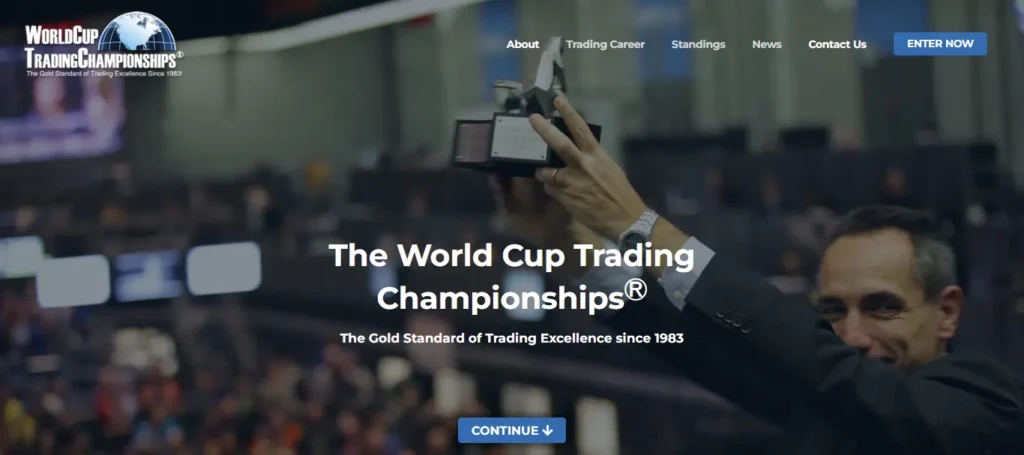

Since 1983, the World Cup Trading Championships® has been the gold standard of trading excellence, inviting traders from across the globe to test their skills in the ultimate arena.

Whether you're a day trader or position holder, using discretionary methods or algorithmic systems, this prestigious competition offers the chance to showcase your trading prowess with real money on the line.

With divisions spanning futures, forex, and stocks, competitors share one goal: achieving the highest possible returns and joining the ranks of legendary winners like Larry Williams, who turned $10,000 into over $1.1 million with an astounding 11,376% return in 1987.

Ready to earn the respect of the trading community and potentially launch your trading career on the world stage?

History and Legacy of World Cup Trading Championships

The World Cup Trading Championships (WCTC) has stood as the gold standard for trading competitions since its inception in 1983, when it was launched by Robbins Trading Company.

Designed as an international stage for traders to test their skills in real-world conditions, the WCTC quickly earned a reputation as the “Olympics” of trading, attracting participants from around the globe in futures, forex, stocks, and more.

Over the decades, the championship has produced legendary stories and record-breaking performances. The most iconic is Larry Williams’ 1987 feat, where he turned a $10,000 account into over $1.1 million—a staggering 11,376% return that remains unmatched. His daughter, Michelle Williams, also made headlines in 1997 by achieving a 1,000% return at just 17 years old, cementing the family’s place in trading history.

Other notable champions include Andrea Unger, a multi-time winner with returns as high as 672% in 2008, and Kurt Sakaeda, who has posted impressive performances across several years and divisions.

The impact of the WCTC on the trading community is profound. Not only does it provide a transparent, real-money platform for traders to prove their strategies and discipline, but it also serves as a launchpad for careers in investment management and hedge funds.

Winners gain international recognition, valuable credibility, and often opportunities to manage capital or offer advisory services. The competition’s global reach and rigorous standards have inspired countless traders to refine their craft, making participation a prestigious milestone and fostering a culture of excellence in trading worldwide.

Competition Structure

The World Cup Trading Championships (WCTC) offers a dynamic and inclusive competition format, catering to traders across a range of asset classes. The primary divisions are Futures and Forex, with additional categories for stocks and cryptocurrencies featured periodically, ensuring that traders of all backgrounds and strategies have an opportunity to compete on the world stage.

Each division is structured to accommodate various trading styles, from short-term day trading to longer-term position holding, and welcomes both discretionary and algorithmic approaches. The competition typically runs for a full calendar year, with entries accepted throughout the period. Recently, quarterly divisions have been introduced, allowing traders to compete for shorter-term honors in both futures and forex.

Entry requirements are straightforward but rigorous, reflecting the real-money nature of the championship. For the Futures division, participants must open an account with a minimum starting balance of $10,000, while the Forex division requires a $5,000 minimum.

Quarterly divisions may accept lower minimums, such as $2,500, making the competition accessible to a broader range of traders. All trading must be conducted through accounts with authorized brokers designated by the organizers, ensuring transparency and regulatory compliance.

A defining feature of the WCTC is its real-money trading format. Unlike simulated or demo contests, every trade is executed with actual capital, adding a layer of authenticity and intensity to the competition. This approach not only tests a trader’s strategy and skill but also their discipline and risk management under real market conditions.

The results are published as a percentage of initial capital, and top performers are recognized with prestigious trophies and global media exposure, further elevating the stakes and prestige of the event.

Rewards and Recognition

The World Cup Trading Championships (WCTC) stands out not just for its competitive rigor but also for the remarkable rewards and recognition it offers to top performers. The most coveted accolade is the iconic “Bull & Bear” trophy, awarded to the top three finishers in each division—an enduring symbol of trading excellence that carries significant prestige within the global trading community.

Beyond the trophy, winners receive widespread notoriety through press releases, interviews, and features in leading financial publications, amplifying their reputation on an international scale.

Perhaps the most transformative reward is the opportunity to join the WorldCupAdvisor.com team. This platform allows top traders to become advisors, where their live trades can be mirrored by subscribers worldwide—a career-changing prospect that has propelled many past champions into professional trading and investment management roles.

The competition’s real-money format ensures that strong performances are not only celebrated but also serve as verified track records, opening doors to hedge fund management, capital allocation, and advisory opportunities.

Numerous champions have leveraged their success to build influential careers. Larry Williams’ legendary 11,376% return in 1987 remains a benchmark for trading achievement, while multi-time winners like Andrea Unger and recent champions such as Sadanand Kalasabail and Ivan Scherman have parlayed their victories into broader industry recognition and professional opportunities.

For many, a top finish at the WCTC is more than a personal triumph—it’s a launchpad to global respect, new ventures, and a lasting legacy in the trading world.

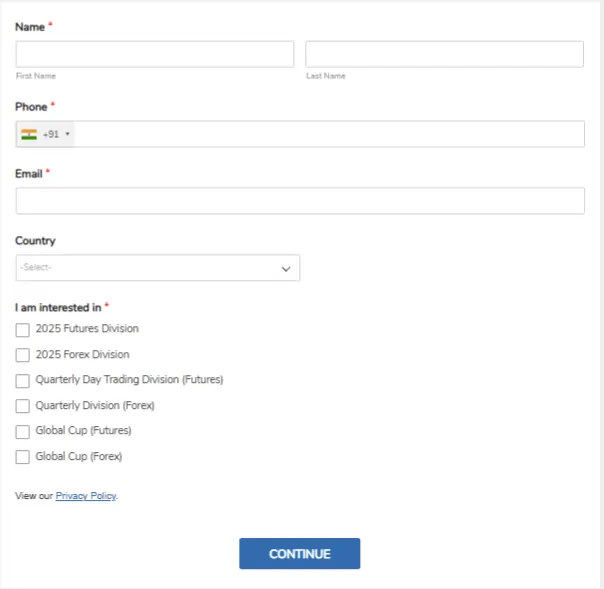

How to Participate in WCTC?

Participating in the World Cup Trading Championships is designed to be accessible yet rigorous, ensuring only serious and skilled traders compete. Registration is open throughout the year, allowing traders to join annual or quarterly contests in futures, forex, and other divisions.

To enter, new participants must complete an online application and entry agreement, selecting their preferred trading platform—such as MetaTrader or Advantage for forex—and submit the required documentation to the organizers.

Existing clients can add new accounts through their broker’s portal, specifying their intent to compete in the championship and funding the account accordingly.

The minimum starting balance varies by division: $10,000 for the Futures competition, $5,000 for Forex, and as low as $2,500 for quarterly events, making it feasible for a range of traders to participate. Trading must be conducted through authorized brokers to ensure transparency and regulatory compliance, and all trades are executed with real money, adding authenticity and pressure to the competition.

Contestants are provided with access to robust trading platforms and tools, including real-time leaderboards and performance tracking, which allow them to monitor their progress and compare with peers. To maximize your chances, it’s crucial to prepare by thoroughly understanding the rules, developing a robust trading strategy, and practicing disciplined risk management.

Reviewing past winners’ strategies, staying updated with market conditions, and setting clear performance goals can also provide a competitive edge. Ultimately, success in the WCTC demands not only trading skill but also resilience, adaptability, and a commitment to continuous improvement.

Do You Know?

Who can Participate in the World Cup Trading Championships?

Anyone meeting the minimum account funding requirements and legal trading age can participate, regardless of nationality or trading experience.

What Markets are included in the Competition?

The main divisions are futures and forex, with periodic competitions in stocks and cryptocurrencies.

Is simulated Trading allowed in the Championship?

No, all trading must be conducted with real money in live accounts through authorized brokers.

How are Winners Determined?

Winners are ranked based on the highest percentage returns relative to their starting capital during the competition period.

What are the main Prizes for Top Performers?

Top finishers receive the prestigious Bull & Bear trophy, global recognition, and potential opportunities with WorldCupAdvisor.com.

End Note

The World Cup Trading Championships remains a benchmark for trading excellence, offering real-money competition, global recognition, and career opportunities.

For traders seeking to prove their skills and join an elite legacy, this is the ultimate stage to showcase talent and ambition.