Funding Pips stands out as a notable Forex prop firm, creating distinct funding challenges and presenting fresh 2025 trading opportunities for traders worldwide.

Situated in Dubai, UAE, and guided by CEO Khaled Ayesh, the company has gained attention for its approach to trader evaluation. It offers three specialized evaluation models – built to identify trading proficiency through structured assessments, providing clear paths for traders aiming for simulated funding.

10% Off Funding Pips Coupon Code

Limited Period

Access limited discount of around 10% on Funding Pips challenges using the code “fundingpips10“.

Save 10%

Funding Pips Challenges Overview

Funding Pips offers a range of trading challenges designed for all experience levels, including the Funding Pips Zero, Funding Pips Pro, and Funding Pro Challenge. These challenges allow traders to access up to $300,000 in simulated capital and earn up to 100% rewards, with no reward denials.

Each challenge features flexible reward cycles—weekly, bi-weekly, or monthly—and is accessible on popular platforms like MetaTrader 5, Match-Trader, and cTrader. The evaluation process is tailored to suit different trading styles, with strict risk management rules: a maximum daily loss of 5%, overall maximum loss of 10%, and profit targets ranging from 5% to 8%, depending on the challenge stage.

Funding Pips Evaluation Models

Funding Pips offers traders several evaluation paths in 2025, recognizing that different individuals benefit from varied approaches. Aspiring funded traders can select from three unique funding challenges: the direct-access FundingPips Zero, the single-phase 1-Step evaluation, or the progressive 2-Step program.

Each model features distinct guidelines, profit expectations, and payout arrangements, providing adaptable options suited for traders with differing experience and trading methods.

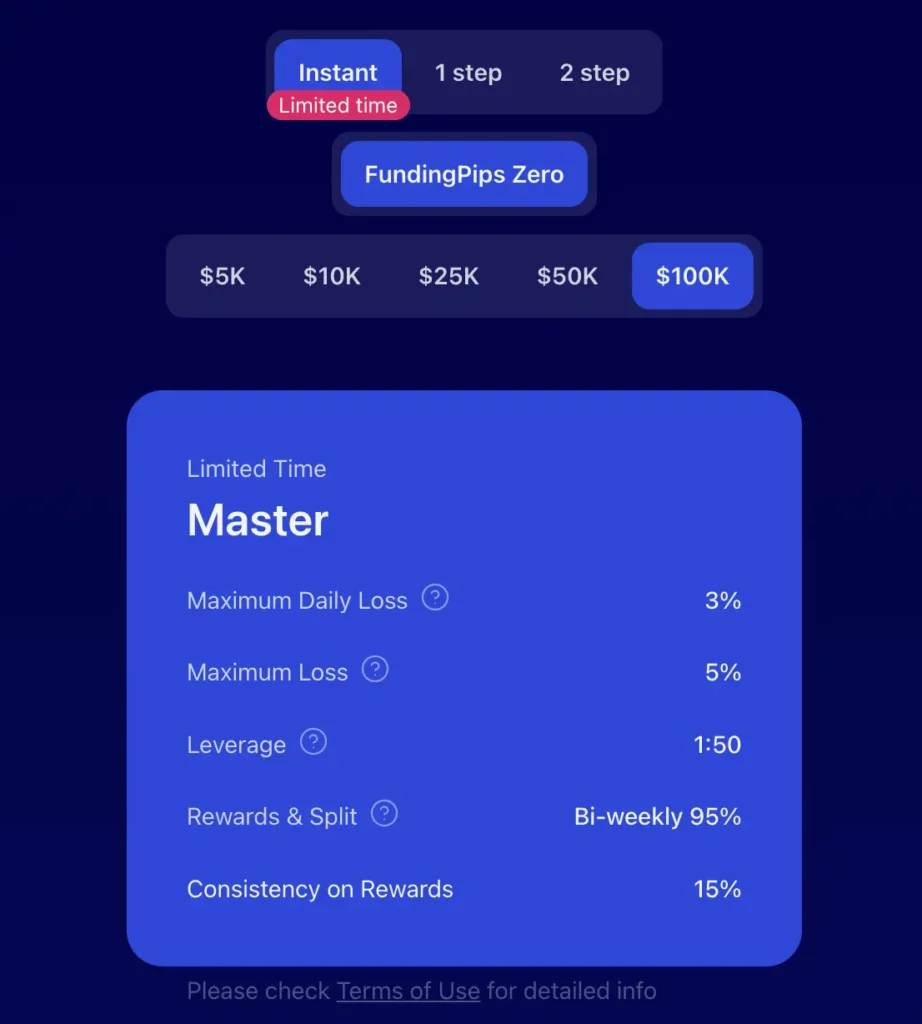

FundingPips Zero: Instant Funding Model

Funding Pips presents the FundingPips Zero model, an instant funding option currently available as a limited-time offer. This program bypasses the usual evaluation stages, granting direct access to simulated funding across all account sizes with consistent trading conditions.

Key parameters include a maximum daily loss limit of 3% and a maximum overall loss of 5% (which trails equity until a 5% profit target is met). Forex trading operates with 1:50 leverage.

Successful traders benefit from bi-weekly payouts, retaining a significant 95% of the simulated profits they generate.

To qualify for rewards, traders must adhere to a 15% consistency rule, meaning their single best trading day must account for less than 15% of their total profit. This structure appeals particularly to confident traders looking for rapid access to simulated trading capital.

FundingPips Zero Pricing

| Account Size | Pricing |

| 5K | $69 |

| 10K | $99 |

| 25K | $199 |

| 50K | $299 |

| 100K | $499 |

The 1-Step Evaluation Program

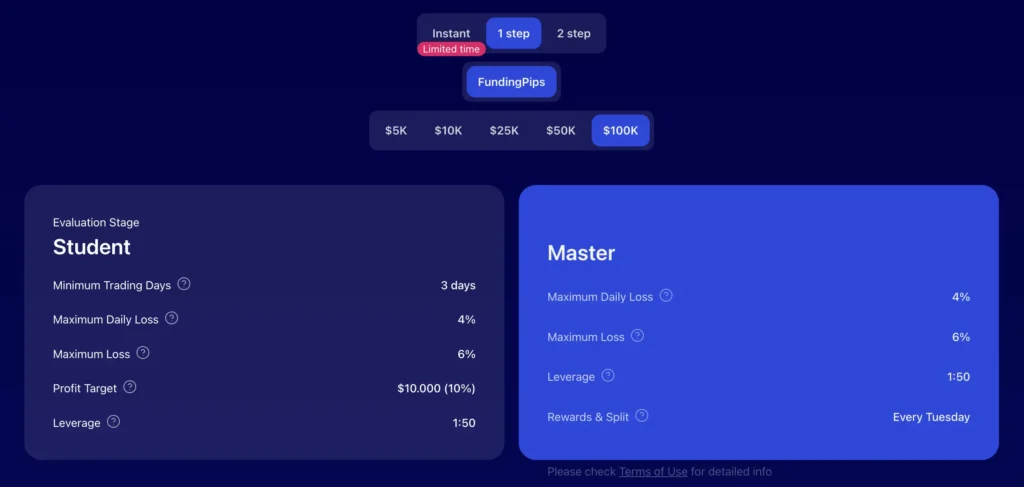

Funding Pips offers a 1-Step Evaluation program designed as a direct path for traders to demonstrate their capabilities.

This model consists of a single evaluation phase, referred to as the “student” stage, where traders must achieve a 10% profit target. Throughout this phase, traders operate under specific risk guidelines: a maximum daily loss of 4% and a maximum overall loss capped at 6% of the initial balance.

A minimum of three trading days is required to complete the evaluation. Forex trading within this program uses 1:50 leverage. Upon successfully meeting the profit target and adhering to the rules, traders advance to the “master” stage, becoming eligible for rewards. Payouts for successful master traders are processed every Tuesday, allowing for frequent access to earned simulated profits.

This evaluation is suitable for individuals who favor a streamlined, single-step assessment process.

1-Step FundingPips Program Pricing

| Account Size | Profit Target | Pricing |

| 5K | $500 (10%) | $59 |

| 10K | $1,000 (10%) | $99 |

| 25K | $2,500 (10%) | $199 |

| 50K | $5,000 (10%) | $299 |

| 100K | $10,000 (10%) | $499 |

The 2-Step Evaluation Program

Funding Pips' standard 2-Step Evaluation program is structured to identify traders who demonstrate consistent profitability and risk management over two distinct phases. The initial phase, known as the “Student” stage, requires traders to achieve an 8% profit target.

During this stage, they must adhere to strict risk controls: a maximum daily loss of 5% and a maximum overall loss of 10% of the initial account balance.

Trading is conducted with 1:100 leverage, and traders must actively trade for a minimum of three days to be eligible to advance.

Upon successful completion of the Student stage, traders proceed to the “Practitioner” phase. This second stage reinforces disciplined trading, maintaining the same 5% maximum daily loss and 10% maximum overall loss limits, along with the 1:100 leverage.

The profit target for this phase is lowered to 5%. Similar to the first phase, a minimum of three active trading days is necessary to complete this stage.

Traders who successfully navigate both the Student and Practitioner phases, meeting profit targets while respecting the drawdown rules, graduate to the “Master” stage. In the Master stage, they manage a funded account, continuing to operate under the 5% daily and 10% maximum loss limits with 1:100 leverage, and become eligible for profit splits.

2-Step FundingPips Program Pricing

(Student Target: 8%, Practitioner Target: 5%)

| Account Size | Pricing |

| 5K | $36 |

| 10K | $66 |

| 25K | $156 |

| 50K | $266 |

| 100K | $470 |

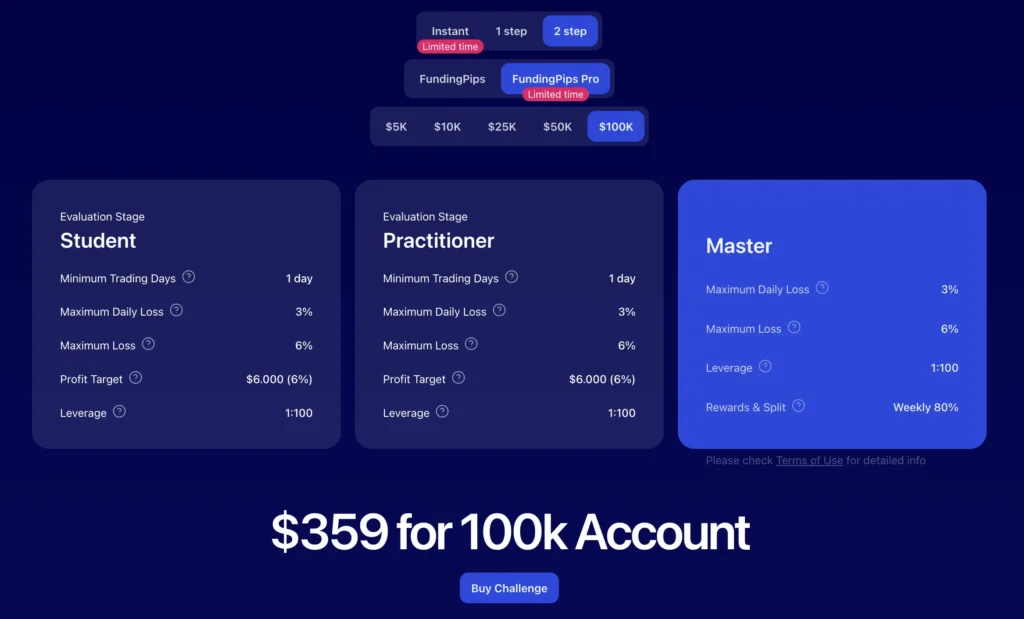

The 2-Step Evaluation Program (Pro)

Funding Pips also presents a variation known as the 2-Step Evaluation Program (Pro), characterized by its uniform structure across evaluation stages and account sizes.

In this model, both the initial “student” stage and the subsequent “practitioner” stage share identical parameters. Each stage requires achieving a 6% profit target with a minimum trading activity of just one day.

The risk management rules are also consistent for both phases: a maximum daily loss limit of 3% and a maximum overall loss capped at 6%.

Trading throughout the Pro evaluation utilizes 1:100 leverage. This simplified approach provides clarity, with the same performance expectations and risk boundaries applying from the start of the evaluation through to its second phase.

2-Step Evaluation Program (Pro) Pricing

| Account Size | Profit Target (Both Stages) | Pricing |

| 5K | $300 (6%) | $29 |

| 10K | $600 (6%) | $55 |

| 25K | $1,500 (6%) | $109 |

| 50K | $3,000 (6%) | $199 |

| 100K | $6,000 (6%) | $359 |

FundingPips Overview: Platforms and Financials

FundingPips, established in November 2022 and based in Dubai, operates with a philosophy of being built “by traders for traders,” aiming to provide resources and support for trader success. They utilize direct liquidity providers rather than a specific retail broker, ensuring direct market access for their users.

Traders have the flexibility to choose from several well-regarded trading platforms, including MetaTrader 5 (MT5), cTrader, and Match Trader, accommodating different user preferences and technical requirements.

Funding Pips facilitates account funding through various methods to suit a global client base. Recent additions include popular e-wallets like Skrill, Neteller, and Paysafecard, enhancing convenience alongside existing options.

While specific availability might vary, common methods like cryptocurrency payments are generally supported by firms in this space. For accessing earned simulated profits, FundingPips employs a structured payout system.

They utilize Rise, a payout processor that supports both bank transfers and cryptocurrency transactions, particularly for amounts exceeding $500. For smaller payouts below $500, cryptocurrency is the standard method, ensuring accessibility even where traditional banking options might be limited.

FundingPips Scaling Plan: A Path to Growth

FundingPips encourages trader development through a structured scaling plan designed to increase trading capital for consistent performers. This program recognizes and rewards progress with tangible benefits at each step.

The Initial Steps:

The journey starts at the Launchpad (Level 1). Here, traders focus on establishing foundational skills.

- Requirement: Secure 4 successful reward payouts and achieve a 10% total profit.

- Benefit: Receive a 20% boost to the initial capital, a 1% increase in the drawdown limit, and an increased daily lot limit.

Next is the Ascender (Level 2) stage for Intermediate Traders building on their experience.

- Requirement: Accumulate 8 successful rewards and reach a 20% total profit.

- Benefit: Gain a 30% capital increase, further relaxation in drawdown limits (another 1% to both max and daily), and another increase to the daily lot allowance.

Advancing Further:

The Trailblazer (Level 3) level awaits Advanced Traders who demonstrate sustained performance.

- Requirement: Reach 12 successful rewards and a 30% total profit.

- Benefit: Enjoy a substantial 40% capital boost, a maximum drawdown limit raised to 13%, and yet another increase in the daily lot limit.

The Pinnacle: Hot Seat

Achieving the Hot Seat signifies reaching the Elite Trader status, a recognition of exceptional skill and consistency.

- Requirement: Garner 16 successful rewards and achieve a 40% total profit.

- Premium Benefits: The initial account balance is doubled, traders gain access to on-demand rewards, a 100% reward split, the potential to manage up to $2 million, and monthly bonuses.

Important Calculation Note:

It's crucial to understand that all scaling increases are calculated based on the original account size, even if accounts have been merged. This ensures clarity in the progression path.

The Funding Pips Hot Seat Program

The Hot Seat Program at FundingPips represents the highest achievement level for its traders, conferring the title of “Elite Trader” status. Attaining this exclusive tier is based on demonstrating exceptional and sustained performance, specifically requiring 16 successful reward payouts and achieving a 40% total profit relative to the initial account size.

Ascending to the Hot Seat unlocks a suite of premium benefits. Traders receive a doubling of their initial simulated capital, providing significantly more resources. Financial flexibility increases with access to on-demand reward payouts, removing standard waiting periods.

A key highlight is the potential for a 100% profit split, allowing traders to keep all the simulated profits they generate. Additionally, Hot Seat members gain eligibility for monthly bonuses determined by their initial account size and may eventually manage up to $2 million in simulated funds, alongside enhanced trading conditions like increased drawdown limits.

Quick Answers Over Funding Pips Challenges

Which trading platforms does Funding Pips offer?

Traders can use MetaTrader 5 (MT5), cTrader, or Match Trader. These platforms are available across desktop, web, and mobile devices for flexibility.

How soon can traders request their first payout?

After successfully trading for a minimum of 5 days on a Master account, traders can request their first payout, with subsequent requests available every 5 days.

Are there different evaluation programs to choose from?

Yes, Funding Pips provides Instant (FundingPips Zero), 1-Step, and 2-Step (Standard and Pro) evaluations, catering to various trader preferences and styles.

Does Funding Pips allow holding trades over weekends?

Yes, traders are permitted to hold positions over the weekend and during major news events, offering greater strategic flexibility compared to some other firms.

How does the account scaling work at Funding Pips?

Consistent profitability and regular payouts allow traders to scale their simulated account size, potentially increasing capital and improving drawdown limits through a structured plan.

Final Thoughts on Funding Pips Challenges

Funding Pips offers a variety of evaluation challenges in 2025, catering to traders with different preferences and experience levels. Whether through the instant access of FundingPips Zero, the streamlined 1-Step, or the progressive 2-Step programs (Standard and Pro), the firm provides structured pathways to simulated funding.

Funding Pips challenges are designed not just as tests, but as mechanisms to assess trading skill, discipline, and consistency against defined profit targets and risk rules. With features like a scaling plan for growth, the aspirational Hot Seat program for top performers, and regular Tuesday payouts, Funding Pips positions itself as a prop firm seeking capable traders.

Funding Pips evaluation models offer distinct routes for individuals aiming to demonstrate their trading abilities and secure a funded account opportunity.