The prop trading world offers exciting opportunities beyond FundedNext Alternatives, and smart traders are exploring alternatives that better match their unique trading styles and goals.

Different firms excel in various areas – some offer more relaxed rules, others provide faster payouts, better profit splits, or greater trading flexibility.

This comparison guide showcases 12 FundedNext Alternatives, helping you discover firms that might align perfectly with your specific needs and preferences for 2025.

Top Mistakes Traders Make with Prop Firms and How to Avoid Them

1. Not Fully Grasping the Rules

One of the quickest ways to run into trouble is by not thoroughly understanding the specific rules of the prop firm challenge you're undertaking. Every firm has its own set of requirements, like profit targets, daily loss limits, maximum drawdown, and sometimes even restrictions on news trading or holding positions over weekends.

2. Playing Fast and Loose with Risk Management

Prop firms are, understandably, very serious about protecting their capital. Ignoring their risk management rules is a surefire way to fail an evaluation or lose a funded account. This includes hitting your daily loss limit, exceeding the maximum drawdown, or using inappropriate position sizes for your account.

3. Rushing the Evaluation or Overtrading

The pressure to hit profit targets can lead traders to rush the process, often resulting in overtrading or making impulsive decisions. This can quickly lead to hitting loss limits or breaking other rules.

4. Trading Without a Clear Plan (Or Ignoring It)

Jumping into trades without a well-defined strategy is like sailing without a compass. Many traders fail because they lack a clear plan or deviate from it due to emotions.

5. Letting Emotions Call the Shots

Fear, greed, frustration, or overconfidence can sabotage even the best trading plans. Emotional trading often leads to impulsive actions like chasing losses, revenge trading, or deviating from your strategy.

Bonus Tip | Start Small if You're New

If this is your first time with a prop firm challenge, consider starting with a smaller account size. This allows you to get used to the firm’s rules, platform, and the general feel of trading under evaluation conditions without the pressure of a very large account.

Building confidence with smaller stakes can prepare you for bigger opportunities.

By being aware of these common mistakes and actively working to avoid them, you can significantly improve your experience with prop firms and increase your chances of achieving and maintaining a funded account.

Beyond FundedNext Alternatives | Comparing Top Prop Firms Side-by-Side

| Prop Firm | Funding Model | Profit Share | Payout Speed | Scaling Potential | Key Unique Features |

|---|---|---|---|---|---|

| Quant Tekel | Evaluation-based, scales up to $2M | Up to 90% | Bi-weekly | $2,000,000 | Multiple evaluation types, no time limits on phases |

| FunderPro | Challenges with no time limits | 80% | Daily (within 8 hrs, once 1% profit) | $5,000,000 | TradeLocker platform, Consistency Rule |

| Spice Prop | 5 unique programs (direct & evaluation) | Up to 90% | As fast as 7 days (some programs) | $2,000,000 | Five distinct program types, cTrader platform support |

| Funding Pips | Relaxed rules, quick evaluations (e.g., Zero Model) | Up to 95% | “Tuesday Pay Day” (sometimes same-day) | Varies | Zero Model evaluation, no min/max trading day limits |

| FTUK | Instant funding model | Up to 80% | On-demand (for some programs) | Fast scaling plan | Direct funding access, no preliminary evaluations needed |

| The Trading Pit | Multi-asset (Forex, futures etc.), EU-regulated | Up to 80% | Varies, regulated | $5,000,000 | European regulation, broad asset choice, multi-platform |

| Blue Guardian | Multiple paths (evaluation & instant funding) | Up to 90% | Bi-weekly (after 14 days funded) | $2,000,000 | “Guardian Shield” risk tool, Consistency Rule |

| The5ers | Long-term growth focus, risk control emphasized | Varies (by scaling) | Varies | $4,000,000 | “Daily pause” risk feature, educational resources, aggressive scaling |

| Traders With Edge | Hybrid (instant & evaluation challenges) | Varies | Varies | $3,000,000 | “Write to Trade” program, customizable challenges, 500+ instruments |

| The Funded Trader | Gamified, themed challenges (e.g., “Knight”) | Up to 95% (+loyalty) | Varies, tiered loyalty rewards | Up to $2.5M | Medieval-themed challenges, active community, loyalty perks |

| Brightfunded | Two-phase evaluation, user-centric features | Up to 100% (scaled) | Varies | Unlimited scaling | “Trade2Earn” loyalty program, proprietary trading platform |

| E8 Markets | 1, 2, or 3-phase evaluations, proprietary tech | Varies | As fast as 8 days | Up to $400k initial accounts | Proprietary E8X Dashboard, very fast payout processing |

1. Quant Tekel | A Strong Contender for Prop Firm Funding

Quant Tekel presents itself as a notable option for traders looking beyond FundedNext Alternatives in 2025. They primarily use an evaluation-based funding model, offering traders a chance to manage virtual funds up to $200,000 after successfully passing a challenge, with the potential to scale up to $2 million.

Key attractions include a profit share of up to 90%, multiple evaluation account types to suit different trading styles and competitive trading conditions like good spreads. Their pricing for evaluation programs is clearly stated, for instance, the two-phase $10,000 account challenge costs $66.

Key Highlights of Quant Tekel

Your Trading Journey with Quant Tekel

Quant Tekel is creating a path for serious Forex traders who seek funding opportunities built on transparent processes and trader-focused benefits, moving away from overly restrictive environments. They aim to support trader growth with substantial capital and favourable profit-sharing.

40% Off Quant Tekel Coupon ✓ Verified Offer

exclusive

Redeem a 40% Off discount on Quant Tekel with limited period launch offer. Start your trading journey now.

40% OFF

2. FunderPro | A Trader-Centric Funding Choice for 2025

FunderPro stands out as a compelling FundedNext alternatives, offering a supportive environment for traders. They are known for their trader-friendly approach, featuring challenges with no time limits and clear rules.

Pricing is transparent, with various account sizes like a $25k challenge for $249. A key attraction is their fast payout system, allowing traders to request daily rewards once they are 1% in profit, typically processed within 8 hours.

FunderPro's Noteworthy Features

FunderPro | Building Success Through Steady Trading

FunderPro encourages a methodical approach to the markets, valuing consistent performance over single, high-risk wins. Their “Consistency Rule” during challenges—where your best day’s profit can't be an overwhelming part of your total profit (e.g., not more than 45% for certain challenges)—is designed to cultivate disciplined trading habits.

This, combined with unlimited time to pass evaluations, helps traders focus on sustainable strategy execution rather than rushing for lucky breaks, fostering genuine skill development.

10% Off FunderPro Coupon Code

exclusive

Get 10% off your next FunderPro prop trading challenge. Use code “fxparkey” at checkout. Limited time offer.

SAVE UP TO 10%

3. Spice Prop | A Zesty Alternative for 2025

Spice Prop is gaining attention as an interesting FundedNext alternatives for 2025. They offer traders varied funding routes through five unique programs, including direct funding and multi-step evaluations for accounts up to $300,000.

Known for simpler rules like no maximum trading days and allowing news trading, they aim for good value with accessible challenge pricing and profit splits up to 90%.

Spice Prop's Special Ingredients

Why Traders Add Spice to Their Journey?

Spice Prop offers a refreshing mix where new traders find clear paths and flexible conditions to begin their funding experience.

Flat 10% Spice Prop Coupon

exclusive

Enter code fxparkey to enjoy a 10% discount on your next Spice Prop challenge purchase.

Save 10% Off

4. Funding Pips | Streamlined Funding for 2025

Funding Pips is carving out a space as a popular FundedNext alternatives by emphasizing a more straightforward path to getting funded. They are recognized for their often more relaxed trading rules, such as offering unlimited time to complete evaluation phases.

Their evaluation process, particularly with options like the “Zero Model,” can be very quick, allowing traders to bypass traditional challenge phases and access master accounts faster. This approach appeals to traders who are confident in their skills and prefer less restrictive conditions.

Funding Pips | Key Trader Advantages

Funding Pips | Empowering Aspiring Traders

Funding Pips provides a clearer route for capable traders, believing in skill and offering genuine chances to manage substantial capital without unnecessary obstacles.

5. FTUK | Direct Funding and Trader Advancement in 2025

FTUK positions itself as a solid FundedNext alternatives by offering an appealing instant funding model, allowing traders to bypass lengthy evaluation processes and start trading with the firm's capital from day one.

This approach is designed for confident traders ready to earn immediately, benefiting from clear profit-sharing arrangements and opportunities for rapid account scaling.

FTUK's Top Advantages for Traders

Building Trader Confidence with Immediate Capital

FTUK cultivates trader confidence from the outset by providing direct access to real trading capital through its Instant Funding programs.

This allows skilled traders to apply their strategies in live market conditions without the typical waiting period of evaluation phases, enabling them to earn from their first successful trades. The firm takes on the initial capital risk, empowering traders to focus on their performance with a significant account right away.

6. The Trading Pit | Versatility and European Standards

The Trading Pit stands out as a FundedNext alternatives for traders valuing a broad selection of tradable assets, including Forex, futures, stocks, and cryptos. They emphasize competitive entry costs with clear pricing and no hidden fees, starting from €99 for some challenges.

Operating from Liechtenstein, they highlight a legally compliant business model, offering a sense of security within a European regulatory context.

The Trading Pit's Key Strengths for 2025

The Trading Pit | Blending Tradition with Opportunity

The Trading Pit merges the assurance of a European-based, regulation-conscious operation with innovative funding pathways for today's global trader.

7. Blue Guardian | Ascending with Trader-Focused Funding in 2025

Blue Guardian is rapidly gaining traction as a strong alternative to FundedNext Alternatives, appealing to traders with its clear rules, dependable payout system, and significant scaling opportunities. They offer various evaluation paths, including one-step, two-step, and even instant funding models, all designed with no time limits on phases, easing the pressure on traders.

Payouts are typically bi-weekly, with traders eligible 14 days after their first funded trade, and profit splits can reach an attractive 90%. Their scaling plan allows successful traders to grow their accounts up to $2 million.

Blue Guardian's Standout Qualities

Fostering Discipline and Growth at Blue Guardian

Blue Guardian encourages consistent, skillful trading through thoughtful features. The “Guardian Shield” acts as a safety net against significant daily drawdowns, while the consistency rule promotes steady performance over quick, unsustainable wins, rewarding disciplined strategies rather than mere luck.

8. The5ers | Nurturing Long-Term Trader Growth and Prudent Risk-Taking

The5ers has established itself as a distinguished FundedNext alternatives, particularly for traders who prioritize sustainable, long-term growth and diligent risk control. They offer various funding programs, including instant funding and evaluation pathways, designed to support traders in scaling their accounts significantly over time—potentially up to $4 million—by consistently meeting profit targets.

A core part of their philosophy involves clear trading objectives and a strong emphasis on risk management, with features like a “daily pause” to prevent substantial losses and suggested risk parameters for traders.

The5ers | Features for the Patient and Consistent Trader

Cultivating a Trader's Mindset at The5ers

The5ers champions the idea that true trading success is built on a foundation of patience and a sound mental approach, valuing thoughtful strategy over rushed execution.

9. Traders With Edge | Versatile Funding and Community Support

Traders With Edge offers a distinct path for those seeking alternatives to FundedNext Alternatives in 2025, providing both direct instant funding routes and structured evaluation challenges.

They stand out by also fostering a supportive environment through initiatives like their “Write to Trade” program, which allows aspiring traders to earn account credits, and by offering customizable challenge parameters to better suit individual approaches.

Traders With Edge | Top Benefits

The Edge Philosophy

Traders With Edge combines performance-driven funding with programs designed to identify and cultivate trading talent through flexible and accessible means.

10. The Funded Trader | Where Challenges Meet Opportunity

The Funded Trader has become a go-to alternative to FundedNext Alternatives, drawing traders in with its engaging, medieval-themed evaluation challenges like the “Knight” or “Dragon” programs.

This approach adds an element of adventure to proving your skills. They are also recognized for offering high-profit shares, with traders potentially earning up to 95%, and even more through tiered loyalty rewards.

The Funded Trader | Key Advantages for 2025

Turning Evaluations into Trading Adventures

The Funded Trader transforms the path to funding into an exciting quest, offering skilled traders adventurous opportunities to secure capital.

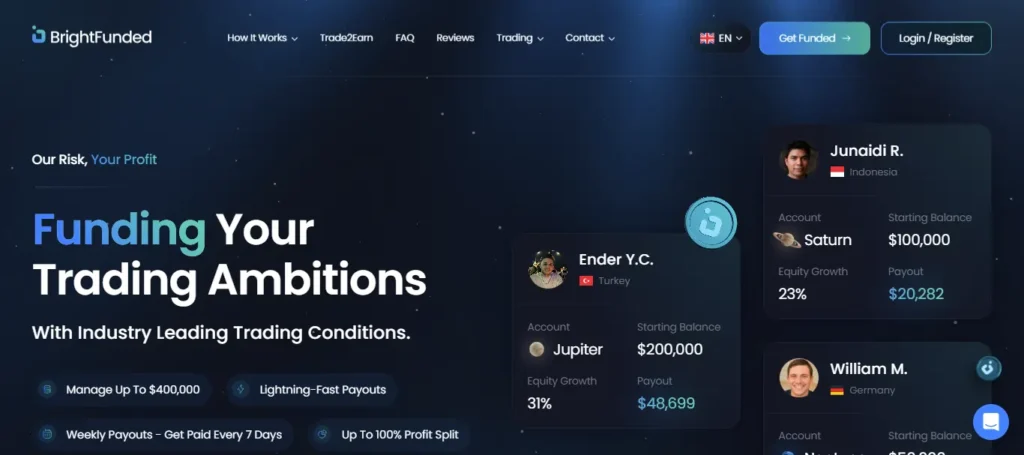

11. Brightfunded | Streamlined Access to Scalable Trading Capital

Brightfunded is making a mark as a fresh alternative to FundedNext Alternatives for 2025, offering traders a streamlined route to potentially significant, scalable funding. They focus on a user-centric experience, highlighted by their proprietary trading platform designed for a tailored feel.

Their model, primarily a two-phase evaluation, aims to identify skilled traders and provide them with capital and a clear path for growth, including an innovative Trade2Earn loyalty program that rewards trading activity.

Why Traders Are Noticing Brightfunded?

Charting a Bright Future for Ambitious Traders

Brightfunded is building tomorrow's trading environment today, offering ambitious traders advanced tools and clear pathways to substantial capital.

Save Big on Brightfunded: 30% Off Today!

exclusive

Exclusive 30% savings at Brightfunded with code STRONG30. Elevate your experience and invest smarter—limited time only!

SAVE UP TO 30%

12. E8 Markets | Advanced Technology and Rapid Funding Paths

E8 Markets, formerly E8 Funding, presents itself as a high-quality FundedNext alternatives, emphasizing rapid progression for traders. They offer a range of funding options, including one, two, and three-phase evaluations, allowing traders to access simulated accounts up to $400,000 and potentially get paid in as little as 8 days.

A key feature is their proprietary E8X Dashboard, designed for a user-friendly experience with a comprehensive overview of trading activities, account management, and analytics, all refreshed automatically every 60 seconds. They also pride themselves on their own technology infrastructure, aiming for faster execution speeds and reliability.

E8 Markets | Must-Know Strengths

Where Innovation Meets Opportunity

E8 Markets fuses its proprietary trading technology with substantial funding opportunities, offering traders a sophisticated platform to accelerate their progress.

Frequently Asked Questions

Which is the Cheapest FundedNext Alternatives?

Quant Tekel offers a $10k challenge for $66, and E8 Markets has a $5k customizable account starting at $33, making them very cost-effective entry points.

Which Firm Offers the Fastest Payout?

FunderPro processes payouts within 8 hours once 1% in profit, and E8 Markets offers payouts in as little as 8 days. Funding Pips also has a “Tuesday Pay Day”.

Which Prop Firm offers Instant Funding?

FTUK is known for its instant funding model. Traders With Edge and Blue Guardian also provide instant funding options alongside evaluations.

Which Alternative is best for Swing Traders?

FunderPro allows weekend and news holding for Swing Accounts. The Trading Pit also permits weekend holding on certain programs. FTMO is also recognized for its swing accounts.

Are there Firms with no time Limits on Challenges?

Yes, Quant Tekel, FunderPro, Funding Pips, FTUK, The5ers, Blue Guardian, and The Funded Trader offer evaluations without strict time limits on phases.

Which Firms allow News Trading?

Spice Prop, The Trading Pit, and FunderPro (for Swing Accounts) permit news trading. FTUK's instant funding also has no news restrictions.

What are common Profit Splits Offered?

Many firms like Quant Tekel, Spice Prop, Blue Guardian, and The Funded Trader offer profit splits up to 90-95% for successful traders.

Can I use Expert Advisors (EAs)?

The5ers allows EAs under specific conditions, and The Funded Trader Program generally permits EA use. Always check the specific firm's rules.

Finding Your Ideal Funding Partner

So, you've seen a dozen strong FundedNext Alternatives , each with its own flavour—from instant funding and unique tech to high payouts or super flexible rules.

The best choice really comes down to your personal trading style and what you value most. Don't hesitate to explore these options; the right prop firm to support your trading journey in 2025 is definitely out there, waiting for you to connect.