As someone who keeps a close watch on the prop firm space, I see why FunderPro Futures is turning heads in 2025.

It’s attracting traders with a straightforward 80% profit split on accounts up to $200,000 and access to major global exchanges.

With different evaluation programs for various trading approaches, it offers a real choice. But do its strict drawdown rules and targets fit your methods?

Let's explore if this is the right opportunity for you.

FunderPro Futures Review: Sharing My Thoughts

FunderPro Futures launched in 2023 with a solid record—drawing on over ten years of technology solutions for traders. It stands out as one of the quickest-rising names among FX prop firms worldwide, recognized for offering real-funded accounts and daily payouts.

Led by Gary Mullen, a respected figure in the industry, the company has built a reputation for innovation and steady growth in the proprietary trading space. Traders are drawn to its flexible evaluation models and consistent profit-sharing opportunities, making it a strong option for those seeking reliable funding and straightforward payouts.

A Trader's Guide to FunderPro Futures Funding Plans

FunderPro Futures offers a direct, one-phase evaluation model designed to get you funded and trading. The plans are built around a clear set of rules and a generous 80% profit split once you're established.

Let's break down the account options and what it takes to succeed.

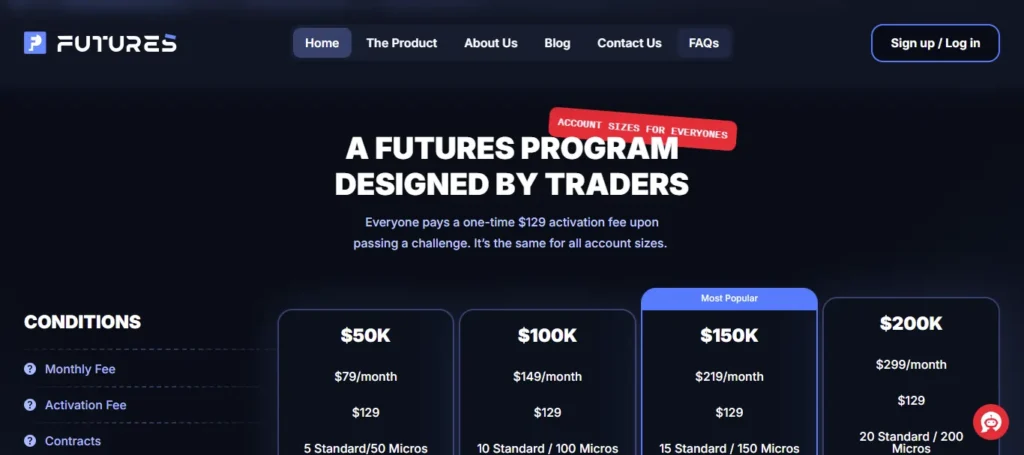

The firm provides four account sizes, each with a monthly subscription fee. After passing the evaluation, all traders pay a single, one-time activation fee of $129 to get their funded account.

Here is a look at the different funding plans available:

| Account Size | Profit Target | Max Trailing Drawdown | Daily Loss | Max Position Size | Monthly Price | Reset Cost |

|---|---|---|---|---|---|---|

| $50,000 | $3,000 | $2,000 | $1,000 | 5 (50 Micros) | $79 | $60 |

| $100,000 | $6,000 | $3,000 | $2,000 | 10 (100 Micros) | $149 | $119 |

| $150,000 | $9,000 | $4,500 | $3,000 | 15 (150 Micros) | $219 | $175 |

| $200,000 | $12,000 | $6,000 | $4,000 | 20 (200 Micros) | $299 | $239 |

Key Trading Rules and Objectives

To pass the evaluation, you must follow a specific set of rules designed to promote consistent and disciplined trading.

Profit Split and Payouts

FunderPro uses a tiered profit split. You receive 60% on your first payout, 70% on the second, and 80% on the third and all future withdrawals.

After your third payout, you become eligible for daily withdrawals on any profits over $100, giving successful traders quick access to their earnings.

FunderPro Futures Trading Rules: What Every Trader Needs to Know?

As someone who's analysed countless prop firms, I find FunderPro Futures sets clear boundaries that actually help traders succeed.

Here's what you need to know about their trading objectives and rules, broken down into digestible points that matter for your trading journey.

Profit Targets and Goals

Daily Loss Protection

Maximum Trailing Drawdown

Consistency Requirements

Position Management Rules

News Trading Limitations

Position Size Controls

Reset and Recovery Options

The beauty of FunderPro Futures' rule structure is its simplicity. Unlike some firms that pile on complex requirements, these rules focus on core risk management principles that any serious trader should already follow.

The 6% profit target is achievable, the daily loss limits prevent account blowups, and the consistency rule encourages steady growth over lucky streaks.

What sets them apart is the flexibility after funding – no ongoing profit targets means you can focus on steady, profitable trading without artificial pressure. The reset option also gives traders multiple chances to prove themselves, which is rare in this industry.

Your Trading Cockpit: FunderPro Futures Supported Platforms

As a trader, your platform is your command center, so it's good to see FunderPro Futures offering a solid lineup of specialised tools. Here are the platforms you can use, each bringing something different to the table.

| Platform | What It's Known For |

|---|---|

| Volbook | Advanced order flow and volume analysis tools. |

| Volsys | Real-time market data and professional charting. |

| Volumetrica | In-depth volume profile and market analytics. |

| Quantower | A multi-asset terminal with powerful trading features. |

Common Queries Relevant to FunderPro Futures Review

What is FunderPro Futures’ Profit Split on Funded Accounts?

Traders receive up to 80% profit split after their third payout, with daily withdrawals available for profits over $100.

How does the Evaluation Challenge Work?

You must hit a 6% profit target to pass. All accounts have clear rules, including daily loss limits and consistency requirements.

What are the main Trading Restrictions?

No overnight or weekend positions are allowed. Trading is paused two minutes before and after high-impact news events.

Can traders reset their Evaluation Accounts?

Yes, you can reset your account as many times as needed during your subscription, keeping unused challenge days.

Which Trading Platforms does FunderPro Futures Support?

Supported platforms include Volbook, Volsys, Volumetrica, and Quantower, each offering specialised trading and analysis tools.

Are there ongoing Profit Targets after Funding?

Once funded, there are no ongoing profit targets required for withdrawals—trade at your own pace.

Closing Thoughts on FunderPro Futures Review

FunderPro Futures stands tall in 2025 as a prop trading firm that makes real funding accessible and straightforward. With its clear profit targets, flexible evaluation models, and an 80% profit split on accounts up to $200,000, it’s easy to see why traders are flocking here.

Strict drawdown rules and daily loss limits keep risk in check, while the reset option gives you room to grow. Access to top platforms like Volbook and Quantower supports diverse strategies. If you value transparency, daily payouts, and a ruleset that encourages disciplined trading, FunderPro Futures deserves your attention.

This prop firm review highlights a strong choice for those seeking reliable forex funding and consistent trading opportunities in 2025.