Futures trading has picked up steam lately, and FundedNext Futures is quickly making a name for itself.

What Sets FundedNext Futures Apart?

They offer traders genuinely flexible account options, lightning-fast payouts, and opportunities that many other firms simply cannot match. From their unique challenge rewards to their trader-friendly approach, FundedNext Futures is creating quite a buzz among both new and experienced futures traders.

15% Split on FundedNext Futures Challenge

exclusive

Claim a 15% profit split on FundedNext Futures challenge. Challenges starting at $129.

Pay Only Once

About FundedNext Futures Review

FundedNext Futures operates under GrowthNext F.Z.C. and launched on March 18, 2022, with its headquarters in Dubai, UAE. The firm has quickly established itself in the proprietary trading space, offering futures and CFD funding programs with account sizes reaching up to $100,000.

Leadership and Vision

The company is led by CEO Abdullah Jayed, a recognised entrepreneur in the digital and retail trading sectors. Jayed has built an impressive portfolio of successful ventures, founding Jayed Corp, Growth Alliance, MoneyBackFX, and eComChef. His mission through FundedNext Futures centres on empowering traders by providing capital access and profit-sharing opportunities that help skilled individuals trade without risking their own money.

What Makes FundedNext Futures Different?

The firm stands out by offering truly flexible account options that cater to traders of all styles and experience levels. They've built strong community support and maintain a global reach through continuous innovation in their trading programs.

Key Features That Matter

The firm's approach reflects Jayed's belief that every motivated person should have the opportunity to pursue their trading goals, making capital accessible to those who can demonstrate their skills through their evaluation process.

FundedNext Futures Account Options

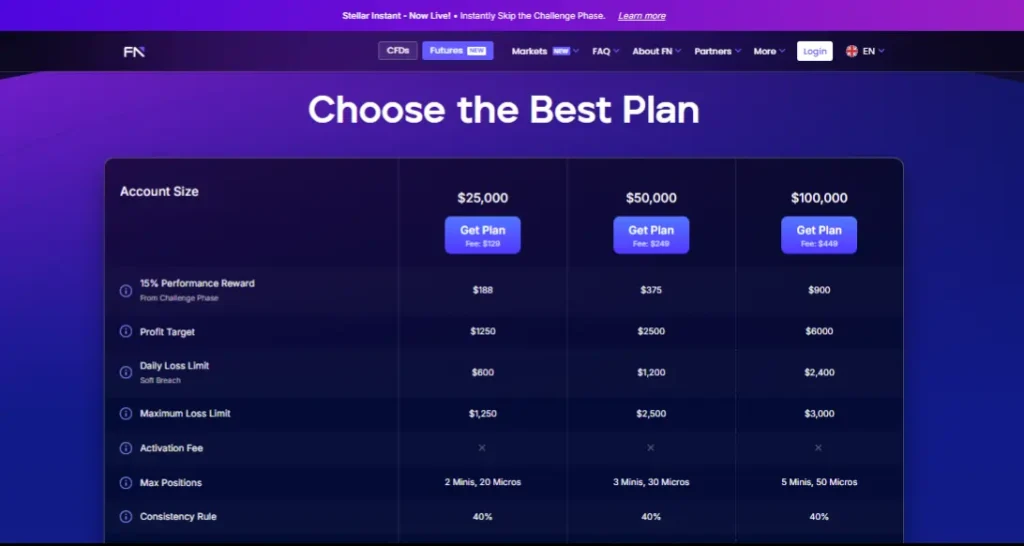

FundedNext Futures gives traders a choice of several funding plans, each designed with clear rules and straightforward goals.

Traders can pick from three main account sizes, each with its profit target, risk limits, and contract allowances. The focus is on making the process simple, fair, and accessible for anyone serious about trading.

| Account Size | Profit Target | Maximum Trailing Drawdown | Daily Loss Limit | Maximum Size (Mini/Micro) | Price |

|---|---|---|---|---|---|

| $25,000 | $1,250 | $600 | $1,250 | 2 (20 Micros) | $129 |

| $50,000 | $2,500 | $1,200 | $2,500 | 3 (30 Micros) | $249 |

| $100,000 | $6,000 | $2,400 | $3,000 | 5 (50 Micros) | $399 |

How the FundedNext Futures Plan Works

When you join FundedNext Futures, you select your preferred account size—$25,000, $50,000, or $100,000. Each plan comes with a clear profit target, which is either 5% or 6% of the account size, depending on the specific program.

Once you hit that target and pass the evaluation, you move into a funded account where you can start withdrawing profits right away. Funded traders keep 100% of their profits.

Trading Rules and Objectives

This setup keeps things simple and focused, making it easier for traders to understand the rules and concentrate on their strategies.

FundedNext Futures: The Main Trading Objectives and Rules

FundedNext Futures keeps things simple and transparent for traders. The rules are designed to help you focus on steady, responsible trading while giving you a clear path to success.

Here’s how it works:

Profit Target:

During the evaluation phase, you need to hit a profit target—typically 5% or 6% of your account size. Once you’re funded, there’s no set profit target to reach; you just trade and grow your account.

Maximum Daily Loss:

You’re allowed to lose up to 2.4% of your account in any single trading day. If you go over this limit, your challenge or account will be closed for the day or breached, depending on the situation.

Maximum Trailing Drawdown:

There’s a real-time trailing drawdown that follows your highest unrealised balance. For most accounts, this is set at 3% or 5%. If your account drops below this limit from its peak, you’ll breach the rules.

Consistency Rule:

No single day’s profit should make up more than 30% of your total profits during the evaluation. This encourages you to build your profits steadily over time rather than relying on big, risky moves.

No Overnight Holding:

All positions must be closed at least one minute before the market closes. Leaving trades open overnight isn’t allowed, and any open positions will be automatically closed to protect your account from overnight risk.

Position Size Limits:

You can’t trade more than the allowed number of contracts at once—for example, up to 5 mini or 50 micro contracts on a $100,000 account. This keeps your risk in check and helps you avoid overexposure.

Quick Reference Table

| Rule | Details |

|---|---|

| Profit Target | 5% or 6% during evaluation; none for funded accounts |

| Maximum Daily Loss | 2.4% of account size per day |

| Maximum Trailing Drawdown | 3% or 5% real-time trailing drawdown (varies by account) |

| Consistency Rule | No day’s profit over 30% of total profits during evaluation |

| No Overnight Holding | Close all trades before market close; no overnight positions allowed |

| Position Size Limits | Strict limits (e.g., 5 mini or 50 micro contracts on a $100K account) |

These rules help you trade safely and fairly, making FundedNext Futures a solid choice for traders who want clear structure and plenty of opportunity.

Supported Trading Platforms

FundedNext Futures works with two major platforms for futures trading:

Both are widely used and fully compatible, giving traders flexibility and reliable access to futures markets.

How the FundedNext Futures Process Works?

Here’s a straightforward look at how you move through FundedNext Futures:

Helpful FAQs

What Account Sizes does FundedNext Futures Offer?

You can choose from three main account sizes: $25,000, $50,000, and $100,000. This setup lets you pick the one that best matches your trading style and goals, making it easy to get started.

Can I keep 100% of My Profits?

Yes! Once you pass the challenge and get your funded account, you keep all the profits you make. There are no profit splits—just straightforward rewards for your trading success.

What is the Maximum Daily Loss Limit?

Each account has a daily loss limit to help you manage risk. For example, the $25,000 account allows a $600 daily loss, the $50,000 account allows $1,200, and the $100,000 account allows $2,400. If you hit this limit, trading is paused for the rest of the day.

Can I hold Trades Overnight?

No, overnight and weekend trades are not allowed. You need to close all positions by a set time before the market closes each day. If you forget, the system will automatically close them for you.

What Trading Platforms are supported?

FundedNext Futures works with NinjaTrader and Tradovate. Both platforms are reliable and popular among futures traders, giving you flexibility and easy access to your trades.

How quickly can I receive My Payout?

Payouts are processed within 24 hours after you request your reward. If there’s a delay, FundedNext Futures adds $1,000 to your payout as compensation, so you get your earnings fast.

Is FundedNext Futures Right for You in 2025?

FundedNext Futures stands out for fast payouts, flexible futures accounts, and solid support for traders. The rules are clear and fair, helping you manage risk while aiming for profits. If you value quick rewards and a straightforward process, FundedNext Futures could be a great match for your trading journey.