You’ve got the skills, the drive, and a killer futures trading strategy but your trading capital is stuck in first gear. Enter prop trading firms like Topstep vs Earn2Trade, offering funded trader programs that promise to supercharge your potential.

But which one actually fits your goals? Are their trading challenges fair? How do their profit splits, evaluation process, fees, and risk management rules stack up?

In this Topstep review vs Earn2Trade review, we’ll break down the real differences between customer support quirks to tech tools and payout rules. Ready to see how the future of prop trading is shifting-and which firm might finally let you trade like a pro?

Let’s get in because in this game, the right partner could mean the difference between a $200 withdrawal and a $200,000 funded account.

Topstep Vs Earn2trade Comparison

| Parameter | Topstep | Earn2Trade |

|---|---|---|

| Evaluation Process | Multi-step (Trading Combine) | Single-step (Gauntlet Mini™) or progressive (Trader Career Path®) |

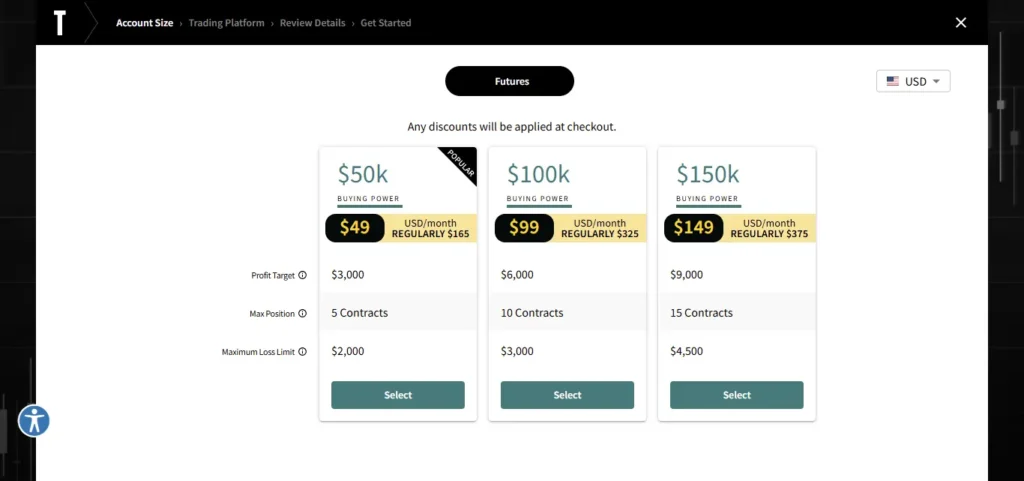

| Account Sizes | $50,000, $100,000, $150,000 | $25,000, $50,000, $100,000, $150,000, $200,000, $400,000 |

| Profit Target Example | $3,000 (50K), $6,000 (100K), $9,000 (150K) | $1,750 (25K), $3,000 (50K), $6,000 (100K), $9,000 (150K), $11,000 (200K) |

| Drawdown / Max Loss | Daily loss and max loss limits (e.g., $1,000 daily/$2,000 max for 50K) | End-of-day drawdown and daily loss limits; progression ladder for contract size |

| Consistency Rule | Yes (Best day ≤ 50% of profit target) | Yes (Best day ≤ 30% of total profit in evaluation) |

| Minimum Trading Days | None | 15 days (Trader Career Path® and Gauntlet Mini™) |

| Allowed Instruments | CME, CBOT, NYMEX, COMEX futures (e.g., ES, NQ, CL, GC, micro contracts, etc.) | CME, CBOT, NYMEX, COMEX futures (stock index, commodity, currency, interest rate futures) |

| Trading Platforms | TopstepX, NinjaTrader, R | Trader Pro, others |

| Monthly Cost (50K acct) | $165 | ~$150 (varies by program and promotions) |

| Profit Split | 100% first $10K, then 90/10 ongoing | 80/20 or 80% to trader, varies by funding partner |

| Payout Frequency | After 5 winning days, processed daily | After 15 trading days, then as frequently as every 5 days (varies by program) |

| Payout Speed | 1–3 business days | 1–3 business days |

| Scaling/Upgrade Path | Multiple funded accounts allowed; can hold up to 5 Express Funded Accounts | Scaling plan: upgrade to larger accounts as you hit targets and withdraw profits |

| Reset Fee | $49 (50K), $99 (100K), $149 (150K) | $80–$220 (varies by account size and program) |

| Community/Education | Extensive: TopstepTV™, coaching, Discord community | Education modules, webinars, support, Discord/Slack communities |

| TrustPilot/Reviews | 4.6/5 (5,500+ reviews) | 6.3/10 (TradersUnion), moderate client satisfaction |

Topstep: A Different Path to Futures Funding?

Founded by former floor trader Michael Patak, Topstep has been around since 2012, carving out a space by offering traders a shot at a funded account without putting their own savings on the line.

Based in Chicago, they've focused exclusively on futures since discontinuing forex. The core idea seems to be identifying and nurturing trading talent.

The Trading Combine®: One Hurdle to Funding

Topstep's evaluation, the Trading Combine®, is designed to test your skills and discipline. Previously a multi-step process, it's presented now as having “1 Rule. 1 Goal” – pass the evaluation, and you could get funded. It's pitched as a way to build better trading habits while aiming for that funded account, potentially securing one in just a couple of days if you meet the criteria.

Support and Staying in Control

Beyond just the evaluation, Topstep emphasizes trader development with resources like coaching and community support. A standout feature is their TopstepX™ platform, which isn't just for placing trades.

It includes specific risk management tools designed by traders, for traders. Think features like manually locking yourself out of trading sessions, setting limits on daily trades, blocking specific symbols, or even pausing activity without closing positions – tools aimed at enforcing discipline.

Reputation & Reliability

With over 12 years in the business and having funded thousands of traders (paying out over 81,000 times in 2024 alone, according to their site), Topstep has built a track record. Their Trustpilot score sits at a solid 4.5, reflecting generally positive user experiences.

They offer a clear path: pass the Combine, pay a one-time activation fee for the funded account, and then focus on trading and potential payouts (starting at 100% up to $10k).

So, Topstep presents a structured path backed by specific tools and a history in the market. But is their model the best fit compared to others out there? That’s the real question when stacking them against the competition…

Earn2Trade: The Learning Curve to Funding?

Earn2Trade positions itself as an education and evaluation company first and foremost, aiming to prepare traders for the realities of professional futures trading. Founded with the goal of bridging the gap for aspiring traders, they offer structured pathways combined with learning resources.

Under the leadership of CEO Osvaldo Guimarães, who notably spearheaded initiatives like the “Trader Career Path“, Earn2Trade emphasizes development alongside evaluation.

Education Meets Evaluation

The core idea here is to teach solid trading habits and risk management before connecting you with one of their partner proprietary trading firms. They offer evaluations designed to test your skills in a simulated environment, essentially acting as a proving ground. If you pass their tests, they guarantee a funding offer from a partner firm. It’s about building proficiency and then getting your shot.

Paths to a Funded Account: TCP & Gauntlet Mini™

Earn2Trade provides distinct evaluation programs:

Backing and Reputation

Earn2Trade has established connections with partner prop firms who provide the actual funding once you pass an evaluation. They've been operating for several years and maintain a solid reputation in the trading community, reflected by their Trustpilot score of 4.4.

Special Offer: Thinking of giving it a go? Earn2Trade currently has a deal: Enjoy professional trading benefits at half the cost for two months with coupon code ‘smartstart.’

So, Earn2Trade offers a structured, education-heavy path with clear evaluation options. But is this learning-focused model the ideal fit for your trading style, especially when compared to other firms? It's certainly something to consider.

Upto 50% Off All Earn2Trade Programs

Apply the “FOREXPARKEY” discount code at checkout on earn2trade.com for a 10% discount on any program.

Upto 50% Off

Broker Options: Topstep vs Earn2Trade

Where your trades actually get executed matters. Here’s a rundown of the brokers associated with live-funded accounts at Topstep vs Earn2Trade, based on the platforms used or partner arrangements.

Topstep | Broker Choices

Topstep offers funded accounts through several well-known brokers, often tied to the trading platform you choose during your evaluation.

| Broker | Brief Description |

|---|---|

| Tradovate | A popular choice, directly integrated for funded accounts, especially if using Tradovate or TradingView platforms. |

| Plus500 | A global brokerage group acting as the FCM for traders using Topstep's T4 platform or the TopstepX platform. |

| NinjaTrader Brokerage | Handles accounts for traders using the widely-used NinjaTrader platform or other Rithmic-feed-based platforms. |

| Dorman Trading | A long-standing Futures Commission Merchant (FCM) is sometimes associated with prop firm accounts. |

| CQG | Primarily known as a data feed provider, often linked with platforms like Tradovate for connectivity. |

Earn2Trade: Broker Connections

Earn2Trade connects successful traders with partner proprietary trading firms, which in turn utilize specific brokers for clearing and execution.

| Broker | Brief Description |

|---|---|

| EdgeClear | An introducing broker known for focusing on active futures traders, partnered with Earn2Trade's funding partners like Helios. |

| Phillip Capital | A global financial institution acting as the Futures Commission Merchant (FCM) often working with EdgeClear for clearing. |

| Dorman Trading | Another established FCM option is available through Earn2Trade's network of partner prop firms. |

Platforms & Payments: Topstep vs Earn2Trade

Here’s how the two firms compare when it comes to the software you can trade on and how funds move in and out.

| Feature | Topstep | Earn2Trade |

|---|---|---|

| Trading Platforms | Jigsaw Daytradr, Tradovate, T4, MotiveWave, Quantower, MultiCharts, Investor/RT, Trade Navigator, Bookmap, Atas Orderflow Trading, VolFix, NinjaTrader, R Trader Pro, Rithmic, TopstepX, Sierra Chart, TradingView | Jigsaw Daytradr, Finamark, Inside Edge Trader, MotiveWave, Quantower, MultiCharts, Investor/RT, Trade Navigator, Bookmap, Atas Orderflow Trading, QScalp, OverCharts, Photon, R Trader, QSI-Quick Screen Trading, VolFix, NinjaTrader, R Trader Pro, Rithmic, Scalp Tool, Sierra Chart |

| Payment Methods (For Evaluations) | Credit/Debit Card, PayPal | Crypto, Credit/Debit Card, PayPal |

| Payout Methods (For Funded Traders) | Wise, ACH, Bank Wire Transfer | Riseworks |

Both firms offer a wide array of compatible trading platforms, covering many popular choices among futures traders like NinjaTrader, Tradovate, Quantower, and Sierra Chart.

Topstep also features its own platform, TopstepX. When it comes to paying for evaluations, Earn2Trade adds Crypto as an option alongside standard cards and PayPal.

For receiving payouts, the methods differ, with Topstep offering several direct options while Earn2Trade utilizes Riseworks.

Trading Power | Topstep's Contract Limits

Let's talk about buying power, or what's often called ‘leverage' in the prop firm world. It's not leverage in the traditional brokerage sense (like 100:1), but rather how much size – how many contracts – you're allowed to trade based on the account size you're managing. This is a key rule because exceeding it can get you disqualified.

Topstep sets clear limits on the maximum number of contracts you can have open at any one time. It scales directly with the size of the account you pass the evaluation for:

These limits are fixed for the standard funded accounts, giving you a clear boundary for your trading size.

Trading Power: Earn2Trade's Contract Limits

Earn2Trade's approach depends slightly on which program you choose, as they have different structures.

For the Gauntlet Mini™: This program also uses a tiered system for maximum contracts based on the evaluation account size you select:

For the Trader Career Path®: This program has a scaling component, but the initial evaluation (and the starting funded account) also has defined contract limits:

The Rulebook | Navigating Topstep vs Earn2Trade

Let's get into the nitty-gritty: the rules of the game. Every prop firm has its own playbook, and understanding the dos and don'ts for Topstep vs Earn2Trade is essential. Think of these as the house rules you need to follow to stay in the game and eventually get paid.

Consistency | Can You Spread Your Wins?

Both firms want to see you make consistent profits, not just land one massive lucky trade. They measure this with a “consistency rule,” but they approach it differently.

Trading Styles: Bots, Copying, and News

How flexible are they with different trading approaches?

Other Key House Rules

Here are some other notable differences in their rulebooks:

So, while both aim to foster disciplined trading, their specific rules on consistency, allowed strategies and daily operations show some clear differences.

Earn2Trade appears slightly more restrictive on consistency and copy trading but allows EAs, while Topstep offers more freedom in strategies but has that unique post-payout drawdown reset.

Choosing between them might depend on which set of rules best suits your trading style and tolerance.

Show Me the Money | Payout Policies Compared

Now, let's talk about the most important part for many traders: getting paid! How do Topstep vs Earn2Trade handle payouts? It's where the rubber meets the road, and they have pretty different ways of slicing the pie.

How the Profit Cookie Crumbles? (The Split)

Getting Your Hands on the Cash (Eligibility & Frequency)

How Much Can You Take? (Amounts & Limits)

The Logistics (Methods & Fees)

So, Topstep lures you in with that initial 100% split and potential for daily access later, while Earn2Trade offers a simpler 80% split from day one and a lower initial profit threshold, but operates on a weekly payout schedule with some specific caps and fees.

Which payout structure feels better depends entirely on your cash flow needs and trading performance.

Topstep vs Earn2Trade | Quick FAQs

Who Offers the better Profit Split for Traders?

Topstep gives you 100% of the first $10,000, then a 90/10 split. Earn2Trade offers a straight 80/20 split from the start. Topstep's initial deal is very appealing.

Which Firm gets you Funded Faster, Topstep vs Earn2Trade?

Topstep's one-step Trading Combine® has no minimum day requirement now. Earn2Trade's Gauntlet Mini™ needs at least 10 trading days. Topstep could be quicker if you're fast.

Can I use Trading Bots or Copy Trade with these Firms?

Topstep allows bots (EAs), news trading, and copy trading. Earn2Trade is okay with EAs and news trading, but strictly prohibits copy trading.

How quickly can I actually get paid by Topstep vs Earn2Trade?

Topstep processes payouts daily once you have 5 winning days ($200+ each). Earn2Trade pays weekly (Tuesdays) after you earn at least $100 profit.

Do I Pay Fees just to start My Funded Account?

Yes, both have setup costs. Topstep charges a one-time Activation Fee ($149) upfront for the Express Funded Account. Earn2Trade deducts a setup fee ($139) from your first payout on LiveSim®.

Which Firm lets you handle bigger Accounts or Scale up more?

Earn2Trade offers initial accounts up to $200k and the Trader Career Path can scale up to $400k. Topstep's standard initial max is $150k. Earn2Trade has higher scaling potential.

The Final Bell | Choosing Your Futures Prop Firm Path

So, the Topstep vs Earn2Trade matchup reveals two solid choices for futures prop firm funding.

Topstep pulls you in with that sweet 100% initial profit split and relaxed trading rules on bots via the Trading Combine®.

Earn2Trade strikes back with its educational foundation, the serious scaling potential on the Trader Career Path®, and the straightforward Gauntlet Mini™ evaluation – though with tighter consistency rules and an 80% take from the start.

Choosing means weighing their distinct evaluation styles, payout systems, and specific guidelines against your own approach. There isn't one “best” funded account; the right futures prop firm depends entirely on your journey to consistent trading and which set of rules feels like a better fit. Which partner helps you build your trading career?