Maven Trading really stays true to its name!

It is a haven for passionate traders looking for an opportunity to showcase their skills!!

Maven Trading has been making waves in the industry since its establishment!

In this comprehensive review, we'll dive deep into what makes Maven Trading stand out from the crowd.

We'll explore the firm's commitment to providing a realistic trading environment with competitive spreads and instant execution, as well as its reputation for responsive and helpful customer support.

You'll also learn about Maven's innovative scaling plan and buyback option, which demonstrate their understanding of the challenges faced by traders and their willingness to support growth.

This review will provide you with the insights you need to determine if Maven Trading is the right fit for your trading journey!

So, let's dive in and discover what makes this prop firm a top choice for aspiring funded traders!

Maven Trading Review | Unveiled

Maven Trading is a dynamic proprietary trading firm that has been making waves in the industry since its founding in 2011. Headquartered in Canada, Maven Trading is the brainchild of CEO Chris Hunter, a seasoned trader with a passion for empowering others to succeed in the fast-paced world of trading.

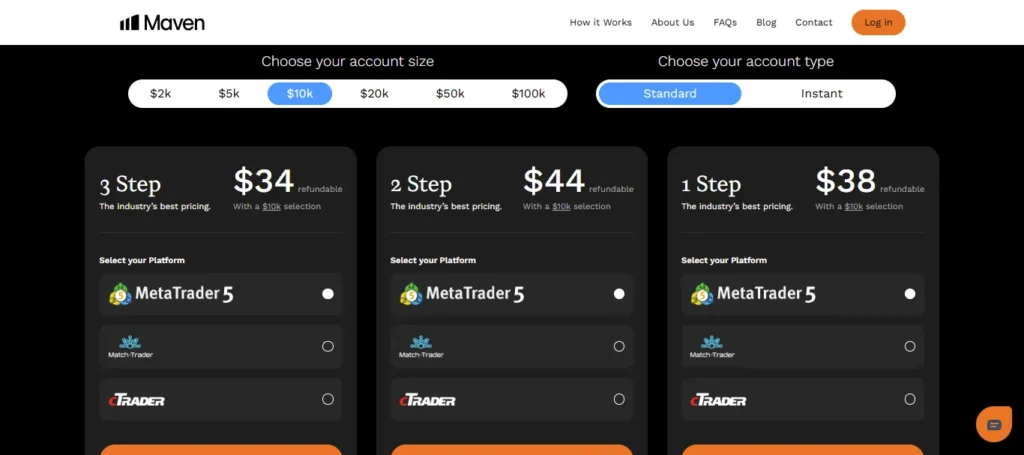

One of the standout features of Maven Trading is its range of trading challenges. The firm offers both Standard and Pro challenges, with account sizes ranging from $2,000 to an impressive $100,000. These challenges are designed to test traders' skills and risk management abilities, with profit targets of 8-9% and maximum drawdowns of 5-11%. Successful completion of a challenge grants traders the opportunity to become funded and trade with Maven's capital.

Maven Trading's success can be attributed to its focus on providing a supportive and educational environment for its traders. The firm offers an intuitive trading platform called Match-Trade, along with a wide range of educational resources to help traders expand their knowledge and hone their skills. As of 2025, Maven has paid out over $1 million to traders worldwide, a testament to the effectiveness of its approach.

| Key Information | Details |

|---|---|

| CEO | Chris Hunter |

| Key features | Funding Opportunities, Diverse Trading, Buyback feature, and Customer Support. |

| Broker | Third-Party |

| Trading Platform | MetaTrader4 and MetaTrader5 |

| Payout Split | 80-85% |

| Payouts | 5-10 days based on the Challenge |

| Daily Drawdown | 3-4% |

| Headquarters | Canada |

| Expert Advisors | Allowed |

| Max Funding | $100,000 |

| Funding Programs | Standard and Pro Challenge |

| Leverage | 75:1 |

| Weekend Holding | Allowed |

| Contact | support@maventrading.com, and a responsive Discord chat |

Maven Trading Key Features

Let’s first take a look at Maven Trading’s key features!

How to Sign Up for Maven Trading? Step-by-Step Guide

Wondering how to Sign up for Maven Trading?! Let me take you through it! (How it works)

Maven Trading Funding Programs

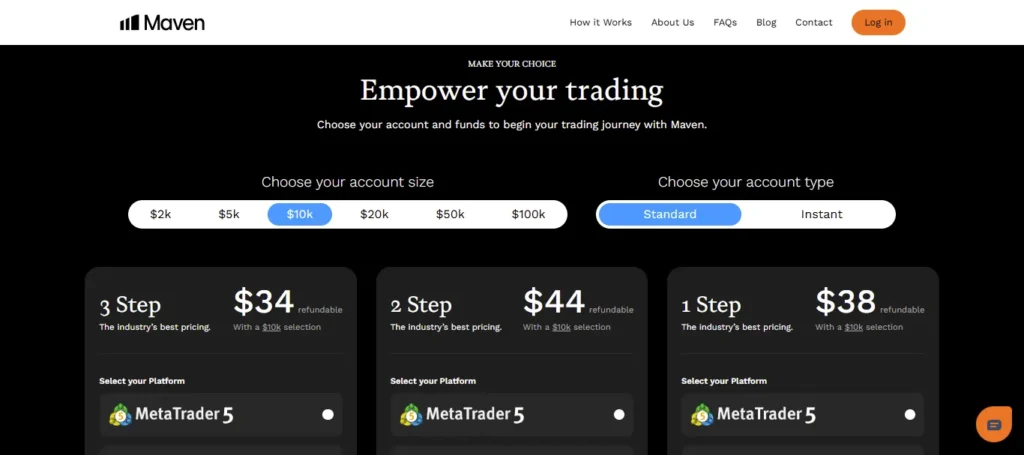

Audacity Capital offers two funding options: Standard and Pro. Both of them are further divided into 2 and 1-step challenges!

1. Standard Challenge:

Maven Trading offers a Standard Challenge in both 1-step and 2-step evaluation formats. The Standard Challenge is designed to assess traders' skills and risk management abilities before providing them with a simulated funded account. The 2-Step Challenge with its static drawdown (8%) is generally recommended over the trailing drawdown of the 1-Step Challenge (5%).

2- Step Standard Challenge

| Account Size | Price |

|---|---|

| $2,000 | $15 |

| $5,000 | $19 |

| $10,000 | $38 |

| $20,000 | $76 |

| $50,000 | $190 |

| $10,000 | $299 |

1- Step Standard Challenge

| Account Size | Price |

|---|---|

| $2,000 | $15 |

| $5,000 | $19 |

| $10,000 | $38 |

| $20,000 | $76 |

| $50,000 | $190 |

| $10,000 | $299 |

2. Pro Challenge

Maven Trading offers a Pro Challenge in both 2-step and 1-step evaluation formats. The Pro Challenge is designed for more experienced traders looking for higher profit splits and faster payouts compared to the Standard Challenge.

Like the Standard Challenge, The 2-Step Pro Challenge with its static 10% drawdown is generally recommended over the trailing 6% drawdown of the 1-Step Pro Challenge! However, experienced traders who are confident in their ability to manage risk tightly may prefer the 1-Step structure.

2- Step Pro Challenge

| Account Size | Price |

|---|---|

| $2,000 | $55 |

| $5,000 | $65 |

| $10,000 | $125 |

| $20,000 | $245 |

| $50,000 | $350 |

| $10,000 | $600 |

1- Step Pro Challenge

| Account Size | Price |

|---|---|

| $2,000 | $55 |

| $5,000 | $65 |

| $10,000 | $125 |

| $20,000 | $245 |

| $50,000 | $350 |

| $10,000 | $600 |

📌 Maven Trading Payouts

Maven Trading offers an attractive payout structure for its funded traders. Once you successfully complete the firm's trading challenge and become a funded trader, you'll be eligible for regular payouts based on your trading performance.

For those with a Standard account, Maven Trading provides an 80% profit split, meaning you get to keep 80% of the profits you generate. If you opt for a Pro account, the profit split increases to an impressive 85%! This is one of the most competitive payout ratios in the prop trading industry.

What's great about Maven is that you can request payouts every 10 days for Standard accounts and every 5 days for Pro accounts! This means you don't have to wait long to reap the rewards of your hard work. However, there is a minimum profit requirement of 1% before you can make a withdrawal request.

Maven Trading offers multiple payout methods, including Deel, Wise, and even cryptocurrency, making it convenient for traders worldwide. The maximum allocation for purchased challenges is $500k, but this can be increased up to $1 million through scaling based on your trading performance.

Does Maven Trading Partner With a Legit Broker?

So… Here’s the thing! Maven Trading partners with a Third Party Broker! However, there’s no transparency with regard to Maven Trading’s Brokerage. It seems Maven Trading works with Blueberry Markets Forex broker, but one can’t be too sure about it!

While Maven Trading aims to offer a unique prop trading opportunity, the use of an offshore broker lacking strong regulatory oversight warrants a cautious approach from prospective traders. More transparency on the broker relationship would help build trust in Maven's program.

Why Should You Choose Maven Trading over Other Prop Firms?

| Features | Maven Trading | FunderPro | FTUK | E8 Funding |

|---|---|---|---|---|

| Trustpilot Rating | 4.7/5 | 4.4/5 | 4.1/5 | 4.8/5 |

| Max Funding | 100,000 | $200,000 | 90,000 | $100,000 |

| Profit Split | Upto 85% | Upto 90% | Upto 80% | Upto 80% |

| Trading Instrument | Forex, Currencies, Indices, Commodities | Forex, Commodities, Indices, and Cryptocurrencies | Forex pairs, indices, metals, commodities, and cryptocurrencies | Forex, commodities, indices, and equities |

| Platforms and Tools | MetaTrader4 and MetatRader5 | TradeLocker | MetaTrader 4/5, TradingView | MetaTrader 5 |

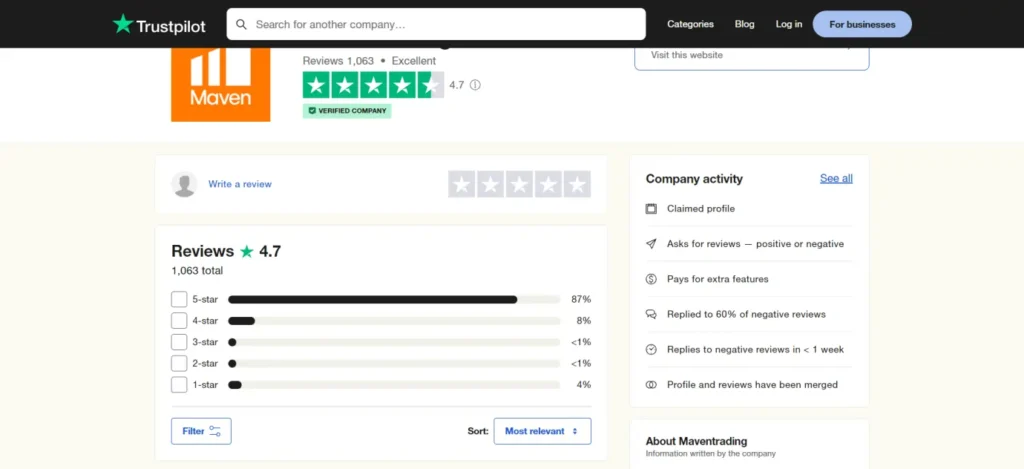

Maven Trading Ratings and Reviews on Trustpilot

Maven Trading rates a whopping 4.7 out of 5 on Trustpilot!!!

Review 1:

One thing you wouldn’t want to compromise on is customer support! And Maven Trading definitely doesn’t compromise on it!

Review 2:

Let’s consider a newbie’s perspective as well! Shall we?!

Review 3:

This user equates Maven Trading with Excellence!!!

FAQs of Maven Trading

How long has Maven Trading been in Business?

Maven Trading was established less than a year ago, under the leadership of CEO Chris Hunter.

What Tradable assets does Maven Offer?

Maven offers over 400 tradable instruments across forex, equities, crypto, commodities, and indices. Major forex pairs, gold, and stock indices like the Dow and FTSE are available.

How does the Scaling Plan work at Maven?

Maven scales the daily drawdown limit based on the current account balance (not the starting balance), allowing drawdown limits to increase as profits grow. Additional capital can also be requested after consistent profitability.

Does Maven allow Algorithmic Trading and EAs?

Yes, Maven permits the use of expert advisors (EAs), algorithmic trading, and copy trading as long as the strategies comply with the firm's rules.

How Frequently does Maven Process Payouts?

Payouts are processed every 10-14 days, with the Pro accounts having a more frequent 10-day payout cycle.

How is Customer Support at Maven?

Many users reviews praise Maven's quick, helpful customer support for resolving issues and answering questions in a timely manner.

🖇️ Final Thoughts

Maven Trading has established itself as a compelling option in the competitive world of proprietary trading firms!

The scaling plan and buyback option demonstrate Maven's understanding of the challenges faced by traders and its willingness to support their growth.

If you're a passionate trader seeking an opportunity to showcase your skills and potentially manage a funded account, Maven Trading is definitely worth considering.

While no trading platform can guarantee success, Maven provides the tools, resources, and support to help dedicated traders thrive!!!

So why not take the first step towards your professional trading career with Maven?

Sign up for a challenge today and put your strategies to the test in a simulated environment.

Don't miss this opportunity to join the Maven Trading community and take your skills to the next level!