Think your trading dreams are too big? Audacity Capital Review laughs in the face of doubt. 😏 This UK prop firm fuels traders with high capital!

With a decade of excellence funding over $2.4 billion in volume, Audacity Capital has hit the big time! Its rocket-like scaling program sends funded accounts soaring to $480,000.

Yet for all its institutional-grade power, Audacity Capital nurtures budding talent too. New traders can prove themselves and secure funding through evaluation programs!

This prop firm turns dreams into reality – if you dare to dream big!

Excited to know more?! Join me as I dissect the Audacity Capital prop firm! A comprehensive review that includes the funding programs, brokers, ratings and reviews and so much more!

Audacity Capital Review | Unveiled

Something about their websites makes me think, they’re journal lovers like me, or maybe not🥴 Anyway! Let’s dive into this review!

Audacity Capital is a leading online forex prop trading firm founded in 2012 and headquartered in London, UK. With over a decade of experience funding traders globally, Audacity Capital empowers traders by providing capital to maximize their potential.

As one of the most well-established prop firms in the industry, Audacity Capital has funded over $2.4 billion in trading volume with an average monthly payout of $2.8 million to its traders. The company offers funding up to $480,000 in capital with 1:100 leverage and a generous up to 85% profit split.

With a presence in over 140 countries, Audacity Capital aims to develop long-term mutually beneficial partnerships with talented traders. The company provides a superior trading infrastructure through its partnership with an institutional liquidity provider, ensuring tight spreads and fast execution.

| Key Information | Details |

|---|---|

| CEO | Karim Yousafi. |

| Key features | Education and Support, Trading Infrastructure, Account Progression, and Mobile Social App. |

| Broker | institutional liquidity provider. |

| Trading Platform | MetaTrader4 and MetaTrader5. |

| Payout Split | 85%. |

| First Payout | 30 days. |

| Subsequent Payouts | Flexible. |

| Daily Drawdown | Different for different funding programs. |

| Headquarters | England, United Kingdom. |

| Expert Advisors | Allowed. |

| Max Funding | $480,000. |

| Funding Programs | The Ability Challenge, Funded Trader Program, Flex Trader Program, and Pro Trader Program. |

| Leverage | 1:100. |

| Weekend Holding | Allowed. |

| Contact | Call on +44 20 8050 1985 or email us: support@audacitycapital.co.uk. |

Audacity Capital Key Features

Key features of Audacity Capital are as follows:

How to Sign Up for Audacity Capital? Step-by-Step Guide

This is a step-by-step guide on how to sign up for Audacity Capital's Funded Forex Trader Program:

Audacity Capital Funding Programs

The Audacity Capital offers four funding options: The Ability Challenge, Funded Trader Program, Flex Trader Program, and Pro Trader Program.

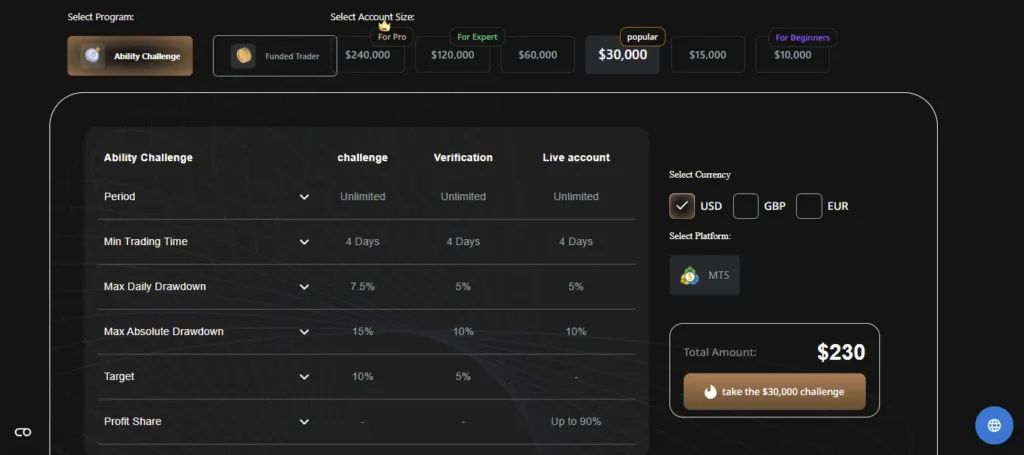

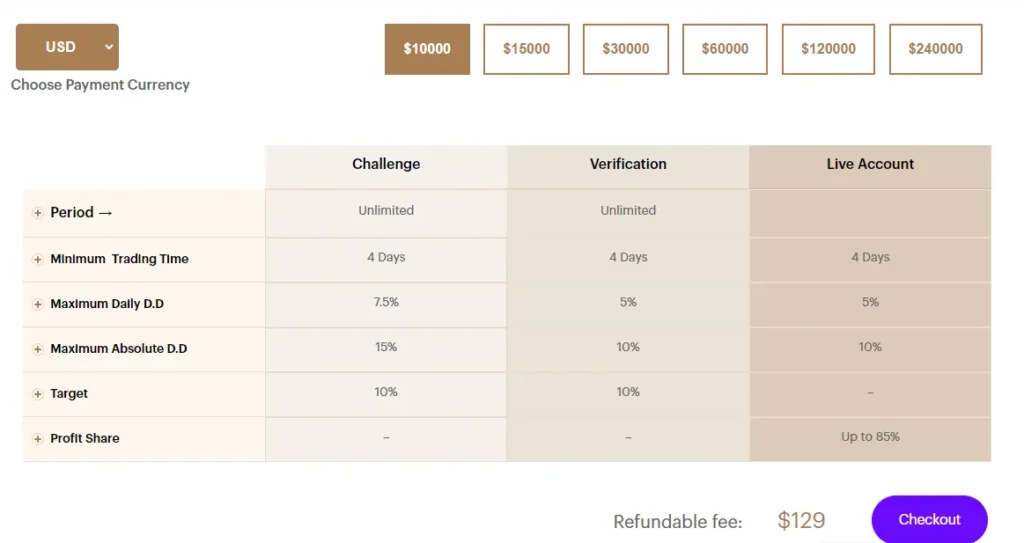

1. The Ability Challenge

The Ability Challenge is a two-phase evaluation process suited for new or less experienced traders to prove themselves. There is a 30-day challenge phase followed by a 60-day verification phase where traders must meet specific profit targets and adhere to risk limits. Those who succeed receive funding up to $120,000 and a favorable 75/25 profit split with the company.

| Account Size | Price |

|---|---|

| $10,000 | $129 |

| $15,000 | $189 |

| $30,000 | $339 |

| $60,000 | $459 |

| $120,000 | $779 |

| $240,000 | $1,559 |

Ability Challenge Scaling Plan

Traders in the Ability Challenge can qualify for account size increases if they demonstrate consistent profitability.

Specifically, if a trader generates positive returns of at least 2.5% per month over a 3-month period AND makes one successful withdrawal in that timeframe, they become eligible for a 100% account balance increase.

2. Funded Trader Program

Funded Trader Program provides instant funding up to $480,000 to experienced, profitable traders after a brief interview process. Traders receive a 50/50 profit split with Audacity Capital and there is no trading challenge or verification required.

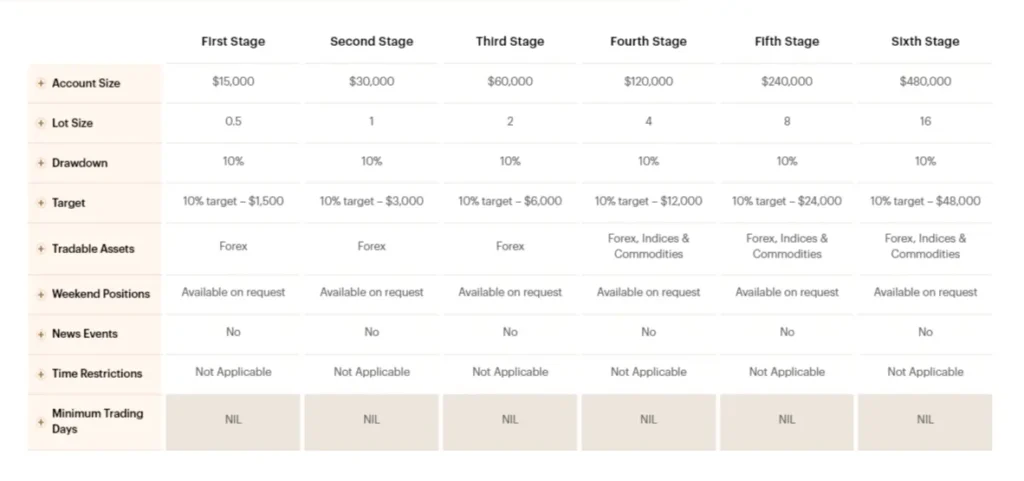

Funded Trader Scaling Plan

The Funded Trader Program account starts with $15,000 in funding and a maximum lot size of 0.5. Traders can progress through the scaling plan by hitting incremental profit targets. Specifically, they must achieve 10% profit growth to move up each tier. So if a trader grows the initial $15,000 account balance to $16,500, they unlock the next level.

Upon hitting each new target, the account balance doubles – so in the example, reaching $16,500 would result in capital increasing from $15,000 to $30,000. In addition, the drawdown limit allowed also rises by 25% alongside each balance increase. So if the initial maximum loss was $1,500, at the next tier it would go up to $1,875.

3. Flex Trader Program

The Flex Trader Program offers experienced traders similar instant funding and profit split as the Funded Trader program but with more flexibility to customize parameters like higher risk limits and access to more trading assets.

Flex Trader Scaling Program

The Flex Program provides experienced traders with an initial $15,000 account balance. To progress to higher funding tiers, traders must achieve set profit targets. Specifically, a 20% return unlocks the next level – for example, growing the starting $15,000 balance to $18,000.

Upon hitting each incremental profit target, the account balance doubles. So in the example, the $15,000 account would scale up to $30,000 after the 20% growth target is reached. Alongside this capital increase, the maximum lot size allowed also doubles at each new tier, starting from 1 lot initially.

4. Pro Trader Program

Pro Trader Program provides seasoned traders instant access to six-figure account funding from the start, bypassing any verification requirements. This exclusive program is targeted at professional traders who can handle tighter risk management rules.

Pro Trader Scaling Plan

The Pro Trader Program provides instant access to sizeable six-figure funding between $100,000 to $480,000 for seasoned professionals who have a proven track record of profitable trading. Given the higher account balances from the start, the program has tighter risk management rules compared to Audacity's other options.

Experienced traders bypass any demo or evaluation phases and immediately begin actively managing their funded accounts. To progress to higher tiers, traders must achieve set profit targets – specifically 20% account growth milestones. Meeting these incremental profit goals doubles the account balance each time.

Audacity Capital Payouts

Audacity Capital offers traders the ability to withdraw profits on a regular basis across all of its funding programs. Payouts vary from 50%- to 75% and are issued quickly thanks to their proprietary portal which allows near-instant processing.

For the Funded Trader and Flex Trader programs, traders can request daily, weekly, bi-weekly, or monthly profit withdrawals. As long as open trade risk is covered, there are no restrictions on the frequency or amount of profit payouts. These flexible options ensure traders have access to their earnings when needed.

The Ability Challenge program has a minimum 3-month term, so payouts align with this timeline. Traders must make at least one withdrawal every 3 months to be eligible for potential account size increases. Payouts are still processed rapidly though – within 24 hours during weekdays.

Across all programs, Audacity Capital issues trader profits directly to their bank account or e-wallet. Their dedicated support team and custom portal make submissions effortless. Payouts hit trader accounts typically in 1-3 business days.

Why Should You Choose Audacity Capital over Other Prop Firms?

While there may be some concerns around the brokerage part, this prop firm has many upsides! Take a look:

Audacity Capital offers funding up to $480,000 to start which is almost half a million! With the ability to rapidly scale accounts higher through their structured progression plan. Each profit target met leads to a doubling of capital! This incentive allows traders to exponentially grow accounts as they demonstrate consistent profitability.

Beginner 😇 or an experienced trader 💪?! Audacity Capital caters to traders at all skill levels with choices like the Funded Trader program for experienced traders or the Ability Challenge for new traders to prove themselves. This versatility makes their offering accessible to a wider audience.

From daily webinars to one-on-one mentorship options, Audacity Capital emphasizes continued learning. Their tools aim to develop the talents of tomorrow's trading superstars! ⭐Hello, future superstar of the prop firms!

| Features | Audacity Capital | FunderPro | Funding Pips | E8 Funding |

|---|---|---|---|---|

| Trustpilot Rating | 4.6/5 | 4.4/5 | 4.3/5 | 4.8/5 |

| Max Funding | 480,000 | $200,000 | $400,000 | $100,000 |

| Profit Split | Upto 85% | Upto 90% | Upto 80% | Upto 80% |

| Trading Instrument | Forex, Currencies, Indices, Commodities | Forex, Commodities, Indices, and Cryptocurrencies | Forex, Commodities, Indices, and Cryptocurrencies | Forex, commodities, indices, and equities |

| Platforms and Tools | MetaTrader4 and MetatRader5 | TradeLocker | MetaTrader4 and MetaTrader5 | MetaTrader 5 |

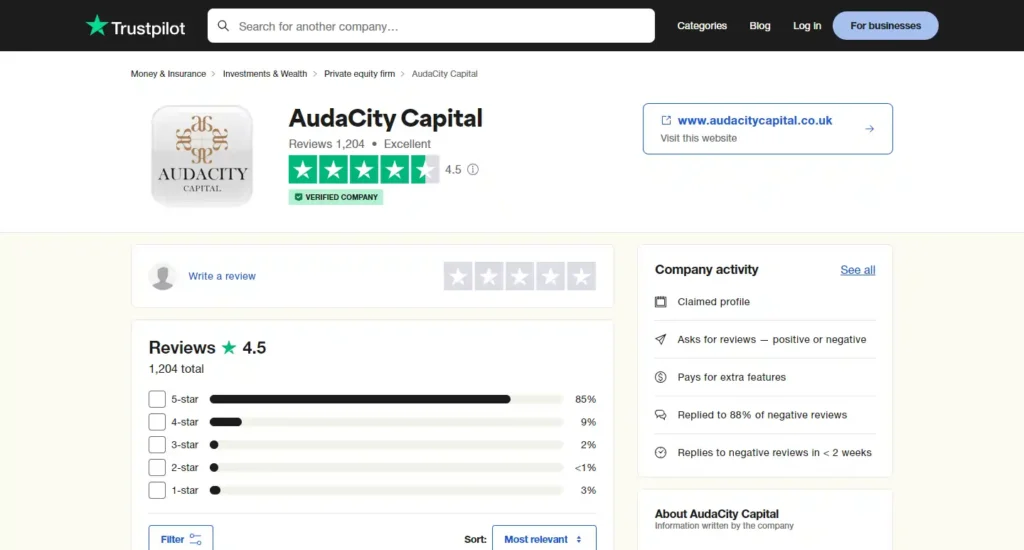

Audacity Capital Ratings and Reviews on Trustpilot

Audacity Capital rates a whopping 4.6/5 on Trustpilot! Great number! Are you curious to know what people have to say about this prop firm?! Let’s dive right into it!

Review 1: This user says Audacity is the “best prop firm” that he has traded with! Now, that’s a flattering compliment!

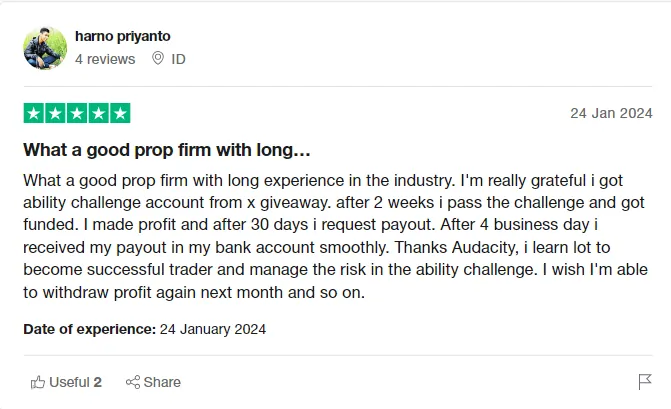

Review 2: This client talks about the long experience Audacity has in the world of prop trading firms! That’s another reason why you should opt for audacity, isn’t it?

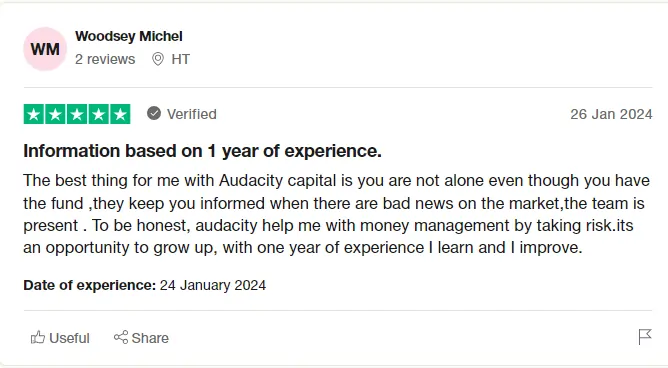

Review 3: This particular client has been working with them for the past year! According to his experience, Audacity has been very helpful, and they’ve been there for him!

FAQs Audacity Capital Review

Is there a Challenge or Test Traders must pass to get Funded?

Yes, the Ability Challenge has a 2-phase evaluation requiring profit targets and risk rules to 0. be met. The Funded Trader Program has no test.

What is the Maximum Drawdown or loss allowed?

Drawdown limits start at 10% of the account balance and increase by 25% at each new funding tier.

How long is the contract period for Funded Accounts?

There is no minimum contract period. Traders can withdraw daily profits as long as open trade risk is covered.

Can Traders use EAs and hold Trades over Weekends?

Yes, the use of EAs is permitted. Holding trades over weekends is allowed.

What Trading Platform does Audacity Capital use?

Funded traders access markets via the popular MetaTrader 4 platform.

Is Audacity Capital regulated?

No, as a prop firm Audacity Capital does not require direct regulation. However, their liquidity providers are regulated entities.

How can I get in touch with Audacity Capital's Support Team?

Contact options include phone, email, social media, and an online chat portal available during business hours.

Wrapping Up

So, what do you think about Audacity Capital? Wait 😠, first I’ll tell you what I think🥰.

For ambitious traders hungry to unlock their true potential, Audacity Capital offers the ultimate springboard to success. Their proven funding programs provide the rocket fuel to ignite your profitability into the stratosphere.

The key ingredients have been assembled – cutting-edge technology, invaluable education, and a thriving community. Now the final step falls on driven individuals willing to seize the opportunity before them.

Audacity Capital brings together the financial markets' most talented minds under one banner, providing strength in numbers on the path to victory.

So why wait on the sidelines? Step into the arena and realize your dreams today!