Alright, pull up a chair. Thinking about jumping into a futures prop firm?

You've probably got Apex Trader Funding and Earn2Trade on your radar – hard to miss 'em, right? Both are well-known names offering traders a path to managing funded futures accounts, but they definitely don't follow the same playbook.

Getting that funded account involves different hoops to jump through depending on which one you choose; think of evaluation challenges that feel pretty distinct. Then there's the actual cost structure – what you pay and when you pay it varies, too.

Plus, what's the day-to-day really like once you're in? We're gonna unpack all that. If you're trying to figure out which path fits your trading approach better, you'll want to see how these two stack up head-to-head.

Earn2Trade vs Apex Trader Funding

Here's a quick look at how Earn2Trade vs Apex Trader Funding stack up on some of the operational details – the brokers they work with, the trading software you can use, and how you pay them and get paid. These nuts and bolts can make a difference in your day-to-day trading experience.

| Feature | Earn2Trade | Apex Trader Funding |

|---|---|---|

| Broker(s) | Works with partner proprietary trading firms like Helios and Appius Trading, who utilize introducing brokers such as EdgeClear, connecting to FCMs like Phillip Capital and Dorman Trading. | Tradovate, Rithmic |

| Platform(s) | NinjaTrader, Finamark, Rithmic R|Trader Pro, Overcharts, Quantower, Sierra Chart, Bookmap, ATAS OrderFlow Trading, Jigsaw Daytradr, MotiveWave, MultiCharts, Trade Navigator, VolFix, Inside Edge Trader, QSI-Quick Screen Trading, Photon, Investor/RT, QScalp, Scalp Tool | NinjaTrader, Tradovate, TradingView, Quantower, Jigsaw Daytradr, Sierra Chart, Bookmap, Rithmic R|Trader Pro, ATAS OrderFlow Trading, MotiveWave, VolFix, EdgeProX, Finamark, WealthCharts |

| Payment Methods | Credit/Debit Card, PayPal, Crypto | Credit/Debit Card |

| Payout Methods | Riseworks | ACH, Bank Wire Transfer |

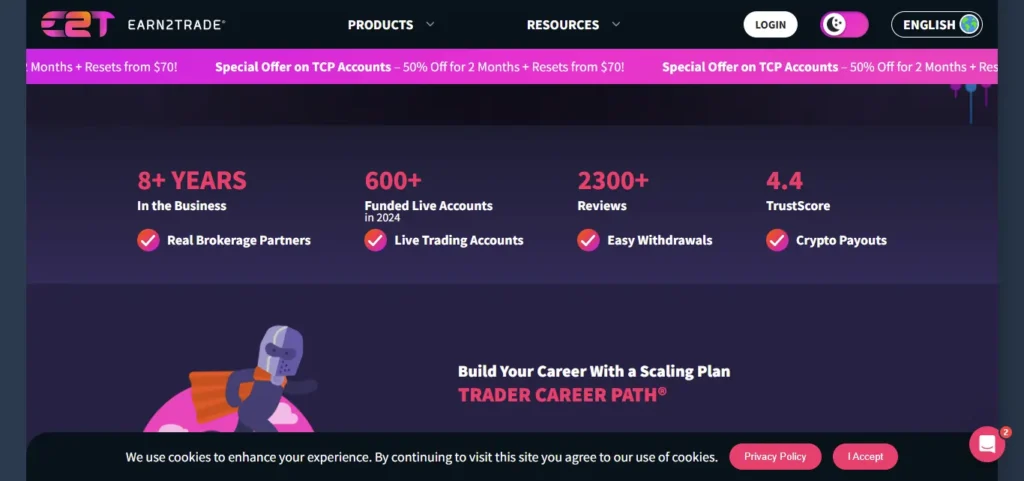

Earn2Trade: Loved by Futures Traders Globally

Since 2017, they've positioned themselves as both a trading school and a gateway to funded futures accounts, focusing on building trader knowledge first.

They offer two main paths: The Gauntlet Mini™ is a quicker, intraday futures evaluation (minimum 10 trading days) for $50k to $200k accounts, guaranteeing a funding offer upon passing. The Trader Career Path® starts with a $25k, $50k, $100k or $200k evaluation and lets successful traders grow their capital up to $400k by hitting targets.

Education is a key part of their model, with resources like a Beginner Crash Course integrated into their programs before the rule-based evaluations.

Pass an evaluation, and you could get funded by partner firms like Appius Trading or Helios Trading Partners, keeping 80% of your profits. They also emphasize straightforward withdrawals.

Earn2Trade suits traders who like a structured learning process combined with clear steps toward funding and account growth. But how does this stack up against Apex's approach? Let's keep comparing.

Upto 50% Off All Earn2Trade Programs

Apply the “FOREXPARKEY” discount code at checkout on earn2trade.com for a 10% discount on any program.

Upto 50% Off

Apex Trader Funding | Get Funded, Trade Your Way

Apex has become popular by offering a direct path to funded futures accounts, often known for good pricing and simpler rules. They're a go-to if you want to qualify and trade funded capital fast.

Their main thing is a one-step evaluation: Pick an account, hit the profit target, trade at least 7 days, and stay above the max trailing drawdown. Pass, and you get a Performance Account (PA). Key perks include allowing news trading and no daily loss limit (just the trailing one).

Why the hype? Their simple evaluation, frequent deep discounts, and a great profit split attract many traders. They focus on getting traders funded quickly post-evaluation.

Apex's model contrasts with Earn2Trade's structured, educational style. It appeals to traders ready to prove profitability fast with fewer restrictions. But is this flexibility the best fit? Let's compare them directly.

Contract Limits Compared Between ATF and E2T

How much trading firepower do you get with each firm? The maximum number of contracts you can have open at once varies quite a bit depending on the account type and size you choose. Here’s how Earn2Trade vs Apex Trader Funding stack up:

Earn2Trade Max Contracts

Earn2Trade uses a “Maximum Position Size” rule and, for the Trader Career Path, a “Progression Ladder” which means you might start with fewer contracts and access more as your account balance grows. Keep in mind, that 10 micro contracts (like MES, MNQ, etc.) typically count as just one standard contract towards these limits.

| Program | Account Size | Max Contracts Allowed (Standard) |

|---|---|---|

| Gauntlet Mini™ | $50k $100k $150k $200k | Up to 6 Up to 12 Up to 15 Up to 16 |

| Trader Career Path® | $25k $50k $100k | Up to 3 (via Progression Ladder) Up to 6 (via Progression Ladder) Up to 12 (via Progression Ladder) |

Apex Trader Funding Max Contracts

Apex generally sets a straightforward maximum contract limit per account size for their evaluations. Micros usually count directly towards the limit based on their proportion (e.g., 10 micros equal 1 mini in position size, but the total number of micros allowed scales with the mini limit). In funded accounts, there might be an initial restriction to trade half the max contracts until the drawdown threshold behaves differently.

| Program | Account Size | Max Contracts Allowed (Standard / Micros) |

|---|---|---|

| 1-Step Evaluation | $25k $50k $75k $100k $150k $250k $300k | 4 / 40 10 / 100 12 / 120 14 / 140 17 / 170 27 / 270 35 / 350 |

| 1-Step Static Drawdown | $100k | 2 / 20 |

Consistency Counts: Steady Trading Rules Compared

Both Earn2Trade vs Apex Trader Fundingwant to see consistent trading, not just one massive lucky day. However, they check for this in different ways and at different points. Let's look at how their consistency rules work.

Earn2Trade Consistency Rule

Earn2Trade uses a “Maintain Consistency” rule during both the Gauntlet Mini™ and Trader Career Path® evaluations. The idea is simple: no single trading day's profit can make up more than 30% of your total profit achieved during the test. If you have a huge day that pushes you over this 30% mark, you don't automatically fail the evaluation.

Instead, you need to keep trading and bank more profits until that big day represents less than 30% of your overall total. They put this rule in place to encourage traders to develop and stick to strategies that deliver steady results, rather than relying on infrequent, large wins. It's about showing you can perform reliably before you get funded.

Apex Consistency Rule

Apex approaches consistency from a couple of angles, primarily focused on funded Performance Accounts (PA).

If your best day makes up too much of the total profit, your payout request might be denied until you accumulate more overall profit to bring that percentage down. They even provide a formula: Your highest profit day divided by 0.3 tells you the minimum total profit needed for that payout request. This rule generally applies for the first several payouts.

While adjusting size based on market conditions or a growing account balance is generally okay, drastic, illogical changes or trying to game the system (e.g., big size early, tiny size later) can lead to payout denial or even account disqualification. They expect you to trade like a professional managing risk consistently, not like a gambler.

So, while Earn2Trade tests your profit consistency upfront as a condition to pass, Apex mainly checks profit consistency when you ask for money out and watches your position sizing habits throughout your funded trading.

Rules Rundown: How Earn2Trade vs Apex Trader Funding Differ?

Beyond the basics, the specific rules each firm enforces can really shape your trading day and strategy. Let's look at some key operational guidelines for both Earn2Trade vs Apex Trader Funding.

Earn2Trade Key Rules & Guidelines

Apex Trader Funding Key Rules & Guidelines

Payout Policies Compared

Okay, let's talk about getting paid – arguably the best part! How you actually withdraw your profits differs between Earn2Trade vs Apex Trader Funding. Here’s the breakdown:

Earn2Trade: Cashing Out Your Profits

Apex Trader Funding: Accessing Your Earnings

Common Queries Answered for E2T and ATF

Which Firm Offers a better Profit Split for Traders?

Apex lets you keep 100% of the first $25k profit per account, then 90%. Earn2Trade offers a straight 80% split from the start.

What's the main difference in getting Funded Between Apex and Earn2Trade?

Apex primarily uses a faster one-step evaluation. Earn2Trade offers one-step options (Gauntlet Mini™) and a multi-stage path focused more on learning (Trader Career Path®).

Which Prop Firm allows Trading during major News Events?

Earn2Trade generally allows news trading. Apex permits it but prohibits holding simultaneous long and short positions in the same market during the news.

How quickly can I pass the Evaluation Challenge at each Firm?

Apex requires a minimum of 7 trading days for its main evaluations. Earn2Trade requires at least 10 or 15 days, depending on the program.

How often can I request Payouts from Apex Versus Earn2Trade?

Apex allows payout requests potentially every 8 trading days (with activity rules). Earn2Trade processes payouts weekly, needing requests submitted by the prior Friday.

Which Firm has been Established Longer in the Prop Trading Space?

Earn2Trade has been operating longer, founded in 2017. Apex Trader Funding was established more recently, starting operations in 2021.

Making Your Choice | Earn2Trade vs Apex Trader Funding?

So, which futures prop firm gets your vote: Earn2Trade vs Apex Trader Funding?

As we've seen, there's no single “winner”-it really depends on what you value as a trader. Earn2Trade, established longer, offers a structured approach with programs like the Trader Career Path® and Gauntlet Mini™, emphasizing learning alongside the evaluation process.

Apex Trader Funding provides a quicker path via its popular one-step evaluation, simpler rules on things like daily drawdowns, and that attractive 100% initial profit split.

Think about your priorities: educational support versus speed to funding, specific evaluation rules, consistency requirements, payout frequency, and the profit share model. Matching these details to your trading style is key to picking the right partner for your funded account journey.