As a Forex Trader, you know the importance of finding a trustworthy place to put your money. The same goes when venturing into forex trading using the popular stablecoin USDT. While the potential rewards may seem high, you need to find the best USDT forex brokers that you can rely on.

I've been reviewing forex brokers for a couple of years to help traders find the most suitable platforms. With dozens of brokers to choose from in 2025, it can get overwhelmingly fast. That's why I've put together this list of the top 10 brokers for USDT trading based on factors like fees, crypto offerings, platform stability, customer support, and more.

Whether you're a beginner seeking an easy-to-use broker or a more advanced trader looking for advanced trading tools, you'll find a good fit for your needs here. As a fellow casino enthusiast, I know the value of finding a trustworthy place to put your crypto chips. Read on as I break down the standout USDT brokers to simplify your search. With the right platform, you can comfortably trade USDT pairs just as you would bet on red or black at the roulette table.

What are USDT Forex Brokers?

USDT forex brokers are online currency trading platforms that allow users to fund their accounts and execute trades using the stablecoin Tether (USDT) instead of fiat money like USD. Tether aims to maintain a 1:1 peg to the US dollar, making it a convenient way for crypto traders to move money between exchanges and brokers without exposing themselves to the volatility typically seen with cryptocurrencies.

As USDT adoption grows in crypto circles, more forex brokers now accept it as a payment method for deposits and withdrawals. Trading with USDT offers quick transfers between wallets and brokers, potential tax advantages, and for some, an alternative banking solution outside the traditional financial system. Accepting USDT can also help brokers differentiate their offerings in a competitive market.

🔥 List of 10 Best USDT Forex Brokers 2025

| Brokers | Features |

|---|---|

| eToro | Access over 3,000 financial instruments + $10 Promo |

| FXCM | Provides access to Trading Station and MetaTrader 4 platforms |

| Plus500 | Supports multiple languages for global traders |

| IG | BitMEX is primarily designed for experienced traders, offering advanced trading options and high-leverage |

| Robinhood | Offers commission-free cryptocurrency trading |

| BitMEX | BitMEX is primarily designed for experienced traders, offering advanced trading options and high-leverage |

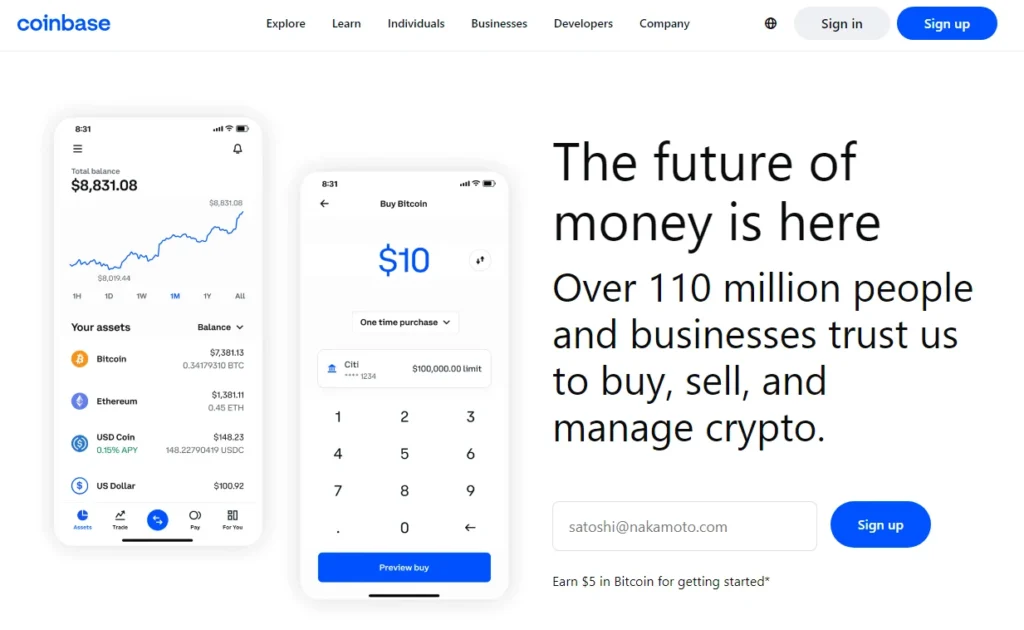

| Coinbase | Provides educational resources and earning opportunities through Coinbase Earn |

| Kraken | Available internationally with some regional restrictions |

| InstaForex | Provides deposit bonuses from 30% to 100% |

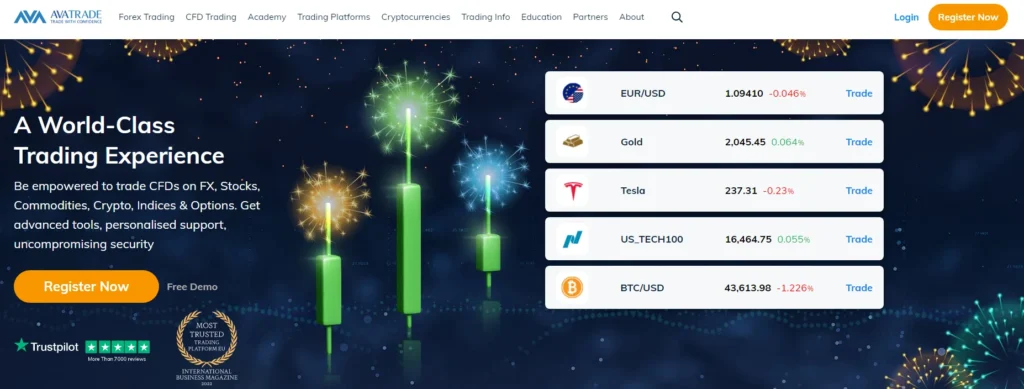

| AvaTrade | Regulated by multiple top-tier authorities |

1. eToro

Founded in 2007, eToro has emerged as a trailblazer in the world of social trading, offering a unique platform that combines traditional trading with social networking. It has revolutionized the trading landscape by enabling users to connect, share strategies, and even replicate the trades of successful investors. With a broad array of assets, including currencies, stocks, cryptocurrencies, ETFs, indices, and commodities, eToro caters to a wide spectrum of traders, from beginners to seasoned professionals.

Its intuitive interface, coupled with a strong emphasis on community engagement and transparency, makes eToro a preferred choice for those seeking a more interactive and collaborative trading experience.

Key Features of eToro

- Follow and copy the trades of experienced investors.

- Intuitive web and mobile platforms for traders.

- Access over 3,000 financial instruments.

- Up to EUR 1 million per client in certain regions.

- Exclusive benefits for eToro Club members.

- A robust selection of crypto assets is available.

Bonuses and Minimum Deposit of eToro

eToro offers bonuses to its users. For instance, a promotional reward of $10 is given upon a single deposit of at least $100, which must remain in the account for a minimum of 90 days. After the first deposit, the minimum deposit amount is only $50 ($10 in the UK and USA).

Leverage Options and Trading Costs of eToro

In the context of trading costs and leverage, eToro charges a 0.09% commission on leveraged positions. It also imposes a set withdrawal fee of $5 regardless of payment processor, withdrawal amount, or geographical region.

Pros and Cons of eToro

Pros

- Highly trusted with a strong regulatory framework.

- Excellent for social and copy trading.

- Offers a wide range of markets and assets.

- Innovative features like social news feeds and community engagement.

Cons

- Higher fees compared to some other platforms.

- No support for automated trading strategies.

- Mandatory stop-loss and take-profit may limit certain strategies.

2. FXCM

FXCM, also known as Forex Capital Markets, was established in 1999 and has since been at the forefront of online foreign exchange trading. Originating in New York, FXCM pioneered the development of electronic trading platforms in the forex industry.

With a history of innovation and expansion, including the acquisition of ODL Group to become one of the world's largest retail forex brokers, FXCM has cemented its position as a leading entity in the global forex market. The company, now headquartered in London, offers a wide range of trading services and has been recognized for its customer support and advanced trading infrastructure.

Key Features of FXCM

- Offers trading in forex, CFDs, and cryptocurrency markets.

- Provides access to Trading Station and MetaTrader 4 platforms.

- Features award-winning customer service available 24/5.

- Includes free EAs and VPS access with MT4 accounts.

- Offers TradingView Pro for free under certain conditions.

Bonuses and Minimum Deposit of FXCM

FXCM entices traders with its Exclusive Trio Offers, which can unlock bonuses up to $10,000, although terms and conditions apply. The platform is accessible with a modest minimum deposit of just $50, making it an attractive option for traders looking to start with a smaller investment.

Leverage Options and Trading Costs of FXCM

In terms of leverage and costs, FXCM provides leverage up to 1:400 and spreads as low as 0.0 pips on certain currency pairs. No commissions are charged, but fees apply for withdrawals and inactivity.

Pros and Cons of FXCM

Pros

- Access to a broad range of markets including forex, shares, and cryptos.

- Multiple trading platforms, including Trading Station and MT4.

- Award-winning customer service.

- Promotional offers and bonuses are available.

- Low minimum deposit requirement.

Cons

- Detailed leverage information not readily available in search results.

- Bonus terms may be subject to specific conditions.

3. Plus500

Plus500 is a leading global fintech company founded in 2008 that provides online trading services for contracts for difference (CFDs), share dealing, futures, and options trading. Headquartered in Israel and listed on the London Stock Exchange, Plus500 operates proprietary technology-based trading platforms and has over 20 million registered customers globally.

Through its subsidiaries, Plus500 offers over 2,000 trading instruments including currencies, stocks, commodities, cryptocurrencies, ETFs, options, and indices.

Key Features of Plus500

- Offers a wide range of over 2000 instruments for trading.

- Provides a proprietary trading platform, available on the web and mobile.

- Offers a free demo account for practice trading.

- Provides negative balance protection and guaranteed stop loss.

- Offers 24/7 customer support via email and live chat.

- Supports multiple languages for global traders.

- Provides real-time price alerts and notifications.

Bonuses and Minimum Deposit of Plus500

Plus500 offers new traders a bonus on their initial deposit, such as $20 for a $100 deposit. The minimum deposit to open an account starts from $100 across most regions.

Leverage Options and Trading Costs of Plus500

In terms of leverage and trading costs, Plus500 offers leverage up to 1:30 for retail clients and up to 1:300 for professional clients. Plus500 operates on a “spread only” basis, meaning there are no additional trade commissions or fees outside the spread.

Pros and Cons of Plus500

Pros

- Wide range of trading instruments.

- User-friendly proprietary trading platform.

- Negative balance protection.

- 24/7 customer support.

Cons

- No phone support for customer service.

- Inactivity fee charged after three months of non-use.

4. IG

Established in 1974, IG is a leading global forex and CFD broker, renowned for its comprehensive trading platform, extensive educational resources, and robust deposit and withdrawal options. It is regulated by multiple top-tier financial authorities worldwide and is publicly traded on the London Stock Exchange, ensuring a secure and trustworthy trading environment.

IG offers a broad range of financial instruments, including forex, indices, shares, commodities, and options, and is recognized for its commitment to customer service and innovative trading technology.

Key Features of IG

- User-friendly desktop and mobile trading platforms with live charts, order types, and monitoring tools.

- Wide range of financial assets including forex, CFDs, and options.

- Comprehensive educational resources including trading tutorials and videos.

- 24/7 customer support is available for account queries, product information, and more.

- Advanced charting package, ProRealTime, available for subscription.

- No minimum funding amount is required for account opening.

Bonuses and Minimum Deposit of IG

IG offers a bonus deposit for qualifying participants. For instance, a $100 bonus is credited to your IG CFD account if you make a one-time initial deposit of $500 or more and meet other criteria. Other promotions may offer up to a $5,000 bonus depending on the deposit amount and trading volume. The minimum deposit for IG Markets is $450.

Leverage Options and Trading Costs of IG

IG offers leverage up to 1:200. Trading costs are competitive with spreads starting from 0.6 pips for key FX pairs and 0.8 points on major indices. There are also other potential charges such as a $12 inactivity fee if no trading activity has occurred for two years or more. Subscribing to ProRealTime costs $40 per month, which is refunded if you place four or more trades a month.

Pros and Cons of IG

Pros

- User-friendly and award-winning trading platforms.

- Comprehensive educational resources.

- Regulated by multiple financial authorities.

- Competitive trading costs.

Cons

- Forex and stock CFD fees can be high.

- Product portfolio is limited in most countries.

5. Robinhood

Robinhood, established in 2013, is a renowned online brokerage platform that has revolutionized the financial markets with its commission-free trading model. It offers a user-friendly interface that allows individuals to trade stocks, options, and cryptocurrencies without the need for a traditional broker.

With its mission to democratize finance for all, Robinhood has made investing more accessible to the masses. The platform is particularly popular among younger, tech-savvy investors who appreciate its mobile-first design and straightforward approach to investing.

Key Features of Robinhood

- Robinhood does not charge commissions on trades, making it more affordable for small investors.

- Users can open a Robinhood account with no minimum deposit, making it accessible to a wide range of investors.

- Robinhood offers margin trading, allowing users to borrow money to invest, potentially amplifying their gains (and losses).

- Users have access to Level 3 options trading, providing more advanced trading strategies.

- Robinhood offers commission-free cryptocurrency trading, including popular coins like Bitcoin and Ethereum.

- Robinhood's platform is designed with a mobile-first approach, making it easy to trade on the go.

Bonuses and Minimum Deposit of Robinhood

Robinhood does not require a minimum deposit to open an account. However, it does offer cash rewards for new customers who deposit certain amounts. a deposit of $1,000-$9,999 can earn a $25 reward, while a deposit of $10,000-$49,999 can earn a $100 reward.

Leverage Options and Trading Costs of Robinhood

Robinhood allows users to trade on margin, effectively borrowing money to invest and potentially amplifying their gains or losses. The platform charges a standard margin interest rate of 12% and a margin interest rate of 8% for Gold customers. While Robinhood does not charge commissions, it does pass on regulatory fees to its users, including a trading activity fee of $0.000166 per share for equity sales and $0.00279 per contract for options sells.

Pros and Cons of Robinhood

Pros

- No commissions on trades

- No minimum deposit is required to open an account

- Offers margin and options trading

- Allows cryptocurrency trading

- User-friendly, mobile-first platform

Cons

- Limited research tools compared to other brokers

- Regulatory fees are passed on to users

6. BitMEX

BitMEX, short for Bitcoin Mercantile Exchange, is a cryptocurrency exchange and derivative trading platform. Established in 2014 by Arthur Hayes, Ben Delo, and Samuel Reed, BitMEX is owned and operated by HDR Global Trading Limited, registered in Seychelles.

The platform offers a variety of cryptocurrency-based financial products, including perpetual contracts, futures contracts, and options contracts. BitMEX is primarily designed for experienced traders, offering advanced trading options and high leverage.

Key Features of BitMEX

- BitMEX operates on a peer-to-peer model, facilitating direct transactions between users.

- BitMEX allows users to buy, sell, and trade a variety of cryptocurrencies.

- BitMEX offers advanced trading options, including futures contracts and perpetual contracts.

- BitMEX employs multi-factor security measures, including two-factor authentication and encryption.

- Developers can build applications on top of BitMEX's comprehensive REST API and WebSocket API.

- BitMEX's interface is designed to be user-friendly, making it easy for traders to navigate and execute trades.

Bonuses and Minimum Deposit of BitMEX

BitMEX does not offer deposit bonuses. The minimum amount to trade varies by product based on the initial margin requirements. For example, the minimum amount to trade the XBTUSD perpetual swap is around $1.

Leverage Options and Trading Costs of BitMEX

BitMEX offers a leverage of up to 100x, allowing traders to increase their potential returns significantly. The platform charges a margin trading fee of 0.075%.

Pros and Cons of BitMEX

Pros

- High leverage options up to 100x.

- Robust security measures.

- User-friendly interface.

- Comprehensive APIs for developers.

Cons

- High minimum deposit, making it less suitable for beginners.

- Only Bitcoin deposits and withdrawals are supported.

7. Coinbase

Coinbase, founded in 2012 by Brian Armstrong and Fred Ehrsam, is a secure online platform for buying, selling, transferring, and storing cryptocurrency. As the largest cryptocurrency exchange in the United States in terms of trading volume, Coinbase offers a comprehensive suite of services, including a self-custody crypto wallet, support for a wide range of cryptocurrencies, and advanced trading features.

The platform is designed to cater to both beginners and experienced traders, providing an easy-to-use interface, extensive educational resources, and advanced trading tools.

Key Features of Coinbase

- Coinbase supports Bitcoin, Ethereum, Solana, Dogecoin, and all Ethereum-compatible networks, among others.

- Coinbase Wallet is a self-custody crypto wallet, giving users complete control of their crypto, keys, and data.

- Coinbase offers advanced trading features, including leverage trading, which allows traders to trade larger value contracts while putting down relatively smaller amounts upfront.

- Coinbase's technology was developed with security and encryption at its core, ensuring the safety of users' assets.

- Coinbase provides educational resources through Coinbase Earn, allowing users to earn crypto rewards while learning about different cryptocurrencies.

Bonuses and Minimum Deposit of Coinbase

New Coinbase users can earn a bonus of $5 in Bitcoin after signing up. Additionally, Coinbase offers staking as a way of earning rewards. The minimum amount of cryptocurrency that users can purchase or sell is as little as 1.00 of digital currency denominated in their local currency.

Leverage Options and Trading Costs of Coinbase

Coinbase provides leverage trading, enabling traders to trade larger value contracts while putting down relatively smaller amounts upfront. The trading fees on Coinbase vary, ranging from 0.5% to 4.5% per trade.

Pros and Cons of Coinbase

Pros

- Supports a wide range of cryptocurrencies.

- Offers advanced trading features, including leverage trading.

- Provides educational resources and earning opportunities through Coinbase Earn.

- Secure platform with a self-custody wallet.

Cons

- Leverage trading can be risky and is not suitable for all investors.

8. Kraken

Kraken is a renowned cryptocurrency exchange that has expanded its offerings to include forex trading. Established in 2011, Kraken has built a reputation for security and a wide range of trading options, catering to both novice and experienced traders.

The platform allows users to trade various fiat currencies and cryptocurrencies, providing a comprehensive trading environment with advanced features and competitive fees.

Key Features of Kraken

- Low Minimum Deposit: Start trading with as little as $1.

- Extensive Asset Range: Trade cryptocurrencies, fiat currencies, indices, and futures.

- Advanced Trading Options: Access spot, margin, and futures trading.

- Robust Security Measures: Benefit from top-tier security protocols.

- Educational Resources: Utilize a wealth of learning materials for traders.

- Global Accessibility: Available internationally with some regional restrictions.

- API Connectivity: Integrate custom trading solutions via Kraken's API.

Bonuses and Minimum Deposit of Kraken

Kraken maintains a minimum deposit requirement of just $1, making it highly accessible for traders at all levels. While Kraken does not offer a sign-up bonus, users can earn through staking and look out for promotional events throughout the year.

Leverage Options and Trading Costs of Kraken

Kraken offers leverage up to 1:5 for margin trading and up to 1:50 for futures trading, with fees ranging between 0.01% and 0.02% to open a position. Trading fees are volume-based and can be as low as 0% for high-volume traders, with the cost depending on the trading pair and whether the order is a maker or taker.

Pros and Cons of Kraken

Pros

- Access to a wide range of cryptocurrencies and fiat currencies.

- Competitive trading fees with volume-based discounts.

- Strong security measures and a history of reliability.

Cons

- Some geographical restrictions may apply.

- The trading interface may be complex for new users.

9. InstaForex

InstaForex is an international broker that provides access to global trading floors, from Forex in ECN to derivatives and commodities. With over 7 million clients worldwide, InstaForex is recognized for its pioneering role in the development and introduction of modern trading technologies and tools.

The company offers a wide range of trading instruments and ensures seamless and safe access to the forex market.

Key Features of InstaForex

- Offers more than 300 trading instruments, including currency pairs, futures, shares, and spot instruments.

- Provides a ForexCopy System, allowing clients to benefit from the experience of successful traders.

- Offers a PAMM System, bringing maximum comfort and usability to both investors and traders.

- Supports cryptocurrency trading.

- Offers a multilingual customer support team.

- Provides a user-friendly and reliable platform for digital currency trading.

Bonuses and Minimum Deposit of InstaForex

InstaForex offers deposit bonuses ranging from 30% to 100%, enhancing the trading experience for its clients. The minimum deposit amount is as low as $1, making it accessible for traders with different financial capabilities.

Leverage Options and Trading Costs of InstaForex

InstaForex offers leverage options from 1:1 up to 1:1000, providing a mechanism for traders to potentially increase their profits. The trading costs are not explicitly stated, but the company ensures the best conditions for replenishing accounts and withdrawing funds.

Pros and Cons of InstaForex

Pros

- Wide range of trading instruments.

- Offers innovative trading tools like the ForexCopy and PAMM systems.

- Provides deposit bonuses from 30% to 100%.

Cons

- The broker’s website and Client Cabinet can be tricky to navigate.

10. AvaTrade

AvaTrade is a globally recognized forex broker established in 2006, offering a wide range of financial instruments across various asset classes. The platform is regulated by multiple top-tier authorities, ensuring a secure trading environment for its users. AvaTrade is committed to empowering people to invest and trade with confidence, providing an innovative and reliable environment supported by best-in-class personal service.

The platform caters to traders of all experience levels, offering extensive educational resources, advanced trading tools, and a customer-first approach.

Key Features of AvaTrade

- Regulated by multiple authorities, providing a safe trading environment.

- Offers over 1,200 trading instruments including forex pairs, cryptocurrencies, commodities, indices, and stocks.

- Provides advanced trading tools like AutoChartist, economic calendars, and market analysis.

- Offers a variety of trading platforms including MetaTrader 4, MetaTrader 5, and AvaTradeGO.

- Provides access to third-party platforms for copy and social trading with AvaSocial, ZuluTrade, DupliTrade, and MQL5 Signal service.

- Offers impressive educational resources through Sharp Trader, segmented into beginner, intermediate, and advanced topics.

Bonuses and Minimum Deposit of AvaTrade

AvaTrade offers a variety of bonuses to attract new clients and reward existing ones. To be eligible for the deposit bonus, traders must make a minimum deposit of $100. The platform also offers a referral bonus, with the bonus amount increasing with the deposit amount.

Leverage Options and Trading Costs of AvaTrade

At AvaTrade, forex traders can trade with a leverage of up to 30:1, although this varies depending on jurisdiction and the asset class being traded. AvaTrade does not charge commissions on any trade, and the platform is known for its competitive spreads and swap rates.

Pros and Cons of AvaTrade

Pros

- Regulated by multiple top-tier authorities.

- Wide range of trading instruments.

- Advanced trading tools and educational resources.

- Multiple trading platforms are available.

- No commissions on trades.

Cons

- Customer support might be slow during peak times.

- Research is limited to Trading Central modules.

What is Tether (USDT)?

Tether (USDT) is a stablecoin backed by the US dollar. This means that one USDT is always equal to one USD. Tether Limited's USDT attempts to combine the price stability of fiat currencies such as USD with the operational capabilities of cryptocurrencies such as Bitcoin and Ethereum.

Peg Mechanism

Tether keeps its 1:1 peg to the US dollar by using the following mechanism:

- Tether Limited issues additional USDT tokens in exchange for USD when demand for USDT rises, boosting supply. This assures that one USDT remains worth one dollar.

- Tether destroys or buys back USDT tokens using its USD reserves when demand for USDT dips, hence lowering supply. Keeping the peg in place once again.

- Users can supposedly redeem 1 USDT for $1 from Tether at any time, and doing so preserves the peg.

Tether claims to have enough USD reserves to keep this mechanism and the peg running. However, there are certain questions about the authenticity of their reserves, which we will address later.

Blockchain Integration

Tether was initially introduced on the Bitcoin blockchain using the Omni Layer protocol, however, it is currently also available on the following major blockchains:

- USDT based on Ethereum – ERC-20 is the most extensively utilized, accounting for more than 60% of total supply. Integrates with Ethereum DeFi ecosystems.

- USDT based on TRC-20 operates on the Tron blockchain. Aims for quick and inexpensive transfers.

- To get exposure to the DeFi ecosystem, Ethereum Classic – ETC's blockchain supports USDT.

Algorand, Solana – USDT is also used as stablecoin infrastructure on these upcoming blockchain platforms.

Why Expert Traders Trade with Regulated Forex Brokers?

The key reasons why expert traders prefer to trade with regulated forex brokers:

- Investor Protection: Regulated forex brokers provide a secure, transparent, and trustworthy environment, ensuring investor protection against scams and fraudulent activities.

- Safety of Funds: Regulated brokers are required to segregate client funds from their own operational funds, reducing the risk of loss due to bankruptcy or insolvency.

- Fair Trading Practices: Regulated brokers must adhere to ethical and professional standards imposed by the regulator, ensuring fair trading practices and preventing market manipulation.

- Access to Reliable Trading Platforms: Regulated brokers often provide access to reliable and advanced trading platforms, offering a wide range of technical analysis tools, real-time market data, and order execution options.

- Educational Resources and Support: Regulated brokers often provide educational resources and support to their clients, including webinars, tutorials, and market analysis, which can be particularly beneficial for novice traders.

- Dispute Resolution: In case of any disputes, traders have the option to escalate their complaints to the regulator, providing an additional layer of security and trust.

- Risk Management: Regulated brokers must have robust risk management policies and procedures in place, including setting appropriate leverage limits and margin requirements.

- Transparency: Regulated brokers are compelled to provide clear and accurate information about trading conditions, risks, and other relevant aspects, ensuring transparency in their operations.

FAQs on Best Forex Brokers for USDT Trading in 2025

Why should I consider Forex brokers that accept USDT?

USDT provides a secure and convenient way to manage your funds in online currency trading. It offers the advantages of fast and cost-effective international money transfers.

Are there any Forex brokers that offer both USDT trading and crypto trading?

Yes, brokers that accept USDT often provide crypto trading in addition to Forex trading.

What are the benefits of trading with Forex brokers that accept USDT?

Forex brokers that accept USDT offer quick and cheap deposit and withdrawal options, stability against traditional cryptocurrency volatility, and progressive trading conditions.

Are Forex brokers that accept USDT regulated?

Yes, many Forex brokers that accept USDT are regulated across multiple jurisdictions, ensuring a safe and secure trading environment.

Can I trade other cryptocurrencies besides USDT with these brokers?

Yes, many Forex brokers that accept USDT also offer trading options for other cryptocurrencies.

Summing Up

In 2025, top Forex brokers for USDT trading include RoboForex, OctaFX, Exness, AvaTrade, and FXTM. These brokers are preferred for their secure and convenient fund management, fast and cost-effective international money transfers, and progressive trading conditions. They also offer trading options for other cryptocurrencies besides USDT.

Many of these brokers are regulated across multiple jurisdictions, ensuring a safe and secure trading environment. They provide a variety of platforms and tools for different levels of traders, from beginners to experts.

These platforms offer features like segregated accounts, investor protection, transparency, secure trading infrastructure, fair trading practices, dispute resolution, and access to investor compensation schemes.

So what are your thoughts on USDT forex brokers? Which one would you choose?

![Best 29 Forex Brokers in Argentina 2025 [Top Picks are Here] 18 Best 29 Forex Brokers in Argentina 2025 [Top Picks are Here]](https://fxparkey.com/wp-content/uploads/2024/01/Best-Forex-Brokers-in-Argentina-300x150.webp)