Welcome to our in-depth CapitalXtend Review! If you're a trader looking for a reliable forex broker, you've come to the right place. CapitalXtend has been making waves in the trading community with its competitive spreads, robust trading platforms, and diverse financial instruments.

Founded in 2020, this broker has quickly gained traction among traders worldwide. With over 30,000 active trading accounts and a presence in multiple countries, CapitalXtend aims to provide a seamless trading experience. Whether you're trading forex, cryptocurrencies, or CFDs, CapitalXtend offers the tools and resources you need to succeed.

📈 CapitalXtend Overview

CapitalXtend is a forex broker that offers online trading services in various financial instruments, including currencies, and CFDs on gold, oil, shares, and stocks. The company provides a range of trading platforms, including MetaTrader 4, and offers leverage of up to 1:1000. CapitalXtend is registered in Saint Vincent and the Grenadines and has a minimum deposit requirement of $100.

Overall, CapitalXtend appears to be a legitimate forex broker that offers a range of trading services and platforms. However, potential clients should carefully review the company's terms and conditions, as well as user reviews, before making a decision.

📅 Founding Year and Background: CapitalXtend was established in 2020, making it a relatively new entrant in the forex trading industry. Despite its recent inception, the company has quickly built a reputation for offering a comprehensive trading experience. CapitalXtend operates as an offshore financial service provider, with its base in Saint Vincent and the Grenadines.

👉 Regulatory Status and Jurisdictions: One crucial aspect to consider when choosing a forex broker is its regulatory status. As of now, CapitalXtend is not regulated by any major financial authority. However, the broker is a member of the Financial Commission, an independent self-regulatory organization.

This membership provides traders with access to a compensation fund of up to €20,000 per claim, ensuring an additional layer of security and dispute resolution services.

🎯 Target Markets and Prohibited Countries: CapitalXtend caters to a global audience, offering its services in multiple languages, including English. However, there are certain regions where the broker does not operate. These prohibited countries include Canada, Japan, the United States, and Saint Vincent and the Grenadines. Traders from these regions will need to look for alternative brokers.

Key Facts and Figures

Here are some key statistics that highlight Capitalxtend's market presence:

Web Traffic and Popularity

CapitalXtend has a significant online presence, with a total of 74,197 monthly visits to its website. The broker ranks 147 out of 815 forex brokers in terms of organic traffic. This high level of engagement indicates a strong interest and trust among traders.

Trading Platforms and Tools

| Platform | Versions Available | Key Features | Additional Tools |

|---|---|---|---|

| MetaTrader 4 (MT4) | Desktop, Mobile, WebTrader | – Real-time pricing- Advanced charting tools- Technical indicators- Automated trading capabilities | – Mobile app for trading on-the-go |

| MetaTrader 5 (MT5) | Desktop, Mobile, WebTrader | – Advanced charting- A wider range of technical indicators- Multi-asset trading (forex, CFDs, stocks, futures) | – Mobile app with robust charting capabilities |

Account Types and Trading Conditions

CapitalXtend offers four account types to suit different trading styles and budgets:

| Account Type | Minimum Deposit | Spreads (minimum) | Leverage |

|---|---|---|---|

| Standard | $100 | $30 | 1:5,000 |

| ECN | $500 | $16 | 1:5,000 |

| Pro-ECN | $10,000 | $2 | 1:5,000 |

| Platinum | $25,000 | $2 | 1:500 |

Financial Instruments

CapitalXtend offers a diverse range of financial instruments, making it a versatile platform for traders. With access to over 350 tradable assets, traders can explore various markets and instruments, including:

Here's a quick overview of the financial instruments available:

| Instrument Type | Examples |

|---|---|

| Forex Currency Pairs | EUR/USD, GBP/USD, USD/JPY |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) |

| CFDs on Stocks | Apple, Google, Amazon |

| Indices | S&P 500, NASDAQ, FTSE 100 |

| Commodities | Gold, Silver, Brent Crude Oil, WTI |

CapitalXtend's extensive range of instruments allows traders to diversify their portfolios and capitalize on various market opportunities.

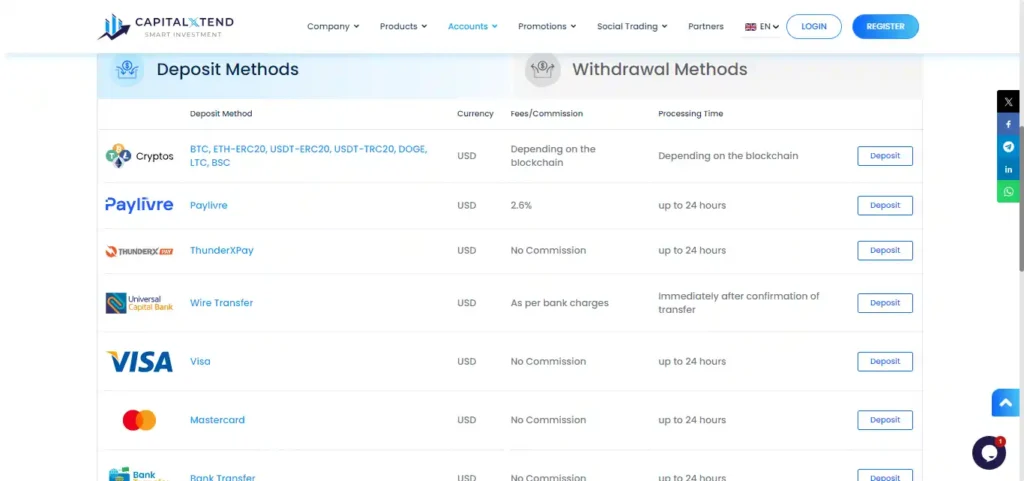

Deposits and Withdrawals

CapitalXtend provides a range of convenient payment methods for deposits and withdrawals, ensuring a smooth trading experience for its clients.

Deposit Methods

The minimum deposit required to open a live trading account with CapitalXtend is $100, making it accessible for traders with various budget levels.

Withdrawal Methods

To ensure the security of funds, only verified clients of the broker can withdraw their profits. CapitalXtend processes withdrawal requests within 24-72 hours, providing a relatively quick turnaround for traders looking to access their funds.

However, it's important to note that withdrawal fees may apply when using certain methods, such as Paylivre and crypto wallets. As a trader, it's essential to factor in these potential costs when planning your transactions.

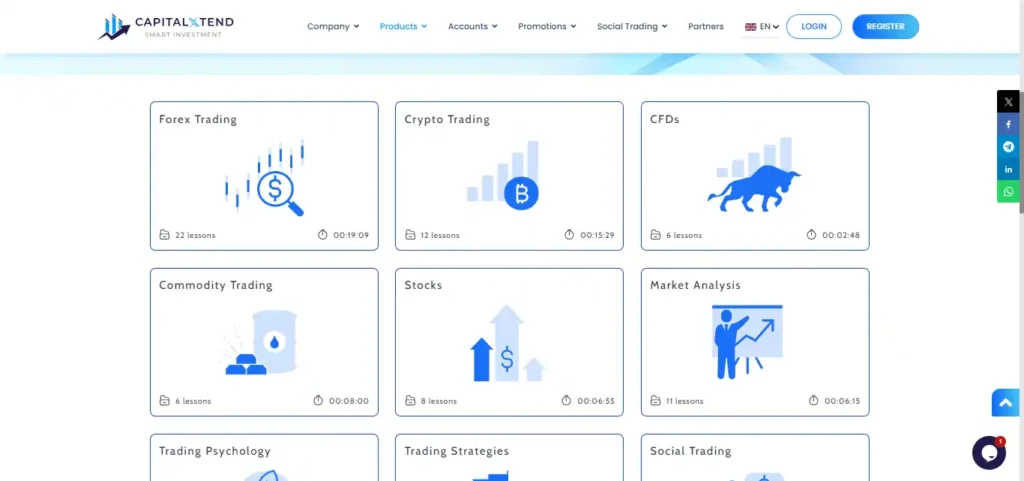

Educational Resources

CapitalXtend provides a wealth of educational materials to help traders improve their skills and knowledge:

Video Tutorials: A comprehensive library of video tutorials covers topics such as:

- Articles and Guides: In-depth articles and guides offer insights into various trading strategies, market analysis, and risk management techniques.

- Webinars: Regular webinars hosted by industry experts provide an interactive learning experience, allowing traders to ask questions and gain valuable insights.

- Demo Accounts: CapitalXtend offers demo accounts, enabling traders to practice their strategies and familiarize themselves with the trading platforms risk-free.

By providing a combination of video tutorials, written content, webinars, and demo accounts, CapitalXtend ensures that traders have access to the resources they need to continually improve their skills and make informed trading decisions.

Pros and Cons

As with any broker, CapitalXtend has its strengths and weaknesses. Let's examine the key advantages and potential drawbacks of trading with them:

Pros

Cons

Awards and Recognition

| Award | Organization | Year | Description |

|---|---|---|---|

| Best CFD Broker Asia | World Economic Magazine | 2022 | Recognized for delivering superior and innovative online forex trading services, competitive trading conditions, multiple account types, and a wide range of financial instruments |

| Best ECN Broker PAN Asia | World Economic Magazine | 2021 | Acknowledged for its excellence in services and superior products as a forex broker |

| Best Standard & ECN Broker | FXDailyInfo | 2021 | Awarded for its outstanding performance in providing both standard and ECN account types |

| Most Trusted Broker | FXDailyInfo | 2021 | Recognized for its reliability and trustworthiness in the forex trading industry |

These awards highlight CapitalXtend's efforts to revolutionize the global financial sector and provide innovative solutions to traders. The recognition from independent organizations like World Economic Magazine and FXDailyInfo adds credibility to the broker's reputation.

🔗 Conclusion

Throughout this comprehensive CapitalXtend review, we've explored the various aspects of this relatively new forex broker. While it offers a diverse range of tradable assets, competitive account types, and user-friendly trading platforms, it's crucial to consider both the strengths and potential drawbacks before making a decision.

CapitalXtend has undoubtedly made strides in the industry, as evidenced by the numerous awards it has received. However, it's essential to note that user experiences vary, with some traders expressing satisfaction with the broker's services while others have raised concerns about account types and customer support.

If you're considering CapitalXtend as your forex broker, we recommend the following: