Day trading: where adrenaline meets analytics. But, let's face it – over-relying on instinct and luck is a recipe for disaster. To grow in this high-stakes game, you need a winning strategy. And that's where the shocking truth comes in:

95% of day traders lose money.

But, what sets the 5% apart? A systematic approach to analyzing performance and refining strategies. This is where Forex Trading Journals emerge as the ultimate game-changer.

A Forex Trading Journal is essentially a detailed record of your trades, allowing you to track your decisions, emotions, and outcomes over time. By meticulously documenting your trading activities, you can gain valuable insights into your strengths and weaknesses, identify patterns in your behavior, and ultimately improve your Forex Trading Journals performance.

Do you Want a trading journal that checks all your boxes?

Here is something for you!

💹 9 Best Forex Trading Journals 💹

| Forex Trading Journals | Key Features | Pricing |

|---|---|---|

| TradesViz | AI-powered insights, advanced analytics, risk management tools. | Free plan, paid plans start at $14.99/month |

| Stonk Journal | Free to use, basic trade logging and analysis, growing user base. | Free |

| TraderSync | AI-driven trade analysis, real-time performance tracking, market replay simulator. | Plans start at $29.95/month |

| Tradervue | Detailed trade execution analysis, risk management reports, sharing features. | Free plan for 30 trades/month, paid plans start at $29/month |

| Trademetria | Automated trade importing, performance analytics, customizable dashboard. | Plans start at $29.95/month |

| Chartlog | Visual trade journaling, customizable chart templates, cloud-based storage. | $14.99 per month |

| Edgewonk | Customizable templates, psychological analysis tools, Monte Carlo simulations. | $169/year |

| AntSignals | AI-driven trade analysis and recommendations, social trading features, mobile app. | €12.90 per month |

| Kinfo | Social trading network, performance analytics, risk management tools. | Free |

1. TradesViz

TradesViz is a comprehensive online Forex Trading Journals that offers a wide range of features to help day traders analyze and improve their performance. With its AI-powered insights and intuitive interface, TradesViz has become a favorite among many active traders. TradesViz enables users to explore patterns, trends, and insights in international trade. The tool aims to make complex trade datasets more accessible and understandable through intuitive visual representations.

TradesViz Key Features

2. Stonk Journal

Stonk Journal is a free Forex Trading Journals that offers basic features for traders on a budget. While it may not have all the bells and whistles of paid options, it's a great starting point for beginners. It offers humorous commentary on market trends, meme stocks, and cryptocurrency phenomena. The journal's content blends financial jargon with internet culture, catering to a younger audience of retail investors and social media-savvy traders.

Stonk Journal Key Features

3. TraderSync

TraderSync is an online Forex Trading Journals that caters to individual traders, offering in-depth performance reports, AI-powered feedback, and a market replay simulator. It allows users to import trades, analyze performance metrics, and generate detailed reports. By providing powerful tools to track and evaluate trading activity, TraderSync aims to help traders identify strengths, weaknesses, and areas for improvement to optimize their strategies and profitability.

TraderSync Key Features

4. Tradervue

Tradervue is one of the pioneers in the online Forex Trading Journals space and continues to be a popular choice for day traders. Its robust reporting capabilities and active community make it an excellent option for those looking to dive deep into their trading data. It offers comprehensive tools to track, analyze, and improve trading performance across various markets. With features like trade importing, detailed reporting, and risk analysis, Tradervue helps traders gain valuable insights into their strategies and decision-making processes.

Tradervue Key Features

5. Trademetria

Trademetria offers user-friendly Forex Trading Journals with a focus on clean design and ease of use. It's an excellent option for traders who want powerful analytics without a steep learning curve. It offers features such as trade tracking, performance metrics, and risk management insights, enabling users to evaluate and optimize their trading activities effectively. Trademetria supports multiple asset classes and integrates with various brokers for seamless data import.

Trademetria Key Features

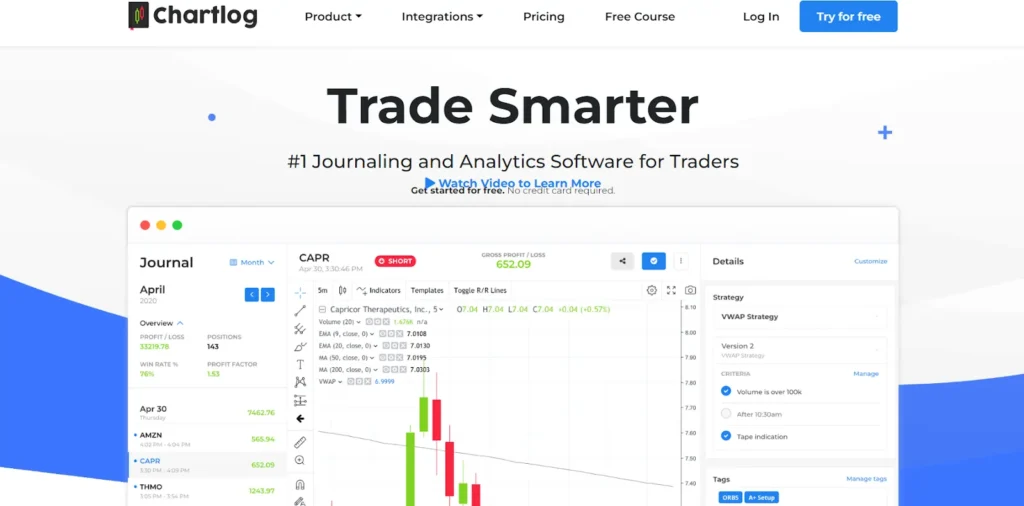

6. Chartlog

Chartlog offers a unique approach to Forex Trading Journals by focusing on the visual representation of trades. This can be particularly helpful for traders who prefer a more graphical analysis of their performance. By offering insightful data analysis, it helps users track their trades, identify patterns, and improve decision-making. With its user-friendly interface, Chartlog aims to support both novice and experienced traders in optimizing their strategies for better trading outcomes.

Chartlog Key Features

7. Edgewonk

Edgewonk offers a unique approach to Forex Trading Journals with its focus on the psychological aspects of trading. This journal is particularly useful for traders looking to improve their mindset and decision-making processes. It offers features such as risk management, performance analytics, and trade planning tools to help traders track and optimize their performance. Edgewonk aims to provide traders with the necessary tools to develop a systematic and disciplined approach to trading.

Edgewonk Key Features

8. AntSignals

AntSignals is a newer entrant in the Forex Trading Journals space but has quickly gained popularity due to its innovative features and AI-powered insights. Designed for both novice and experienced traders, it offers real-time insights, automated trading options, and a user-friendly interface. AntSignals aims to simplify crypto trading by providing data-driven recommendations and reducing emotional decision-making in volatile markets.

AntSignals Key Features

9. Kinfo

Kinfo combines Forex Trading Journals with social trading features, allowing users to learn from and interact with other traders. Kinfo allows users to track and share their investment portfolios, offering transparency and insights into successful investors' strategies. The platform aims to democratize investing knowledge by enabling users to learn from and follow top performers.

Kinfo Key Features

🔗 Tips for Making Forex Trading Journals a Daily Habit

Quick Answers

What is The Primary Purpose of a Trading Journal?

To track trades, analyze performance, and improve trading strategies.

Which Trading Journal offers a Free option suitable for Beginners?

Stonk Journal.

What Unique Feature does Edgewonk offer?

Focus on psychological aspects of trading and Monte Carlo simulations.

Which Journal is known for its Visual approach to Trade Analysis?

Chartlog.

What Advanced Features do TradesViz and TraderSync offer?

AI-powered insights and analysis.

How many Brokers does TraderSync Integrate with?

Over 900 brokers.

What Social Feature does Kinfo provide?

A social trading network where users can learn from and interact with other traders.

📌 The End Note

Choosing the right Forex Trading Journals is a crucial step in developing a successful day trading strategy. The best Forex Trading Journals offer a combination of powerful analytics, user-friendly interfaces, and features suited to trader’s specific needs.

If you're a beginner looking for a free option like Stonk Journal or an experienced trader seeking advanced AI-powered insights from platforms like TradesViz or TraderSync, there's a journal out there for you.

These top Forex Trading Journals provide essential tools for tracking performance, analyzing trades, and identifying areas for improvement. By consistently using a trading journal, day traders can gain valuable insights into their trading patterns, emotions, and decision-making processes. This self-awareness is key to refining strategies and improving overall profitability.

Remember, the best Forex Trading Journals are the ones you'll use consistently. Consider your trading style, the markets you trade, and your budget when making your choice. With the right trading journal by your side, you'll confidently tackle the challenges of day trading and work towards achieving your financial goals.

![Equity in Forex Trading 📖 Forex Glossary [2025 Edition] 8 Equity](https://fxparkey.com/wp-content/uploads/2024/04/Equity-300x189.webp)

![Earnings Per Share (EPS) in Forex Trading 📖 Forex Glossary [2025 Edition] 9 Earnings per Share (EPS)](https://fxparkey.com/wp-content/uploads/2024/03/Earnings-per-Share-EPS-300x189.webp)

![Demo Account in Forex Trading 📖 Forex Glossary [2025 Edition] 13 Demo Account](https://fxparkey.com/wp-content/uploads/2024/03/Demo-Account-1-300x189.webp)