The Smart Money Concept (SMC) is a trading approach that aims to identify and follow the actions of large institutional traders, often referred to as “smart money.” One of the key components of SMC is the use of order blocks, which are specific price levels where these institutional traders have placed significant buy or sell orders. Understanding and utilizing order blocks can provide valuable insights into market dynamics and potential entry points for trades.

What Are Order Blocks?

Order blocks are specific price levels where large institutional traders, such as banks, hedge funds, and market makers, have placed substantial buy or sell orders.

These orders are often split into smaller blocks to prevent drastic price movements and to execute their trades more efficiently.

In the context of the Smart Money Concept, order blocks represent areas of high liquidity and can act as support or resistance levels.

When the price reaches these levels, it is believed that institutional traders will step in to defend their positions, leading to potential price reversals or continuations.

🤔 Why are Order Blocks Important?

Order blocks are a crucial component of the Smart Money Concept (SMC) in trading, providing valuable insights into the actions of large institutional players. These blocks represent areas where significant buying or selling activity has occurred, often indicating the presence of “smart money” in the market.

They are important because they offer traders a glimpse into the intentions and strategies of major market participants, whose actions can significantly influence price movements. By identifying and understanding order blocks, traders can anticipate potential support and resistance levels, predict trend reversals, and make more informed decisions about entry and exit points.

Furthermore, order blocks help traders align their strategies with those of institutional investors, potentially increasing their chances of success. Order blocks serve as a powerful tool for decoding market structure and liquidity flow, enabling traders to pilot the market with greater confidence and precision.

Types of Order Blocks

There are two main types of order blocks:

Bullish Order Blocks

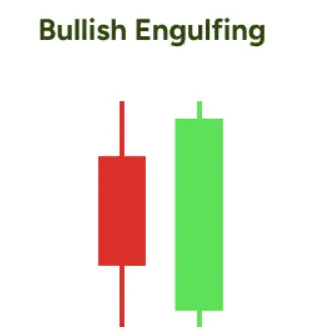

Bullish order blocks, also known as demand zones, form during a downward price movement. They are characterized by the area where the last bearish candle appears before a significant upward price shift.

These blocks suggest that institutional buyers are overwhelming sellers, potentially leading to an increase in price.

Bearish Order Blocks

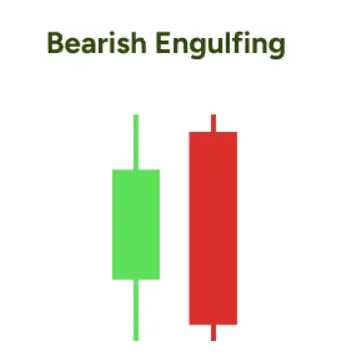

Conversely, bearish order blocks, or supply zones, are found during an upward price movement. They are characterized by the area where the last bullish candle appears before a significant downward price shift.

These blocks indicate that institutional sellers are overwhelming buyers, likely leading to a decrease in price.

How to Identify Order Block?

Engulfing Patterns

One of the most reliable ways to identify an order block is by looking for engulfing candlestick patterns on the chart. An engulfing pattern occurs when a candle completely “engulfs” the previous candle, indicating a potential shift in market sentiment. Bullish engulfing patterns, where a bullish candle engulfs a previous bearish candle, can signify a bullish order block.

Conversely, bearish engulfing patterns, where a bearish candle engulfs a previous bullish candle, may indicate a bearish order block. These patterns suggest that institutional traders have placed significant orders at these levels, which can influence future price movements.

Price Behavior

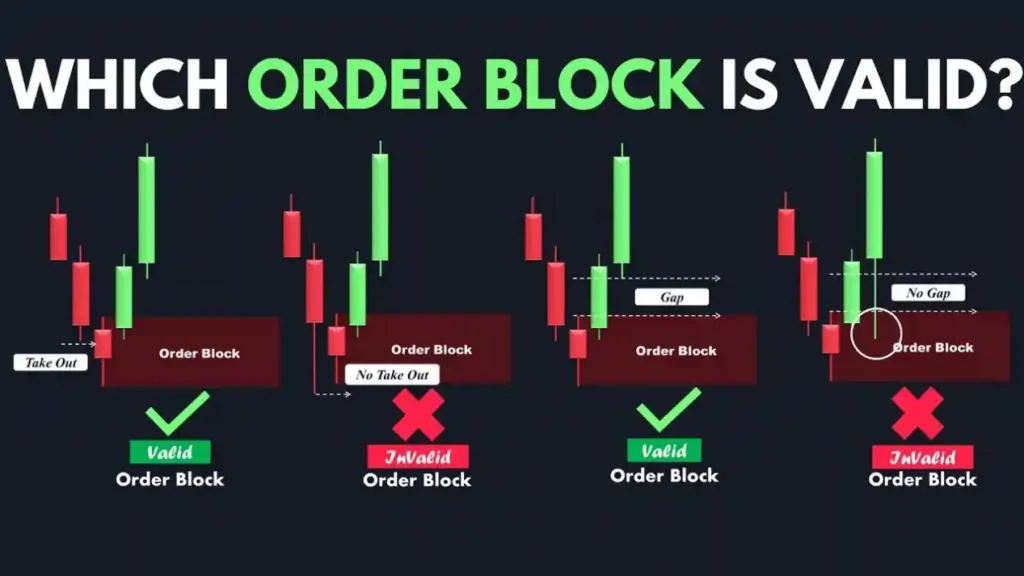

To confirm the validity of an order block, observe how the price behaves around the potential order block area. If the price approaches the order block and then quickly reverses or consolidates, it indicates that the level is significant and may be acting as support or resistance. This price behavior suggests that there are substantial orders at this level, which can absorb buying or selling pressure and cause the price to react accordingly. Pay attention to how the price interacts with the order block level on multiple timeframes to gauge its strength and potential impact on future price action.

Support and Resistance

Profitable order blocks often coincide with key support and resistance levels, indicating potential trend reversals. When identifying order blocks, look for areas where the price has previously reacted strongly, such as bouncing off a support level or struggling to break through a resistance level. These levels can be identified using various technical analysis tools, such as horizontal lines, trendlines, or Fibonacci retracements. If an order block aligns with a significant support or resistance level, it strengthens the likelihood of the level holding and influencing future price movements.

One-Time Use

It's important to note that once an order block is mitigated, it is no longer considered valid

Mitigation occurs when the price breaks through the order block level with significant momentum, indicating that the orders at that level have been filled or canceled. Once an order block is mitigated, it loses its potential to influence future price action, and traders should no longer rely on it as a key level. This highlights the dynamic nature of order blocks and the need to reassess their validity as the market evolves continuously.

Break of Structure

A significant order block should lead to a notable change in market structure, such as a shift of structure or change of character an order block is formed, it often precedes a significant price move that alters the overall market structure. This could involve changing from a bullish trend to a bearish trend, or vice versa, or shifting from a ranging market to a trending one. By observing how the market structure changes following the formation of an order block, traders can assess the significance of the level and its potential impact on future price action.

How do Order Blocks Work?

Trading Strategies with Order Blocks

Traders can incorporate order blocks into their strategies in several ways:

Questions You Might Have In Regards to Order Block

How Can You Identify an Order Block on a Chart?

Look for engulfing patterns, observe price behavior, and identify key support and resistance levels.

Are Order Blocks Valid Forever?

No, once an order block is mitigated (price breaks through with momentum), it is no longer valid.

What Should a Significant Order Block Lead to?

A significant order block should lead to a notable change in market structure, such as a trend reversal.

How do Order Blocks Work in the Context of Smart Money?

Large traders partially execute orders, leaving pending orders in the order block zone for later execution.

What are Some Trading Strategies that Incorporate Order Blocks?

Support and resistance trading, breakout trading, pullback trading, and combining with pivot point indicators.

Should Order Blocks be the only tool used in Trading?

No, order blocks should be used as part of a comprehensive trading strategy with risk management.

What is Required for Success in Trading with Order Blocks?

Success with order blocks requires practice, patience, continuous learning, and a well-rounded trading approach.

Wrapping It Up

Order blocks are a crucial component of the Smart Money Concept, providing traders with valuable insights into the actions of large institutional players. By understanding how to identify and trade with order blocks, traders can potentially enhance their ability to spot high-probability trading opportunities and make more informed decisions in the market.

However, it's important to remember that order blocks should be used as part of a comprehensive trading strategy, combined with other forms of technical analysis and robust risk management practices. As with any trading technique, success with order blocks requires practice, patience, and continuous learning.