Neteller has emerged as one of the most popular e-wallets among forex traders worldwide, offering quick transactions and enhanced security features.

For traders looking to maximise their efficiency, choosing forex brokers that support Neteller payments has become increasingly important. This payment option allows for instant deposits, faster withdrawals, and often comes with minimal or no transaction fees.

Our 2025 ranking highlights the Best Neteller Forex brokers operating in regulated environments, combining competitive pricing, diverse asset portfolios, and advanced trading tools. These brokers accept Neteller for instant deposits and withdrawals, streamlining fund management while adhering to strict compliance standards.

This detailed guide evaluates 12+ leading Neteller Forex brokers in 2025, analyzing platform reliability, fee transparency, and regulatory oversight. From established firms to newer entrants, we assess each broker’s strengths and limitations to align with varied trading strategies.

Know More on Neteller Forex Brokers

Since its launch in 1999, Neteller has become a globally recognized digital payment system, trusted by millions for efficient financial transactions. The platform supports Neteller as a payment option for online purchases, cross-border transfers, and secure fund storage, prioritizing user accessibility and regulatory compliance.

Licensed by the UK’s Financial Conduct Authority (FCA), Neteller is a safe choice due to its strict anti-money laundering (AML) and know-your-customer (KYC) protocols.

Within the Forex market, Accept Neteller Forex Brokers to streamline deposits and withdrawals, appealing to traders who value speed and security. The list of the best trading brokers in 2025 highlights platforms integrating Neteller alongside competitive spreads and diverse asset offerings. Neteller also enables instant account funding, minimizing delays in executing trades.

Top 12+ Neteller Forex Brokers in 2025

| Broker | Key Features | Pricing |

|---|---|---|

| XM | 1,000+ instruments, Neteller integration, MT4/5, $5 min deposit. | Spreads from 0.6 pips, No Neteller fees, Inactivity fees after 90 days. |

| RoboForex | 3,500+ CFDs, CopyFX social trading, MT4/5, R Trader. | ECN commissions from $2.5/lot, High leverage (1:2000). |

| AvaTrade | 1,250+ instruments, AvaOptions, AvaTradeGO, MT4/5. | Spreads from 0.9 pips, $100 min deposit, 1:400 leverage. |

| IC Markets | Raw spreads (0.0 pips), cTrader, 2,100+ CFDs, NY4/LD5 servers. | $200 min deposit, $3.5/lot commissions, No copy trading. |

| EasyMarkets | dealCancellation tool, Freeze Rate, MT4/web platform. | Higher spreads, 1:400 leverage (MT4), $25 min deposit. |

| FXCM | 440+ instruments, TradingView integration, NinjaTrader. | Spreads from 0.8 pips, $50 min deposit, $50/year inactivity fee. |

| HF Markets | MetaTrader suite, 1,200+ instruments, WebTrader. | $5 min deposit, No Neteller fees, High min deposit for premium accounts. |

| FXTM | $5 min deposit, MT4/5, 250+ instruments, VIP perks. | 0.0 pips + $0.8–$4/lot fees, $10/month inactivity fee. |

| NAGA | 1,000+ CFDs, Copy Trading, MT4/5, social features. | $250 min deposit, Inactivity fee after 6 months. |

| InstaForex | 300+ instruments, MT4/5, 1:1000 leverage. | 0 pips spreads, $1 min deposit, Offshore regulation. |

| EXNESS | MT4/5, 200+ instruments, crypto trading. | Withdrawal fees for some methods, Tight spreads. |

| FXTrading.com | Advanced charting tools, MT4/5, crypto CFDs. | Limited product range, Withdrawal fees apply. |

| Pepperstone | 1,200+ CFDs, Capitalise AI, MT4/5, cTrader, TradingView. | Raw spreads (0.0 pips), $20 int’l withdrawal fee, $0 Neteller fees. |

| Eightcap | 1,000+ CFDs, Capitalise.ai automation, MT4/5. | $100 min Neteller withdrawal, $0 deposit fees, Tier-1 liquidity. |

1. XM

XM is a leading online forex and CFD broker, offering traders a secure and regulated platform to access the global markets.

With a strong emphasis on transparency and client protection, XM has established itself as a trusted Neteller forex brokers, catering to traders worldwide.

Regulated by top-tier authorities, including CySEC, ASIC, and DFSA, XM ensures compliance with stringent financial standards, safeguarding client funds through segregated accounts and negative balance protection.

Key Features of XM

Pros and Cons of XM

Pros

Cons

2. RoboForex

RoboForex, a leading online forex and CFD broker offers traders a secure and regulated platform with seamless Neteller integration.

Established in 2009, RoboForex has built a reputation for providing a diverse range of trading instruments, competitive pricing, and innovative technology.

With a strong emphasis on client satisfaction and support, RoboForex caters to traders of all experience levels, from beginners to seasoned professionals.

Key Features of RoboForex

Pros and Cons of RoboForex

Pros

Cons

3. AvaTrade

AvaTrade is a leading online forex and CFD broker that offers seamless integration with Neteller Forex Brokers for fast and secure deposits and withdrawals.

Established in 2006, AvaTrade has built a solid reputation for providing a diverse range of trading instruments, competitive pricing, and cutting-edge trading platforms to clients worldwide.

Regulated by top-tier authorities such as the Central Bank of Ireland, ASIC, and FSA, AvaTrade ensures a safe and transparent trading environment for its clients.

Key Features of AvaTrade

Pros and Cons of AvaTrade

Pros

Cons

4. IC Markets

IC Markets is a prominent online forex and CFD broker that offers seamless integration with Neteller for fast and secure deposits and withdrawals.

Established in 2007, IC Markets has earned a reputation for providing competitive spreads, deep liquidity, and cutting-edge trading platforms to clients worldwide.

Regulated by top-tier authorities such as ASIC and FSA, IC Markets ensures a safe and transparent trading environment, with segregated client funds and negative balance protection.

Key Features of IC Markets

Pros and Cons of IC Markets

Pros

Cons

5. EasyMarkets

EasyMarkets is a well-established online forex and CFD broker that offers seamless integration with Neteller for fast and secure deposits and withdrawals.

Founded in 2001, EasyMarkets has built a solid reputation for providing a user-friendly trading platform, competitive pricing, and innovative features to traders worldwide.

Regulated by top-tier authorities such as CySEC, ASIC, and FSA, EasyMarkets ensures a safe and transparent trading environment for its clients.

Key Features of EasyMarkets

Pros and Cons of EasyMarkets

Pros

Cons

6. FXCM

FXCM is a pioneering online forex and CFD broker that offers seamless integration with Neteller.

Established in 1999, FXCM has been at the forefront of the forex industry, providing traders with advanced trading platforms, competitive pricing, and a wide range of educational resources.

Regulated by top-tier authorities such as the FCA, ASIC, and FSA, FXCM ensures a safe and transparent trading environment for its clients.

Key Features of FXCM

Pros and Cons of FXCM

Pros

Cons

7. HF Markets

HF Markets, a leading forex and CFD broker, has garnered a reputation for its user-friendly trading platforms, competitive pricing, and diverse range of financial instruments.

With a strong emphasis on transparency and client satisfaction, the broker offers a seamless trading experience for both novice and experienced traders.

Notably, HF Markets' integration with Neteller, a renowned online payment system, has streamlined the funding and withdrawal processes, ensuring a hassle-free financial management experience for traders worldwide.

Key Features of HF Markets

Pros and Cons of HF Markets

Pros

Cons

8. FXTM

FXTM, or Forex Time, is a leading online forex and CFD broker that caters to traders worldwide.

With a strong emphasis on cutting-edge technology and innovative trading solutions, FXTM has garnered a reputation for its user-friendly platforms and seamless integration with popular payment methods like Neteller.

Neteller, a widely recognized e-wallet service, allows FXTM clients to deposit and withdraw funds swiftly and securely, enhancing the overall trading experience.

Key Features of FXTM

Pros and Cons of FXTM

Pros

Cons

9. NAGA

NAGA is a leading forex and CFD broker that offers a unique social trading experience to over 1 million users worldwide.

With a strong focus on innovation and user-friendly platforms, NAGA has integrated popular payment methods like Neteller, allowing clients to deposit and withdraw funds swiftly and securely.

Regulated by CySEC, NAGA provides access to over 1,000 trading instruments, including forex, stocks, indices, and cryptocurrencies, catering to traders of all levels.

Key Features of NAGA

Pros and Cons of NAGA

Pros

Cons

10. InstaForex

InstaForex, a leading forex and CFD broker, has been serving over 7 million clients worldwide since 2007.

With a strong emphasis on innovation and user-friendly platforms, InstaForex has integrated popular payment methods like Neteller, allowing clients to deposit and withdraw funds swiftly and securely.

Regulated by the BVI FSC, InstaForex offers access to more than 300 trading instruments, including forex, stocks, indices, and commodities, catering to traders of all levels.

Key Features of InstaForex

Pros and Cons of InstaForex

Pros

Cons

11. EXNESS

EXNESS is a leading Neteller forex brokers that offers a diverse range of trading instruments, including currencies, metals, energies, and cryptocurrencies.

With a strong focus on innovation and customer satisfaction, EXNESS has established itself as a trusted name in the industry.

One of its standout features is the seamless integration with Neteller, a popular online payment system, allowing traders to deposit and withdraw funds with ease.

Key Features of EXNESS

Pros and Cons of EXNESS

Pros

Cons

12. FXTrading.com

FXTrading.com is a renowned Neteller forex brokers that has garnered a reputation for its cutting-edge trading platforms and seamless integration with Neteller, a leading online payment solution.

With a strong emphasis on security and transparency, FXTrading.com offers a diverse range of trading instruments, catering to both novice and experienced traders alike.

Key Features of FXTrading.com

Pros and Cons of FXTrading.com

Pros

Cons

13. Pepperstone

Pepperstone cements its position as a top Neteller forex brokers in 2025, offering zero deposit fees and instant transactions via the e-wallet.

Regulated by ASIC, FCA, and CySEC, it provides access to 1,200+ CFDs, including forex, indices, cryptocurrencies, and commodities, with raw spreads from 0.0 pips and execution speeds under 30 milliseconds.

Traders benefit from MetaTrader, cTrader, and TradingView integration, alongside advanced tools like Capitalise AI for automated strategies. While Neteller withdrawals are free, international bank transfers incur a $20 fee.

Key Features of Pepperstone

Pros and Cons of Pepperstone

Pros

Cons

14. Eightcap

Eightcap emerges as a leading Neteller forex brokers in 2025, offering zero-fee deposits/withdrawals via the e-wallet alongside 1,000+ CFDs, including forex, crypto, and indices.

Regulated by ASIC, FCA, and CySEC, it ensures secure trading with segregated funds and negative balance protection. Traders benefit from MetaTrader 4/5 platforms, raw spreads from 0.0 pips, and execution speeds under 30ms.

While Neteller forex brokers transactions are free, withdrawals require a $100 minimum, and advanced educational resources remain limited compared to competitors.

Key Features of Eightcap

Pros and Cons of Eightcap

Pros

Cons

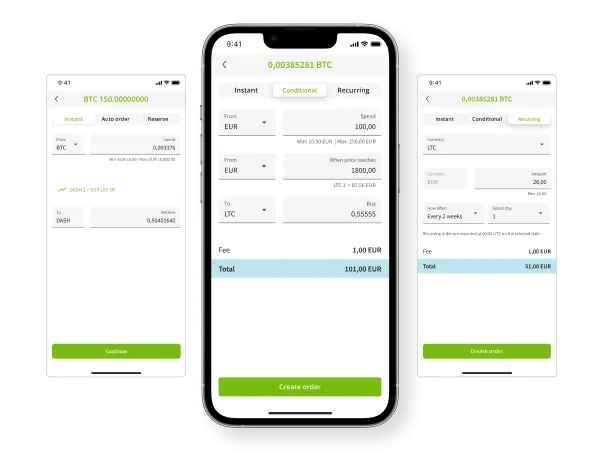

How do I Deposit with Neteller? Step-by-Step Guide

Depositing funds into your forex trading account using Neteller is a straightforward and secure process. Neteller is a widely accepted e-wallet service that allows you to transfer money electronically, making it a convenient option for forex traders.

Here's a step-by-step guide on how to deposit with Neteller:

- Open a Neteller Account:

If you don't already have a Neteller account, you'll need to sign up for one. Visit the Neteller website and follow the registration process, providing your personal and financial details. Neteller accounts are available in multiple currencies, so choose the one that suits your needs.

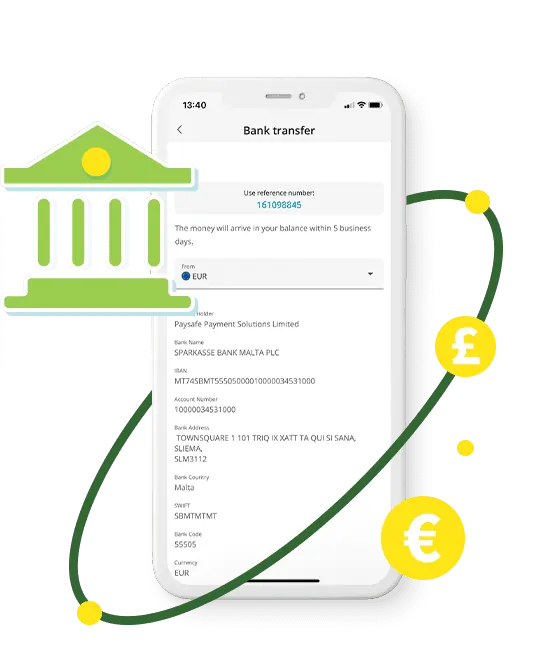

- Fund Your Neteller Account:

Once your account is set up, you'll need to fund it. Neteller offers various funding options, including bank transfers, credit/debit cards, and other e-wallets. Choose the method that works best for you and follow the instructions to transfer funds into your Neteller account.

- Log in to Your Neteller Forex Brokers Client Area:

Access your Neteller forex brokers client area or trading platform and navigate to the deposit section. Most reputable brokers will have Neteller listed as one of the available deposit methods.

- Select Neteller as the Deposit Method:

Choose Neteller as your preferred deposit method and enter the amount you wish to transfer to your trading account.

- Enter Your Neteller Account Details:

You'll be prompted to enter your Neteller account details, such as your email address and secure ID. Double-check these details to ensure accuracy.

- Confirm the Transaction:

Review the details of your deposit, including the amount and any applicable fees. If everything looks correct, confirm the transaction.

- Transfer Funds from Neteller to Your Trading Account:

Once you've confirmed the transaction, the funds will be transferred from your Neteller account to your Forex broker's account. This process is typically instantaneous, allowing you to start trading immediately.

How do I Withdraw with Neteller? Step-by-Step Guide

Transferring funds from your Forex account to a Neteller e-wallet is efficient and secure, supported by brokers for 2025 that prioritize user-friendly trading services. Neteller deposits and withdrawals are widely available across leading platforms, enabling quick transactions with minimal processing delays.

To withdraw, first confirm your broker’s policies regarding forex fees for Neteller transactions, as charges may vary. Reputable brokers typically process withdrawals within 24 hours, ensuring timely access to funds. Always verify account details to avoid errors, and review Neteller’s security protocols for added protection.

By selecting brokers that integrate Neteller, traders benefit from streamlined processes and competitive fee structures. This method remains a preferred choice for balancing speed and reliability in Forex transactions.

- Log in to Your Forex Broker's Client Area:

Access your forex broker's client area or trading platform and navigate to the withdrawal section. Most reputable brokers will have Neteller listed as one of the available withdrawal methods.

- Select Neteller as the Withdrawal Method:

Choose Neteller as your preferred withdrawal method and enter the amount you wish to transfer from your trading account to your Neteller account.

- Enter Your Neteller Account Details:

You'll be prompted to enter your Neteller account details, such as your email address and secure ID. Double-check these details to ensure accuracy, as any mistakes may result in a failed or delayed withdrawal.

- Provide Additional Information (if required):

Depending on your broker's policies and regulatory requirements, you may need to provide additional information or documentation, such as proof of identity or address. This is a standard security measure to prevent fraud and comply with anti-money laundering regulations.

- Review and Confirm the Transaction:

Before finalizing the withdrawal, carefully review the details, including the amount, your Neteller forex brokers account information, and any applicable fees. If everything looks correct, confirm the transaction.

- Wait for the Withdrawal to be Processed:

Once you've confirmed the withdrawal, your forex broker will process the request. The processing time can vary depending on the broker, but it typically takes 1-3 business days for the funds to be transferred to your Neteller account.

- Check Your Neteller Account:

After the withdrawal has been processed, log in to your Neteller account to verify that the funds have been credited. You can then choose to keep the money in your Neteller account for future use or transfer it to your bank account or another payment method.

FAQs on Neteller Forex Brokers

Are there any Fees for using Neteller?

Most forex brokers do not charge any fees for Neteller deposits. However, Neteller itself may charge a small fee for funding your e-wallet or making withdrawals.

Can I Withdraw Funds to my Neteller Account?

Yes, reputable forex brokers allow you to withdraw funds from your trading account back to your Neteller e-wallet quickly and securely.

Is Neteller available Globally?

Neteller is available in over 200 countries worldwide, making it a convenient option for international traders.

Are there any Forex Brokers that don't accept Neteller?

While Neteller is widely accepted, some brokers may not offer it as a payment method, especially in certain regions due to local regulations.

Is Neteller safe for Forex Trading?

Neteller uses advanced encryption and security measures to protect user data and funds, making it a safe option for forex transactions when used with a regulated, reputable broker.

Can I use other E-wallets besides Neteller?

Yes, many Neteller forex brokers also accept other popular e-wallets like Skrill, PayPal, and WebMoney for deposits and withdrawals.

Bottom Line

For Forex traders, secure payment methods are essential. Many forex brokers accept Neteller, a trusted e-wallet known for efficient trading fees and rapid processing. The brokers that offer Neteller in this guide prioritize transparency, low costs, and user-focused features, making them a best investment for traders prioritizing reliability.

These neteller forex brokers offer diverse assets, intuitive platforms, and educational tools to help you learn more about forex. By partnering with brokers supporting Neteller, you gain quick access to funds while minimizing transactional delays. To choose the best broker, compare fee structures, regulatory compliance, and Neteller integration. Top platforms highlighted here balance affordability and security, ensuring your focus remains on strategy execution.