Are you a trader curious about the FundedNext payout structure? You’re in the right place!

FundedNext, a leading proprietary trading firm, offers an enticing profit-sharing model that rewards skilled traders. From Evaluation Challenge or Express Challenge to Stellar Challenge, understanding the payout system is crucial for maximizing your earnings.

In this article, we’ll explore the different account types, profit-sharing percentages, and payout frequencies of the FundedNext payout process. From the initial 15% profit share during challenge phases to the potential 90% profit split in funded accounts, we’ll cover everything you need to know about cashing in on your trading success with FundedNext.

FundedNext Payout Structures

Payouts from FundedNext are a crucial aspect of the trading experience, as they determine how much profit the trader can withdraw after trading.

The payout structure is generally designed to be transparent and rewarding, with several key features:

Buy1Get1Free Account on FundedNext

exclusive

Treat yourself with onec in an year deal on FundedNext. Use the code “BGFN” and get 1 free account on passing. Don’t Miss This Limited-Time Offer!

B1G1 Account

FundedNext Payout Methods

FundedNext offers several convenient payout methods to ensure that traders can easily access their earnings. Here are the primary methods available:

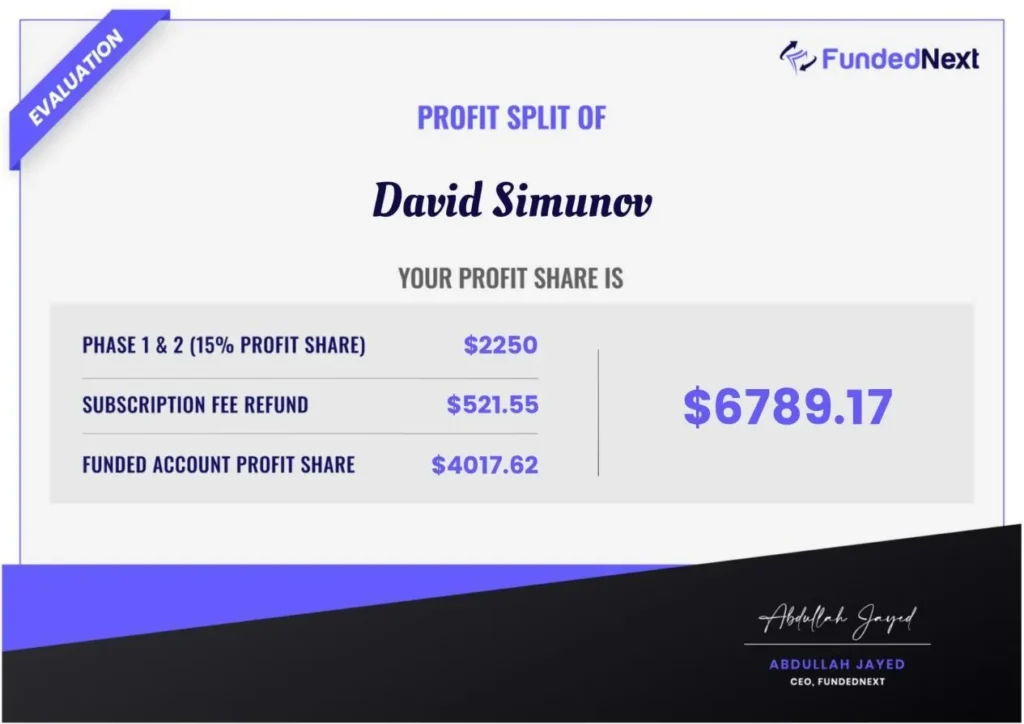

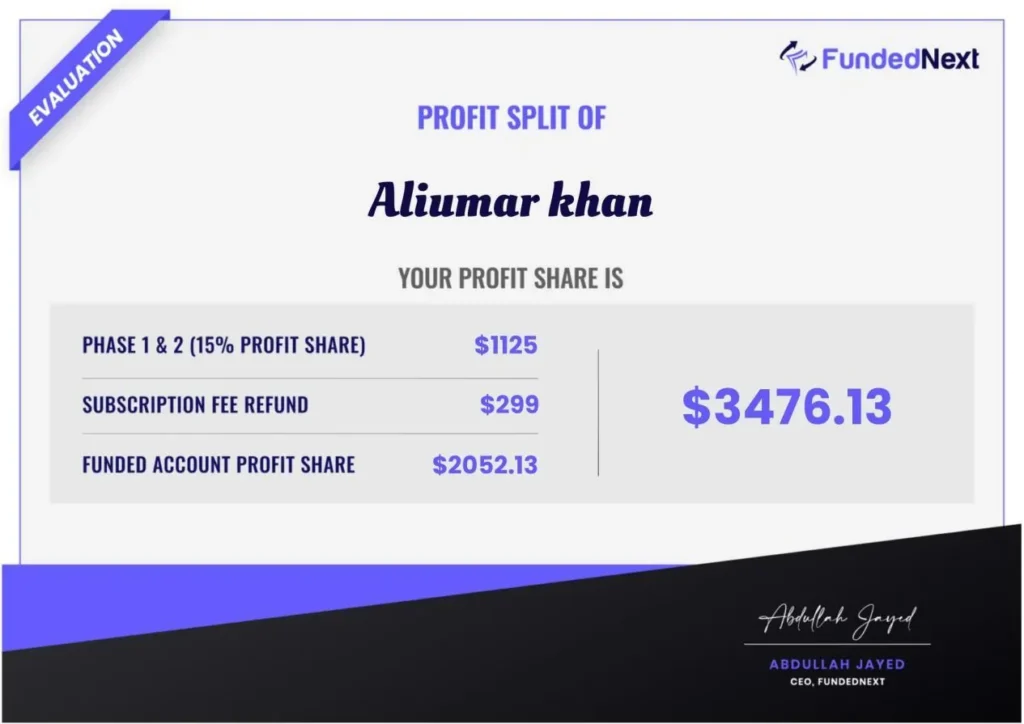

🔎 Notable FundedNext Payouts: Quick Look at the Numbers

FundedNext has made headlines in the trading community not only for its innovative funding model but also for its impressive payouts. Here, we explore some of the most notable payouts, showcasing both ends of the spectrum—largest and smallest payouts.

Largest FundedNext Payouts

Smallest FundedNext Payouts

While large payouts capture attention, smaller payouts also reflect the reality of trading and the diverse experiences of traders within the platform:

FundedNext Payout Processing Time

The processing time for payouts at FundedNext is designed to be efficient and user-friendly, ensuring that traders can access their earnings in a timely manner. Typically, once a withdrawal request is submitted, FundedNext aims to process it within 1 to 5 business days, depending on the chosen payout method.

For instance, e-wallet options like PayPal and Skrill often provide quicker processing times, with funds available almost instantly after approval. In contrast, bank transfers may take a few days longer due to standard banking procedures.

FundedNext emphasizes transparency throughout the payout process, keeping traders informed about the status of their requests via email notifications. This commitment to swift and clear communication helps to enhance the overall trading experience, allowing traders to focus on their strategies without unnecessary delays in accessing their funds.

FundedNext Payout Certificates

FundedNext offers profit split certificates as a vital feature designed to enhance transparency and provide assurance to traders regarding their earnings. These certificates serve as official documentation that confirms the successful withdrawal of profits, detailing critical information such as the payout amount, transaction date, and the trader’s account details. By issuing these certificates, FundedNext not only validates the accomplishments of its traders but also fosters a sense of professionalism and trust within the trading community.

This documentation can be particularly beneficial for traders when they need to provide proof of income for financial planning, loans, or tax purposes. Moreover, the availability of profit split certificates underscores FundedNext’s commitment to creating a transparent environment where traders can confidently manage their capital and withdrawals, reinforcing the integrity of the trading process. Overall, these certificates play a crucial role in building a trustworthy relationship between the firm and its traders, enhancing their overall trading experience.

FundedNext Profit Sharing and Scalability

FundedNext employs a profit-sharing model that not only rewards traders for their performance but also enhances scalability within their trading operations. Under this model, traders typically retain a significant percentage of the profits they generate—often ranging from 75% to 90%—which incentivizes them to maximize their trading strategies while maintaining responsible risk management. This approach not only fosters a competitive environment but also allows traders to scale their earnings as they grow more proficient.

As traders achieve higher profit levels, they can reinvest a portion of their earnings into trading larger accounts or exploring new strategies, thereby increasing their profit potential. FundedNext’s focus on scalability is evident in its tiered funding options, which enable successful traders to access progressively larger amounts of capital. This alignment of interests between FundedNext and its traders creates a mutually beneficial ecosystem where traders can thrive and the firm can grow alongside them.

Why Traders Choose FundedNext?

Traders are increasingly drawn to FundedNext for several compelling reasons. Here are the key factors that make it an attractive option:

Frequently Asked Questions

What is the FundedNext Payout model?

FundedNext operates on a profit-sharing model, allowing traders to retain 75% to 90% of their earnings.

How often can Traders Withdraw Funds from FundedNext?

Traders can typically make withdrawals monthly, depending on their performance and funding agreement.

What Payout Methods Does FundedNext Offer?

FundedNext provides several payout options, including bank transfers, PayPal, Skrill, Neteller, and cryptocurrency.

How long does it take to Process Payouts at FundedNext?

Payouts at FundedNext are processed within 1 to 5 business days, depending on the chosen withdrawal method.

Are there Minimum Payout Amounts at FundedNext?

Yes, traders can withdraw as little as $1,000, particularly beneficial for new traders refining their strategies.

What are Payout Certificates at FundedNext?

Payout certificates are official documents confirming a trader’s successful withdrawal, enhancing transparency and accountability.

Can Traders Receive Performance Bonuses at FundedNext?

Yes, FundedNext offers performance bonuses for traders who exceed their profit targets, incentivizing successful trading.

What is The Significance of Scalability in FundedNext Payouts?

Scalability allows traders to access progressively larger amounts of capital as they achieve higher profit levels, boosting earning potential.

Wrapping Up on FundedNext Payouts

FundedNext stands out as an innovative prop trading firm that offers a compelling framework for traders to access capital and optimize their trading strategies without risking their funds.

With a transparent profit-sharing model that rewards traders for their performance, the firm fosters motivation and growth within its community.

The variety of payout methods, efficient processing times, and the provision of payout certificates contribute to a seamless experience, ensuring that traders can easily and confidently access their earnings.

Furthermore, the scalability of funding options allows successful traders to grow their accounts significantly over time, paving the way for greater financial independence. By prioritizing transparency, efficiency, and trader support, FundedNext has created a robust environment where traders can thrive, making it an attractive choice for both novice and experienced traders looking to enhance their trading journeys.