Liquidity, in the Smart Money Concept, refers to the ease with which an asset can be bought or sold without significantly affecting its price. In other words, it is the measure of how quickly and efficiently an asset can be converted into cash or exchanged for another asset.

Liquidity is a crucial concept in trading and investing, as it determines the speed and cost at which market participants can enter or exit positions. Highly liquid assets, such as major currency pairs or blue-chip stocks, are characterized by high trading volumes, tight bid-ask spreads, and the ability to absorb large orders without causing drastic price movements.

On the other hand, illiquid assets, such as some exotic currencies or small-cap stocks, may have wider spreads, lower trading volumes, and more significant price impact when buying or selling. Understanding liquidity is essential for traders and investors, as it influences their ability to execute trades effectively, manage risk, and take advantage of market opportunities.

💸 Why is Liquidity Important?

Liquidity is of paramount importance in financial markets for several reasons. First and foremost, it enables market participants to execute trades quickly and efficiently, without incurring significant costs or experiencing excessive price slippage. This is particularly crucial for traders who rely on timely execution of their strategies, such as those engaged in high-frequency trading or arbitrage.

Moreover, liquidity is essential for maintaining fair and orderly markets, as it allows for the smooth absorption of buy and sell orders, reducing the likelihood of sudden price spikes or crashes. Adequate liquidity also contributes to market stability and investor confidence, as it ensures that assets can be readily bought or sold at reasonable prices.

Furthermore, liquidity is a key consideration for portfolio managers and institutional investors, as it affects their ability to rebalance portfolios, manage risk, and meet redemption requests from clients.

🔗 Characteristics of Liquidity

- Ease of conversion: Liquidity refers to how easily an asset can be converted into cash without significantly affecting its market price. The most liquid asset is cash itself, as it can be readily exchanged for goods and services.

- Tightness: Liquidity is often measured by the bid-ask spread of an asset. A tighter or narrower bid-ask spread indicates higher liquidity, as there is a smaller difference between the price at which an asset can be sold and bought.

- Depth: Market depth, or the existence of abundant orders above and below the current trading price, is another key aspect of liquidity. A deeper market can absorb large transactions without causing drastic price movements.

- Resilience: A liquid market is characterized by price resilience, which is the speed at which prices return to equilibrium after a shock or large order. Highly liquid markets tend to have greater resilience.

- Immediacy: Liquidity also involves the speed at which orders can be executed. In a liquid market, buyers and sellers can transact quickly with minimal impact on the asset's price. This reflects the efficiency of the trading, clearing, and settlement processes.

The Role of Liquidity in Market Movements

The role of liquidity in market movements is a crucial aspect of the Smart Money Concept (SMC) and plays a significant part in shaping market dynamics. Smart money, typically representing institutional investors and large market players, strategically targets liquidity zones to execute substantial orders without causing drastic price fluctuations.

Liquidity zones are areas in the market where a high concentration of orders accumulates, often around key price levels such as support and resistance, trend lines, and swing highs or lows. These zones are prime targets for smart money operations because they offer the opportunity to fill large positions with minimal slippage.

The process of liquidity grabbing or inducement involves pushing the price into these liquidity-rich areas to trigger the execution of pending orders and stop losses. This action can lead to sudden and often counterintuitive price movements that may confuse retail traders.

For instance, a price might briefly break above a resistance level, triggering buy orders and stopping losses, only to reverse sharply downwards as smart money sells into the newly created liquidity.

Understanding these liquidity-driven movements is essential for traders aiming to align their strategies with smart money flows. By identifying potential liquidity zones and anticipating how large players might interact with them, traders can gain valuable insights into future price directions and potential reversal points. This knowledge can help in making more informed trading decisions and potentially avoiding traps set by market manipulators.

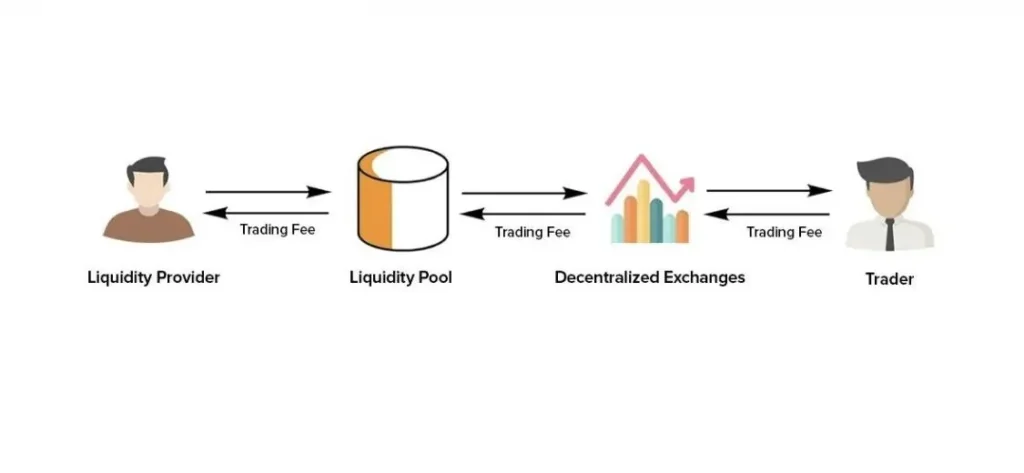

What are liquidity pools?

Liquidity pools enable users to contribute equal values of token pairs (e.g., ETH/USDC) to create trading liquidity. These pools use automated market maker (AMM) algorithms to determine token prices based on the ratio of assets in the pool. Traders can swap tokens directly with the pool without needing a counterparty, paying a small fee that is distributed to liquidity providers. In return for providing liquidity, contributors receive LP (liquidity provider) tokens representing their share of the pool. These LP tokens can be redeemed to withdraw the original assets plus accrued fees. Liquidity pools power decentralized exchanges like Uniswap and PancakeSwap, offering constant liquidity, reduced slippage for traders, and passive income opportunities for liquidity providers.

🤔 How do liquidity pools work?

- Users deposit equal values of two tokens to create a trading pair (e.g. ETH/USDC).

- The pool uses an automated market maker (AMM) algorithm to determine token prices based on the ratio of assets in the pool.

- Traders can swap tokens directly with the pool without needing a counterparty.

- Each trade incurs a small fee that is distributed to liquidity providers.

- Liquidity providers receive LP tokens representing their share of the pool.

- LP tokens can be redeemed to withdraw original assets plus accrued fees.

Liquidity grabs

Liquidity grabs are a common occurrence in financial markets and play a significant role in the Smart Money Concept. A liquidity grab happens when the price of an asset temporarily breaks through a crucial level, such as a support or resistance, only to quickly reverse back in the opposite direction. This swift move is often orchestrated by large market participants, known as smart money, to take advantage of the liquidity available at these key price points.

The purpose of a liquidity grab is twofold. First, it allows smart money to fill their large orders at favorable prices without significantly impacting the market. By pushing the price beyond a key level, they trigger pending orders, such as stop losses or limit orders, placed by other market participants. These orders provide the necessary liquidity for smart money to execute their trades without causing a drastic price change.

Second, liquidity grabs create short-term volatility that can shake out retail traders and other less-informed market participants. As the price breaks through a key level, it may trigger a cascade of stop losses, leading to a sudden spike in volatility. Retail traders who are caught off-guard by this move may panic and close their positions at a loss, providing additional liquidity for smart money to exploit.

It's essential for traders to recognize and understand liquidity grabs, as they can provide valuable insights into market progression and potential reversal points. By identifying key levels where liquidity is likely to be concentrated, traders can anticipate potential liquidity grabs and adjust their strategies accordingly. This may involve placing orders to capitalize on the expected price reversal or avoiding entering trades at these levels altogether.

However, it's crucial to note that not every break of a key level is a liquidity grab. Sometimes, a genuine breakout may occur, signaling the start of a new trend. As such, traders should use liquidity analysis in conjunction with other technical and fundamental analysis tools to make well-informed trading decisions.

Liquidity ratios

Liquidity ratios are essential financial metrics that provide insight into a company's ability to meet its short-term obligations using its current assets. These ratios are crucial for assessing the financial health and stability of a business, as they indicate how quickly a company can convert its assets into cash to pay off its liabilities.

Types of Liquidity Ratios

There are several types of liquidity ratios, each focusing on different aspects of a company's short-term financial position:

- Current Ratio

The current ratio is the broadest measure of liquidity, comparing a company's total current assets to its total current liabilities. It is calculated as:

Current Ratio = Current Assets / Current Liabilities.

A current ratio of 1.5 or higher is generally considered healthy, indicating that the company has sufficient current assets to cover its short-term obligations.

- Quick Ratio (Acid-Test Ratio)

The quick ratio, also known as the acid-test ratio, is a more stringent measure of liquidity. It excludes inventories from current assets, as they may take longer to convert into cash. The quick ratio is calculated as:

Quick Ratio = (Cash + Accounts Receivable + Marketable Securities) / Current Liabilities.

A quick ratio of 1.0 or higher is generally considered favorable.

- Cash Ratio

The cash ratio is the most conservative liquidity ratio, as it only considers a company's cash and cash equivalents relative to its current liabilities. It is calculated as:

Cash Ratio = (Cash + Cash Equivalents) / Current Liabilities.

A cash ratio of 0.5 or higher is generally considered adequate.

Trading Strategies Based on Liquidity

Understanding liquidity can inform various powerful trading strategies that align with smart money movements and market dynamics. Here are some key approaches:

- Wait for Liquidity Sweeps

Instead of entering at obvious support or resistance levels, patient traders wait for the price to sweep beyond these levels before considering an entry. This strategy aligns with the actions of smart money and can lead to more favorable entry points.

By waiting for the sweep, traders:

- Fade False Breakouts

When the price briefly breaks a key level but fails to follow through, it may indicate a liquidity grab. Savvy traders can look to enter in the opposite direction of the initial breakout.

This strategy involves:

- Use Lower Timeframes for Confirmation

After identifying a potential liquidity zone on higher timeframes, traders switch to lower timeframes to look for entry confirmation signals.

This multi-timeframe approach allows for:

Additionally, traders can incorporate other techniques such as:

Information Center

Why is Liquidity important in Trading?

Liquidity enables efficient trade execution, maintains market stability, reduces slippage, and allows for better risk management and portfolio rebalancing.

What are The main Characteristics of Liquidity?

Key characteristics include ease of conversion, tightness of bid-ask spreads, market depth, price resilience, and immediacy of order execution.

How do Liquidity Zones work in Trading?

Liquidity zones are areas with high order concentration, attracting price action and often targeted by smart money for large trades.

What is a Liquidity grab in Trading?

A liquidity grab occurs when the price briefly breaks a key level to trigger stop losses and pending orders before reversing.

How can Traders use Liquidity in their Strategies?

Traders can wait for liquidity sweeps, fade false breakouts, and use multi-timeframe analysis to confirm entries in liquidity zones.

What are Liquidity Ratios and Why Are They Important?

Liquidity ratios measure a company's ability to meet short-term obligations, indicating financial health and stability to investors and creditors.

How does Smart Money use Liquidity in the Market?

Smart money targets liquidity zones to execute large orders without significantly impacting prices and to potentially manipulate short-term market movements.

How can Understanding Liquidity Improve Trading Decisions?

Knowledge of liquidity helps anticipate price movements, identify potential reversal points, and align strategies with smart money flows for better entries and exits.

💸 Conclusion

Liquidity plays a pivotal role in the financial markets, influencing trading strategies, market stability, and overall economic health. Understanding liquidity is crucial for traders, investors, and market participants at all levels. From identifying liquidity zones and anticipating smart money movements to utilizing liquidity ratios for assessing company health, the concept of liquidity permeates various aspects of finance.

By recognizing the characteristics of liquid markets and assets, traders can make more informed decisions, manage risks effectively, and potentially align their strategies with larger market forces. However, it's important to remember that liquidity analysis should be used in conjunction with other technical and fundamental tools for a comprehensive approach to trading and investing.