Quant Tekel have a different set of rules for all of its challenges, it is highly recommended to check FAQs and Rules properly or contact support team for better assistance.

Forex trading is a battlefield. You need skill, strategy, and a partner that actually sets you up for success. That is where Quant Tekel comes in. They are not here to make you jump through endless hoops. They are here to give you a real shot at getting funded.

Their evaluation programs are built for traders who are ready to prove themselves without unnecessary roadblocks. Phase 1? Just 7% profit. Phase 2? Only 5%. That is one of the most achievable challenges in the industry. If you have got the discipline, you are already halfway there.

While most firms cap you at 80%, Quant Tekel pushes you higher. And when it is time to cash out, they do not mess around. Their blockchain-verified payouts include a record-breaking $84,533 withdrawal. No shady delays. Just your money, when you earn it.

This is not some fly-by-night operation. Quant Tekel is run by experts who know the ins and outs of forex prop firms and broker operations. Their Quant Tekel Rules are built for traders who respect risk management but do not want to be suffocated by unnecessary restrictions.

So if you are serious about trading and want a fair, transparent, and rewarding path to funding, Quant Tekel is the move. Clear Quant Tekel rules. Big payouts. Real results. Are you ready?

Exclusive 40% Off Quant Tekel Coupon

exclusive

Redeem a 40% Off discount on Quant Tekel with limited period launch offer (Use code: “fxparkey“). Start your trading journey now.

SAVE UP TO 40%

Mastering the Path to Funded Trading Success

Understanding Quant Tekel’s pathway to securing a funded account boils down to three actionable stages, each governed by clear, trader-focused guidelines:

1. Select Your Evaluation Model

Traders pick from three evaluation options, each with unique profit targets and risk parameters:

2. Clear Targets, Secure Funding

Once profit goals are met, Quant Tekel reviews the account (3–5 business days) and issues a contract. Signing it unlocks a funded account within 30 minutes—provided traders adhered to Quant Tekel rules like avoiding high-frequency strategies.

3. Optimize Funded Account Management

Stay Informed: Regularly check FAQs for updates on scaling opportunities or regional platform access.

Understanding Profit Withdrawal Policies

Quant Tekel’s performance fee structure balances flexibility with clear guidelines, ensuring traders can access earnings predictably. Here’s how it works:

Eligibility & Timing

Processing & Minimums

Account Management

Payment Options

Submit a ticket through Quant Tekel’s Freshdesk portal. This streamlined process ensures traders spend less time on paperwork and more on trading.

Managing Account Limits & Copy Trading Strategies of Quant Tekel

Quant Tekel’s allocation policies blend flexibility with clear guardrails, allowing traders to scale while maintaining market integrity.

Here’s how their $400,000 maximum allocation Quant Tekel rules works:

Under $400,000 Allocation

At $400,000 Allocation

Avoiding Rule Breaches

By balancing opportunity with compliance, Quant Tekel ensures traders expand their portfolios without compromising fair play.

Using Expert Advisors & Trade Copiers

Quant Tekel supports automated trading tools but enforces guidelines to maintain market fairness. Here’s what traders need to know:

Expert Advisors (EAs)

Trade Copiers

Quant Tekel’s commission model prioritizes simplicity:

This predictable fee structure helps traders calculate expenses upfront, avoiding surprises during profit withdrawals.

Quant Tekel Rules: Scaling Your Account with the 10% Milestone

Reaching a 10% profit target in a funded account unlocks Quant Tekel’s structured growth opportunities. Here’s how traders progress:

Account Growth & Rewards

Earning Through Managed Capital

Exclusive Perks

Regional & Operational Notes

After consistently meeting targets, traders might undergo an interview to discuss their experience and roadmap for scaling further.

Keeping Your Quant Tekel Account Active

Quant Tekel’s inactivity policy ensures traders stay engaged while aligning with broker platform requirements.

Here’s how it works:

Why Trade Every 30 Days?

To avoid automatic archival by brokers, Quant Tekel mandates at least one trade within a 30-day window. This keeps accounts active without disrupting the unlimited timeframes for evaluation challenges.

Consequences of Inactivity

Failing to trade for 30 straight days results in a hard breach, permanently deleting the account. Reactivation isn’t possible, so consistency is key.

Staying Compliant

While evaluations have no time limits, the 30-day Quant Tekel rules applies to all accounts. Traders can strategize freely but must avoid prolonged inactivity.

QT Evaluation Programs

QT PRIME Evaluation

The QT PRIME evaluation model balances structured risk management with adaptable trading conditions, catering to traders prioritizing disciplined growth. Here’s a breakdown:

Evaluation Models & Profit Targets

QT PRIME offers two formats:

| Challenge Type | Phase 1 Target | Phase 2 Target | Phase 3 Target |

|---|---|---|---|

| 2-Step | 8% | 5% | – |

| 3-Step | 6% | 6% | 6% |

Risk Management

Trading Requirements

Key Rules for Funded Accounts

Account Options

Leverage & Payouts

QT PRIME suits traders seeking clear Quant Tekel rules, competitive leverage, and a balance between flexibility and accountability.

QT INSTANT Evaluation

For traders eager to skip evaluations and dive straight into funded trading, QT INSTANT provides immediate account access with clear guidelines:

Instant Access & Withdrawals

Risk Controls

Trading Costs & Leverage

| Instrument | Leverage | Commission |

|---|---|---|

| Forex | 1:30 | $4 per lot |

| Indices/Oil | 1:15 | $4 per lot |

| Crypto | 1:1 | $4 per lot |

Key Protocols

QT INSTANT blends speed with structure, offering traders a direct path to funded accounts while emphasizing disciplined strategy.

Quant Tekel Rules: Prohibited Practices & Policies

1. Account Integrity Violations

2. Payment Restrictions

3. Geographic Restrictions

Traders from these regions cannot use Quant Tekel services:

4. Banned Trading Strategies

Quant Tekel prohibits methods exploiting market flaws, including:

5. Coupon Misuse

FAQs: Quant Tekel Rules

What are Quant Tekel’s Evaluation Profit Targets?

QT PRIME: 7% (Phase 1) and 5% (Phase 2). QT INSTANT: 8% total. Exceeding targets unlocks funded accounts.

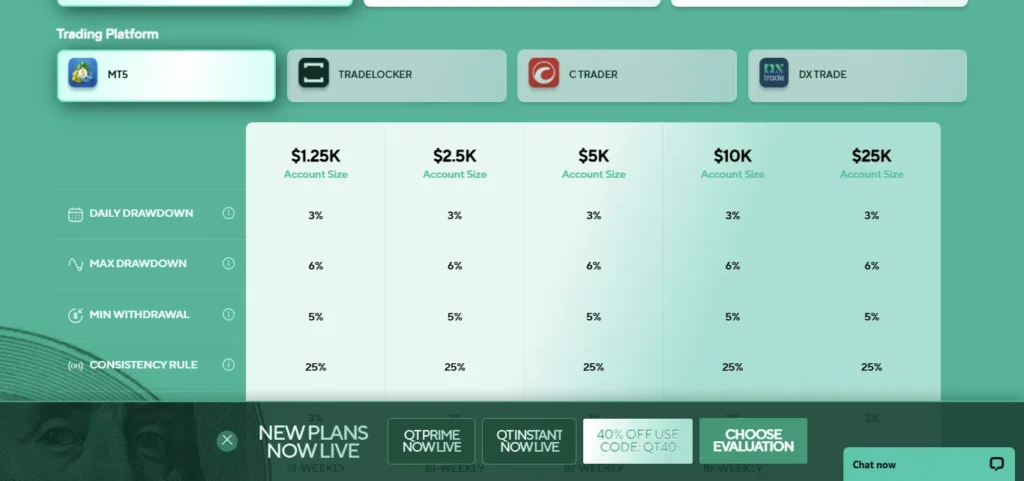

How does the Daily Drawdown Limit Work?

Daily drawdown is 4% of the initial balance for QT PRIME, 3% for QT INSTANT. Exceeding it breaches the account.

Are Expert Advisors (EAs) allowed?

Yes, but pre-approval is required. Submit EA details to Quant Tekel’s support team for compliance checks.

What happens if I violate the Inactivity Quant Tekel Rules?

Accounts inactive for 30 days are permanently deleted. Trade once monthly to stay active.

Can I Trade During High-Impact News Events?

Allowed during evaluations. Funded accounts cannot trade 5 minutes before/after news releases.

What is Quant Tekel’s Profit Split Percentage?

Up to 90% for Legacy Plan, 80% standard. Payouts occur biweekly.

Which Countries are Restricted from Trading?

Iran, Iraq, North Korea, Russia (MT5), U.S./Canada (MT5/cTrader). Access triggers instant breaches.

How long do Withdrawals Take to Process?

Approved payouts are processed within 5 business days. Minimum withdrawal: $110.

What Trading Strategies are Prohibited?

Arbitrage, latency trading, high-frequency scalping, and group hedging. Violations cause account termination.

Is Copy Trading Permitted?

Allowed below $400k allocation. Above this, use distinct strategies per account.

Mastering Quant Tekel’s Framework for Success

Winning in forex is about skill and discipline. Quant Tekel gives traders the structure they need—without the nonsense.

Their Quant Tekel rules are built for traders who want a real path to success. The profit targets? Achievable. Just 7% in Phase 1, 5% in Phase 2. The profit split? Unmatched. Up to 90% in the Legacy Plan. Payouts? Blockchain-verified and rock solid. They even set a record with an $84,533 withdrawal.

But here is what really sets them apart—they play fair, but they play smart. Drawdowns are kept between 3-6% to protect your account. Activity requirements keep traders engaged. High-risk gambling? Not allowed. They are here for serious traders who know how to manage risk, not for people rolling the dice.

Traders get to choose their path. QT PRIME for structured growth. QT INSTANT for instant funding. Both come with live liquidity access, AUM profit sharing, and real opportunities to scale.

If you are ready to trade with clarity, confidence, and a real shot at success, Quant Tekel is the firm that actually backs its traders.

No fluff. No gimmicks. Just a real chance to make it big.