Are you looking for a reliable and transparent forex broker that serves both retail and institutional traders?

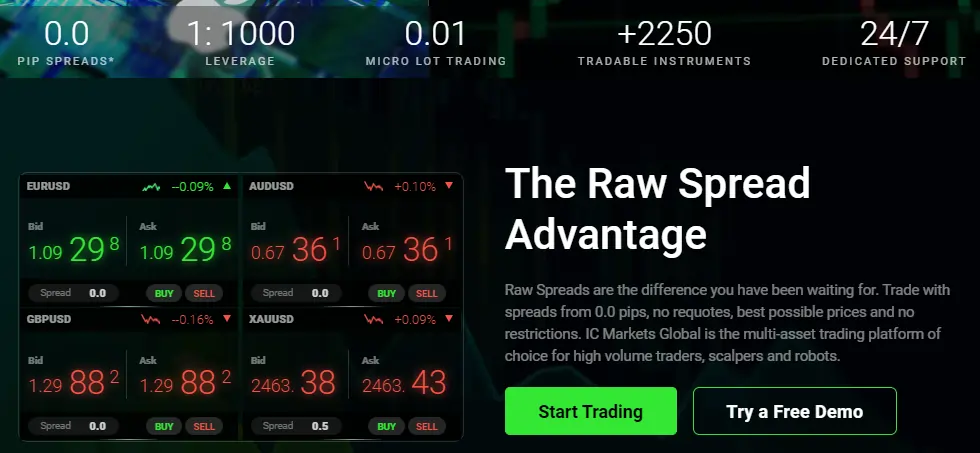

Consider IC Markets, a top CFD and forex trading platform that has been changing online trading since 2007. Known for its tight spreads, deep liquidity, and advanced technology, IC Market is a favorite among active day traders, scalpers, and algorithmic trading enthusiasts worldwide.

IC Markets has earned a strong reputation in the industry, handling an impressive US$1.64 trillion in trading volume as of April 2025 and serving over 200,000 active clients globally.

Their dedication to excellence is reflected in their stellar 4.8/5 rating on Trustpilot, showcasing their exceptional service and trading conditions.

Key Facts About IC Markets

Trust and Regulation Around IC Markets

Trust and regulation are paramount when entrusting your hard-earned money to a forex broker. IC Market understands this and has taken significant steps to ensure the safety and security of client funds while following strict regulatory requirements.

IC Markets operates under three entities, each regulated by a respected financial authority:

| Entity | Regulator |

|---|---|

| Raw Trading Ltd | Financial Services Authority (FSA) of Seychelles |

| International Capital Markets Pty Ltd | Australian Securities and Investments Commission (ASIC) |

| IC Markets (EU) Ltd | Cyprus Securities and Exchange Commission (CySEC) |

The broker's lengthy operating history of 16 years and a high level of transparency further support its credibility. Accounts held with the Raw Trading Ltd entity are insured for up to $1 million by Lloyds, providing an extra layer of protection for clients' investments.

IC Market complies with strict client fund segregation policies, ensuring that client money is held in separate accounts with top-tier banking institutions. These funds are never used for operational expenses or any other purpose, giving traders peace of mind knowing that their capital is secure.

The broker also employs strong anti-money laundering (AML) policies and procedures in accordance with the FSA Anti-Money Laundering and Counter-Terrorism Financial Act. This commitment to compliance and strong corporate governance sets IC Markets apart as a trusted and reliable partner for forex and CFD trading.

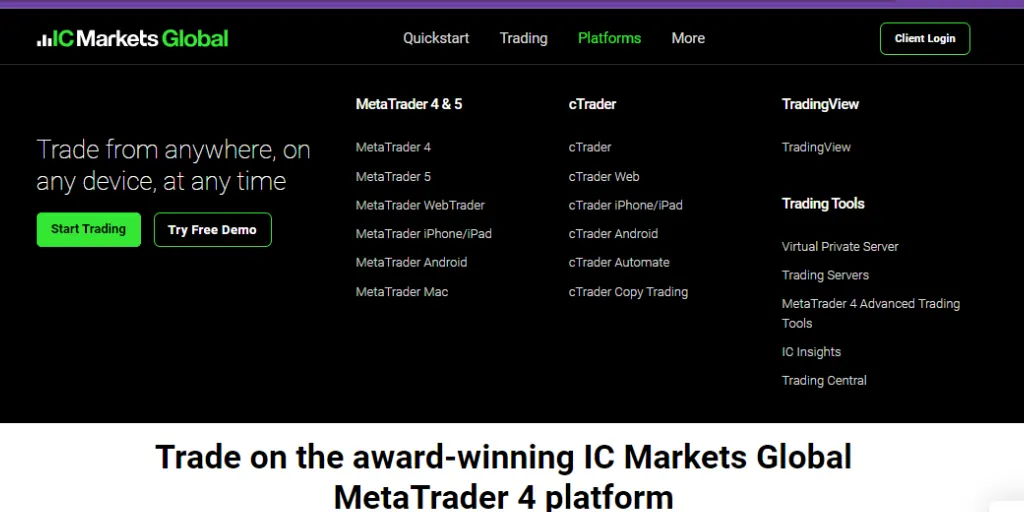

Trading Platforms Available on IC Markets

IC Markets offers a suite of advanced trading platforms to serve the diverse needs of traders worldwide. Whether you prefer the time-tested reliability of MetaTrader, the advanced features of cTrader, or the intuitive interface of TradingView, IC Market has you covered.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaTrader is the go-to platform for millions of traders, and for good reason. IC Markets' MT4 and MT5 platforms come packed with:

Plus, with IC Market's raw pricing, you can enjoy spreads from 0.0 pips* and lightning-fast execution speeds, thanks to the broker's low-latency Equinix NY4 server.

cTrader Platform

For traders seeking a more modern and feature-rich experience, IC Market's cTrader platform delivers:

cTrader's server is located in the Equinix LD5 data center in London, ensuring optimal execution for traders in and around Europe.

TradingView Integration

IC Markets has recently integrated with TradingView, giving traders access to:

With IC Markets ranking #2 on TradingView within its first month and displaying a 4.7-star rating, it's clear that traders appreciate the powerful combination of IC Market's competitive offering and TradingView's detailed toolset.

| Platform | Key Features |

|---|---|

| MT4/MT5 | Powerful charting, EAs, 0.0 pip spreads |

| cTrader | Intuitive UI, advanced order types, cAlgo |

| TradingView | 400+ indicators, social trading, seamless execution |

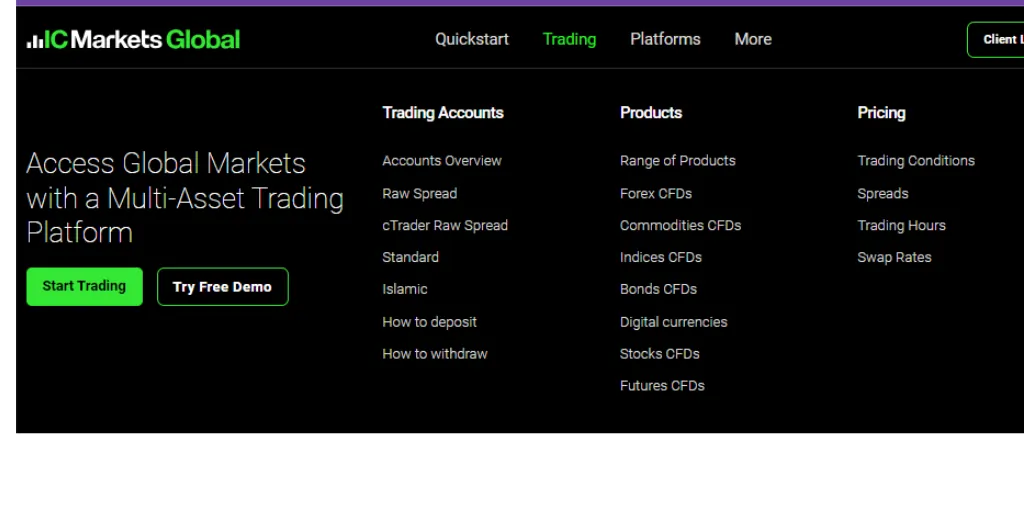

Trading Instruments and Markets

IC Markets provides traders access to an extensive range of instruments across multiple asset classes, including:

With competitive spreads, deep liquidity, and flexible leverage, IC Market enables traders to capitalize on opportunities in global markets.

Forex Trading

Indices, Commodities, and Futures

Traders can also diversify their portfolios with:

Stocks, Bonds, and Cryptocurrencies

For those interested in other asset classes, IC Markets provides:

With such a diverse range of instruments, IC Market empowers traders to seize opportunities in virtually every corner of the financial markets.

Trading Accounts and Conditions

IC Markets offers a range of account types designed to meet the unique needs of every trader, from beginners to seasoned pros. Whether you prefer the tried-and-true MetaTrader platform or the advanced cTrader, IC Market has an account that's right for you.

Account Types

| Account | Platform | Commission | Spreads from (pips) |

|---|---|---|---|

| Standard | MetaTrader 4/5 | $0 | 0.8 |

| Raw Spread | MetaTrader 4/5 | $3.5 per lot per side | 0.0 |

| cTrader Raw Spread | cTrader | $3.0 per USD 100k | 0.0 |

All account types feature a low minimum deposit of just $200, making it easy for anyone to start trading.

Leverage and Margin

IC Markets offers flexible leverage up to 1:500, allowing traders to maximize their potential returns. However, it's essential to remember that higher leverage also amplifies risk. Margin requirements vary depending on the instrument traded and market conditions.

For example, if you're trading EUR/USD with 1:100 leverage, you only need to deposit 1% of the total trade value as a margin. This means you can control a $100,000 position with just $1,000 in your account.

Execution and Spreads

IC Markets prides itself on lightning-fast execution, with an average speed of under 40ms. By aggregating prices from over 25 top-tier liquidity providers, IC Market ensures that you always get the best available price.

Spreads on major currency pairs like EUR/USD can go as low as 0.0 pips on the Raw Spread and cTrader Raw Spread accounts, with an average of just 0.1 pips. Even on the Standard account, spreads start at a competitive 0.8 pips.

Trading Fees and Costs | Transparent and Competitive

One of the key factors to consider when choosing a forex broker is the cost of trading. IC Markets offers transparent and competitive pricing across all account types.

As mentioned earlier, spreads vary depending on the account type and instrument traded. Here's a quick overview of the average spreads for some popular forex pairs:

| Currency Pair | Standard Account | Raw Spread Account |

|---|---|---|

| EUR/USD | 0.8 pips | 0.1 pips |

| GBP/USD | 1.0 pips | 0.3 pips |

| USD/JPY | 0.9 pips | 0.2 pips |

Keep in mind that spreads are variable and can widen during times of high volatility or low liquidity.

Commissions

IC Markets charges commissions on its Raw Spread and cTrader Raw Spread accounts. For the MetaTrader Raw Spread account, the commission is $3.5 per lot per side, which equates to $7 per round turn. On the cTrader Raw Spread account, the commission is $3.0 per USD 100,000 traded or $6 per round turn.

No commissions are charged on the Standard account, as the costs are built into the spread.

Overnight Financing (Swap RATES)

If you hold a position overnight, you may be subject to overnight financing charges, also known as swap rates. These rates are determined by the interest rate differential between the two currencies in a pair and whether you're long or short.

IC Market offers competitive swap rates, which can be viewed directly from the trading platform. It's worth noting that swap rates can be positive or negative, depending on the direction of your trade and the interest rates of the currencies involved.

Deposit and Withdrawal Fees

IC Market does not charge any fees for deposits or withdrawals. However, some payment methods may incur charges from the service provider. For example, credit card deposits may be subject to a small processing fee.

It's always a good idea to check with your payment provider to understand any potential fees before making a transaction.

By offering competitive spreads, transparent commissions, and no hidden fees, IC Markets ensures that you can focus on what matters most – your trading.

Mobile Trading Apps With IC Markets Global

In our busy lives, the ability to trade anywhere is key. IC Market understands this, which is why they offer a range of mobile trading apps that put the power of the markets right in the palm of your hand.

MetaTrader 4 and MetaTrader 5 Mobile Apps

IC Markets MetaTrader mobile apps, available for both Android and iOS devices, provide a seamless trading experience on the go. With these apps, you can:

| Feature | MT4 Mobile | MT5 Mobile |

|---|---|---|

| Real-time quotes | ✓ | ✓ |

| One-click trading | ✓ | ✓ |

| Interactive charts | ✓ | ✓ |

| Technical indicators | 30+ | 30+ |

| Customizable layout | ✓ | ✓ |

The MetaTrader mobile apps are accessible, feature-rich, and offer the same tight spreads and fast execution speeds that IC Markets is known for.

cTrader Mobile App

For traders who prefer the cTrader platform, IC Markets offers the cTrader mobile app. This app provides a premium mobile trading experience, allowing you to:

The cTrader mobile app is intuitive, and powerful, and offers a range of features that cater to both novice and experienced traders.

Key Benefits of IC Markets' Mobile Apps

With IC Market's mobile trading apps, you can seize opportunities and manage your positions wherever you are, ensuring that you never miss a beat in the fast-moving world of forex and CFD trading.

Pros and Cons of IC Markets

When considering a forex broker, it's essential to weigh up the pros and cons to determine if they're the right fit for your trading needs. Let's take a closer look at the advantages and drawbacks of trading with IC Markets.

Pros

Cons

Ultimately, whether the advantages outweigh the drawbacks will depend on your individual trading needs and preferences. However, for traders seeking a reliable, cost-effective, and feature-rich broker, IC Markets is certainly worth considering.

IC Markets Vs Other Brokers

When choosing a forex broker, it's essential to consider how they compare to other leading providers in the industry. Let's take a closer look at how IC Markets stacks up against some of its top competitors.

IC Markets vs. Key Competitors

| Broker | Minimum Deposit | Average EUR/USD Spread | Regulation |

| IC Markets | $200 | 0.1 pips | ASIC, CySEC, FSA |

| Pepperstone | $200 | 0.77 pips | FCA, ASIC, CySEC, DFSA, BaFin, CMA, SCB |

| FP Markets | $100 | 0.41 pips | ASIC, CySEC |

| XM | $5 | 1.6 pips | ASIC, CySEC, IFSC |

As we can see, IC Markets offers a competitive minimum deposit of $200, which is on par with Pepperstone but slightly higher than FP Markets and XM.

However, where IC Markets really shines is in its ultra-tight spreads, with an average EUR/USD spread of just 0.1 pips. This is significantly lower than its competitors, making IC Markets an attractive choice for cost-conscious traders.

In terms of regulation, IC Markets holds licenses from top-tier authorities such as ASIC and CySEC, as well as the FSA in Seychelles. While some of its competitors, like Pepperstone, claim a wider range of regulatory oversight, IC Markets' regulatory status is still solid and should provide peace of mind for most traders.

Unique Selling Points of IC Markets

So, what sets IC Markets apart from the crowd? Here are a few key advantages:

- Ultra-low spreads: As mentioned, IC Markets offers some of the tightest spreads in the industry, making it an excellent choice for traders looking to minimize their trading costs.

- Extensive range of trading instruments: With over 65 forex pairs, as well as CFDs on indices, commodities, stocks, futures, bonds, and cryptocurrencies, IC Markets provides a diverse selection of trading opportunities.

- Multiple trading platforms: IC Markets supports a variety of popular trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, catering to the preferences of different types of traders.

- Excellent customer support: The broker's knowledgeable and responsive customer support team is available 24/7 to assist with any questions or concerns.

While IC Markets may not have the same brand recognition as some of the larger, more established brokers, its competitive pricing, diverse product offering, and strong customer support make it a compelling choice for many traders.

Who Should Consider Trading with IC Markets?

IC Markets is particularly well-suited for the following types of traders:

- Algorithmic traders: With its fast execution speeds, low latency, and support for popular platforms like MetaTrader and cTrader, IC Markets is an excellent choice for those looking to run automated trading strategies.

- Cost-conscious traders: IC Markets' ultra-tight spreads and competitive commissions make it an attractive option for traders looking to minimize their trading costs

- Traders seeking a diverse range of instruments: With over 3,500 tradable instruments across multiple asset classes, IC Markets caters to traders with diverse interests and strategies.

- Those who value strong customer support: IC Markets' 24/7 customer support team is highly regarded for its responsiveness and expertise, making it a good fit for traders who prioritize reliable assistance.

Common Queries on IC Markets Global

What are the Account Types Available at IC Markets?

IC Markets offers three main account types: Standard, Raw Spread, and cTrader account.

What is the Minimum Deposit to Open an Account with IC Markets?

The minimum deposit to open an account with IC Markets is $200 for most account types.

What Trading Platforms do IC Markets offer?

IC Markets offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader trading platforms.

What is The Maximum Leverage offered by IC Markets?

IC Markets offers leverage up to 1:500 (for IC Markets Global) and up to 1:30 (for IC Markets AU).

How Fast is Ordered Execution with IC Markets?

IC Markets provides fast order execution with average speeds under 40ms.

What Markets Can You Trade with IC Markets?

IC Markets offers over 2250 tradable instruments including forex, commodities, stocks, indices, bonds, and cryptocurrencies.

Is IC Markets a Regulated Broker?

Yes, IC Markets is regulated by the Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and Seychelles Financial Services Authority (FSA).

Is IC Markets Right for You?

Throughout this review, we've taken an in-depth look at what IC Markets has to offer. From its competitive pricing and wide range of trading instruments to its easy-to-use platforms and excellent customer support, IC Markets has a lot to offer both novice and experienced traders alike.

While the broker may not have the most extensive research and educational resources compared to some of its competitors, it has made great progress in improving its offering in recent years. Additionally, while its regulatory oversight may not be as comprehensive as some other brokers, it still maintains licenses from respected authorities such as ASIC and CySEC.

Overall, IC Markets presents a solid choice for traders seeking a reliable, cost-effective, and feature-rich broker.

Ultimately, whether IC Markets is the right broker for you will depend on your individual trading needs and preferences. However, for those seeking a cost-effective, feature-rich, and reliable broker, IC Markets is worth considering.