The Smart Money Concept (SMC) has gained significant traction in the trading community as a framework for understanding market dynamics and institutional trading behavior. Within this concept, breaker blocks emerge as a crucial element for identifying potential market reversals and entry points.

This article will explore breaker blocks in detail, their significance in SMC trading, and how traders can effectively incorporate them into their strategies.

📌 Understanding Breaker Blocks

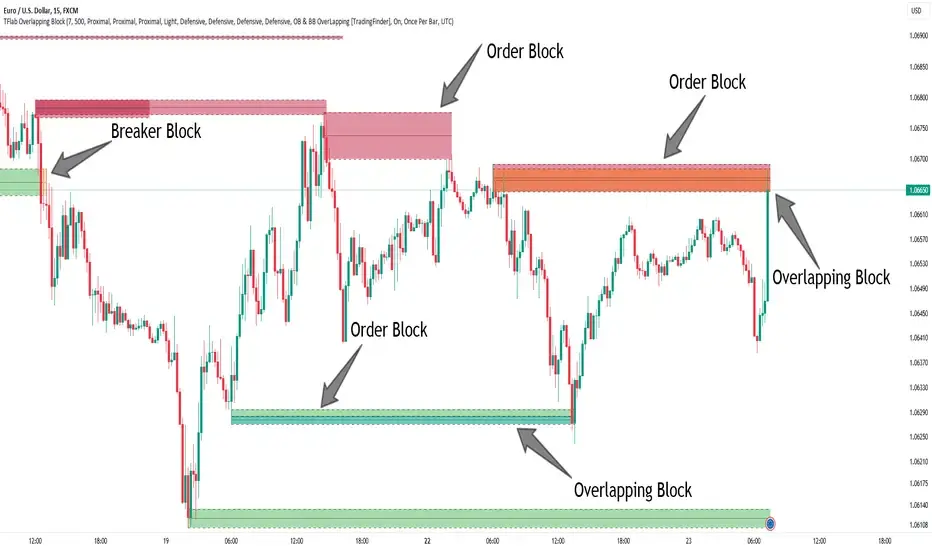

A Breaker Block is essentially a failed order block that results in a significant shift in market liquidity and structure.

To recognize Breaker Blocks fully, it's crucial to first understand order blocks, which are areas on a price chart where significant buying or selling activity has occurred.

The Transformation | From Order Block to Breaker Block

A Breaker Block emerges when an order block fails to hold as support or resistance, signaling a potential reversal in market direction.

This transformation is significant because it represents a shift in market structure and liquidity. Here's how it happens:

Significance of Breaker Blocks

Breaker Blocks are powerful indicators for several reasons:

- Market Structure Shift: They signal a change in the overall market structure, often preceding significant trend reversals.

- Liquidity Zones: Breaker Blocks represent areas where large amounts of liquidity have been absorbed, potentially leading to strong price movements.

- Smart Money Activity: They can indicate where institutional traders have changed their positions or market outlook.

Types of Breaker Blocks

There are two primary types of Breaker Blocks:

- Bullish Breaker Block: This is a failed bearish order block. It forms when the price closes above the high of a bearish order block, indicating a potential upward movement.

- Bearish Breaker Block: Conversely, this is a failed bullish order block. It occurs when the price closes below the low of a bullish order block, suggesting a potential downward movement.

Identifying Breaker Blocks

To effectively trade using Breaker Blocks, traders must develop a systematic approach to identifying these key market zones.

Here's a step-by-step guide:

- Identify Market Structure Shift

Look for a clear break in the previous market structure, such as a breach of a significant support or resistance level. This shift is crucial as it signals a potential change in market direction and sets the stage for Breaker Block formation.

- Locate the Failed Order Block

Once a market structure shift is observed, identify the order block that has been broken. This failed order block will now serve as the Breaker Block. Pay close attention to areas where significant buying or selling pressure was previously evident but has now been overcome.

- Confirm the Breakout

Ensure that the breakout is valid by examining trading volume and candle patterns. A genuine breakout should be accompanied by increased trading volume and decisive price action. Look for strong, well-formed candles that clearly breach the previous order block.

- Wait for Retest

After the initial breakout, it's crucial to wait for the price to return to the Breaker Block area. This retest confirms the Breaker Block as a new support or resistance level. The retest phase is critical as it provides validation of the Breaker Block's significance and offers potential entry points for trades.

Trading with Breaker Blocks

Incorporating Breaker Blocks into your trading strategy requires a thoughtful approach. Here are key considerations:

- Entry Strategies

- Risk Management

Developing a Breaker Block Trading Strategy

- Identify Key Levels

Look for significant support and resistance levels on your charts. These levels form the foundation of potential Breaker Blocks.

- Monitor for Breakouts

Watch for price breakouts above or below these key levels, which may signal potential Breaker Block formations.

- Confirm the Breakout

Analyze volume and price action to ensure the breakout is valid.

- Wait for Retest

Allow the price to return to the Breaker Block level, confirming it as new support or resistance.

- Enter the Trade

Execute your trade in the direction of the breakout, using appropriate risk management techniques.

- Manage the Trade

Continuously monitor the position, adjusting stop-losses as necessary and being prepared to exit if market conditions change.

Quick Answers

How do you identify a Bullish Breaker Block?

A Bullish Breaker Block forms when the price closes above the high of a bearish order block, indicating potential upward movement.

What's the difference between an Order Block and a Breaker Block?

An Order Block is an area of significant trading activity, while a Breaker Block is a failed Order Block indicating trend reversal.

How can Traders use Breaker Blocks in their Strategy?

Traders can use Breaker Blocks for trend continuation trades, and entry points, and to identify potential market structure shifts.

What confirms a valid Breaker Block?

A valid Breaker Block is confirmed by increased trading volume, decisive price action, and a clear break of the order block.

Where should Stop Losses be placed when Trading Breaker Blocks?

Place stop losses just beyond the Breaker Block, at recent swing lows for long trades or swing highs for shorts.

How do Breaker Blocks relate to the Smart Money Concept?

Breaker Blocks indicate where institutional traders may have changed positions, aligning with Smart Money Concept principles.

What's the significance of a retest in Breaker Block Trading?

A retest confirms the Breaker Block as new support/resistance and provides potential entry points for trades.

How do Breaker Blocks help identify Market Reversals?

Breaker Blocks signal a change in market structure and liquidity, often preceding significant trend reversals.

🔗 Conclusion

Breaker Blocks represent a significant concept within Smart Money Concept trading, offering insights into potential market reversals and high-probability trading opportunities. By understanding how to identify and trade Breaker Blocks effectively, traders can align themselves with the actions of institutional investors and potentially improve their trading outcomes.

However, like all trading strategies, success with Breaker Blocks requires practice, discipline, and a thorough understanding of market dynamics. Traders should combine Breaker Block analysis with other technical and fundamental factors to make informed trading decisions. As with any trading approach, continuous learning and adaptation are key to long-term success in the ever-evolving financial markets.