This strategic approach to market risk can provide valuable insights to assist in making informed trading decisions. Trend trading is like surfing the waves of the financial markets. Imagine catching a wave just as it starts to build momentum, riding it as it expands, and gracefully exiting before it crashes.

This is the center of trend trading—a strategy where traders identify and capitalize on the direction of market trends.

Whether the market is moving up, down, or sideways, trend traders use various indicators to spot these movements and make informed decisions. It's a dynamic and exciting approach that can offer significant rewards if you can master the art of timing and analysis.

👀 What is Trend Trading?

Trend trading is a strategy that involves identifying and following the direction of market trends. It's based on the premise that securities tend to move in a particular direction over time. A trend trader aims to capitalize on this movement by buying when the trend is upward and selling when the trend is downward.

In Forex trading, trends can occur in any direction—upwards, downwards, or sideways—and can last for varying periods—from short-term to long-term. The key to successful trend trading lies in accurately identifying these trends and making trades that align with the direction of the trend.

Importance of Trend Analysis in Forex Trading

Trend analysis is a critical aspect of Forex trading. By understanding the direction and strength of a trend, traders can make predictions about future price movements and adjust their strategies accordingly.

One of the main advantages of trend trading is its potential for high profitability. Because this strategy involves riding the market's momentum, it can result in significant profits if the trend continues for an extended period.

Additionally, trend trading can help to reduce risk. By trading in the direction of the trend, traders can limit their exposure to adverse market movements. This is particularly important in Forex trading, where price volatility can result in substantial losses.

Moreover, trend analysis can provide valuable insights into market sentiment. By observing how other market participants are reacting to current trends, traders can gain a better understanding of the market dynamics and make more informed trading decisions.

Identifying Trends in Forex

Being able to identify trends is a critical skill in forex trading. This is because the overall market trend can significantly impact the performance of a forex trade. The two main components to consider when identifying trends are the types of trends and the tools and indicators used for trend identification.

Recognizing Different Types of Trends

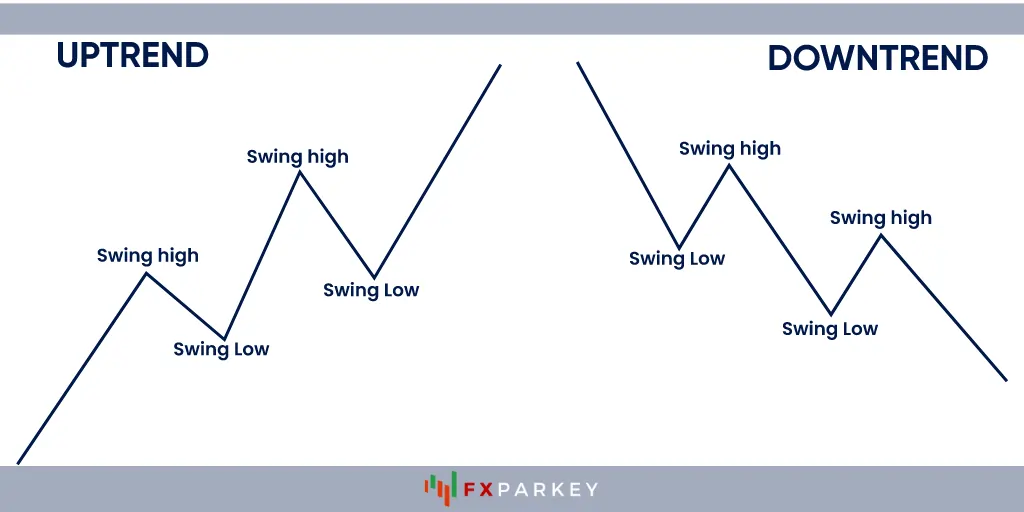

There are three primary types of trends in forex trading: uptrends, downtrends, and sideways or horizontal trends.

- An uptrend is characterized by higher highs and higher lows in the market. This trend indicates that the buyers are in control of the market.

- A downtrend is characterized by lower highs and lower lows. This trend signifies that the sellers are dominating the market.

- A sideways or horizontal trend occurs when the market is not making higher highs or lower lows. This trend suggests that the market is in a state of equilibrium, with neither the buyers nor the sellers in control.

Understanding these trends is key for implementing various trading strategies such as swing trading, day trading, and position trading.

Tools and Indicators for Trend Identification

Several tools and indicators can assist traders in identifying trends in the forex market. These include:

These tools and indicators are essential for implementing various trend trading strategies, such as scalping, carry trade, range trading, breakout trading, and counter-trend trading.

Strategies for Trend Trading

Successful trend trading depends on the ability to identify and adapt to market trends. This includes both trend-following and counter-trend trading strategies.

Trend Following Strategies

Trend-following strategies, as the name implies, involve identifying and following the direction of the prevailing market trend. These strategies are typically used in longer-term scenarios and can be beneficial during strong, directional market trends.

One common trend following strategy is breakout trading. In breakout trading, traders look for price levels that a currency pair hasn't been able to move beyond, and then place trades based on the assumption that price momentum will continue in the direction of the breakout. This strategy can be highly effective in volatile markets.

Another popular trend following strategy is position trading. Position trading involves holding a position over a long period, often weeks or months, following the primary trend. This strategy requires patience and a comprehensive understanding of long-term market cycles.

| Trend Following Strategy | Description |

|---|---|

| Breakout Trading | Trading based on the assumption that price momentum will continue in the direction of the breakout |

| Position Trading | Holding a position over a long period, following the primary trend |

Counter-Trend Trading Strategies

Counter-trend trading strategies, on the other hand, involve betting against the prevailing market trend. These strategies can be riskier than trend-following strategies as they require predicting when a trend might reverse. Traders using these strategies typically look for potential price corrections or reversals within a larger overall trend.

One common counter-trend strategy is range trading. In range trading, traders identify currency pairs that are trading within a specific price range and place trades based on the assumption that the price will bounce off the range's high and low levels.

Another counter-trend strategy is news trading, which involves making trades based on significant news events that are expected to cause market volatility. This strategy requires traders to stay informed about current events and understand how they might impact currency prices.

| Counter-Trend Strategy | Description |

|---|---|

| Range Trading | Trading based on the assumption that the price will bounce off the high and low levels of a specific range |

| News Trading | Making trades based on significant news events that are expected to cause market volatility |

Whether a trader chooses a trend following or a counter-trend trading strategy will depend on their personal trading style, risk tolerance, and understanding of the market. Both approaches come with their own set of risks and rewards, and neither guarantees success. Therefore, traders need to understand their chosen strategy thoroughly and apply it consistently to maximize their chances of success in trend trading.

Risk Management in Trend Trading

In the dynamic world of Forex trading, managing risk is as critical as identifying profitable opportunities. When it comes to trend trading, risk management strategies like setting stop loss and take profit levels, and determining appropriate position sizing and risk-reward ratios, can help protect traders from volatile market swings and enhance their profit potential.

Setting Stop Loss and Take Profit Levels

One of the first steps in risk management for trend trading is setting stop loss and take profit levels. These predefined levels help traders control potential losses and lock in profits.

A stop loss is a price level at which a trader will sell a currency pair to prevent further losses if the market moves against the intended direction. Ideally, the stop loss should be set at a point where the trader believes the trend is no longer valid. For instance, if the trend line breaks, it could be an indication to exit the trade.

Position Sizing and Risk-Reward Ratios

Another key aspect of risk management in trend trading is determining the appropriate position size and risk-reward ratio.

Position sizing refers to the number of units of a currency pair a trader buys or sells in a trade. It's a critical decision that should align with the trader's risk management strategy. Trading too large a position relative to the account size can lead to significant losses if the trade goes against the trader.

The risk-reward ratio, on the other hand, is a measure of the potential loss (risk) in a trade compared to the potential profit (reward). A favorable risk-reward ratio ensures that potential profits outweigh potential losses over the long term.

| Risk-Reward Ratio | Description |

|---|---|

| 1:1 | The potential loss is equal to the potential profit |

| 1:2 | Potential profit is twice the potential loss |

| 1:3 | Potential profit is three times the potential loss |

For example, a trader may decide never to risk more than 1% of their trading capital on a single trade and aim for a risk-reward ratio of at least 1:2. This means for every dollar risked, the trader aims to make two dollars in profit.

Managing risk in trend trading requires careful planning and disciplined execution. It's a continuous process that begins before a trade is placed and continues until it's closed. By setting appropriate stop loss and take profit levels and determining the right position size and risk-reward ratio, traders can control their potential losses and enhance their profit potential in trend trading.

Fine-Tuning Your Trend Trading Approach

Refining the trend trading approach is a critical component of maximizing profits in Forex trading. In this section, we will discuss the importance of selecting appropriate timeframes for trend analysis and the value of combining multiple indicators for confirmation.

Timeframes for Trend Analysis

Choosing the correct timeframe for trend analysis in Forex trading can significantly influence the effectiveness of a trader's strategy. This choice is often dictated by the trader's style and preference, whether they engage in swing trading, day trading, position trading, or scalping.

Short-term traders, such as day traders and scalpers, might favor smaller timeframes like the 5-minute or 15-minute charts. These charts provide more trading opportunities but also come with increased market noise and volatility.

On the other hand, swing traders and position traders might opt for larger timeframes, such as the 4-hour, daily, or weekly charts. These charts offer a broader view of the market trends, but trading opportunities are less frequent.

| Trading Style | Preferred Timeframes |

|---|---|

| Scalping | 1M, 5M |

| Day Trading | 15M, 30M, 1H |

| Swing Trading | 4H, 1D |

| Position Trading | 1W, 1M |

Regardless of the chosen timeframe, it's crucial for traders to consistently analyze the market trends and adjust their strategies as needed.

Combining Multiple Indicators for Confirmation

While one indicator can provide insight into the market's direction, combining multiple indicators can give traders a more comprehensive view of the market trends. This can lead to more accurate trade entries and exits, ultimately boosting profitability in trend trading.

For instance, a trader might use a trend indicator like the Moving Average to identify the direction of the trend. Simultaneously, they could use a momentum indicator such as the Relative Strength Index (RSI) to gauge the strength of the trend and identify potential reversal points.

By combining these indicators, traders can confirm the trend's direction and strength, providing a strong basis for their trading decisions. This multi-indicator approach can help traders avoid false signals and improve the overall accuracy of their trend trading strategy.

Expert Insights and Tips for Maximizing Profits

When it comes to trend trading, some certain attributes and skills can significantly enhance a trader's ability to maximize profits. Two of these key attributes are patience and discipline, which form the cornerstone of successful trading. Furthermore, continuous learning and improvement in trend analysis can also greatly contribute to a trader's success.

Patience and Discipline in Trend Trading

In the realm of trend trading, patience and discipline are paramount. Traders must possess the patience to wait for the right trading opportunities and the discipline to stick to their trading plan.

Patience in trend trading involves waiting for a strong trend to develop before entering a trade. This can often require considerable time and patience, as the market does not always move in clear trends. Moreover, once a trade is entered, patience is needed to allow the trade to unfold and reach its profit target.

Continuous Learning and Improvement in Trend Analysis

Trend trading is not a static process. Markets evolve, and so must traders' skills and knowledge. Continuous learning and improvement in trend analysis are key to staying ahead in the ever-changing forex market.

This involves staying updated on the latest market news, learning new trend identification tools and indicators, and refining one's trading strategies based on market feedback. Traders should also be open to exploring different types of trading strategies, such as swing trading, day trading, position trading, scalping, carry trade, range trading, breakout trading, counter-trend trading, and news trading, to find the ones that best fit their trading style and goals.

Common Queries Related to Trend Trading

What is Trend Trading?

How do you identify a Trend?

What are The types of Trends?

What Tools are used in Trend Trading?

Can Trend Trading be used in all Markets?

💭 Conclusion

Trend trading is a powerful strategy that leverages market momentum to maximize gains. By understanding and identifying trends, traders can make informed decisions, about whether the market is moving up, down, or sideways.

Utilizing tools like moving averages, MACD, RSI, and ADX, trend traders can effectively analyze market conditions and predict future price movements. However, it's crucial to remember that no strategy is foolproof. Successful trend trading requires discipline, patience, and robust risk management. As you embark on your trend trading journey, stay informed, stay vigilant, and always be prepared to adapt to changing market dynamics.

![Bid Price in Forex Trading 📖 Forex Glossary [2025 Edition] 7 Bid Price](https://fxparkey.com/wp-content/uploads/2024/02/WHAT-IS-Bid-Price-300x150.webp)

![What is Forex Trading? Complete Guide on Forex [2025 Edition] 11 What is Forex Trading? Complete Guide on Forex [2025 Edition]](https://fxparkey.com/wp-content/uploads/2024/01/Forex-Trading-3-300x150.webp)