Forex trading's popularity has surged recently. Its low entry barriers, 24-hour markets, and high liquidity create exciting opportunities for traders and investors to trade forex. However, forex is complex and risky for beginners. Reading the right forex trading books is crucial for developing the knowledge, skills, and mindset needed to trade forex.

This article provides an overview of the top 16 forex trading books to help new traders and investors succeed in 2025. These best forex trading books, from foundational technical analysis to advanced strategies, offer guidance on terminology, charting, risk management, psychology, and more, setting you up to trade forex.

These resources offer practical insights from experienced professionals, and can help you learn how to trade forex and potentially start making money. Whether you're just starting or want to level up, this list of the best forex trading books has something for every aspiring trader and investor

📚 How Did We Choose the Top Forex Trading Books For Beginners?

Selecting the top forex trading books for beginners is crucial to building a solid educational foundation. I researched over 50 top-rated books and shortlisted based on critical acclaim, best sellers status, real trader reviews, and expert recommendations.

Our panel evaluated each book on parameters like actionable trading strategies, risk management tactics, engaging style, and suitability for modern markets.

Special focus was given to forex trading books that simplify complex forex concepts for beginners using visual aids and real trading examples, so we didn't recommend any books that were too complicated.

The final forex trading books equip new traders to analyze charts, control emotions, develop winning mindsets, and achieve long-term profitability so you can start trading. So embark on your forex journey armed with practical knowledge and the proper trading volume from these invaluable guides.

Top 16 Forex Trading Books For Beginners in 2025

| Book Title | Author | Main Feature |

|---|---|---|

| Technical Analysis of the Financial Markets | John J. Murphy | Provides a foundation for understanding technical analysis. |

| Trading in the Zone | Mark Douglas | Focuses on psychology and developing the proper trading mindset. |

| The Alchemy of Finance | George Soros | Insights from a legendary trader on reflexivity and markets. |

| Market Wizards | Jack D. Schwager | Interviews with successful traders on their strategies. |

| The Black Swan | Nicholas Taleb | How to account for rare and unpredictable events. |

| Bollinger on Bollinger Bands | John Bollinger | The creator of bands explains how to use them effectively. |

| Japanese Candlestick Charting Techniques | Steve Nison | Understanding candlestick patterns for analysis. |

| Trend Following | Michael Covel | How to profitably trade trends in all markets. |

| Naked Forex | Alex Nekritin and Walter Peters | Focuses on simplicity in forex trading systems. |

| Forex for Beginners | Anna Coulling | A comprehensive introduction to Forex trading. |

| Beat the Forex Dealer | Agustin Silvani | Insider perspective on dealer behavior. |

| Forex Fundamental Analysis | FX-Chief | Practical guide to fundamental analysis. |

| The Dummy Guide to Forex Trading | John Williams | Up-to-date basics for total beginners. |

| Currency Trading for Dummies | Kathleen Brooks & Brian Dolan | Demystifies forex trading with explanations of currency pairs and indicators. |

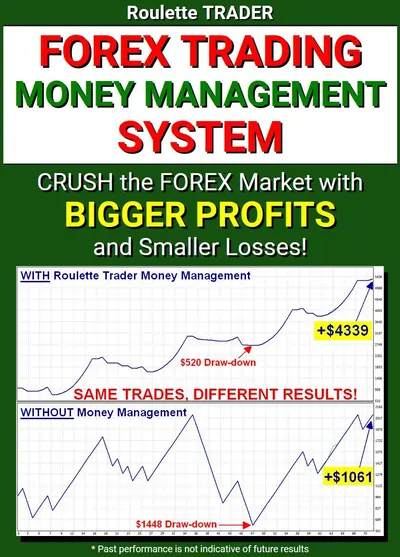

| Forex Trading Money Management System | Don Guy | Adapts probability models to forex, focusing on risk management. |

| Day Trading and Swing Trading the Currency Market | Kathy Lien | Combines algorithmic trading patterns with fundamental analysis. |

1. Technical Analysis of the Financial Markets

John J. Murphy's Technical Analysis of the Financial Markets has become an investing classic, providing the ultimate guide to understanding and profiting from technical analysis specific to forex.

Covering everything from chart patterns, trends, and indicators to trading tactics and money management, this book equips beginners with a solid foundation in the concepts of forex trading.

Key features include actionable techniques for analyzing market behaviors, real-world chart examples, guidance on computerized analysis, and tips from professional traders, helping you become a profitable trader.

With comprehensive coverage and a highly accessible writing style, Murphy's seminal work remains a must-read introduction to leverage technical analysis for successful investing. Arm yourself with practical skills and valuable insights and strategies to navigate the financial markets confidently.

Key Features of Technical Analysis of the Financial Markets

| Feature | Detail |

|---|---|

| Author | John J. Murphy. |

| Main Focus | Comprehensive foundation in technical analysis. |

| Price | $67.99 (Kindle), $110 (Hardcover). |

| Beginner Accessibility | Highly accessible writing style. |

| Key Topics | Chart patterns, indicators, Intermarket analysis, trading tactics. |

2. Trading in the Zone

Mark Douglas' seminal work Trading in the Zone delves into the psychology of trading to help you develop a winning mindset. Blending real-world examples and anecdotes with expert insights and strategies on managing emotions provides a framework to thrive under pressure.

Key features include practical tactics to build self-confidence, adapt to market conditions, overcome fear, and trade with discipline. Douglas exposes the myths that lead to financial downfalls while offering wisdom to achieve consistency, helping you learn the fundamentals.

With simple yet profound advice on establishing a competitive edge, sticking to your trading plan, and getting into the flow, this book remains an indispensable guide to master yourself before you master the markets, and understand price. It offers practical strategies and insights on why traders tend to make certain decisions.

Key Features of Trading in the Zone

| Feature | Detail |

|---|---|

| Author | Mark Douglas. |

| Main Focus | Trading psychology and developing a proper mindset. |

| Price | $10.99 (Kindle), $15 (Paperback), $65 (Hardcover). |

| Beginner Accessibility | Highly engaging and simplified writing style. |

| Key Topics | Discipline, confidence, probabilities, risk management, overcoming fear. |

3. The Alchemy of Finance

In his seminal 1987 work, legendary investor George Soros unveils his innovative Theory of Reflexivity connecting perceptions and markets.

Blending philosophy and finance, he explains how emotions shape investor behavior, creating feedback loops that drive booms and busts. Soros reveals how leveraging reflexive connections allowed him to profit against the British pound.

With insightful analysis of credit markets, macroeconomics, and more, this profound book offers timeless lessons on understanding market psychology.

Key features include Soros’s personal trading strategies, insights on bubble dynamics, and prescriptions for regulating markets. An intellectual tour de force, The Alchemy of Finance delivers eternal wisdom for navigating the financial world.

Key Features of The Alchemy of Finance

| Feature | Detail |

|---|---|

| Author | George Soros. |

| Main Focus | Theory of reflexivity in financial markets. |

| Price | $10.99 (Kindle), $15 (Paperback). |

| Beginner Accessibility | Complex ideas, aimed at advanced readers. |

| Key Topics | Reflexivity, market psychology, bubbles, regulation. |

4. Market Wizards

Legendary author Jack Schwager reveals the trading tactics, strategies, and mindsets of the world’s top traders in his investing classic Market Wizards. Through in-depth interviews, Schwager uncovers hard-won insights from superstar investors across different markets about their keys to success.

Packed with engaging anecdotes and timeless wisdom, it illuminates the psychology behind winning in the markets.

Key features include perspectives on risk management, trend following, and overcoming emotions as shared by icons like Paul Tudor Jones and Michael Marcus. Market Wizards remains a must-read guidebook for navigating the ups and downs of trading with the mindset of a master.

Key Features of Market Wizards

| Feature | Details |

|---|---|

| Author | Jack D. Schwager. |

| Main Focus | Interviews and insights from successful traders. |

| Price | $15 (paperback), $10 (Kindle). |

| Beginner Accessibility | Engaging stories suitable for beginners interested in trading philosophies. |

| Key Topics | Trading strategies, psychology, risk management. |

5. The Black Swan

In his profound 2007 work, Nassim Nicholas Taleb coined the term “Black Swan” for highly improbable events that have massive impact and seem predictable in hindsight. Exploring philosophy, history, and behavioral science, he reveals why we struggle to prepare for such extreme outliers.

Key insights include how biases blind us, technology increases black swans, and power laws better model disruption.

Offering intellectual tools to appreciate randomness, Taleb empowers readers to exploit uncertainty rather than be fragile to catastrophes. A modern classic, The Black Swan transforms how we perceive risk and human progress in an increasingly complex world.

Key Features of The Black Swan

| Feature | Detail |

|---|---|

| Author | Nassim Nicholas Taleb. |

| Main Focus | Highly improbable and unpredictable events that have massive impacts. |

| Price | $10.99 (Kindle), $15 (Paperback), $19.39+ (Hardcover). |

| Beginner Accessibility | Complex ideas and writing style, better suited for advanced readers. |

| Key Topics | Unpredictability, human bias, randomness, probability, history. |

6. Bollinger on Bollinger Bands

In his seminal 2002 work, John Bollinger – creator of the wildly popular Bollinger Bands – reveals how to leverage his namesake indicator for smarter trades. Blending theory and practice, Bollinger himself explains core concepts from calculating bands to identifying patterns.

Key features include tactics for combining bands with other indicators, adjusting for volatility, and exploiting band squeezes. With crystal-clear guidance, customizable parameters, and annotated charts, this guidebook empowers traders across assets and timeframes.

For both band basics and advanced analytics, Bollinger on Bollinger Bands remains the definitive playbook from the master technician who devised this indispensable tool.

Key Features of Bollinger on Bollinger Bands

| Feature | Detail |

|---|---|

| Author | John Bollinger. |

| Main Focus | How to effectively use Bollinger Bands. |

| Price | $10.99 (Kindle), $15 (Paperback), $38+ (Hardcover) |

| Beginner Accessibility | Highly accessible writing style. |

| Key Topics | Calculating bands, combining with indicators, trading signals. |

7. Japanese Candlestick Charting Techniques

Steve Nison's definitive guide unlocks the ancient Japanese art of candlestick charting for modern traders.

Blending centuries-old wisdom with technical analysis equips readers to identify patterns for smarter trades. Key features include tactics for combining candlesticks with indicators, adjusting for volatility, and leveraging reversals.

With engaging explanations of over 40 vital candlestick formations, Nison reveals how this visual methodology empowers you to time the market based on buyer/seller dynamics.

Packed with examples, customizable parameters, and practical guidance, this modern classic remains the ultimate handbook for harnessing candlestick charts.

Key Features of Japanese Candlestick Charting Techniques

| Feature | Detail |

|---|---|

| Author | Steve Nison. |

| Main Focus | Understanding and using candlestick charts. |

| Price | $9.99 (Kindle), $15 (Paperback). |

| Beginner Accessibility | Highly accessible writing style. |

| Key Topics | 40+ candlestick patterns, trend analysis, reversals. |

8. Trend Following

In his seminal book, Michael Covel distills the tactics of legendary traders to reveal the power of identifying and riding market trends across stocks, futures, and currencies.

Key features include insights on combining moving averages, breakouts, and other tools to design systems, wisdom on the psychology of trend discipline, and anecdotes from icons like John Henry and Ed Seykota.

Outlining a straightforward framework requiring no predictions, Covel makes the case for trend following as a strategy offering asymmetric payoffs.

Updated with contemporary data, this modern classic remains the definitive playbook for exploiting persistence in financial markets.

Key Features of Trend Following

| Feature | Detail |

|---|---|

| Author | Michael Covel. |

| Main Focus | Tactics and insights from legendary trend traders. |

| Price | $18.99 (Kindle), $15+ (Paperback). |

| Beginner Accessibility | Highly engaging stories suitable for all levels. |

| Key Topics | Trading psychology, risk management, system design. |

9. Naked Forex

In their acclaimed book Naked Forex, Traders Alex Nekritin and Walter Peters reveal how to profit using straightforward price action techniques without technical indicators.

Key features include actionable strategies like Kangaroo Tails and Belts, insider wisdom on market mechanics, and guidance for developing a trading mindset.

Whether you day trade volatile swings or target longer-term trends, Naked Forex provides the essential knowledge to identify high-probability setups.

With statistics, real trading examples, and clear explanations, this modern classic describes proven methodologies to compete successfully – even against the big players.

Key Features of Naked Forex

| Feature | Detail |

|---|---|

| Authors | Alex Nekritin, Walter Peters. |

| Main Focus | Price action trading techniques without indicators. |

| Price | $10.99 (Kindle), $15 (Paperback). |

| Beginner Accessibility | Highly accessible writing style. |

| Key Topics | Support/resistance, candlestick patterns, risk management. |

10. Forex for Beginners

Anna Coulling’s definitive guidebook covers everything beginners need to understand and succeed in forex trading. Blending trading psychology, proven strategies, and risk management, equips readers with core competencies.

Key features include actionable advice on analyzing charts, building trading plans, overcoming emotions, and selecting brokers.

Whether your goal is day trading or long-term investing, Forex for Beginners provides the essential education on market mechanics, terminology, executing orders, and basic analytics to compete in the world’s largest financial market.

Key Features of Forex for Beginners

| Feature | Detail |

|---|---|

| Author | Anna Coulling. |

| Main Focus | A comprehensive introduction to Forex trading. |

| Price | $4.99 (Kindle), $12.99 (Paperback). |

| Beginner Accessibility | Very high, written specifically for novices. |

| Key Topics | Analysis methods, trading psychology, risk management. |

11. Beat the Forex Dealer

In his hard-hitting exposé Beat the Forex Dealer, former bank trader Agustin Silvani reveals how small investors are systematically exploited by unscrupulous FX brokers. Detailing shady practices like stop-hunting, price shading, and trading against clients, he equips readers to sidestep dealer traps.

Key features include actionable strategies to counter manipulation, wisdom from successful traders, and tips for selecting ethical brokers.

While controversial, Silvani exposes real-world realities beginners face. Traders armed with this insider’s look can better fight back against dealer advantages to compete on a more level playing field.

Key Features of Beat the Forex Dealer

| Feature | Detail |

|---|---|

| Author | Agustin Silvani. |

| Main Focus | Insider perspective on unethical dealer practices. |

| Price | $15 (Paperback), $65 (Hardcover). |

| Beginner Accessibility | High, exposes realities of retail trading. |

| Key Topics | Dealer manipulation tactics, trading strategies, psychology. |

12. Forex Fundamental Analysis

FX-Chief’s definitive guidebook demystifies forex fundamental analysis for novice traders. Blending trading psychology with economic concepts builds core competencies. Key features include interpreting news events, analyzing economic indicators, and incorporating fundamentals into a trading plan.

Whether your strategy relies on technicals or pure fundamentals, Forex Fundamental Analysis provides indispensable education on global macroeconomics.

Traders armed with this practical knowledge can better gauge currency valuation and spot profitable opportunities.

Key Features of Forex Fundamental Analysis

| Feature | Detail |

|---|---|

| Author | FX-Chief. |

| Main Focus | Practical guide to fundamental analysis. |

| Price | $19.99 (Kindle), $29.99 (Paperback). |

| Beginner Accessibility | Likely high if focused on fundamentals. |

| Key Topics | Economic indicators, news events, trading psychology. |

13. The Dummy Guide to Forex Trading 2024-2025

As forex trading surges in popularity among retail investors, many beginners feel overwhelmed navigating this complex marketplace. The Dummy Guide to Forex Trading 2024-2025 offers a simplified roadmap for new traders seeking to profit from currency price movements.

Key features include step-by-step tutorials on technical and fundamental analysis, risk management wisdom from seasoned professionals, and actionable strategies for both short and long-term timeframes.

Written clearly without complex jargon, this handbook provides indispensable education on core competencies to capitalize on the world’s largest financial market this year.

Key Feature of The Dummy Guide to Forex Trading

| Feature | Detail |

|---|---|

| Author | John Williams . |

| Main Focus | Simplified forex education for total beginners. |

| Price | $2.99 (Kindle). |

| Beginner Accessibility | Very high, written specifically for novices. |

| Key Topics | Analysis methods, trading strategies, risk management. |

14. Currency Trading for Dummies

Currency Trading for Dummies by Kathleen Brooks & Brian Dolan remains a best-selling primer for forex traders, breaking down complex concepts like currency pairs and market psychology into digestible insights.

Its practical approach aligns with strategies forex traders use daily, making it a staple for mastering foundational skills across popular forex trading books platforms.

The 2025 edition sharpens its focus on modern challenges, analyzing post-pandemic market shifts and crypto-forex interplay through updated case studies.

These real-world scenarios help beginners contextualize economic indicators and central bank policies, bridging theory with execution on live trading platforms. Praised for its actionable framework, the book integrates QR codes linking to interactive trading simulations used by professionals. Authors Brooks and Dolan combine decades of market experience to deliver tools tailored for forex trading platforms, cementing this guide’s status as a best-selling roadmap for turning theoretical knowledge into executable strategies.

Key Feature of Currency Trading for Dummies

| Feature | Detail |

|---|---|

| Author | Kathleen Brooks & Brian Dolan. |

| Main Focus | Foundational forex/CFD concepts. |

| Price | $24.99 (Paperback), $14.99 (Kindle). |

| Beginner Accessibility | Simplified explanations with visual aids. |

| Key Topics | Currency pairs, leverage, central bank policies, CFD rollovers. |

15. Forex Trading Money Management System

Forex Trading Money Management System by Don Guy is a risk-centric manual that applies probability models to the forex market, teaching traders to manage positions with precision.

This approach offers beginners looking to safeguard their capital a system for approaching the forex market with calculated strategies.

The 2025 revision incorporates advanced tools, including AI-powered risk calculators and live portfolio tracking, enhancing traditional risk management techniques.

By utilizing these cutting-edge resources, even those with a nascent understanding of the forex market can gain insights into mitigating potential losses. Guy’s guide is aimed at traders who want the basics explained in simple terms to grasp position sizing and risk-reward ratios. It transforms the complexities of the forex market into manageable concepts, making it an invaluable resource for beginners looking for a protective strategy.

Key Features of Forex Trading Money Management System

| Feature | Detail |

|---|---|

| Author | Don Guy. |

| Main Focus | Mathematical risk management. |

| Price | $19.99 (eBook), $29.99 (Hardcover). |

| Beginner Accessibility | Requires basic math comprehension. |

| Key Topics | Position sizing, probability grids, volatility-adjusted lot sizes. |

16. Day Trading and Swing Trading the Currency Market

Day Trading and Swing Trading the Currency Market by Kathy Lien, now in its 4th edition, is considered one of the foremost forex trading books, blending algorithmic patterns with fundamental analysis for a hybrid strategy.

This comprehensive guide equips traders with the knowledge to navigate both day trading and swing trading in the currency market and trading CFDs.

The 2025 update introduces machine learning-enhanced technical indicators and ESG-focused currency analysis, reflecting Lien's commitment to evolving with market trends.

Traders gain access to cutting-edge tools that refine decision-making processes for both short-term and long-term investments in the forex arena. Lien presents complex concepts in an easy-to-understand manner, making this a comprehensive guide that is accessible to a broad audience. The book enables traders to approach the currency market and trading CFDs with a holistic perspective, solidifying its position among the top forex trading books.

Key Features of Day Trading and Swing Trading the Currency Market

| Feature | Detail |

|---|---|

| Author | Kathy Lien. |

| Main Focus | Technical/fundamental fusion strategies. |

| Price | $39.99 (eBook), $59.99 (Hardcover). |

| Beginner Accessibility | Moderate (requires charting basics). |

| Key Topics | Order flow analysis, correlation matrices, news trading algorithms. |

How Forex Trading Books Can Help in Your Trading Psychology?

Forex trading books provide invaluable insights into the psychological aspects of trading. As highlighted in “Trading in the Zone“, developing strong emotional discipline is critical for long-term success as you begin your forex trading journey. Books teach techniques like meditation, visualization, and positive self-talk to control reactions to market volatility and give you the tools needed to navigate the market with confidence.

Additionally, having a detailed trading plan outlined in books to learn helps maintain focus amid turbulence by defining entry/exit methods, position sizing, and risk management.

Books also emphasize cultivating a growth mindset centered on consistency and continuous improvement. By tracking performance and tweaking advanced trading strategies, traders overcome frustrations during drawdowns. Furthermore, as Brett Steenbarger discusses in “The Psychology of Trading“, books to learn offer practical strategies for managing emotions, governing greed/fear, and developing mental toughness in order to help navigate the market with confidence.

FAQS Related to Forex Trading Books For Beginners

What are the Best Forex Trading Books for Beginners in 2025?

Top picks include Forex for Beginners (Anna Coulling) and Currency Trading for Dummies, covering technical analysis, currency pairs, and risk management basics for new traders.

Which Forex Books Focus on Risk Management and Trading Psychology?

Trading in the Zone (Mark Douglas) and Forex Trading Money Management System teach emotional discipline, position sizing, and probability models to avoid common trading mistakes.

How do Forex Trading Books help Master Technical Analysis?

Books like Technical Analysis of Financial Markets (John Murphy) and Japanese Candlestick Charting decode chart patterns, Bollinger Bands, and price action strategies for market analysis.

Are there Books Combining Fundamental and Technical Forex Analysis?

Kathy Lien’s Day Trading and Swing Trading the Currency Market merges economic indicators with algorithmic patterns for hybrid strategies in volatile markets.

Where can I buy these Top Forex Trading Books?

These books are available on Amazon, Barnes & Noble, Kobo, Audible, Apple Books, and other major online book retailers. Many offer instant digital downloads. Used print copies may also be available.

What Format are these Books Available in – Digital, Print, Audio?

The books are available in print (paperback and hardcover), Kindle, and other digital ebook formats, and some as audiobooks on Audible/Amazon. Digital formats may be lower cost.

Should I Read all 16 Books as a Beginner?

It's not necessary to read all 16 books as a total beginner. Good options to start with are Trading in the Trading in the Zone, Day Trading and Swing Trading the Currency Market, or Forex for Beginners. Read reviews and pick 1-2 focused on your learning goals.

📚 Wrapping Up on Forex Trading Books

This definitive list of the top forex trading books equips new traders with education from legendary authors. Spanning technical and fundamental analysis, proven strategies, psychology tactics, risk management wisdom, and insights from professional traders, these indispensable guides build core competencies.

Whether your goal is day trading or long-term investing, this reading list offers beginners a solid foundation. As you embark on your forex journey in 2025, arm yourself with knowledge from these classics. And remember, learning never stops for successful traders – keep reading to continually improve your skills.