When it comes to forex trading, choosing the right broker can make all the difference. As an Australian trader, you want a broker that is regulated locally and offers tight spreads, fast execution, and advanced trading platforms. Our team has researched over 40 Australia-based brokers to come up with this definitive list of the best 10.

Whether you're a beginner seeking education and support, or an experienced trader looking for advanced features – you'll find the perfect broker here. My rankings factor in fees, platforms, tools, research, ease of use, and more.

Read on to discover which brokers made the cut for the Best 10 Australian Forex Brokers, as well as an overview of their key features.

Kickstarting on to finding the broker that best fits your needs is key to succeeding with forex trading in Australia.

How Did We Choose the Best Australian Forex Brokers?

Selecting the best forex brokers in Australia requires in-depth research and analysis. We examined Over 40 Forex Brokers licensed to operate in Australia to provide traders with the definitive best 10. Our methodology focuses on the key aspects you need: regulation, fees and commissions, trading platforms, research and tools, customer support, and reputation.

We dig into the specifics around spreads, execution speeds, platform capabilities, educational resources, response times, and more. Hours of testing and real trader reviews inform our rankings. The top forex brokers excel across the board to give you a great experience. This list represents the best in class to meet any Australian trader's needs whether you're new to forex or an advanced practitioner.

🦘 List of the 10 Best Australia Forex Brokers

| Broker | Main Features |

|---|---|

| IG | Largest retail forex broker in Australia; Tight spreads; Advanced trading platforms |

| Saxo Bank | Highly regulated; Excellent trading platforms and tools; Wide range of tradable instruments |

| CMC Markets | 300+ currency pairs; Pattern recognition scanner; No commissions |

| City Index | Competitive pricing; MT4 and web trader platforms; Quality research tools |

| eToro | Leading social trading platform; Copy trading available; Supports crypto trading |

| AvaTrade | Beginner-friendly; Copy trading available; Fixed and floating spreads |

| Blueberry Markets | Fast execution; MT4 and MT5 platforms; Raw ECN spreads |

| XM | Ultra-low spreads; Free VPS hosting for clients; MT4 and MT5 platforms |

| Eightcap | ECN broker; Spreads from 0 pips; Fast execution speeds |

| Markets.com | User-friendly web trader platform; ASIC regulated; 300+ instruments |

1. IG

IG is one of the world's leading online trading platforms, offering retail traders access

to over 17,000 financial markets including forex, shares, indices, commodities, and

cryptocurrencies. Established in 1974, IG has grown to serve over 239,000 active

clients globally.

It is regulated across multiple jurisdictions like the UK, EU, Australia, and Japan. IG provides traders with advanced web and mobile apps packed with tools for analysis and execution. Features include risk management functions, fast trade execution, customizable charts and alerts, sentiment indicators, automated trading via EAs, and more.

With competitive spreads from 0.6 pips, 24/5 customer service, and education for all skill levels, IG aims to give both new and experienced traders the best chance for trading success.

IG Key Features

- Regulated across 8 tier-1 jurisdictions including the UK, EU, and Australia for security.

- A publicly traded company listed on the London Stock Exchange since 1974.

- Over 239,000 active traders worldwide use IG's platforms.

- Trade over 17,000 financial markets including forex, crypto, shares, and indices.

- Advanced web & mobile trading apps with charts, alerts, and risk management tools.

- Ultra-low spreads from 0.6 pips on forex pairs & commissions from $3 per trade.

| Feature | Details |

|---|---|

| Leverage | Up to 1:30 |

| Instruments | Forex, Stocks, Indices, Commodities, Bonds, ETFs, Cryptocurrencies |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, PayPal, Skrill, NETELLER, Trustly |

| Crypto Deposit and Withdrawal | Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash |

2. Saxo Bank

Saxo Bank is an online investment bank founded in 1992 that enables clients to trade global financial markets.

Headquartered in Copenhagen, Saxo Bank serves over 1 million clients worldwide with assets exceeding $100 billion. Saxo Bank holds banking licenses and is regulated across Europe, Asia, and Australia to provide clients with secure market access.

Traders can access over 71,000 instruments including forex, stocks, ETFs, futures, listed options, bonds, and CFDs through Saxo's user-friendly trading platforms. Features include advanced charts, risk management tools, algorithmic trading, expert analysis, and more.

Saxo also works with institutional partners and fintech firms to power trading infrastructure technology. With 24/5 support and education for all skill levels, Saxo Bank gives traders and investors the tools to succeed.

Saxo Key Features

- Founded in 1992, over $100 billion in client assets and 1 million clients globally.

- Banking license & regulated across Europe, Asia, and Australia for security.

- Trade 71,000+ instruments – forex, stocks, ETFs, futures, bonds, CFDs.

- Powerful web & mobile platforms with advanced charts & analysis tools.

- Features include risk management, algo trading, expert commentary.

- Works with partners to power trading infrastructure technology.

| Feature | Details |

|---|---|

| Leverage | Up to 1:100 |

| Instruments | Stocks, Forex, CFDs, Futures, Options, Bonds, ETFs |

| Deposits and Withdrawals Methods accepted | Via bank transfers and debit cards |

| Crypto Deposit and Withdrawal | Bitcoin crypto ETFs and Crypto ETNs, Ethereum crypto ETFs and Crypto ETNs, Stellar crypto ETF, Polkadot |

3. CMC Markets

Founded in 1989, CMC Markets is a leading global provider of online trading across shares, forex, and contracts for difference (CFDs) to retail, professional, and institutional clients.

Headquartered in London with hubs in Sydney and Singapore, CMC Markets is listed on the London Stock Exchange. With innovative proprietary technology, CMC Markets offers an award-winning trading experience across web and mobile platforms suited to all skill levels.

Features include risk management tools, sentiment indicators, advanced charts, and over 10,000 financial instruments. Regulated across Europe, Australia, and Asia-Pacific, CMC Markets provides clients with secure market access. With competitive pricing, 24/5 support, and a comprehensive education hub, CMC Markets empowers informed decision-making so traders can capitalize on worldwide financial markets.

CMC Markets Key Features

- Founded in 1989, listed on the London Stock Exchange, with over 300,000 clients globally.

- Regulated across Europe, Australia, and Asia-Pacific for security.

- Award-winning proprietary web & mobile apps for all skill levels.

- Trade 10,000+ instruments – forex, shares, indices, commodities, crypto.

- Features include advanced charts, risk management tools, and sentiment analysis.

- Competitive spreads from 0.7 pips & transparent low commissions.

| Feature | Details |

|---|---|

| Leverage | Up to 1:500 |

| Instruments | Forex, Stocks, Indices, Commodities, Bonds, ETFs, Cryptocurrencies |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards (Visa, Mastercard), and PayPal. |

| Crypto Deposit and Withdrawal | Tether USD, Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash BNB, |

4. City Index

City Index is an award-winning global broker founded in 1983 that provides online trading access across forex, shares, indices, commodities, and cryptocurrencies. Headquartered in London and regulated in the UK, EU, and globally, City Index serves over one million clients worldwide.

City Index offers traders advanced web and mobile trading platforms packed with exclusive tools, fast execution, and competitive pricing. Features include risk management functions, performance analytics, smart trade signals, fast deposits and withdrawals, and more.

With over 40 years of market experience, 24/5 customer support, and comprehensive education for all skill levels, City Index aims to give both new and experienced traders the best opportunity to navigate financial markets successfully.

City Index Key Features

- Founded in 1983, serves over 1 million clients, regulated globally.

- Award-winning web & mobile trading platforms packed with tools.

- Trade forex, shares, indices, commodities, crypto with fast execution.

- Features include risk management, performance analytics, smart signals.

- Competitive pricing with transparent fees & fast deposits/withdrawals.

- 40+ years market experience & 24/5 customer support all levels.

| Feature | Details |

|---|---|

| Leverage | Up to 1:30 |

| Instruments | Forex, Stocks, Indices, Commodities, Bonds, ETFs, Cryptocurrencies |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, PayPal |

| Crypto Deposit and Withdrawal | Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Dogecoin, Ada, Tether |

5. eToro

Founded in 2007, eToro is a global multi-asset investment platform that empowers over 27 million users across more than 140 countries to trade and invest. eToro aims to make trading accessible for everyone through an innovative social investment network and user-friendly interface.

eToro offers commission-free trading in stocks, ETFs, currencies, cryptocurrencies, indices, and commodities. Key features include copy trading, risk management tools, research and news feeds, and more. eToro is regulated in several jurisdictions including the UK, Europe, Australia, and the US to provide a secure trading environment.

With a commitment to simplicity, transparency, and building community, eToro gives both beginning and experienced traders the confidence to invest in global markets.

eToro Key Features

- Founded in 2007, regulated globally, over 27 million users worldwide.

- Commission-free trading of stocks, ETFs, crypto, currencies, commodities.

- Innovative social investment platform with copy trading available.

- User-friendly interface ideal for beginner and experienced traders.

- Features include risk management tools, research, news feeds.

- Transparent fees, fast and secure deposits and withdrawals.

| Feature | Details |

|---|---|

| Leverage | Up to 5x leverage offered on stocks varies by asset class |

| Instruments | Stocks, ETFs, Commodities, Currencies, Cryptocurrencies |

| Deposits and Withdrawals Methods accepted | Bank transfer, Credit cards, PayPal, Skrill, Neteller |

| Crypto Deposit and Withdrawal | Up to 5x leverage offered on stocks varies by asset class |

6. AvaTrade

AvaTrade is an innovative online forex and CFD broker, providing retail and institutional traders access to over 1000 financial instruments since 2006. Headquartered in Ireland and regulated in several jurisdictions, AvaTrade aims to give clients a premier trading experience with an array of platforms, tools, and educational resources suitable for all skill levels.

Traders can access 24/5 multi-lingual support and competitive pricing. Features include risk management, copy trading, automated trading options, fast deposits/withdrawals, and more. With a focus on local regulation, transparency, and advanced trading infrastructure, AvaTrade empowers informed decision-making.

AvaTrade adapts to evolving markets, having introduced crypto and commodities trading early on. By combining robust trading capabilities with personalized support, AvaTrade helps traders reach their potential.

AvaTrade Key Features

- Founded in 2006, and regulated globally, provides access to 1000+ instruments.

- Trade forex, crypto, CFDs, stocks, commodities with fixed & floating spreads.

- User-friendly platforms suited for beginner and advanced traders.

- Features include risk management, copy trading, auto trading options.

- 24/5 multi-lingual support & competitive pricing on trades.

- Transparent fees, fast deposits & withdrawals.

| Feature | Details |

|---|---|

| Leverage | Up to 30:1. |

| Instruments | Over 1000 including Forex, Stocks, Indices, Commodities, Bonds, ETFs, Cryptocurrencies |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, PayPal, Skrill, Neteller, WebMoney, Klarna, Boleto |

| Crypto Deposit and Withdrawal | Bitcoin(BTC), Ethereum (ETH), Binance Coin(BNB), Cardano(ADA) |

7. Blueberry Markets

Founded in 2016 by Dean Hyde, Blueberry Markets is an Australian-based online forex and CFD broker providing access to over 300 financial instruments. Blueberry Markets aims to give traders a premier trading experience through its powerful yet easy-to-use proprietary platform packed with advanced tools, tight spreads, and fast execution.

Blueberry Markets is regulated in Australia to offer clients a secure trading environment. With a focus on market expertise, transparency, and customer service, Blueberry Markets provides 24/5 multi-lingual support, comprehensive education for all levels, automated trading options, integrated third-party services, and more.

By combining robust trading infrastructure with personalized service, Blueberry Markets helps traders capitalize on market opportunities

Blueberry Markets Key Features

- Australian-based online forex & CFD broker founded in 2016.

- Regulated in Australia to provide a secure trading environment.

- Proprietary web & mobile platforms with advanced tools.

- Tight spreads from 0 pips & fast trade execution speeds.

- 300+ tradable financial instruments including forex & crypto.

- Comprehensive education, multi-lingual 24/5 support at all levels.

| Feature | Details |

|---|---|

| Leverage | Up to 1:500 |

| Instruments | 300+ including Forex, Indices, Commodities, Cryptocurrencies, Stocks/CFDs |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, PayPal, Skrill, Neteller, Crypto |

| Crypto Deposit and Withdrawal | Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ripple |

8. XM

XM is an online forex and CFD broker providing access to over 1000 trading instruments across currency pairs, commodities, indices, stocks, precious metals, and energies. Founded in 2009, XM empowers over 4 million clients across 196 countries with competitive trading conditions, advanced trading platforms, and dedicated 24/5 multi-lingual support.

XM is regulated by top-tier jurisdictions like Cyprus, Australia. and South Africa to offer a secure trading environment. With ultra-tight spreads from 0 pips and fast execution on trades, XM enables informed decision-making for all trading styles and skill levels. Through comprehensive educational resources, XM aims to give new traders a solid foundation while helping experienced traders refine their strategies.

XM Key Features

- Founded in 2009, over 4 million clients, regulated globally.

- Access 1000+ instruments – forex, commodities, stocks, indices.

- Ultra-tight spreads from 0 pips & fast trade execution.

- Advanced MT4 and MT5 platforms available.

- 24/5 support in 30+ languages.

- Segregated client funds and tier-1 bank partnerships.

| Feature | Details |

|---|---|

| Leverage | Up to 1000:1 |

| Instruments | Over 1000 including Forex, Indices, Commodities, Stocks, Crypto, ETFs |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, Skrill, Neteller, WebMoney, UnionPay, and more |

| Crypto Deposit and Withdrawal | Bitcoin, Bitcoin Cash, Ethereum, Cardano, Tron Solana, Xrp |

9. Eightcap

Eightcap is an online forex and CFD broker providing traders access to over 800 financial instruments since 2009. Headquartered in Australia and regulated across multiple tier-1 jurisdictions, Eightcap aims to give clients a premier trading experience with tight spreads from 0 pips, fast execution speeds, and advanced MetaTrader platforms.

With a focus on market transparency and customer service, Eightcap provides 24/5 support, algorithmic trading via Capitalise.ai, and third-party integrations. Though Eightcap’s educational resources are limited, its competitive pricing, ECN account options, and global regulatory oversight empower informed trading.

By combining robust trading infrastructure with dedicated account management, Eightcap accommodates active investors looking to capitalize on forex and CFDs across currencies, indices, shares, crypto, and commodities.

Eightcap Key Features

- Australian broker founded in 2009, regulated globally.

- 800+ tradable CFD instruments – forex, crypto, commodities.

- Tight spreads from 0 pips & fast trade execution speeds.

- Advanced MetaTrader 4 & 5 platforms available.

- 24/5 support & algorithmic trading via Capitalise.ai.

- Tier-1 bank partnerships & segregated client funds.

| Feature | Details |

|---|---|

| Leverage | Up to 1:500 |

| Instruments | Over 800 including Forex, Indices, Commodities, Stocks/CFDs, Crypto |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, PayPal, Skrill, Neteller, Crypto |

| Crypto Deposit and Withdrawal | BTCUSD. Bitcoin, ETHUSD. Ethereum, XRPUSD Ripple, BCHUSD BitcoinCash |

10. Markets.com

Markets.com is an award-winning global multi-asset broker providing online trading access across forex, stocks, indices, ETFs, commodities, and cryptocurrencies since 2008. Regulated in several tier-1 jurisdictions including Australia, Markets.com serves over 300,000 clients worldwide.

Markets.com offers user-friendly proprietary web and mobile trading platforms packed with insights, alerts, and risk management tools. With transparent pricing, fast execution speeds, 24/7 customer support, and comprehensive education, Markets.com provides traders with the resources to make informed decisions.

By combining innovative technology with a focus on client-centric service, Markets.com gives both new and experienced traders the ideal gateway to global markets in a secure, reliable trading environment.

Markets.com Key Features

- Global multi-asset broker founded in 2008, 300,000+ clients.

- Regulated across tier-1 jurisdictions including Australia.

- Award-winning proprietary web & mobile trading platforms.

- Access forex, stocks, indices, commodities, crypto.

- Packed with insights, alerts & risk management tools.

- Transparent pricing & fast trade execution speeds.

| Feature | Details |

|---|---|

| Leverage | Up to 1:300 |

| Instruments | Including Forex, Indices, Commodities, Stocks, ETFs, Crypto, Stocks/CFDs, Crypto |

| Deposits and Withdrawals Methods accepted | Bank wire, Credit/Debit cards, PayPal, Skrill, Neteller |

| Crypto Deposit and Withdrawal | Xrp, Solana, Bnb, Dogecoin, Avalanche, Ltc |

How to Choose an Australian Forex Broker?

While choosing an Australian Forex Broker, here are some of the key points to consider:

Regulation

- ASIC (Australian Securities and Investments Commission) regulates forex brokers in Australia. Brokers must hold an Australian Financial Services (AFS) license from ASIC to operate legally.

- ASIC has strict capital, segregated accounts, dispute resolution, and other requirements for licensed brokers. The minimum capital is AUD 1 million.

- ASIC cooperates with other Australian regulators like APRA and ACCC.

Licensing Requirements

- To get an AFS license, brokers must meet minimum capital, have Australian directors, provide ownership/management information, and pay fees.

- The application process takes a minimum of 6 months. After approval, a bank account can be established.

- Only brokers with 10%+ revenue or $1 million+ from Australian clients need a license. Offshore brokers can serve non-retail Australian clients.

Protections for Traders

- ASIC regulation provides protections like segregated accounts, negative balance protection, leverage limits, and dispute resolution.

- Brokers must follow standards like the FX Global Code. ASIC takes complaints seriously and investigates disputes.

- An investor compensation scheme protects client funds if a broker becomes insolvent.

Verification

- ASIC-regulated brokers have a unique AFS license number that can be verified on ASIC's website. Brokers also mention it on their websites.

Trends

- The Australian forex market has seen strong growth, with an average daily turnover of over $400 billion. Retail trading is also rising in popularity.

More About the Australian Forex Market

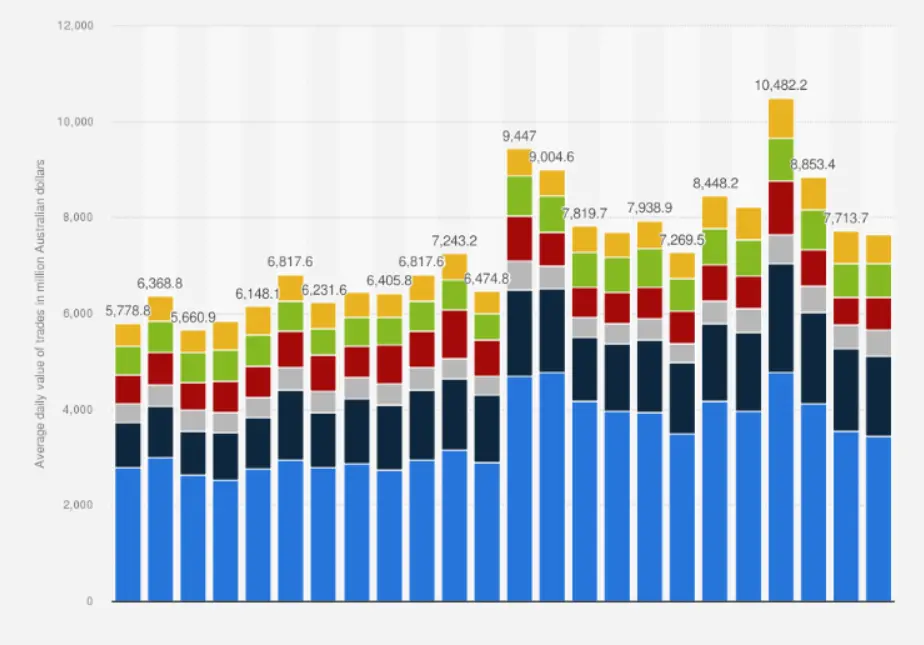

The Australian foreign exchange (forex) market has seen tremendous growth over the past decade, with average daily turnover reaching $406 billion in April 2019, a 66% increase from 2016. This makes Australia the 7th largest forex market globally.

The Australian dollar (AUD) is the 6th most traded currency worldwide, involved in 6.8% of all forex transactions. The AUD/USD pair specifically accounts for 5.4% of global daily volume. The most traded pairs in Australia are AUD/USD, AUD/JPY, EUR/AUD and NZD/AUD.

High trading volumes reflect the rising popularity of forex and CFD trading among Australian retail investors. Over 100,000 Australians traded CFDs in 2021, though this was a dip from the prior year. Online trading platforms have improved access and made forex more appealing.

Australia's strong, stable economy and its role as a major commodity exporter make the AUD sensitive to global growth and commodity price fluctuations. This can increase volatility and trading opportunities. Regulatory oversight from ASIC also provides confidence.

The growth trends highlight Australia's position as a significant global forex hub. With technological progress and education, retail participation could expand further.

FAQ Related to Australian Forex Brokers

What is the regulatory body for Forex brokers in Australia?

The Australian Securities and Investments Commission (ASIC) regulates Forex brokers in Australia.

What are the trading hours for the Australian Forex market?

The Forex market operates 24 hours a day, starting from 5.00 am (Sydney time) on Monday and closing at 5.00 pm (New York time).

How are the fees structured by Australian Forex brokers?

Fees can include spreads, commissions, and sometimes inactivity fees. The specific structure varies by broker.

Are Australian Forex brokers required to follow a code of conduct?

Can I trade with offshore Forex brokers as an Australian resident?

Wrapping Up on Australian Forex Brokers

And there you have it, a comprehensive overview of what to look for when choosing an Australian forex broker in 2024. With proper regulation, competitive pricing, advanced platforms, and strong customer support now the norm, you're spoiled for choice.

Ultimately, the best broker comes down to your personal trading style and priorities.

⚡ Do you want tight spreads or lightning-fast execution?

📊 Do you need integrated charting tools or automated trading algorithms?

✅ Build a checklist of must-haves, nice-to-haves, and dealbreakers.

Test drive a few broker demo accounts. Compare how they stack up on your key criteria. Don't rush—take your time evaluating each platform's strengths and weaknesses. The right broker can turbocharge your trading. The wrong one can seriously hinder it.

So choose wisely, my friend! Wherever your trading journey leads next, I wish you smooth sailing and profitable pips.