Check out my Fidelcrest review sharing my overall experience around this well-known prop firm!

Fidelcrest emerges as a distinctive figure in the proprietary trading firm landscape, offering a unique proposition for experienced traders. Established in 2018 and based in Cyprus, Fidelcrest has carved a niche for itself by providing virtual accounts that can be converted into real accounts, allowing traders to leverage Fidelcrest's funds for trading.

This innovative approach not only opens up new avenues for traders to amplify their trading strategies but also underscores Fidelcrest's commitment to fostering trading talent across the globe.

The firm offers a range of account types, including Pro and Micro accounts, tailored for trading currency pairs and CFDs on a variety of assets such as stocks, indices, metals, and commodities through the MT4 terminal.

This flexibility caters to the diverse needs and preferences of traders, ensuring that there is something for everyone. The minimum funding provided by Fidelcrest starts at $10,000, stretching up to a substantial $2 million, which is a testament to the firm's robust financial backing and its confidence in its traders' abilities.

Starting Off the Fidelcrest Review

| Aspect | Detail |

|---|---|

| Establishment | 2018 |

| Location | Cyprus |

| Unique Offering | Virtual accounts that can transition into real accounts |

| Trading Capital Range | $10,000 to $2 million |

| Account Types | Pro Trader and Micro Trader account for trading currency pairs and CFDs on assets like stocks, indices, metals, and commodities. |

| Trading Platform | MT4 terminal |

| Assessment Process | Traders must pass an assessment process to access Fidelcrest's funds |

| Education Collaboration | Collaboration with NeuroStreet Trading Academy for simulation training |

| Regulatory Status | Not a brokerage firm and does not hold clients' money, hence not licensed by financial regulators |

| Customer Feedback | Generally positive on platforms like Trustpilot, praising customer service and trading experience |

| Considerations | Operations such as trading order execution and fund withdrawals are not directly regulated |

Key Highlights of Fidelcrest👑

- Fidelcrest is a proprietary trading firm established in 2018, based in Cyprus, offering a unique model where virtual accounts can become real accounts.

- The firm provides traders with the opportunity to trade with its funds, starting from $10,000 to $2 million.

- Traders can trade currency pairs and CFDs on various assets through the MT4 terminal with Pro and Micro account options.

- Fidelcrest requires traders to pass an assessment process to ensure quality and risk management.

- The firm collaborates with NeuroStreet Trading Academy for simulation training, emphasizing trader education.

- Fidelcrest is not a brokerage firm and does not hold clients‘ money, hence it is not licensed by financial regulators.

- Operations such as trading order execution and fund withdrawals are not directly regulated, which may be a concern for some traders.

- Customer feedback on Trustpilot is generally positive, praising Fidelcrest's customer service and trading experience.

- Fidelcrest's innovative approach and positive trader feedback make it a noteworthy option for experienced traders.

Models Offered by Fidelcrest

Fidelcrest provides two main trading programs for traders:

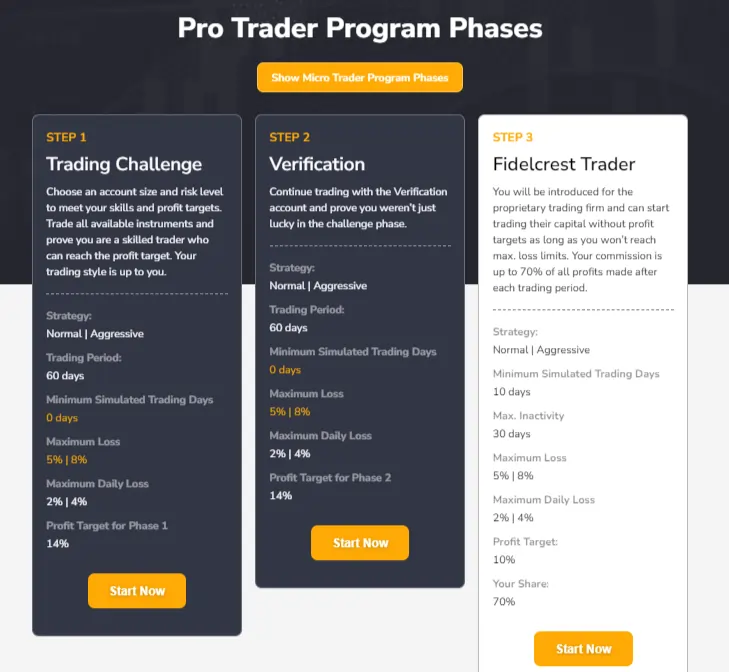

Fidelcrest Pro Trader Program

- Pro Trader Normal: Offers a starting capital of $250,000 with normal risk parameters.

- Pro Trader Aggressive: Provides a higher risk option with the potential for larger capital.

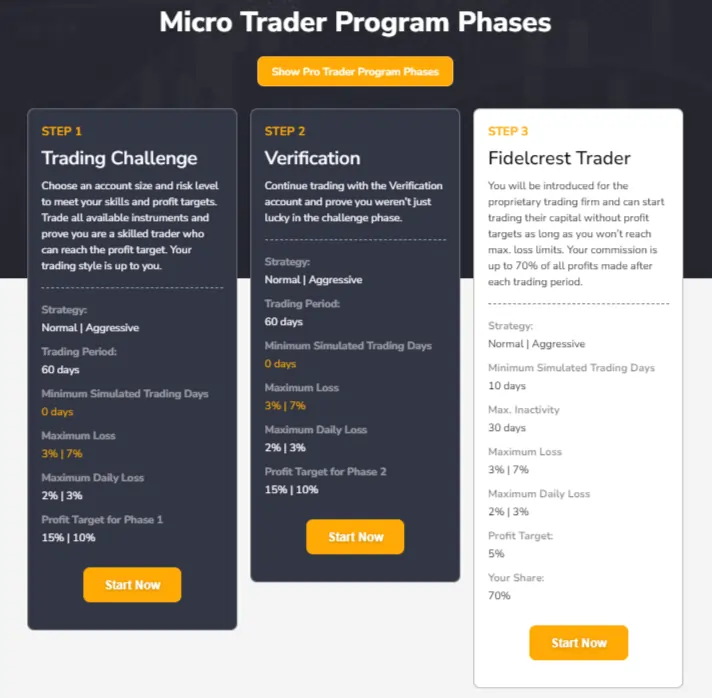

Fidelcrest Micro Trader Program

- Micro Trader Normal: Designed for traders to test their skills and strategy with smaller account sizes before moving to larger accounts.

- Micro Trader Aggressive: A two-step evaluation account that, upon completion, awards a funded account with no profit targets but with strict loss rules.

Both programs require traders to pass through an evaluation process that includes multiple phases:

Phase 1: Traders take the Fidelcrest Challenge and must meet a profit target of 5% for both Phase 1 and Phase 2.

Phase 2: Verification for the funded account to start earning real money.

Phase 3: The professional stage where traders are eligible for a better profit share.

Traders can choose between different risk levels, account sizes, and bonus options. The trading platform used is the MetaTrader 4 (MT4) terminal, and the leverage offered is up to 1:100.

Pricing Details of Fidelcrest Models

Fidelcrest offers a variety of account sizes and programs for traders, each with a one-time setup fee. Here are the pricing details for their Micro Trader and Pro Trader programs:

Micro Trader Program

- $10,000 Account: €99 fee

- $15,000 Account: $99 fee

- $60,000 Account: $299 fee

Pro Trader Program

- $250,000 Account:

- Normal Risk: $999 fee

- Aggressive Risk: $1,999 fee

- $500,000 Account:

- Normal Risk: $1,899 fee

- Aggressive Risk: $3,499 fee

- $1,000,000 Account:

- Normal Risk: $2,999 fee

- Aggressive Risk: Not available for the aggressive account.

Additional Information

- Profit splits range from 80% to 90%, depending on the account type.

- There are no recurring charges, only the one-time setup fee.

- Traders can opt for bonuses such as doubling their capital or receiving a second chance for free if they fail the first challenge phase.

- The trading period for the Fidelcrest Challenge is typically 30 days.

- Withdrawal options include bank transfer, PayPal, PaySafe, and Bitcoin.

Getting Funded with Fidelcrest | Step-by-Step Guide

To become a funded trader with Fidelcrest, a proprietary trading firm, you must go through a comprehensive evaluation process. Here's a step-by-step guide:

- Register an Account: Start by creating a Fidelcrest trading account and complete the registration process.

- Choose a Plan: Select from the various trading programs offered by Fidelcrest, such as the Pro Trader Program or Micro Trader Program, each with different risk levels and capital sizes.

- Pass the Evaluation Process: Fidelcrest evaluates traders based on their skills and experience. You will need to pass their evaluation process, which includes meeting profit targets and adhering to risk management rules.

- Get Funded: If your evaluation and trading plan are approved, Fidelcrest will provide you with funding to trade. The amount of funding can be up to $400,000, depending on the program and your performance.

- Trade and Grow Your Account: Use the Fidelcrest-funded trading account to trade and grow your account. Your performance will be monitored, and the funding amount may be adjusted based on your results.

- Profit and Capital Raise: As a funded trader, you can keep a significant share of the profits. Fidelcrest also offers a capital raise of 25% every three months, provided you meet certain criteria, such as not exceeding a 5% daily loss and securing a 15% profit over three months.

The minimum number of trading days to become funded is one, but traders have 30 days to meet the requirements. It's important to note that becoming a funded trader with Fidelcrest is competitive, and not all applicants will be approved.

Trading Conditions of Fidelcrest

Fidelcrest, a proprietary trading firm, offers traders the opportunity to trade with its capital after passing a comprehensive evaluation process. Here are the key trading conditions and features of Fidelcrest's programs:

- Trading Challenge Period: Traders have a period of 30 calendar days to meet the profit targets set by Fidelcrest.

- Minimum Trading Days: The requirement for minimum trading days varies depending on the account and program. For some accounts, traders must trade for at least 10 days within the 30-day period. while for others, there is no minimum trading day requirement.

- Profit Targets: Traders must meet specific profit targets during the evaluation phase. The targets are set as a percentage of the initial capital and differ between the Micro Trader and Pro Trader programs.

- Maximum Daily Loss: There is a maximum daily loss limit that traders cannot exceed. If this limit is breached, the trader may fail the evaluation.

- Overall Drawdown Limit: Traders must also adhere to an overall drawdown limit, which is a percentage of the initial capital. Exceeding this limit can result in failing the test.

- Trading Platform: Fidelcrest uses the MetaTrader 4 (MT4) terminal for trading.

- Tradable Instruments: Traders can trade a variety of instruments including currency pairs, and CFDs on stocks, indices, metals, commodities, and cryptocurrencies.

- Profit Share: Traders can earn up to 80-90% of the profits made after each trading period.

- Risk Management: All trading activity is monitored in real-time to ensure adherence to risk restrictions and guidelines.

- Regulatory Status: Fidelcrest is not regulated as it is not a brokerage firm and does not hold clients' money.

Pros and Cons of Fidelcrest 👀

Pros

Cons

FAQs Related to Fidelcrest

What is Fidelcrest?

Fidelcrest is a proprietary trading firm that offers traders the opportunity to trade with its capital after passing a comprehensive evaluation process. It was established in 2018 and is based in Cyprus.

How can I start trading with Fidelcrest?

To start trading with Fidelcrest, you need to register an account, choose a trading program, pass the evaluation process, and then you will be provided with funding to trade.

What types of accounts does Fidelcrest offer?

Fidelcrest offers Pro and Micro Trader programs with different risk levels and capital sizes, catering to a variety of trading preferences.

What is the profit split with Fidelcrest?

Fidelcrest offers a profit split of up to 90%, which is among the highest in the industry.

Does Fidelcrest provide educational resources?

Fidelcrest collaborates with NeuroStreet Trading Academy for simulation training, but there is a noted absence of other educational and informative materials.

Is Fidelcrest regulated?

Fidelcrest is not a brokerage firm and does not hold clients' money, hence it is not licensed by financial regulators. However, this might be a consideration for some traders regarding the security of their funds.

How can profits be withdrawn from Fidelcrest?

Profits can be withdrawn from Fidelcrest through various methods including bank transfer, PayPal, PaySafe (Skrill, Neteller), or Bitcoin.

Concluding the Fidelcrest Review

In conclusion, Fidelcrest stands out in the proprietary trading firm industry with its innovative model that allows traders to start with virtual accounts and transition to real accounts, using the firm's capital to trade.

With a high-profit split of up to 90%, a range of account sizes, and a rigorous two-phase evaluation process, Fidelcrest offers a competitive environment for traders.

While the firm's lack of direct regulation and the absence of educational materials may be drawbacks for some, the positive customer feedback, particularly regarding customer service and trading conditions, speaks volumes about its reliability.

Traders considering Fidelcrest should weigh these pros and cons, along with the firm's transparent trading conditions and the potential for significant capital backing, to determine if it aligns with their trading goals and risk appetite.