AI-powered trading bots have emerged as powerful tools for investors seeking to maximize profits and minimize risks. This article explores 15+ top contenders, examining their key features, pricing structures, and pros and cons to help you find the ideal bot for your trading needs.

Top 15+ AI Crypto Trading Bots

| S/N | AI Crypto Trading Bots | Pricing |

|---|---|---|

| 1 | Pionex | 0.05% maker/taker fee |

| 2 | Mizar | Pay as you go |

| 3 | Dash2Trade | Free |

| 4 | Cryptohopper | Free |

| 5 | Altrady | Free |

| 6 | 3Commas | Free |

| 7 | HummingBot | Free |

| 8 | TokenSets | Free |

| 9 | Cryptohero | Free |

| 10 | Gunbot | $199/month |

| 11 | Octobot | Free |

| 12 | Arbitrage Scanner | $69/month |

| 13 | Kryll | $KRL (native token) |

| 14 | TradeSanta | $25/month |

| 15 | BitsGap | $27/month |

| 16 | Wiener AI | $0.000713 per token (pre-sale) |

What are AI Crypto Trading Bots all about?

AI Crypto Trading Bots are sophisticated software programs that leverage artificial intelligence and machine learning algorithms to automate cryptocurrency trading.

These bots are designed to analyze vast amounts of market data, identify trading opportunities, and execute trades with speed and precision that surpass human capabilities.

15+ Best AI crypto trading bots

1. Pionex

Pionex is a cryptocurrency exchange that stands out for its integration of free automated trading bots. Founded in 2019, it offers a unique combination of a traditional crypto exchange with built-in trading bot functionality.

Pionex is regulated in Singapore and the United States, providing a level of security and legitimacy to its operations.

Pionex Key Features

- Integrated Trading Bots: Pionex offers 16 free trading bots, including Grid Trading, DCA (Dollar-Cost Averaging), and Arbitrage bots. These bots allow users to automate their trading strategies without the need for coding or complex setups.

- Low Trading Fees: Pionex boasts some of the lowest trading fees in the industry, with a flat fee structure of 0.05%. The platform also offers leveraged trading with slightly higher fees of 0.1% for both maker and taker orders.

- Liquidity Aggregation: Pionex aggregates liquidity from major exchanges like Binance and Huobi Global, ensuring deep liquidity and competitive prices for its users.

Pionex Pricing

Pionex does not charge any subscription fees for using its platform or trading bots. The main costs associated with using Pionex are the trading fees:

- Spot Trading: 0.05% maker/taker fee

- Leveraged Trading: 0.1% maker/taker fee

- Withdrawal Fees: Vary by cryptocurrency

Pros and Cons of Pionex

Pros

Cons

2. Mizar

Mizar is an innovative crypto trading platform that combines automated trading bots, copy trading, and advanced order management tools. Mizar supports over 10 major cryptocurrency exchanges and provides tools for both CeFi and DeFi trading, including a unique D-Mizar product for Uniswap trading.

With backing from prominent investors like Nexo, KuCoin, and Huobi, Mizar has quickly gained popularity among crypto traders.

Mizar Key Features

- Copy Trading and Bot Marketplace: Mizar offers a diverse marketplace of trading bots and strategies created by experienced traders. Users can easily browse, analyze, and copy these bots with just a few clicks, allowing them to benefit from professional trading strategies.

- Smart Trading Terminal: Mizar's Smart Trading Terminal is built on top of the popular TradingView charting platform, providing a unified interface for executing trades and managing positions across multiple exchanges.

- DCA (Dollar Cost Averaging) Bots: Mizar offers customizable DCA bots that allow users to implement sophisticated investment strategies. These bots can be configured to automatically buy or sell assets at predetermined intervals or price points, helping to mitigate the impact of market volatility.

Mizar Pricing

Mizar operates on a unique pricing model with no fixed subscription fees. Instead, users pay fees based on their trading volume:

- Pay-as-you-go option: 0.1% fee on trading volume

- Trader plan: $15/month

- Pro plan: $30/month

Pros and Cons of Mizar

Pros

Cons

3. Dash2Trade

Dash2Trade is an innovative crypto analytics and trading platform designed to empower both novice and experienced traders.

Launched in 2022, it offers a suite of tools for market analysis, strategy development, and automated trading. The platform stands out for its integration of social metrics, on-chain data, and technical indicators to provide a holistic view of the crypto market.

Dash2Trade Key Features

- Trading Signals and Analytics: Dash2Trade provides real-time trading signals based on technical analysis, social sentiment, and on-chain data. The platform offers a comprehensive dashboard that tracks hundreds of cryptocurrencies, providing insights on channel breakouts, moving average crossovers, and support/resistance levels.

- Strategy Builder and Backtester: Dash2Trade offers a robust strategy builder and backtesting tool, allowing traders to develop and test their trading strategies against historical market data.

- Automated Trading Bots: The platform provides access to automated trading bots, including Dollar-Cost Averaging (DCA) and Grid bots. The DCA bot enables systematic investing at regular intervals, while the Grid bot capitalizes on price fluctuations within a defined range. Dash2Trade plans to expand its bot offerings, allowing users to create custom bots using over 10 technical indicators.

Dash2Trade Pricing

Dash2Trade offers a tiered pricing model:

- Free Tier: Basic cryptocurrency information, trending coins analysis, limited back tester usage (1 per month)

- Professional Tier: $120 for 12 months, includes full access to all features including DCA and Grid bots, unlimited backtests, and upcoming Signal Engine bots.

Pros and Cons of Dash2Trade

Pros

Cons

4. Cryptohopper

Cryptohopper is a cloud-based cryptocurrency trading bot platform that offers automated and semi-automated trading solutions for traders of all experience levels.

Founded in 2017, it has quickly become one of the most popular crypto trading bots in the market. Cryptohopper allows users to manage multiple exchange accounts, implement various trading strategies, and access a marketplace for trading signals and bot templates.

Cryptohopper Key Features

- Automated Trading and Strategy Builder: Cryptohopper's core feature is its automated trading capability, powered by advanced algorithms. Users can create custom strategies using the platform's drag-and-drop Strategy Designer, which offers access to over 130 indicators and candlestick patterns.

- Social Trading and Marketplace: Cryptohopper offers a vibrant social trading ecosystem through its Marketplace. Here, users can access a wide range of pre-configured bot templates, trading strategies, and signals from experienced traders. This feature is particularly beneficial for beginners who can “copy trade” successful strategies.

- Backtesting and Paper Trading: Cryptohopper provides robust tools for strategy optimization and risk-free practice. The backtesting feature allows users to test their strategies against historical market data, providing insights into potential performance. Users can adjust parameters and see how changes affect results, helping to refine strategies before live deployment.

Cryptohopper Pricing

Cryptohopper offers a tiered pricing model with monthly and annual subscription options:

- Pioneer (Free): Limited features, 20 open positions per exchange

- Explorer ($24.16/month if billed annually): 80 positions, basic features

- Adventurer ($57.50/month if billed annually): 200 positions, advanced features

- Hero ($107.50/month if billed annually): Unlimited positions, all features

Pros and Cons of Cryptohopper

Pros

Cons

5. Altrady

Altrady is an advanced multi-exchange cryptocurrency trading platform designed for both novice and experienced traders. Founded in 2017 and based in the Netherlands, Altrady offers tools for automated trading, portfolio management, and market analysis across multiple exchanges.

Altrady Key Features

- Multi-Exchange Trading: Altrady supports trading on multiple major cryptocurrency exchanges, including Binance, KuCoin, and Coinbase Pro, among others. Users can manage their portfolios and execute trades across different exchanges from a single interface.

- Advanced Trading Bots: Altrady offers sophisticated trading bots, including Signal Bots and Grid Bots, to automate trading strategies. These bots can execute trades based on predefined parameters, technical indicators, or external signals.

- Base Scanner and Quick Scanner: These proprietary tools are designed to help traders identify potential trading opportunities quickly. The Base Scanner, based on the QFL (Quickfinger Luc) strategy, scans the market for specific patterns and setups, while the Quick Scanner helps identify rapid price movements across multiple markets.

Altrady Pricing

Altrady offers a tiered pricing model with three main plans:

- Free: €0/month

- Basic: €24.95/month (€17.47/month if billed annually)

- Essential: €44.95/month (€31.47/month if billed annually)

- Premium: €79.95/month (€55.97/month if billed annually)

A 14-day free trial is available for new users to test the platform's features.

Pros and Cons of Altrady

Pros

Cons

6. 3Commas

3Commas is a popular cryptocurrency trading platform that offers automated trading bots and portfolio management tools.

Founded in 2017, it provides traders with a user-friendly interface to create, manage, and execute trading strategies across multiple exchanges. With support from over 23 major exchanges and a robust set of analytical tools, 3Commas aims to simplify and enhance the crypto trading experience.

3Commas Key Features

- Trading Bots: 3Commas offers a variety of automated trading bots, including DCA (Dollar Cost Averaging), Grid, and Options bots. These bots allow users to implement complex trading strategies without constant manual intervention. The DCA bot, for instance, helps users accumulate assets over time, while the Grid bot capitalizes on market volatility by buying low and selling high within a predefined price range.

- SmartTrade Terminal: The SmartTrade feature provides advanced order types and risk management tools for manual trading. It allows users to set up complex order scenarios, including trailing stop losses, take profit levels, and simultaneous long and short positions. The terminal integrates with TradingView charts, offering a comprehensive view of market data and technical indicators.

- Portfolio Management and Analytics: 3Commas offers robust portfolio tracking and analysis tools. Users can connect multiple exchange accounts to get a consolidated view of their crypto holdings, track performance across different timeframes, and analyze profits and losses.

3Commas Pricing

3Commas offers a tiered pricing model with four plans:

- Free: Limited features, including 1 SmartTrade, 1 DCA bot, 1 Grid bot

- Pro: $37/month

- Expert: $59/month

- Custom Plan: Comes with extra limits

Higher-tier plans offer more bots, advanced features, and unlimited usage of certain tools. A 3-day free trial of the Pro plan is available for new users.

Pros and Cons of 3Commas

Pros

Cons

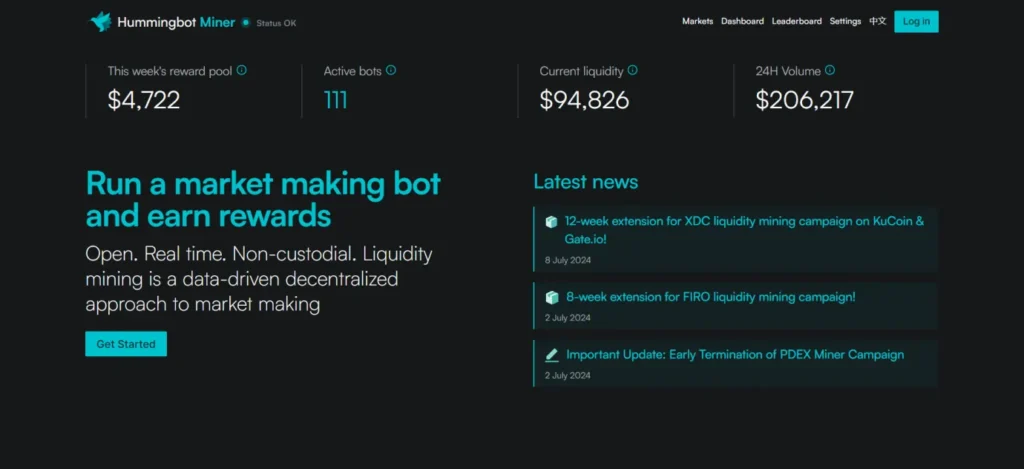

7. HummingBot

Hummingbot is an open-source, modular cryptocurrency trading bot framework designed for both retail and professional traders. Launched in 2019, it allows users to create and run automated trading strategies across multiple centralized and decentralized exchanges.

Hummingbot Key Features

- Automated Trading Strategies: Hummingbot offers a range of pre-built trading strategies, including pure market making, cross-exchange market making, and arbitrage. Users can customize these strategies or create their own using Hummingbot's scripting language.

- Liquidity Mining: Hummingbot pioneered the concept of decentralized market-making through its Liquidity Mining program. This feature allows token projects and exchanges to create liquidity mining campaigns, incentivizing traders to provide liquidity for specific trading pairs.

- Open-Source and Community-Driven: As an open-source project, Hummingbot's codebase is publicly available and auditable, fostering trust and transparency.

Hummingbot Pricing

Hummingbot is free to use and open-source. Users can download and run the software at no cost. However, there may be associated costs

Pros and Cons of Hummingbot

Pros

Cons

8. TokenSets

TokenSets is a decentralized platform for creating, managing, and investing in tokenized asset portfolios on the Ethereum blockchain. Launched by Set Protocol, it allows users to create and trade “Sets” – ERC-20 tokens that represent baskets of other crypto assets.

TokenSets Key Features

- Set Creation and Management: TokenSets allows users to create custom Sets, which are ERC-20 tokens representing a basket of underlying assets. Fund managers can define the composition of their Sets, set fee structures, and implement various investment strategies.

- Automated Trading Strategies: TokenSets offers a range of automated trading strategies, including trend trading and range-bound trading. These strategies use smart contracts to automatically rebalance the Set's composition based on predefined rules and market conditions.

- Social Trading and Marketplace: TokenSets includes a marketplace where users can browse and invest in Sets created by other managers. This social trading aspect allows investors to access a wide range of strategies and portfolios created by experienced traders or institutions.

TokenSets Pricing

TokenSets itself does not charge fees for using the platform.

Pros and Cons of TokenSets

Pros

Cons

9. Cryptohero

CryptoHero is a cloud-based cryptocurrency trading bot platform that offers automated trading solutions for both novice and experienced traders.

Founded by seasoned fund managers with decades of trading experience, CryptoHero aims to simplify crypto trading by providing user-friendly tools for creating, testing, and deploying trading bots across multiple exchanges.

CryptoHero Key Features

- Automated Trading Bots: CryptoHero offers a variety of bot types, including Simple, DCA (Dollar Cost Averaging), Grid, and Arbitrage bots. The platform supports both long and short strategies, with options for multiple indicator triggers and advanced settings. Bots can be set to trade at frequencies as low as 5 minutes (on higher-tier plans), allowing for responsive trading in volatile markets.

- Strategy Backtesting and Optimization: CryptoHero provides powerful backtesting tools that allow users to test their strategies against historical data before deploying them live.

- Multi-Exchange Support and Paper Trading: CryptoHero supports a wide range of popular cryptocurrency exchanges, including Binance, Coinbase, Kraken, and many others. Users can connect multiple exchange accounts and manage them from a single interface.

CryptoHero Pricing

CryptoHero offers three subscription tiers:

- Basic (Free): Limited to 1 active bot, simple bot types, and 15-minute minimum trading frequency

- Premium ($13.99/month): Up to 15 active bots, advanced bot types, and 15-minute minimum trading frequency

- Professional ($29.99/month): Up to 30 active bots, all bot types including Grid, and 5-minute minimum trading frequency

Pros and Cons of CryptoHero

Pros

Cons

10. Gunbot

Gunbot is a powerful and customizable cryptocurrency trading bot platform that runs directly on users' devices. Founded in 2016, it offers automated trading solutions for both novice and experienced traders across multiple exchanges.

The platform supports various operating systems including Windows, macOS, Linux, and ARM devices, providing flexibility for users to run their trading bots 24/7 without relying on cloud services.

Gunbot Key Features

- Automated Trading Strategies: Gunbot offers over 20 pre-configured trading strategies, including popular options like Grid Trading, Dollar Cost Averaging (DCA), and arbitrage.

- Multi-Exchange Support: Gunbot provides support for a wide range of cryptocurrency exchanges, including major platforms like Binance, Coinbase, Kraken, and many others.

- Backtesting and Optimization: Gunbot includes powerful backtesting tools that allow users to test their trading strategies against historical market data before deploying them in live trading.

Gunbot Pricing

Gunbot offers a one-time license fee model with different tiers:

- Standard: $199 (promotional price)

- Pro: $299 (promotional price)

- Ultimate: $499 (promotional price)

Pros and Cons of Gunbot

Pros

Cons

11. Octobot

OctoBot is an open-source, AI-powered cryptocurrency trading bot platform designed for both novice and experienced traders. Founded in 2018, it offers a wide range of automated trading strategies and tools for crypto investing.

OctoBot stands out for its user-friendly interface, customizable features, and transparent approach to strategy performance. The platform supports multiple exchanges and provides both cloud-based and self-hosted options.

OctoBot Key Features

- Automated Trading Strategies: OctoBot offers a diverse range of built-in trading strategies, including DCA (Dollar Cost Averaging), Grid trading, and AI-powered bots. Users can implement these pre-configured strategies or create custom ones using technical indicators, AI integrations, or even ChatGPT predictions.

- Backtesting and Optimization: OctoBot provides robust backtesting tools that allow users to test their strategies against historical market data before deploying them in live trading.

- Multi-Exchange Support and Portfolio Management: OctoBot supports trading on multiple major cryptocurrency exchanges, including Binance, Coinbase, and KuCoin, among others. Users can manage their portfolios across different exchanges from a single interface, providing a comprehensive view of their crypto holdings.

OctoBot Pricing

OctoBot offers a tiered pricing model with both free and paid options:

- Investor (Free): Includes unlimited DCA, Grid, and AI crypto trading bots, 14-day paper trading, and basic features.

- Investor Plus ($4.99/month): Adds crypto basket bot, TradingView bot, advanced features, and extended paper trading.

- Pro Trader ($24.99/month): Includes all features, custom crypto baskets, advanced TradingView bot, and more.

Pros and Cons of OctoBot

Pros

Cons

12. Arbitrage Scanner

ArbitrageScanner is a cloud-based cryptocurrency trading tool designed to identify and capitalize on arbitrage opportunities across multiple exchanges and blockchains.

Founded in 2018, it offers real-time monitoring of price discrepancies for a wide range of cryptocurrencies on both centralized (CEX) and decentralized (DEX) exchanges.

ArbitrageScanner Key Features

- Multi-Exchange and Blockchain Support: ArbitrageScanner offers comprehensive coverage of over 75 cryptocurrency exchanges, including both CEX and DEX platforms. It supports scanning across 20+ blockchain networks, including popular ones like Ethereum, BNB Chain, Arbitrum, and Avalanche.

- Customizable Alerts and Notifications: ArbitrageScanner provides a highly flexible alert system that allows users to set up personalized notifications based on their specific trading preferences.

- Educational Resources and Community Support: Recognizing the complexity of arbitrage trading, ArbitrageScanner offers a range of educational resources to help users maximize their trading potential.

ArbitrageScanner Pricing

ArbitrageScanner offers a tiered pricing model with four main plans:

- Test: $69/month

- Business: $199/month

- Platinum: $399/month

- Enterprise: $799/month

Pros and Cons of ArbitrageScanner

Pros

Cons

13. Kryll

Kryll is an advanced Web3 intelligence platform designed to simplify cryptocurrency investing and portfolio management. Founded with the mission of bringing Web3 intelligence to the masses, Kryll offers a suite of AI-powered tools that provide clear, actionable advice on crypto investments.

Kryll Key Features

- SmartFolio: This AI-powered portfolio management tool allows users to track and optimize their entire Web3 portfolio across multiple blockchains, including Ethereum, Solana, and EVM-compatible Layer 2 solutions.

- X-Ray: Serving as a smart Web3 assistant, X-Ray simplifies cryptocurrency investing by using deep learning and predictive algorithms to evaluate tokens. It analyzes smart contracts, on-chain data, social activity, and financial indicators to provide comprehensive token assessments.

- Gem Detector: This multi-chain monitoring tool is designed to identify emerging tokens with high growth potential before they gain mainstream attention. Gem Detector employs advanced algorithms and deep-learning models to automatically evaluate new tokens in real time, assessing their risks and potential.

Kryll Pricing

Kryll offers a native token called $KRL. Users are encouraged to “Buy $KRL,” suggesting a token-based model for accessing premium features or participating in the platform's ecosystem.

Pros and Cons of Kryll

Pros

Cons

14. TradeSanta

TradeSanta is a cloud-based cryptocurrency trading bot platform designed to automate trading strategies for both novice and experienced traders. Founded in 2018, it offers a user-friendly interface to create, manage, and execute automated trading bots across multiple exchanges.

TradeSanta Key Features

- Automated Trading Bots: TradeSanta offers a variety of bot types, including DCA (Dollar Cost Averaging), Grid, and MACD bots. Users can easily create and customize bots without coding knowledge, setting parameters like entry and exit points, stop-loss, and take-profit levels.

- Social Trading and Marketplace: TradeSanta provides a social trading ecosystem where users can share and copy successful trading strategies. The marketplace allows experienced traders to showcase their bot configurations and performance metrics, while newcomers can browse and implement proven strategies.

- Multi-Exchange Support and Portfolio Management: TradeSanta integrates with multiple major cryptocurrency exchanges, including Binance, Coinbase Pro, and KuCoin, among others.

TradeSanta Pricing

TradeSanta offers a tiered pricing model with three main plans:

- Basic: $25/month (or $156/year)

- Advanced: $45/month (or $276/year)

- Maximum: $70/month (or $420/year)

Pros and Cons of TradeSanta

Pros

Cons

15. Bitsgap

Bitsgap is an all-in-one cryptocurrency trading platform that offers automated trading bots, portfolio management tools, and a unified interface for trading across multiple exchanges.

Founded in 2017, Bitsgap aims to simplify crypto trading by providing users with advanced tools and strategies without requiring extensive technical knowledge.

Bitsgap Key Features

- Automated Trading Bots: Bitsgap offers a variety of trading bots, including Grid, DCA (Dollar Cost Averaging), and COMBO bots. These bots allow users to automate their trading strategies based on predefined parameters. The Grid bot, for instance, capitalizes on market volatility by buying low and selling high within a set price range. Users can customize bot settings, and backtest strategies, and monitor performance in real-time.

- Multi-Exchange Trading Terminal: Bitsgap's trading terminal provides a unified interface for trading across multiple exchanges. This feature allows users to view and manage their portfolios across different platforms, execute trades, and analyze market data from a single dashboard.

- Portfolio Management and Analytics: Bitsgap offers robust portfolio tracking and analysis tools. Users can connect multiple exchange accounts to get a consolidated view of their crypto holdings, track performance across different timeframes, and analyze profits and losses.

Bitsgap Pricing

Bitsgap offers a tiered pricing model with three main plans:

- Basic: $22/month (billed annually) or $27/month (billed monthly)

- Advanced: $51/month (billed annually) or $63/month (billed monthly)

- Pro: $111/month (billed annually) or $139/month (billed monthly)

All plans come with a 7-day free trial of the Pro plan. Discounts are available for annual subscriptions.

Pros and Cons of Bitsgap

Pros

Cons

16. Wiener AI

WienerAI is an innovative cryptocurrency project that combines meme coin appeal with advanced AI-powered trading capabilities. Launched in 2024, it features a sausage dog mascot and aims to simplify crypto trading for both novice and experienced investors.

WienerAI Key Features

- AI-Powered Trading Bot: WienerAI's flagship feature is its advanced AI crypto trading bots. Users can interact with the bot using natural language, asking questions about market trends, potential investments, or trading strategies.

- Staking and Rewards: WienerAI offers a robust staking mechanism for WAI token holders. Users can lock their tokens in smart contracts to earn passive income through staking rewards. During the presale phase, the platform offered exceptionally high Annual Percentage Yields (APYs), with rates reported as high as 324% or even 729% per annum.

- Meme Coin Appeal and Community Focus: While offering practical utility through its AI crypto trading bots features, WienerAI also embraces meme coin culture to foster a strong and engaged community. The project's branding, centered around a sausage dog character, aims to inject fun and humor into the crypto trading experience.

WienerAI Pricing

WienerAI's native token, WAI, was initially offered through a presale with a price of $0.000713 per token. The project raised over $7.5 million during its presale phase. Post-launch pricing will be determined by market forces once the token is listed on decentralized exchanges (DEXs).

Pros and Cons of WienerAI

Pros

Cons

Some Trending Queries

Are AI Crypto Trading Bots Suitable for Beginners?

Many AI crypto trading bots offer user-friendly interfaces and pre-configured strategies that make them accessible to beginners.

Can AI Crypto Trading Bots Guarantee Profits?

No trading bot can guarantee profits. While AI crypto trading bots can potentially improve trading efficiency and identify opportunities, cryptocurrency markets are highly volatile and unpredictable.

How do AI Crypto Trading Bots compare to Traditional Manual Trading?

AI crypto trading bots can process large amounts of data quickly, trade 24/7, and remove emotional biases from trading decisions.

Are AI Crypto Trading Bots safe to use?

Reputable AI crypto trading bots implement strong security measures. However, users should be cautious about granting API access to their exchange accounts and should only use bots from trusted providers.

Can I Customize The Trading Strategies Used by AI Crypto Trading Bots?

Most advanced AI crypto trading bots allow users to customize trading strategies or create their own. This can involve setting specific technical indicators, defining entry and exit rules, or even coding custom algorithms on some platforms.

Do I need Coding Skills to use an AI Crypto Trading Bot?

Many AI crypto trading bots are designed to be user-friendly and don't require coding skills.

Can AI Crypto Trading Bots be used on Multiple Exchanges Simultaneously?

Many AI crypto trading bots support multiple exchanges, allowing users to execute trades across different platforms from a single interface.

To Conclude

AI crypto trading bots have revolutionized the cryptocurrency market, offering traders powerful tools to navigate the complex and volatile world of digital assets. From user-friendly platforms like Cryptohopper and 3Commas to advanced solutions like Gunbot and Bitsgap, there's a wide range of options to suit every trader's needs and experience level.

Stay informed, practice proper risk management, and use these bots as part of a broader, well-thought-out trading strategy. With the right approach, AI crypto trading bots can be valuable allies in your journey to master the cryptocurrency markets.