If you’re looking for a one-stop resource to navigate a powerful multi-asset trading platform, this dx trade guide is here to walk you through the essentials.

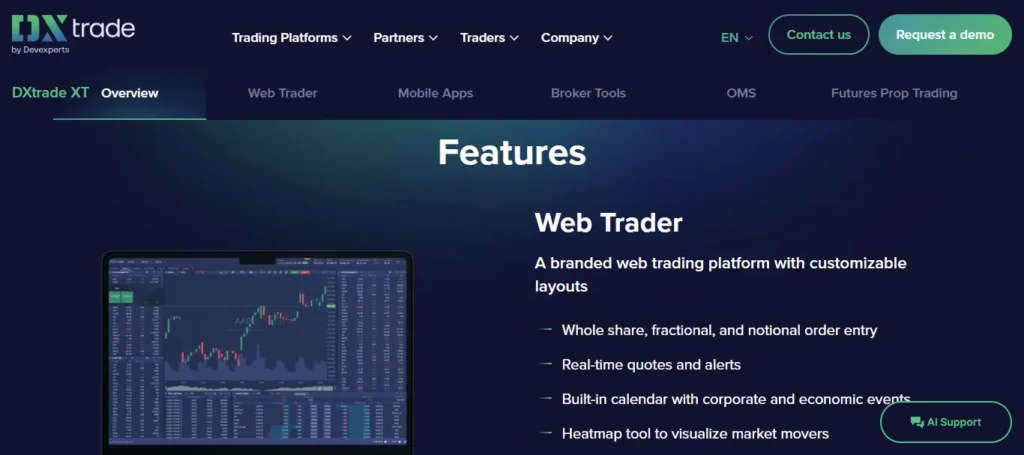

Designed with user-friendly tools, real-time risk management, and flexible trading options, DXtrade aims to streamline your trading experience.

Below, you’ll learn how it works, what sets it apart, and how you can make the most of its robust features.

Getting Into the DXtrade Guide

DXtrade is a specialized trading platform often provided by brokers to their clients. Although brokers handle the technical setup, it’s helpful for you to understand the foundation so you know where to find everything you need.

Start with Easy Onboarding

Embrace the Multi-Asset Environment

Modern trading is rarely limited to just one asset class. DXtrade supports:

That variety means you can explore different markets without juggling multiple platforms. Want to hedge your portfolio with futures, try your hand at options, or expand into spread betting? DXtrade packs it all under one roof.

Use Multi Asset Capabilities

You might be curious about why a single interface with this many products can be so valuable. Let’s be honest, no one wants to log into four platforms just to see how your FX trades stack up against your stock positions. With DXtrade’s multi-asset approach, you simplify your workflow.

Benefits of Diversifying in One Place

This convenience is especially handy if you’re an active trader shifting between markets. You’ll see how the entire portfolio interacts, not just one account at a time.

Explore Advanced Features

DXtrade isn’t just about variety, though. It also offers advanced functionalities that can give you an edge and help you adapt to market changes. Here’s a closer look at some of its standout tools:

Leverage Fractional and Notional Trades

Fractional and notional trading let you buy smaller chunks of pricey stocks or large futures contracts. So if you’ve always wanted to invest in a high-priced share without dropping all your capital at once, fractional trading may be your ticket in.

When your broker gives you these options on DXtrade, you’ll open the door to broader opportunities without overspending.

Simplify Real-time Margin Calculations

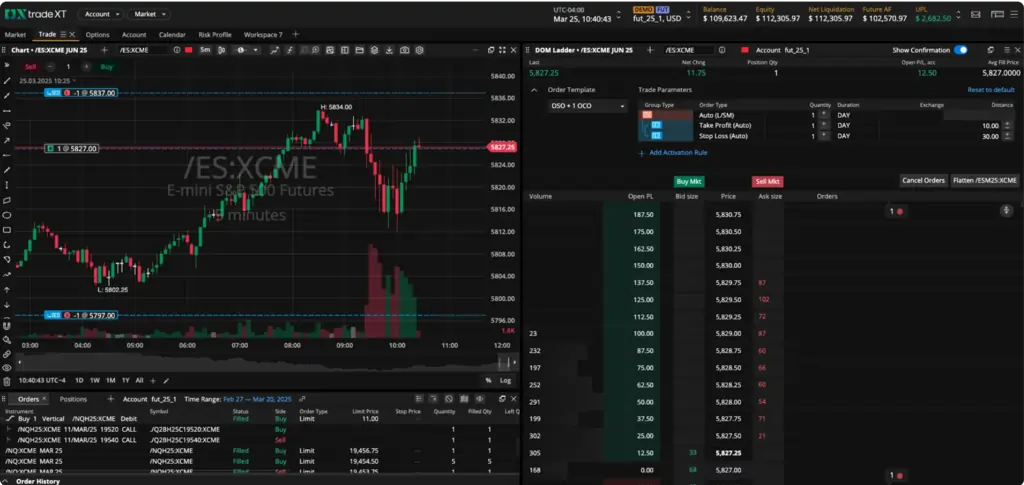

Risk management can be tricky when you’re juggling different asset classes. DXtrade offers real-time margin calculations for equities, options, and futures. You’ll typically see:

Real-time margin helps you understand requirements as trades happen. Say you want to quickly open a new futures position. The platform updates your margin in seconds, so you won’t get blindsided by margin calls.

Rely on Built-in 24/7 Support

Because the market doesn’t sleep (especially if you’re trading crypto or Forex pairs), 24/7 support is essential. Many brokers integrate live chat options directly in the platform. If you do hit a question at 2 a.m., you can often get quick help from a support specialist.

Additionally, frequent software updates mean you’ll see ongoing improvements in speed and reliability. You may notice an upgrade to your mobile layout one day or a new metrics dashboard the next, all designed to keep your trading smooth and flexible.

Brand your Trading Experience

Even though DXtrade is built by Devexperts, each broker can customize it. That’s why the platform might look slightly different depending on your broker. But this personalization goes beyond just colors and logos.

How do Brokers Customize?

Manage Risk Effectively

It’s no secret that successful trading hinges on strong risk management. DXtrade includes multiple features to help you keep tabs on your exposure, adjust your positions, and handle potential volatility.

Stay on Top of Real Time Exposure

The moment you open or close a position, you can see how your exposure changes in real time. If you notice you’re overly concentrated in one particular asset, you can pivot quickly. For example, let’s say you’re holding a large position in technology stocks. If the market starts shifting, you may decide to hedge with futures or options, all in the same platform.

Check Execution Settings

DXtrade typically supports flexible order types and execution settings, including:

These are standard, but the platform’s real-time feedback helps you make sure your orders are placed correctly. If your broker enables partial fills or advanced stops, you’ll see even more ways to protect your trades.

Explore the Spread Bets Feature

One of DXtrade’s newer additions is spread betting. If you’re a UK-based trader, you might find spread bets appealing for their tax advantages (often free from capital gains tax and stamp duty). DXtrade lets brokers hedge spread bets with CFD markets in the background, so liquidity remains healthy. This can mean tighter spreads and potentially smoother execution for you.

Consider Regulations and Compliance

Most of the heavy lifting on compliance is your broker’s responsibility, but it never hurts to know your trades meet regulatory standards. From the Financial Industry Regulatory Authority (FINRA) in the US to the UK’s Financial Conduct Authority (FCA), compliance dictates how brokers can operate and protect your investments.

Why licensing matters?

FINRA, for example, usually processes broker-dealer license applications within 180 days. Knowledge of these processes isn’t mandatory for you, but understanding that your broker follows best practices can give you extra peace of mind.

Plan for the Future

Ready to stay competitive in a rapidly changing market? You’re not alone. Over 130 million people used stock trading apps in 2021. And the global market for stock trading apps was valued at around USD 21.1 billion in 2022, with an expected growth rate of 19%+ from 2023 to 2032.

Keep an Eye on Platform Updates

DXtrade evolves according to market needs. For instance, Devexperts invests in new features like:

If your broker is growth-oriented, you’ll likely notice new features popping up regularly. This agile development means your trading experience can keep pace with emerging trends, whether it’s AI-powered analytics or enhanced user dashboards.

Integrate with your Broader Strategy

It’s always smart to look at DXtrade as part of your overall trading ecosystem. Maybe you also use charting tools, screeners, or a specialized risk model outside the platform. When you see a new DXtrade update or add-on, think about how it complements your existing strategies. The more synergy you create, the smoother your day-to-day trading becomes.

Frequently Asked Questions about DXtrade

What makes DXtrade different from other Trading Platforms?

DXtrade stands out with its multi-asset support, customizable interface, advanced risk management, and real-time margin calculations, all tailored for both beginners and professionals.

Can I Trade Multiple Asset Classes on DXtrade?

Yes, DXtrade allows you to trade stocks, options, futures, forex, CFDs, mutual funds, bonds, and spread bets—all from a single platform.

How does DXtrade help with Risk Management?

DXtrade provides real-time exposure monitoring, flexible stop-loss settings, instant margin updates, and built-in tools to help you manage risk efficiently.

Is the DXtrade Interface Customizable?

Absolutely. You can personalize layouts, chart settings, and even mobile app branding, depending on your broker’s configuration.

What Support Options are available on DXtrade?

DXtrade offers 24/7 support, in-platform tutorials, and regular updates to ensure a smooth and responsive trading experience.

Recap and Next Steps

If you’ve made it this far, you’re well on your way to understanding what DXtrade brings to your trading routine. By consolidating multiple asset classes, real-time risk calculations, and customizable interfaces, this platform can help you trade more confidently. Whether you’re using fractional share purchases or tackling newly introduced spread bets, DXtrade aims to streamline your workflow so you can focus on making well-informed decisions.

Here’s a quick reminder of what you’ve learned:

Your next step is to jump into the platform if you haven’t already. Adjust your layout, try a small fractional trade, or talk to your broker about enabling spread betting if that suits your strategy. No matter where you are in your trading journey, DXtrade is there to give you the flexibility and tools to aim higher. Go ahead and make the most of it. Happy trading!