Blue Guardian provides funding and support to traders looking to profit from the financial markets.

Do you know, what is a key aspect which traders analyze when selecting a prop firm?? Any guesses?? Yes! It is the Blue Guardian payouts policy and payout (profit) split model!

So, are you on a hunt for the best prop firm out there? Let me reveal y’all a bit!

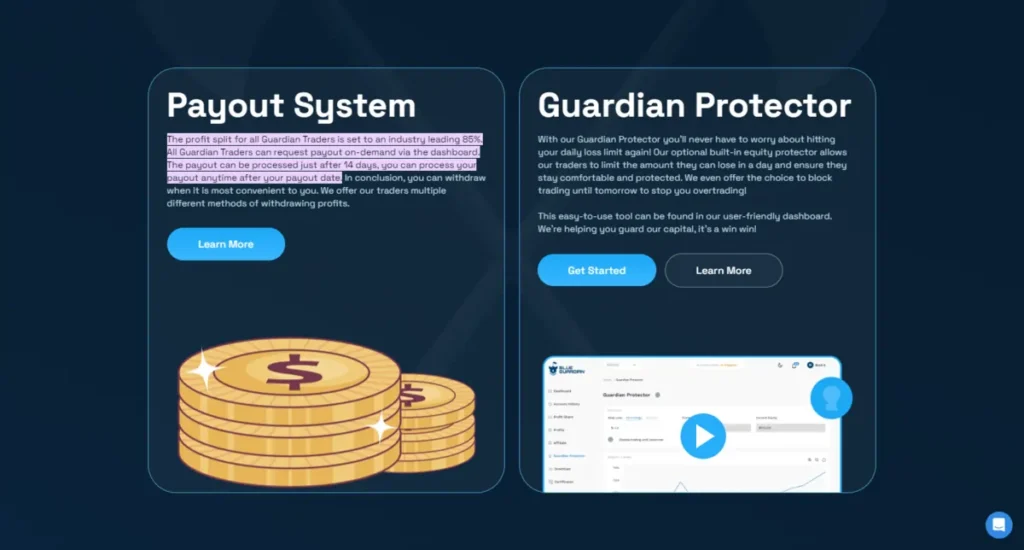

Funded traders receive an 80%-85% profit split, which is among the highest in the industry!

This article will break down Blue Guardian payouts structure, including timelines, eligibility criteria, and statistics.

Outlook Over Blue Guardian Payouts

Blue Guardian is a proprietary trading firm that provides traders with the opportunity to manage and grow funded accounts through a structured evaluation process.

The firm is known for its competitive and realistic targets, making it an attractive option for serious traders looking to leverage their skills without risking personal capital.

30% Blue Guardian Discount Code

Verified

Apply the “BG30” discount code at checkout on blueguardian.com for a 30% discount on any account size.

SAVE UP TO 30%

Savings From 30% to 50% on BG

Save from 30% to 50% on Blue Guardian with verified coupon code. Valid on all challenges. Limited period offer.

30% to 50% Off

| Key Information | Details |

|---|---|

| Blue Guardian CEO | Sean Bainton |

| Restricted Countries | The evaluation process at Blue Guardian is designed to assess a trader's skill and discipline over two phases. The first phase requires traders to achieve an 8% profit target. The second phase has a 4% profit target. There are no minimum trading days required, and the trading period is unlimited, providing traders with the flexibility to progress at their own pace. The maximum daily loss is set at 4% of the account balance, with a maximum overall loss limit of 8%. |

| Key features | The evaluation process at Blue Guardian is designed to assess a trader's skill and discipline over two phases. The first phase requires traders to achieve an 8% profit target. The second phase has a 4% profit target. There are no minimum trading days required, and the trading period is unlimited, providing traders with the flexibility to progress at their own pace. The maximum daily loss is set at 4% of the account balance, with a maximum overall loss limit of 8%. |

| Evaluation System | The evaluation process at Blue Guardian is designed to assess a trader's skill and discipline over two phases. The first phase requires traders to achieve an 8% profit target. The second phase has a 4% profit target. There are no minimum trading days required, and the trading period is unlimited, providing traders with the flexibility to progress at their own pace. The maximum daily loss is set at 4% of the account balance, with a maximum overall loss limit of 8%. |

| Support | The firm offers 24/7 technical support Accessible via main communication channels like email, live chat, and tickets. They aim to answer all emails within 24 hours on business days. |

Who are the Partners of Blue Guardian?

The company partners with brokers EightCap and Purple Trading to offer trading services across forex, commodities, indices, and cryptocurrencies.

1. EightCap

Eightcap, a regulated broker, plays a crucial role in elevating the trading experience for Blue Guardian's traders. This partnership ensures traders have access to a wide range of trading instruments, including currencies, cryptocurrencies, indices, commodities, and gold.

Eightcap's reputation for providing exceptional financial services, backed by regulations in multiple locations, offers a secure and reliable trading environment.

The collaboration with Eightcap allows Blue Guardian to offer MetaTrader 4 and MetaTrader 5 platforms, catering to traders' preferences and ensuring a user-friendly and efficient trading experience.

2. Purple Trading

The return of Purple Trading as an option for selecting challenges marks a significant update for Blue Guardian's community. This partnership introduces competitive spreads starting from 0.0 and the advantage of positive slippage, where over 80% of trades executed result in the same or better prices.

Purple Trading's commitment to providing favorable trading conditions and cutting-edge technologies, along with negative balance protection, ensures traders are shielded from abrupt market fluctuations.

This collaboration signifies a leap forward in offering enhanced tools and resources for informed and successful trading.

Blue Guardian's partnerships with Eightcap and Purple Trading Seychelles are instrumental in providing traders with a superior trading experience. These collaborations ensure access to competitive spreads, a wide range of trading instruments, and secure, reliable trading platforms, positioning Blue Guardian as a leading choice for forex traders.

What are Blue Guardian Payouts?

In the realm of Forex trading, Blue Guardian payouts are a common scenario in Binary Options Trading, PAMM Accounts, Proprietary Trading Firms, etc.

Prop trading firms provide capital to traders to trade on the firm's behalf. Payouts in this scenario refer to the profit share that traders receive from the profits generated through their trades. The Blue Guardian payouts structure and frequency can vary widely among firms, with some offering bi-weekly payouts and others requiring traders to reach certain profit targets before receiving their shares.

Understanding Blue Guardian Payouts

1. Payout Timeline

Blue Guardian stands out with one of the fastest payout timelines in the prop trading industry. The process is as follows:

2. Payout Eligibility

To qualify for payouts, Blue Guardian traders must:

3. Payout Split

The Bue Guardian Payout Split works as follows:

4. Payout Methods

Blue Guardian provides traders flexibility in how they receive earnings. It offers payout withdrawals via the following methods:

5. Sample Payouts

While formal statistics are limited given Blue Guardian's recent launch, payout evidence can be found from client withdrawals and reviews:

Maximizing Earnings

To optimize payouts from Blue Guardian, traders should focus on consistency, risk management, and scaling up strategies once funded. Key tips include:

Meeting targets steadily can lead to larger account tiers and that 85% split compounding profits.

Blue Guardian Payouts Ratings and Reviews

Out of 900 independent reviews, Blue Guardian has a whopping 4.7/5.0 rating on Trustpilot!

Let us take a look at some of these reviews!

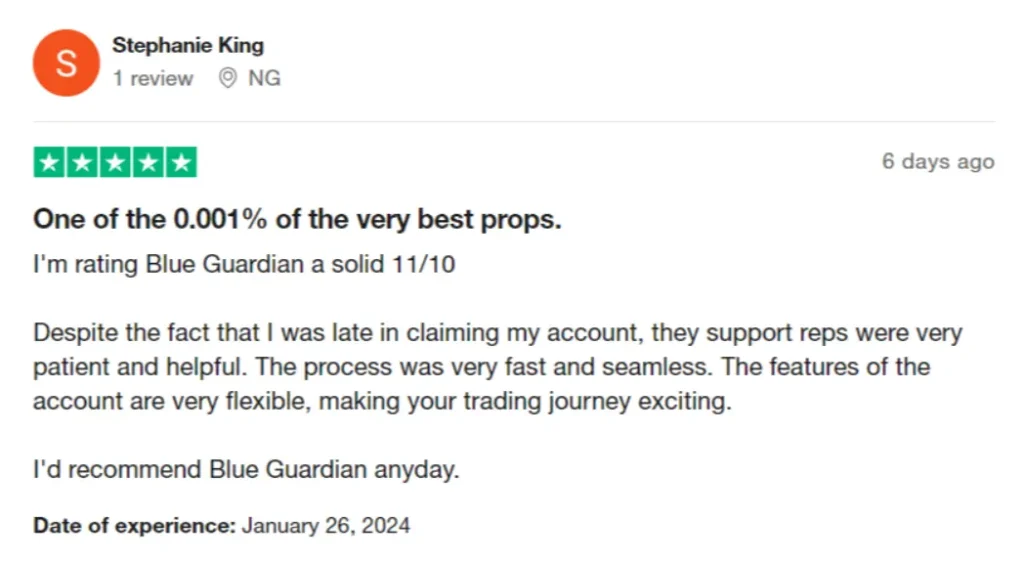

Review 1:

Review 2:

FAQs on Blue Guardian Payouts

Where is Blue Guardian Based?

Blue Guardian is a proprietary trading firm based in the UK.

What is the Maximum Daily loss?

The maximum daily loss is set at 4% of the account balance. The maximum overall loss limit is 8%.

What is the Profit Split for Funded Traders?

Funded traders receive an 85% profit split, which is among the highest in the industry.

Does Blue Guardian restrict Trading Strategies?

No, Blue Guardian does not restrict the use of EAs, trade copiers or news trading strategies.

What Risk Management tools are Offered?

Blue Guardian provides the Guardian Protector tool to help traders manage daily loss limits.

What Trading Platforms can be used?

Blue Guardian offers user-friendly MetaTrader 4 and MetaTrader 5 platforms.

What Account Sizes are available?

Account sizes range from $10,000 up to $200,000, with the potential to scale up to $2,000,000.

Is the Evaluation Fee Refundable?

Yes, the fee is fully refundable once sufficient profits have been generated.

Bottom Line

First of all, if you’ve made it this far, here’s a high-five 🙏 cutie!

Let me summarize the above for you:

Blue Guardian is a leading choice for forex traders seeking a prop firm that offers favorable profit splits, a supportive trading environment, and the potential for significant account scaling.

With its realistic evaluation targets, bi-weekly payouts, and commitment to trader success, Blue Guardian is well-positioned to attract and nurture talent in the competitive forex trading landscape.

All in all, Blue Guardian's payout policies, combined with its trader-centric features, make it a standout option for those looking to maximize their trading potential in the forex market.

Don’t waste more time! Try it today!