breakout trading! This strategy is all about spotting those moments when an asset's price smashes through its support or resistance levels, potentially signaling the start of a new trend.

It's like being a market detective, searching for clues that could lead to big profits. But hold your horses – breakout trading isn't just about jumping on every price movement you see.

It takes skill, patience, and a keen eye to separate the real deals from the false alarms.

👀 What is Breakout Trading?

Breakout trading is a strategy that involves identifying and capitalizing on significant price moves or ‘breakouts' that occur when the price of a currency pair moves above resistance or below support levels. These resistance and support levels are typically established by past price patterns.

The principle behind breakout trading is simple: when the price breaks out of a range, it is likely to continue moving in the direction of the breakout. Traders, therefore, aim to enter the market just as the breakout occurs, riding the momentum until the price movement slows or reverses.

Importance of Breakout Strategies in Forex Trading

Breakout strategies play a pivotal role in forex trading due to their potential for high returns. By correctly identifying breakouts, traders can open positions that align with the market's momentum, increasing the chances of a profitable trade.

Moreover, breakout trading strategies are versatile and can be adapted to various trading styles, including day trading, swing trading, and position trading. This flexibility makes breakout trading a valuable tool in a trader's arsenal.

However, like all forex trading strategies, breakout trading requires careful analysis, planning, and risk management. Identifying breakouts can be complex, and not all breakouts result in profitable trades. It's crucial for traders to understand the market conditions that lead to breakouts and to use appropriate risk management techniques to protect their capital.

Identifying Breakout Opportunities

In the world of Forex trading, the ability to identify breakout opportunities can be a game-changer. This involves recognizing key indicators and utilizing effective technical analysis tools.

Key Indicators for Breakouts

Identifying breakout opportunities primarily involves looking for certain patterns in the price movement of a currency pair. Traders watch for these patterns as they suggest a possible breakout from a current market trend or price range.

| Indicator | Description |

|---|---|

| Price Levels | Monitor support and resistance levels |

| Trading Volume | Look for sudden increases in volume |

| Market Volatility | Watch for increased market fluctuations |

| Price Consolidation | Observe when prices start to converge |

Technical Analysis Tools for Breakout Trading

To support the identification of breakout opportunities, traders utilize a variety of technical analysis tools. These tools help to highlight potential breakouts and provide valuable insights into price trends and patterns.

| Tool | Description |

|---|---|

| Trend Lines | Drawn between two or more price points |

| Moving Averages | Smooths out price data |

| Bollinger Bands | Consists of a middle band and two outer bands |

| Volume Indicators | Highlight sudden increases in trading volume |

Understanding these indicators and tools can help Forex traders better identify breakout opportunities, and thus, more effectively implement breakout trading strategies. This knowledge can serve as a valuable addition to their trading toolkit, whether they're engaged in swing trading, day trading, or position trading.

Types of Breakouts

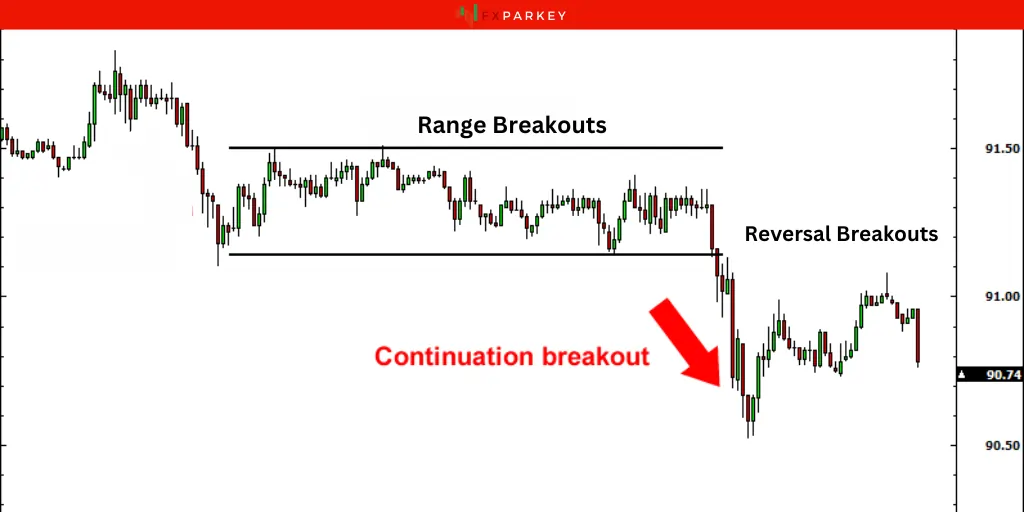

In the realm of breakout trading, it's crucial to familiarize oneself with the different types of breakouts. These can largely be categorized into three types: continuation breakouts, reversal breakouts, and range breakouts. Each of these types has unique characteristics and requires different strategies for successful trading.

Continuation Breakouts

Continuation breakouts, as the name suggests, signal the continuation of an existing trend. They occur when the price breaks through a resistance level in an uptrend or a support level in a downtrend. Traders can use continuation breakouts to take advantage of the ongoing trend and potentially profit from the extended price movement.

Continuation breakouts are a significant component of trend trading strategies, where the main objective is to identify and follow the market trend. It's important to note, however, that a continuation breakout does not guarantee the trend will persist indefinitely. Traders must be vigilant and ready to exit the trade if the trend reverses.

Reversal Breakouts

Reversal breakouts indicate a potential reversal of the current trend. They occur when the price breaks through a resistance level in a downtrend or a support level in an uptrend. These breakouts can signal the end of the current trend and the beginning of a new one in the opposite direction.

Reversal breakouts are often used in counter-trend trading strategies. Traders who identify a reversal breakout can enter a trade in the direction of the new trend and potentially profit from the price change. As with all trading strategies, it's crucial to manage risk effectively when trading reversal breakouts.

Range Breakouts

Range breakouts occur when the price breaks out of a defined range, moving above the resistance level or below the support level. These breakouts can signal the start of a new trend or the continuation of an existing one.

Range breakouts often form the basis of range trading strategies. Traders can use these breakouts to enter a trade at the start of a new trend or to add to a position in an existing trend. As always, it's important for traders to manage risk and stay alert to potential trend reversals or continuation.

Implementing Breakout Trading Strategies

To effectively apply breakout trading in the forex market, traders need to identify appropriate entry and exit points and effectively manage their risk.

Entry and Exit Points

Determining when to enter or exit a trade is crucial in breakout trading. The entry point is typically when the price moves beyond the identified resistance or support level with increased volume. Timing the entry correctly can optimize potential profits.

As for the exit point, it's usually set at a pre-determined level. This could be a specific target price or a stop-loss level to protect against significant losses if the trade does not go as planned. It's important to have a clear exit strategy in place to manage potential risks and protect your trading capital.

| Entry Point | Exit Point |

|---|---|

| Beyond resistance or support level | Pre-determined target price or stop-loss level |

Risk Management in Breakout Trading

Effective risk management is vital in breakout trading. Traders need to manage their risk by setting stop-loss orders, determining appropriate trade sizes, and not risking more than a certain percentage of their trading capital on any single trade.

Stop-loss orders are crucial in limiting potential losses when the market moves against a trade. They should be placed at a level that allows the trade enough room to move in the trader's favor, but not so much that the trader risks losing a significant portion of their trading capital if the trade goes wrong.

Determining the appropriate trade size is another important aspect of risk management. The size of the trade should be in line with the trader's risk tolerance and the size of their trading account.

Finally, it's generally recommended not to risk more than 1-2% of the trading capital on any single trade. This helps to preserve the trading capital and allows the trader to weather any short-term losses.

| Risk Management Techniques | Description |

|---|---|

| Stop-loss orders | Limit potential losses when the market moves against a trade |

| Appropriate trade size | It should be in line with the trader's risk tolerance and account size |

| Risking a set percentage of capital | Generally, not more than 1-2% on any single trade |

Implementation of breakout trading strategies requires a good understanding of the forex market and technical analysis tools. A well-executed breakout trading strategy can offer the potential for high returns, but like all trading strategies, it's not without risks. For more information on other trading strategies like swing trading, day trading, and position trading, feel free to explore our other articles.

Common Mistakes in Breakout Trading

While breakout trading offers numerous advantages, traders often make certain mistakes that can potentially hinder their success. By understanding these common errors, traders can develop more effective strategies and avoid pitfalls.

Overlooking Market Conditions

A common mistake in breakout trading is neglecting to consider the overall market conditions. Traders may focus solely on the price action of a specific currency pair without considering the broader market context.

For instance, significant economic events, such as policy announcements by central banks or the release of economic data, can cause sharp price movements that may lead to false breakouts. Similarly, market volatility can also impact the effectiveness of breakout strategies.

Ignoring Confirmation Signals

Another common mistake is ignoring confirmation signals. Traders may rush to open a position as soon as they identify a potential breakout, without waiting for further confirmation. This can lead to premature entries and an increased risk of losses.

Confirmation signals can come in various forms, including candlestick patterns, indicators, or even a simple retest of the breakout level. By waiting for these signals, traders can increase their chances of successful trades and reduce their risk exposure.

Failing to Adjust Stop Loss Levels

Failing to adjust stop loss levels is another common pitfall in breakout trading. Once a breakout occurs and a position is opened, traders need to manage their risk by adjusting their stop loss levels accordingly.

A stop-loss order should be placed at a level that allows the trade enough room to move in the trader's favor, but not so much that a reversal would result in a significant loss. If the stop loss is set too close to the entry point, it may be hit prematurely. Conversely, if it's set too far, the trader risks losing a larger portion of their capital if the trade goes against them.

Advantages of Breakout Trading

The application of breakout trading strategies in forex markets offers several advantages. These benefits include the potential for high returns, the ability to capture significant market moves, and adaptability to various trading styles.

Potential for High Returns

One of the primary benefits of breakout trading is the potential for high returns. As a breakout trader, the aim is to identify trade breakouts that occur when the price moves beyond a defined support or resistance level with increased volume. Since these breakouts often lead to significant price movements, traders have the opportunity to generate substantial profits if the trade is executed correctly.

Ability to Capture Significant Market Moves

Breakout trading also allows traders to capture significant market moves. A significant breakout can lead to a substantial price movement, providing traders with the opportunity to generate profits. This strategy is especially useful in volatile markets where large price swings are common.

It's important to note that while capturing these major market moves can be lucrative, it also comes with increased risk. Therefore, implementing effective risk management strategies is crucial to protect your trading capital.

Adaptability to Various Trading Styles

Another advantage of breakout trading is its adaptability to various trading styles. Whether you're a scalper, day trader, swing trader, or position trader, breakout trading can be integrated into your trading strategy.

For instance, scalpers may use breakouts in a much smaller timeframe, capitalizing on the price movements that occur in the minutes following a breakout. On the other hand, swing traders and position traders may use breakouts to enter long-term trades, holding their positions until they reach their profit target or the market reverses.

Common Queries Related to Breakout Trading

What is Breakout Trading?

Breakout trading involves entering trades when an asset's price breaks through predefined resistance or support levels, indicating potential new trends.

What are The Common Types of Breakout Patterns?

What are Effective Entry Strategies for Breakout Trading?

How do you manage risks in breakout trading?

What is a false Breakout?

What are Essential Exit Strategies in Breakout Trading?

💭 Conclusion

Breakout trading remains a powerful strategy for capitalizing on market momentum and potential trend reversals. While it offers exciting profit opportunities, traders must approach it with caution and a well-defined plan. Key to success is the ability to identify genuine breakouts, set appropriate stop-loss and take-profit levels, and manage risk effectively.

As with any trading strategy, continuous learning and adaptation are crucial. Market conditions evolve, and successful breakout traders stay ahead by refining their techniques, embracing technological tools, and maintaining emotional discipline.

![What is Forex Trading? Complete Guide on Forex [2025 Edition] 11 What is Forex Trading? Complete Guide on Forex [2025 Edition]](https://fxparkey.com/wp-content/uploads/2024/01/Forex-Trading-3-300x150.webp)