $351 |

| $90,000 | $366 |

| $95,000 | $381 |

| $100,000 | $396 |

| $105,000 | $411 |

| $110,000 | $427 |

| $115,000 | $442 |

| $120,000 | $457 |

| $125,000 | $471 |

| $130,000 | $486 |

| $135,000 | $500 |

| $140,000 | $513 |

| $145,000 | $527 |

| $150,000 | $540 |

| $155,000 | $553 |

| $160,000 | $556 |

| $165,000 | $578 |

| $170,000 | $591 |

| $175,000 | $603 |

| $180,000 | $615 |

| $185,000 | $627 |

| $190,000 | $638 |

| $195,000 | $650 |

| $200,000 | $661 |

8. FTMO

FTMO is a proprietary trading firm based in the Czech Republic that offers traders the opportunity to manage up to $200,000 in trading capital after passing a two-step evaluation process called the FTMO Challenge.

Key Features

- Profit sharing up to 90% for successful traders, with the ability to scale up to $2 million in trading capital based on consistent profitability.

- A wide range of trading tools and services, such as Account MetriX for performance tracking, Statistical App for trade analysis, Trading Journal, and Mentor App for guidance.

- Flexibility to trade forex, indices, commodities, cryptocurrencies, and stocks with leverage up to 1:100. Weekend holding allowed during evaluation.

- Strict risk management rules, including maximum daily loss, overall loss limits, and minimum trading day requirements to ensure responsible trading.

Evaluation Program

| Account Sizes | Pricing |

|---|---|

| $10,000 | €155 |

| $25,000 | €250 |

| $50,000 | €345 |

| $100,000 | €540 |

| $200,000 | €1,080 |

9. SmartPropTrader

Smart Prop Trader is a leading proprietary trading firm based in Austin, Texas, offering aspiring traders an opportunity to manage funded accounts of up to $100,000. Founded by experienced trader Blake Olson in 2022, Smart Prop Trader aims to simplify trading and provide the best conditions for success.

Key Features

- Competitive pricing and low-profit targets, with an 80/20 profit split that can increase to 90/10 through their scaling plan.

- No minimum trading days and unrestricted trading during news events, allowing flexibility in trading styles and strategies.

- Comprehensive educational resources, including a performance coach, trading journal, and statistical application to enhance traders' skills and edge.

- Efficient onboarding process and fast payouts, with a strong commitment to trader success and 24/7 support through their Discord community.

Evaluation Program

| Account Sizes | Pricing |

|---|---|

| $10,000 | $97 |

| $25,000 | $197 |

| $50,000 | $297 |

| $100,000 | $497 |

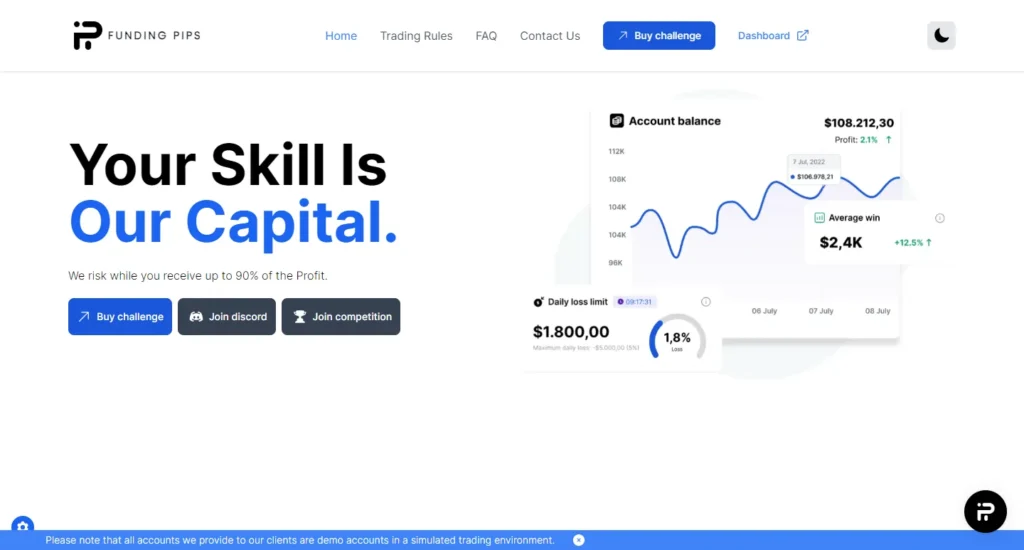

10. Funding Pips

Funding Pips is a proprietary trading firm that empowers traders by providing them with capital to maximize their potential. The firm offers a unique two-phase evaluation process followed by a funded account, allowing skilled traders to manage huge capital.

Key Features

- Traders can use Expert Advisors (EAs), hold positions during news events and weekends, and trade with high leverage.

- Payouts are processed every 5 days with an 80% profit split, which increases to 90%, and on-demand payouts for elite “Hot Seat” traders.

- Traders can increase their account size, maximum loss limits, and daily loss limits by achieving profit targets and payout milestones.

- Funding Pips offer forex, crypto, indices, metals & energies with raw spreads and low commissions.

Evaluation Program

| Account Sizes | Pricing |

|---|---|

| $5,000 | $32 |

| $10,000 | $60 |

| $25,000 | $139 |

| $50,000 | $239 |

| $100,000 | $399 |

11. Lux Trading Firm

Lux Trading Firm is a proprietary trading company that focuses primarily on forex trading. The firm provides traders with access to substantial capital, up to $10 million, to trade on the forex market and keep a large portion of the profits, typically 75%.

Key Features

- Offers several account sizes ranging from $25,000 to $200,000 for standard qualification, with the potential to scale up to $10 million for professional traders.

- Provides access to popular trading platforms like MetaTrader 4, Trader Evolution, and TradingView.

- Requires traders to pass an evaluation on a demo account first. The enrollment fee is fully refunded if the evaluation is successful.

- Partners with reputable institutions like Barclays, Credit Suisse, and Goldman Sachs, and uses Global Prime as its liquidity provider.

Two-Step Evaluation Challenge

| Account Sizes | Pricing |

|---|---|

| $50,000 | £299 |

| $200,000 | £599 |

One-Step Evaluation Challenge

| Account Sizes | Pricing |

|---|---|

| $1,000,000 | £1,499 |

12. Funded Trading Plus

Funded Trading Plus is a UK-based proprietary trading firm that offers traders the opportunity to access substantial trading capital through their innovative simulated-live funded trading programs. Their primary goal is to provide a simple path for traders to manage up to $2,500,000 in trading capital and keep up to 100% of the profits.

Key Features

- Funded Trading Plus offers the Experienced Trader Program (one-step evaluation), Advanced and Premium Trader Programs (two-step evaluations), and the Master Trader Program (direct funding).

- Unlike many other prop firms, Funded Trading Plus does not impose strict time constraints during the evaluation phase, allowing traders to work at their own pace to achieve the profit targets.

- Traders who achieve 10% profit can qualify to scale up their account size at any time, without waiting periods like at other prop firms. The maximum scaling plan goes up to $2,500,000.

- Funded Trading Plus provides access to a wide range of tradable instruments including forex, indices, commodities, and cryptocurrencies through their partnerships with regulated brokers like Eightcap and ThinkMarkets.

Experienced Trader Program

| Account Sizes | Pricing |

|---|---|

| $12,500 | $119 |

| $25,000 | $199 |

| $50,000 | $349 |

| $100,000 | $499 |

| $200,000 | $949 |

Advanced Trader Program

| Account Sizes | Pricing |

|---|---|

| $25,000 | $199 |

| $50,000 | $349 |

| $100,000 | $499 |

| $200,000 | $949 |

Premium Trader Program

| Account Sizes | Pricing |

|---|---|

| $25,000 | $247 |

| $50,000 | $397 |

| $100,000 | $547 |

| $200,000 | $1,097 |

Master Trader Program

| Account Sizes | Pricing |

|---|---|

| $5,000 | $225 |

| $10,000 | $450 |

| $25,000 | $1,125 |

| $50,000 | $2,250 |

| $100,000 | $4,500 |

Comparison of TradingFunds with its Competitors

| Aspect | TradingFunds | Competitors |

|---|---|---|

| Fees | High fees for evaluation programs and costs vary based on account size and challenge type | Some competitors offer alternatives with lower fees, providing more affordable access to funded accounts |

| Flexibility | Flexible funded account options catering to various traders and strategies | Other prop firms offer a more flexible trading environment without unnecessary rules or pressure |

| Monthly Profit Targets | No monthly profit targets once approved, providing flexibility in trading | Varies among competitors, some may have monthly profit targets |

| Customer Support | Robust customer support via email and live chat, detailed Q&A section on the website | Customer support quality may vary among competitors |

| Educational Content | Limited information on educational content provided | Some competitors offer educational content for traders |

FAQs Related to TradingFunds Alternatives

What are prop trading firms and how do they differ from traditional brokerages?

Prop trading firms provide traders with capital to trade on behalf of the firm. Unlike traditional brokerages where traders use their own capital, prop firms allow traders to leverage the firm's funds and share in the profits.

What are some key factors to consider when selecting a prop trading firm?

When choosing a prop firm, important factors include the firm's reputation and credibility, support and training offered, profit-sharing structure, trading platform and tools, and the types of assets available for trading.

What are some of the top prop trading firms to consider as alternatives to TradingFunds?

Some of the best prop trading firms include Audacity Capital, E8 Trading, TopTier Trader, FTMO, FundedNext, and Blue Guardian.

What are the typical requirements and rules for trading with a prop firm?

Most prop firms have specific profit targets, maximum drawdown limits, and minimum trading day requirements. Traders must adhere to these rules to avoid breaching their contracts and losing access to the funded accounts.

How do prop firms evaluate and select traders for funding?

Many prop firms have evaluation programs or challenges where traders must demonstrate their skills and meet certain metrics before receiving a funded account. These evaluations often involve a combination of simulated and real money trading.

What assets can be traded with prop trading firms?

Prop firms allow trading on a variety of assets, including forex, cryptocurrencies, commodities, indices, stocks, and futures. However, the specific assets available may vary between firms.

Bottom Line

When considering the best-funded trader programs, it's clear that there are many excellent options available to help you kickstart your trading career!

But what’s the important step in all of this?! To take action!

Don't let analysis paralysis hold you back from pursuing your dream of becoming a successful trader!

Research the programs, choose one that aligns with your goals and trading style, and dive in!

Start honing your skills, developing your strategy, and working towards that funded account.

By seizing the opportunities provided by these top-notch funded trader programs, you'll be well on your way to achieving your aspirations.

So don't wait – pick a program and start your funded trading journey today!