Breakout trading is a popular strategy used by forex traders to capitalize on significant price movements. It involves identifying key levels of support and resistance, and entering trades when the price breaks through these levels with increased volume.

Breakouts often signify the start of a new trend or a continuation of an existing one. By understanding the anatomy of breakouts and using appropriate risk management techniques, traders can potentially capture substantial profits in the forex market.

What is a Breakout?

In forex trading, a breakout refers to a price movement that exceeds a significant level of support or resistance. It occurs when the price breaks out of a well-defined trading range, signaling a potential shift in market sentiment. Breakouts can happen in any direction, either upwards or downwards, and they often indicate the beginning of a new trend.

Traders look for breakouts as they offer opportunities to enter trades at favorable price levels. By identifying breakouts, traders attempt to capitalize on potential profits resulting from substantial price movements. It's important to note that breakouts can occur on various timeframes, ranging from short-term intraday charts to longer-term daily or weekly charts.

Why Breakouts are Important in Forex Trading?

Breakouts play a crucial role in forex trading for several reasons. Here are a few key reasons why breakouts are highly valued by traders:

- Opportunity for Profits: Breakouts provide traders with the opportunity to enter trades at the early stages of a new trend. By gaining early exposure to a potential price movement, traders can aim to capture substantial profits.

- Trend Identification: Breakouts often indicate the emergence of new trends. By identifying breakouts and confirming them with other technical analysis tools, traders can gain insights into the direction of the market and align their trading strategies accordingly.

- Risk Management: Breakouts can also serve as markers for defining risk levels. Traders typically set stop-loss orders below support levels in case of a breakout to limit potential losses. This risk management technique allows traders to protect their capital and maintain discipline in their trading approach.

- Market Sentiment: Breakouts can reflect shifts in market sentiment. When a breakout occurs, it suggests that there is a significant imbalance between the buying and selling pressure in the market. Traders interpret breakouts as a sign of increased market interest and use them to gauge the overall sentiment of the market.

Understanding breakouts and their significance in forex trading is essential for traders looking to capitalize on profitable opportunities. By keeping a close eye on breakouts and employing appropriate strategies, traders can potentially enhance their trading performance in the dynamic forex market.

Identifying Breakout Patterns

To effectively trade breakouts in Forex, it is crucial to identify breakout patterns accurately. Breakout patterns indicate a potential shift in the price of a currency pair, offering traders opportunities for profit. In this section, we will discuss three common breakout patterns: horizontal line breakouts, trendline breakouts, and triangle breakouts.

Horizontal Line Breakouts

Horizontal line breakouts occur when the price of a currency pair breaks through a horizontal level of support or resistance. Support is a price level at which buying pressure increases, preventing the price from falling further. Resistance, on the other hand, is a price level at which selling pressure increases, preventing the price from rising further.

Traders typically look for a significant breakout above a resistance level or below a support level as an indication of a potential trend reversal or continuation. This breakout can be confirmed by an increase in volume, which suggests strong market participation. By analyzing historical price data and identifying key horizontal levels, traders can anticipate potential breakout opportunities.

Trendline Breakouts

Trendline breakouts occur when the price of a currency pair breaks through a trendline that connects higher lows in an uptrend or lower highs in a downtrend. Uptrends represent a series of higher highs and higher lows, indicating bullish market sentiment. Downtrends, on the other hand, represent a series of lower highs and lower lows, indicating bearish market sentiment.

A breakout above a downtrend line or below an uptrend line can signal a potential trend reversal or continuation. Traders often look for confirmation of a trendline breakout through increased volume and price momentum. By drawing trendlines on a chart and monitoring the price action, traders can identify potential breakout opportunities.

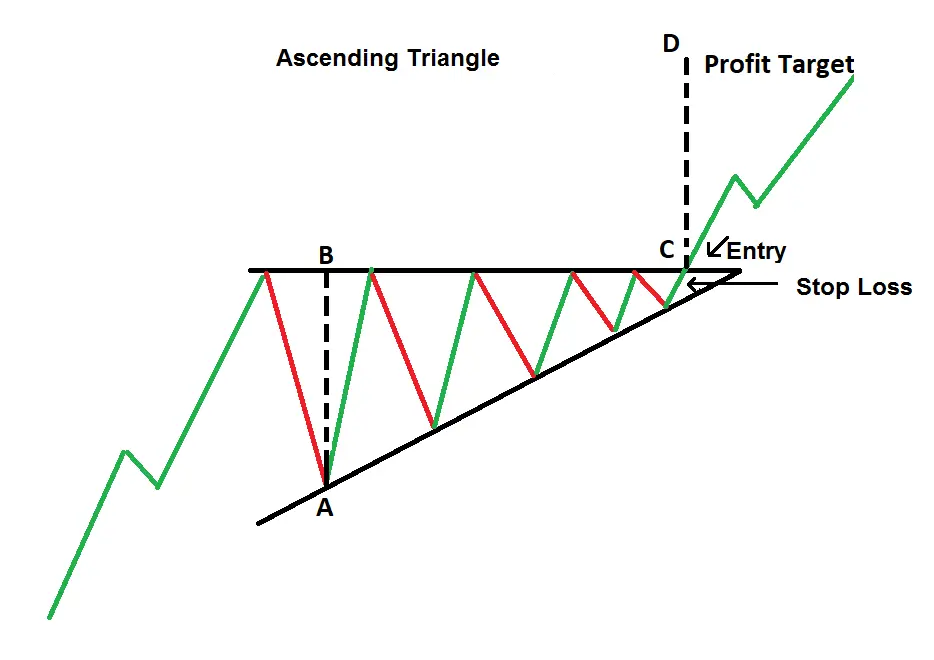

Triangle Breakouts

Triangle breakouts occur when the price of a currency pair breaks out of a triangle pattern. A triangle pattern is formed by connecting a series of higher lows and lower highs, creating a converging range. This pattern suggests a period of consolidation and indecision in the market.

A breakout from a triangle pattern can indicate a potential shift in price direction and the start of a new trend. Traders typically wait for the price to break above the upper trendline in a bullish triangle or below the lower trendline in a bearish triangle. Confirmation of the breakout through increased volume and price momentum can provide further validation for traders.

By understanding these breakout patterns, Forex traders can enhance their ability to identify potential trading opportunities. It is important to note that breakout trading carries its own risks, and traders should employ proper risk management strategies. For more information on risk management and other important concepts in Forex trading, explore our Forex Glossary.

Key Factors to Consider

When it comes to trading breakouts in Forex, there are several key factors that traders need to consider. These factors play a crucial role in determining the success of breakout trades. Let's explore three important factors: volume, volatility, and confirmation signals.

Volume

Volume refers to the number of shares or contracts traded within a specific period. In breakout trading, volume is a significant factor as it provides insight into the strength and validity of the breakout. High volume during a breakout suggests strong market participation and increases the likelihood of a sustained move.

Traders often look for volume confirmation when a breakout occurs. An increase in volume during the breakout indicates that there is substantial interest from traders and reinforces the potential of the breakout is genuine. On the other hand, a breakout accompanied by low volume might be considered weak and less reliable.

Volatility

Volatility, in the context of breakout trading, refers to the degree of price fluctuations in the market. Breakout traders thrive on volatility as it provides opportunities for significant price movements. Higher volatility can lead to more substantial breakouts and potential profit potential.

Traders generally look for periods of low volatility followed by a breakout, as it suggests a potential shift in market sentiment. Breakouts occurring during periods of high volatility may also present trading opportunities, but it's important to assess the risk and manage positions accordingly.

To gauge volatility, traders often use technical indicators such as average true range (ATR) or Bollinger Bands. These indicators help identify periods of high or low volatility, allowing traders to adjust their strategies accordingly.

Confirmation Signals

Confirmation signals are additional indicators or patterns that traders use to validate a breakout. These signals provide further evidence that the breakout is genuine and not a false alarm. Common confirmation signals include candlestick patterns, chart patterns, or the convergence of multiple technical indicators.

For example, a breakout accompanied by a bullish candlestick pattern, such as a bullish engulfing or hammer, may strengthen the conviction in the breakout. Similarly, if a breakout occurs at a key support or resistance level, it adds to the credibility of the breakout.

Traders should not solely rely on a single confirmation signal but rather look for multiple signals aligning to increase the probability of a successful breakout trade.

By considering these key factors – volume, volatility, and confirmation signals – traders can make more informed decisions when trading breakouts in Forex. It's important to analyze these factors in conjunction with other market variables, such as bid price, bear market, bull market, currency pair, commodities, contract for difference (CFD), and capital gain, to enhance trading strategies and maximize profit potential.

Strategies for Trading Breakouts

When it comes to trading breakouts in forex, having a well-defined strategy is essential. Here, we will explore three popular strategies that traders often employ to take advantage of breakout opportunities: the pullback entry strategy, the momentum entry strategy, and the range expansion entry strategy.

Pullback Entry Strategy

The pullback entry strategy is based on the concept of price retracements during a breakout. When a currency pair experiences a breakout, it is common for the price to temporarily pull back or retrace before continuing in the direction of the breakout. Traders utilizing the pullback entry strategy aim to enter the market during this retracement phase, capitalizing on a potential opportunity to buy at a lower price in an uptrend or sell at a higher price in a downtrend.

To implement this strategy, traders typically wait for the price to retrace to a key level of support or resistance. They then look for confirmation signals, such as candlestick patterns or indicators, that suggest the retracement is ending and the original breakout trend is resuming. Once the confirmation is received, traders can enter the market with a buy or sell order, depending on the direction of the breakout.

Momentum Entry Strategy

The momentum entry strategy focuses on entering the market once a breakout has gained significant momentum. Traders using this strategy believe that strong momentum indicates a higher probability of continued price movement in the breakout direction. They look for clear signs of strong buying or selling pressure, often accompanied by an increase in trading volume, to confirm the strength of the breakout.

To employ the momentum entry strategy, traders typically wait for the price to break through a significant level of support or resistance with conviction. They then enter the market in the direction of the breakout, aiming to capture the continued momentum. This strategy requires careful monitoring of price action and volume to identify optimal entry points and manage risk effectively.

Range Expansion Entry Strategy

The range expansion entry strategy is based on the idea that breakouts often occur after periods of consolidation or range-bound trading. Traders using this strategy look for currency pairs that have been trading within a relatively narrow range and anticipate a breakout that will lead to a significant price movement.

To apply the range expansion entry strategy, traders identify the boundaries of the range or consolidation pattern and wait for the price to break out decisively above or below these levels. They then enter the market in the direction of the breakout, expecting the price to move rapidly as the range is broken. This strategy requires careful analysis of price patterns and the ability to identify when the market is transitioning from a period of consolidation to a breakout phase.

Implementing a well-defined strategy is crucial when trading breakouts in forex. Traders should carefully consider their risk tolerance, market conditions, and the specific characteristics of the currency pair they are trading. By utilizing strategies such as the pullback entry strategy, the momentum entry strategy, or the range expansion entry strategy, traders can enhance their chances of capitalizing on breakout opportunities and potentially unlocking profit potential.

Managing Risk in Breakout Trading

While trading breakouts in Forex can be profitable, it's essential to manage risk effectively to protect your investments. Proper risk management involves setting stop loss levels, implementing proper position sizing, and using trailing stops.

Setting Stop Loss Levels

Setting stop-loss levels is a crucial aspect of risk management in breakout trading. A stop loss is a predetermined level at which a trade will automatically be closed to limit potential losses. By placing a stop-loss order, traders can define their acceptable level of risk and protect themselves from significant market fluctuations.

The placement of stop-loss levels in breakout trading is typically based on technical analysis and the specific breakout pattern being traded. Traders may choose to set their stop loss below the breakout level or at a support level for long trades, and above the breakout level or at a resistance level for short trades. This helps to minimize losses if the breakout fails to sustain momentum.

Implementing Proper Position Sizing

Implementing proper position sizing is another critical element of risk management in breakout trading. Position sizing refers to determining the appropriate amount of capital to allocate to a trade based on the risk tolerance and account size of the trader. This helps to ensure that no single trade poses a significant risk to the overall trading account.

One commonly used method for position sizing is the fixed percentage method. This involves risking a fixed percentage of the trading account on each trade, typically ranging from 1% to 3%. By using a fixed percentage, traders can adjust their position sizes based on the volatility and risk associated with each trade.

Using Trailing Stops

Trailing stops are an effective tool for managing risk and maximizing profits in breakout trading. A trailing stop is a stop loss order that automatically adjusts as the price moves in favor of the trade. It allows traders to lock in profits while giving the trade room to continue in the desired direction.

When using trailing stops in breakout trading, traders can set the stop loss level at a certain percentage or a fixed amount below the highest price reached after the breakout. This ensures that if the price reverses, the trade will be closed, securing profits along the way. Trailing stops help traders to capture as much profit as possible while still protecting against potential reversals.

By setting stop loss levels, implementing proper position sizing, and using trailing stops, traders can effectively manage risk in breakout trading. It's important to remember that risk management is a fundamental aspect of successful trading and should always be prioritized. For more information on Forex trading concepts, check out our Forex Glossary.

![What is Forex Trading? Complete Guide on Forex [2025 Edition] 10 What is Forex Trading? Complete Guide on Forex [2025 Edition]](https://fxparkey.com/wp-content/uploads/2024/01/Forex-Trading-3-300x150.webp)

![Bid Price in Forex Trading 📖 Forex Glossary [2025 Edition] 12 Bid Price](https://fxparkey.com/wp-content/uploads/2024/02/WHAT-IS-Bid-Price-300x150.webp)

![Contract for Difference (CFD) in Forex Trading 📖 Forex Glossary [2025 Edition] 13 Contract for Difference (CFD)](https://fxparkey.com/wp-content/uploads/2024/02/Contract-for-Difference-CFD-300x150.webp)