As a Financial Trader, you know the importance of finding a trustworthy place to put your money. The same goes when venturing into forex trading using the popular stablecoin USDT. While the potential rewards may seem high, you need to find the best USDT forex brokers that you can rely on.

I've been reviewing USDT forex brokers for a couple of years to help traders find the most suitable platforms. With dozens of brokers to choose from in 2025, it can get overwhelmingly fast. That's why I've put together this list of the top 10 USDT forex brokers trading based on factors like fees, crypto offerings, platform stability, customer support, and more.

Whether you're a beginner seeking an easy-to-use broker or a more advanced trader looking for advanced trading tools, you'll find a good fit for your needs here. As a fellow casino enthusiast, I know the value of finding a trustworthy place to put your crypto chips. Read on as I break down the standout USDT forex brokers to simplify your search.

What are USDT Forex Brokers?

USDT forex brokers are online currency trading platforms that enable users to fund their accounts and execute trades using the stablecoin Tether (USDT) instead of traditional fiat currencies like the USD.

Tether aims to maintain a 1:1 peg to the American dollar, providing a convenient way for crypto traders to transfer funds between exchanges and brokers without exposure to the volatility commonly associated with digital assets.

As USDT adoption grows in crypto circles, more USDT forex brokers now accept it as a payment method for deposits and withdrawals. Trading with USDT offers quick transfers between wallets and brokers, potential tax advantages, and for some, an alternative banking solution outside the traditional financial system. Accepting USDT can also help brokers differentiate their offerings in a competitive market.

🔥 List of 10 Best USDT Forex Brokers 2025

| Brokers | Features |

|---|---|

| eToro | Access over 3,000 financial instruments + $10 Promo. |

| FXCM | Provides access to Trading Station and MetaTrader 4 platforms. |

| Plus500 | Supports multiple languages for global traders. |

| IG | BitMEX is primarily designed for experienced traders, offering advanced trading options. |

| Robinhood | Offers commission-free cryptocurrency trading. |

| BitMEX | BitMEX is primarily designed for experienced traders, offering advanced trading options. |

| Coinbase | Provides educational resources and earning opportunities through Coinbase Earn. |

| Kraken | Available internationally with some regional restrictions. |

| InstaForex | Provides deposit bonuses from 30% to 100%. |

| AvaTrade | Regulated by multiple top-tier authorities. |

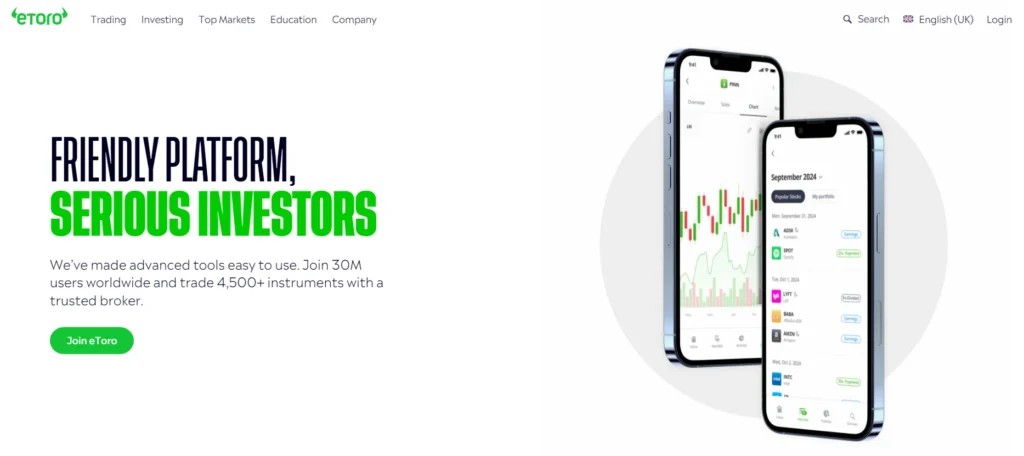

1. eToro

Founded in 2007, eToro has emerged as a trailblazer in the world of social trading, offering a unique platform that combines traditional trading with social networking. It has revolutionized the trading landscape by enabling users to connect, share strategies, and even replicate the trades of successful investors. With a broad array of assets, including currencies, stocks, cryptocurrencies, EFTs, indices, and commodities, eToro caters to a wide spectrum of traders, from beginners to seasoned professionals.

Its intuitive interface, coupled with a strong emphasis on community engagement and transparency, makes eToro a preferred choice for those seeking a more interactive and collaborative trading experience.

Key Features of eToro

Pros and Cons of eToro

Pros

Cons

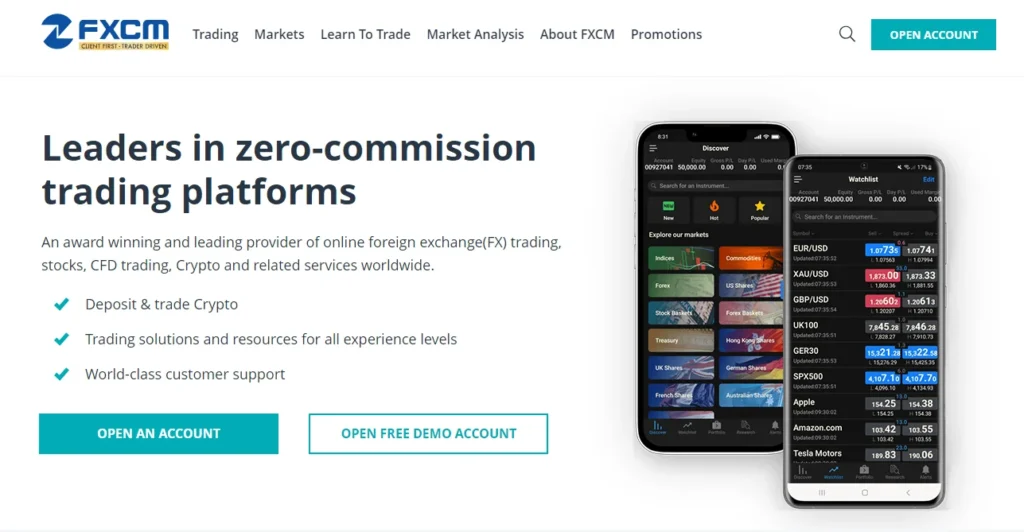

2. FXCM

FXCM, also known as Forex Capital Markets, was established in 1999 and has since been at the forefront of online foreign exchange trading. Originating in New York, FXCM pioneered the development of electronic trading platforms in the forex industry.

With a history of innovation and expansion, including the acquisition of ODL Group to become one of the world's largest retail USDT forex brokers, FXCM has cemented its position as a leading entity in the global forex market. The company, now headquartered in London, offers a wide range of trading services and has been recognized for its customer support and advanced trading infrastructure.

Key Features of FXCM

Pros and Cons of FXCM

Pros

Cons

3. Plus500

Plus500 is a leading global fintech company founded in 2008 that provides online trading services for contracts for difference (CFDs), share dealing, futures, and options trading. Headquartered in Israel and listed on the London Stock Exchange, Plus500 operates proprietary technology-based trading platforms and has over 20 million registered customers globally.

Through its subsidiaries, Plus500 offers over 2,000 trading instruments including currencies, stocks, commodities, Digital coins, ETFs, options, and indices.

Key Features of Plus500

Pros and Cons of Plus500

Pros

Cons

4. IG

Established in 1974, IG is a leading global forex and CFD broker, renowned for its comprehensive trading platform, extensive educational resources, and robust deposit and withdrawal options. It is regulated by multiple top-tier financial authorities worldwide and is publicly traded on the London Stock Exchange, ensuring a secure and trustworthy trading environment.

IG offers a broad range of financial instruments, including forex, indices, shares, commodities, and options, and is recognized for its commitment to customer service and innovative trading technology.

Key Features of IG

Pros and Cons of IG

Pros

Cons

5. Robinhood

Robinhood, established in 2013, is a renowned online brokerage platform that has revolutionized the financial markets with its commission-free trading model. It offers a user-friendly interface that allows individuals to trade stocks, options, and crypto tokens without the need for a traditional broker.

With its mission to democratize finance for all, Robinhood has made investing more accessible to the masses. The platform is particularly popular among younger, tech-savvy investors who appreciate its mobile-first design and straightforward approach to investing.

Key Features of Robinhood

Pros and Cons of Robinhood

Pros

Cons

6. BitMEX

BitMEX, short for Bitcoin Mercantile Exchange, is a cryptocurrency exchange and derivative trading platform. Established in 2014 by Arthur Hayes, Ben Delo, and Samuel Reed, BitMEX is owned and operated by HDR Global Trading Limited, registered in Seychelles.

The platform offers a variety of digital asset-based financial products, including perpetual contracts, futures contracts, and options contracts. BitMEX is primarily designed for experienced traders, providing advanced trading tools and features.

Key Features of BitMEX

Pros and Cons of BitMEX

Pros

Cons

7. Coinbase

Coinbase, founded in 2012 by Brian Armstrong and Fred Ehrsam, is a secure online platform for buying, selling, transferring, and storing digital assets. As the largest cryptocurrency exchange in the United States in terms of trading volume, Coinbase offers a comprehensive suite of services, including a self-custody crypto wallet, and advanced trading features.

The platform is designed to cater to both beginners and experienced traders, providing an easy-to-use interface, extensive educational resources, and advanced trading tools.

Key Features of Coinbase

Pros and Cons of Coinbase

Pros

Cons

8. Kraken

Kraken is a well-known digital asset exchange that has broadened its services to encompass forex trading opportunities. Established in 2011, Kraken has built a reputation for security and a wide range of trading options, catering to both novice and experienced traders.

The platform allows users to trade various fiat currencies and cryptocurrencies, providing a comprehensive trading environment with advanced features and competitive fees.

Key Features of Kraken

Pros and Cons of Kraken

Pros

Cons

9. InstaForex

InstaForex is an international broker that provides access to global trading floors, from Forex in ECN to derivatives and commodities. With over 7 million clients worldwide, InstaForex is recognized for its pioneering role in the development and introduction of modern trading technologies and tools.

The company offers a wide range of trading instruments and ensures seamless and safe access to the forex market.

Key Features of InstaForex

Pros and Cons of InstaForex

Pros

Cons

10. AvaTrade

AvaTrade is a globally recognized forex broker established in 2006, offering a wide range of financial instruments across various asset classes. The platform is regulated by multiple top-tier authorities, ensuring a secure trading environment for its users. AvaTrade is committed to empowering people to invest and trade with confidence, providing an innovative and reliable environment supported by best-in-class personal service.

The platform caters to investors of all experience levels, offering extensive educational resources, advanced trading tools, and a customer-first approach.

Key Features of AvaTrade

Pros and Cons of AvaTrade

Pros

Cons

What is Tether (USDT)?

Tether (USDT), have become a popular choice for currency investors due to their price stability and ease of use. Tether is a stablecoin pegged to the US dollar, meaning one unit of it is always equal to one USD. This unique feature combines the stability of fiat currencies like the USD with the flexibility and efficiency of cryptocurrencies like Bitcoin and Ethereum.

Peg Mechanism

Tether maintains its 1:1 peg to the US dollar through a straightforward mechanism:

Users can theoretically redeem one unit of the stablecoin for $1 at any time, which helps maintain trust in the peg. However, questions have been raised about the transparency and adequacy of Tether’s reserves, which we’ll explore later.

Blockchain Integration

Originally launched on the Bitcoin blockchain using the Omni Layer protocol, Tether has expanded to several other major blockchains, including:

Why Expert Traders Trade with Regulated Forex Brokers?

The key reasons why expert traders prefer to trade with regulated forex brokers:

FAQs on Best USDT Forex Brokers for Trading in 2025

Why use Stablecoin-Friendly Forex Platforms?

They enable secure fund management and fast international transfers via blockchain technology.

Can I Trade Multiple Digital Assets?

Yes, including major cryptocurrencies (BTC, ETH) alongside traditional forex pairs1.

What Are the Advantages of Using USDT Forex Brokers for Trading?

USDT forex brokers offer quick and cheap deposit and withdrawal options, stability against traditional cryptocurrency volatility, and progressive trading conditions.

Are Brokers that handle USDT Transactions Regulated?

Yes, many of these brokers operate under regulatory oversight in multiple jurisdictions, which helps to ensure a safe and secure trading environment.

Can I Trade other Cryptocurrencies Besides USDT Forex Brokers?

Yes, many USDT Forex brokers that accept USDT also offer trading options for other cryptocurrencies.

Summing Up

In 2025, top USDT Forex brokers for trading include RoboForex, OctaFX, Exness, AvaTrade, and FXTM. These brokers are preferred for their secure and convenient fund management, fast and cost-effective international money transfers, and progressive trading conditions. They also offer trading options for other cryptocurrencies.

Many of these brokers are regulated across multiple jurisdictions, ensuring a safe and secure trading environment. They provide a variety of platforms and tools for different levels of investors, from beginners to experts.

These platforms offer features like segregated accounts, investor protection, transparency, secure trading infrastructure, fair trading practices, dispute resolution, and access to investor compensation schemes.

So what are your thoughts on USDT forex brokers? Which one would you choose?