Looking to maximize your forex trading profits in 2025? The secret might be hiding in your broker's spread fees.

Finding the best low spread forex brokers can significantly impact your bottom line, especially for day traders and scalpers where every pip counts.

With spreads starting as low as 0.0 pips plus minimal commissions, the right broker can substantially reduce your trading costs over time. This guide examines the top-rated low spread forex brokers, comparing their competitive pricing structures, minimum deposits, and trustworthiness based on real trader reviews.

Let's discover the brokers combining narrow spreads with robust trading tools to optimize your forex activities this year.

How Did We Choose The Best Low Spread Forex Brokers?

Selecting the best low spread forex brokers requires a careful, data-driven approach. We evaluated brokers based on their average and minimum spreads across major currency pairs, ensuring consistently low trading costs.

Our team also considered factors like trading platform reliability, regulatory compliance, execution speed, and transparency of fees. User reviews and real-world trading experiences played a key role in our analysis.

By focusing on brokers that offer competitive spreads without sacrificing trust or performance, we’ve curated a list that meets the needs of both beginner and professional forex traders seeking the lowest spread brokers in the industry.

Top of the Line Low Spread Forex Brokers

| Broker | Main Feature |

|---|---|

| IC Markets | World's biggest low spread forex brokers by volume, average EUR/USD spread of 0.1 pip. |

| Exness | Provides average GBP/USD spread of just 0.1 pip, regulated broker operating in over 130 countries. |

| Tickmill | Known for having tight spreads, with commissions from only $2 per round turn. |

| FP Markets | Super fast order execution and favorable trading conditions spreads as low as 0.1 pips. |

| Pepperstone | UK-regulated broker with spreads from 0.0 pips, no commissions charged. |

| IG | Industry pioneer offering competitive spreads from 0.6 pips, award-winning web trading platform. |

| CMC Markets | Next Generation platform with consistently low spread FOREX Brokers, no commissions charged. |

| Forex.com | Competitive spreads from 1.0 pip, diverse selection of currency pairs. |

| Capital.com | Beginner-friendly broker offering tight spreads from 0.6 pips, minimum deposit of just $20. |

| Global Prime | ECN spreads from 0 pips by connecting trades directly into tier 1 liquidity pools. |

| Fusion Markets | Raw ECN spreads from 0.0 pips, $0 minimum deposit. |

| Trade Nation | UK regulated broker with spreads from 0.0 pips, no commissions charged. |

| VT Markets | Fast deposits/withdrawals, competitive spreads, $1M client insurance. |

| MultiBank | Top-tier liquidity, commission-free accounts, $1M insurance, global presence. |

| Interactive Brokers | Trade 150+ markets, advanced tools, low fees, global access. |

1. IC Markets

As the world's largest low spread forex brokers by trading volume, IC Markets provides traders access to ultra-competitive pricing across over 75 currency pairs. With average spreads as low as 0.1 pip on the benchmark EUR/USD, IC Markets leverages its scale as a market leader to connect clients with deep liquidity and optimized trade execution.

Regulated across major jurisdictions like Australia and Seychelles, the broker offers account insurance up to $1 million to assure your funds are secure. From trading manually to employing automated strategies, IC Markets delivers the technology, features, and pricing to maximize your opportunities.

With fast account opening, dedicated account managers, and 24/7 multilingual support, IC Markets reduces friction to keep you focused on trading. As a trusted broker for over 15 years, IC Markets provides the ideal environment for forex traders of all experience levels.

Reasons to Choose IC Markets

| Feature | Details |

|---|---|

| Spreads | Average EUR/USD spread of just 0.1 pip, among the tightest globally. |

| Execution Speed | Fast order execution from Equinix NY4 data center location. |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and cTrader platforms offered. |

| Account Offerings | Multiple account types including commission-based “Raw Spread” accounts. |

| Regulations | Regulated across major jurisdictions like Australia and Seychelles. |

2. Exness

Established in 2008, Exness has earned a reputation as a trusted global forex and CFD broker known for competitive spreads starting from 0.1 pips. Catering to over 800,000 active traders worldwide, Exness provides access to 75+ currency pairs alongside commodities, indices, and crypto.

With regulation spanning Cyprus, the UK, Australia, and beyond, traders can feel secure depositing funds. Exness distinguishes itself by offering unique social trading features to copy expert strategies or share your own. For beginners, the broker provides extensive educational resources from video courses to analytics tools for honing your skills.

With multilingual 24/7 customer support, responsive trading platforms, and account offerings tailored to various trade styles, Exness aims to serve traders of all experience levels.

Reasons to Choose Exness

| Feature | Details |

|---|---|

| Spreads | Ultra-competitive spreads from 0 pips on major pairs. |

| Execution Speed | Super-fast order execution in under 25ms. |

| Trading Platforms | MT4, MT5, Exness Trader offered. |

| Account Offerings | Multiple account types for all trader types and strategies. |

| Regulations | Regulated across major jurisdictions like FCA, CySEC. |

3. Tickmill

Established in 2014, Tickmill has rapidly emerged as a competitive forex and CFD broker known for tight spreads and fast execution speeds. Regulated across major jurisdictions, Tickmill provides traders access to over 80 tradable instruments through its MT4 and MT5 platforms.

For algorithmic traders, Tickmill delivers order execution in just 0.30 seconds alongside dedicated VPS hosting services. With multiple account types tailored to different trade styles, Tickmill offers pricing from 0 pip spreads alongside commissions as low as $2 per lot.

Traders also benefit from risk management tools, integrated third-party plugins for analytics, and multilingual support. As an award-winning broker focused on trading technology, Tickmill aims to provide an optimal environment for forex and CFD traders of all experience levels.

Reasons to Choose Tickmill

| Feature | Details |

|---|---|

| Spreads | Tight spreads starting from 0.0 pips. |

| Execution Speed | Ultra-fast execution around 0.30 seconds. |

| Trading Platforms | MT4, MT5, and FIX API connectivity offered. |

| Account Offerings | Multiple account types for all trade styles. |

| Regulations | Regulated across major jurisdictions like FCA UK. |

4. FP Markets

Established in 2005, FP Markets is an Australian-based global forex and CFD broker known for fast execution speeds and tight spreads starting as low as 0.0 pips. Regulated by ASIC, FP Markets provides traders access to over 10,000 tradable instruments across shares, forex, indices, commodities, and cryptocurrencies, making it a good choice for diverse investment strategies.

Key features include deep liquidity from top-tier banks, dedicated account managers, and integrated third-party plugins on the MT4 and MT5 platforms for advanced analytics. While zero spread implies potentially lower costs, traders should be aware of forex trading risks and other associated fees. With multiple account offerings tailored to different trade styles alongside virtual private server hosting services, FP Markets aims to cater to traders who like various approaches to the forex currency market.

As a trusted broker with over 15 years of experience, FP Markets delivers optimal trading conditions and technology to maximize opportunities with super-fast order execution and favorable trading conditions.

Reasons to Choose FP Markets

| Feature | Details |

|---|---|

| Spreads | Spreads as low as 0.1 pips on Razor account. |

| Execution Speed | Super fast order execution around 30 milliseconds. |

| Trading Platforms | MT4, MT5, and cTrader platforms offered. |

| Account Offerings | Multiple account types including commission-based “Raw Spread” accounts. |

| Regulations | Regulated by ASIC in Australia and other tier-1 jurisdictions. |

5. Pepperstone

Established in 2010, Pepperstone has rapidly emerged as an award-winning global forex and CFD broker, often appearing on picks for the best low-spread lists, known for razor-sharp spreads from 0 pips, fast execution speeds, and an extensive product range across currencies, indices, commodities, shares, cryptocurrencies, and more. Pepperstone is one of the low-cost brokers stack, making it a good choice for traders.

Regulated across major jurisdictions, Pepperstone provides traders access to over 1200 instruments through its popular cTrader and MetaTrader 4/5 platforms optimized for desktop and mobile, with competitive spread pricing offered.

With multiple account types tailored to suit different trading styles and strategies, Pepperstone offers ECN-style pricing, deep liquidity from top-tier banks, risk management tools, integrated trading signals, a low minimum deposit, and dedicated 24/5 multilingual client support. As a trusted broker focused on trading technology, Pepperstone aims to provide an optimal environment for forex and CFD traders of all experience levels.

Reasons to Choose Pepperstone

| Features | Details |

|---|---|

| Spreads | Razor-sharp spreads from 0 pips. |

| Execution Speed | Less than 30ms execution speeds. |

| Trading Platforms | Award-winning MT4, MT5, cTrader, and TradingView platforms offered. |

| Account Offerings | Wide range of account types. |

| Regulations | Regulated in 7 jurisdictions globally including Australia and UK. |

6. IG

Established in 1974, IG is an award-winning global leader in online trading, offering clients access to over 17,000 tradable markets across shares, forex, indices, commodities, bonds, interest rates, options, and cryptocurrencies, solidifying its position as an excellent low-cost broker.

Regulated across major jurisdictions like the UK, EU, US, and Australia, IG provides advanced web and mobile trading platforms alongside powerful research tools, risk management features, and integrated trading signals, ensuring the broker is taking measures to protect its clients.

With over 300,000 active forex traders worldwide, IG has earned a reputation for trust and excellence – winning “Most Trusted Broker” for five consecutive years and ranking #1 for customer service. As an early industry pioneer, IG delivers an all-around fantastic trading experience, including access to zero spread trading accounts.

Reasons to Choose IG

| Feature | Details |

|---|---|

| Spreads | Competitive spreads starting from 0.6 pips on EUR/USD. |

| Execution Speed | Trades executed in less than 1 second, with an average execution speed of 0.017 seconds. |

| Trading Platforms | Access to a range of platforms including MetaTrader 4 and IG's proprietary web and mobile apps. |

| Account Offerings | Over 17,000 tradable markets including forex, indices, commodities, and more. |

| Regulations | Regulated by top-tier authorities like the FCA, ASIC, and CFTC. |

7. CMC Markets

Established in 1989, CMC Markets is an award-winning global provider of online trading across forex, indices, commodities, cryptocurrencies, and more. Regulated across major jurisdictions, CMC Markets delivers institutional-grade trading technology alongside powerful risk management tools, integrated market analysis, and dedicated 24/5 multilingual support.

With multiple account offerings tailored to suit different trading styles, CMC Markets provides access to over 10,000 financial instruments alongside competitive pricing. As an industry pioneer and trusted broker for over 30 years, CMC Markets aims to give clients the best opportunity to maximize their trading potential.

Reasons to Choose CMC Markets

| Feature | Details |

|---|---|

| Spreads | Competitive spreads with typical spreads of 0.61 pips on the EUR/USD. |

| Execution Speed | Lightning-fast execution in 0.0030 seconds. |

| Trading Platforms | Access to MetaTrader 4 and CMC's proprietary Next Generation platform. |

| Account Offerings | Over 10,000 tradable assets including forex, indices, commodities, and more. |

| Regulations | Regulated by top-tier authorities like the FCA, ASIC, and others. |

8. Forex.com

Established in 2001, Forex.com is an award-winning forex and CFD broker known for competitive pricing, advanced trading platforms, and extensive market access across over 80 currency pairs alongside global equities, indices, commodities, and more.

Regulated by top-tier authorities like the FCA, ASIC, and CFTC, Forex.com provides traders with a secure environment to analyze markets using integrated tools like Reuters news and Trading Central research.

With intuitive web and mobile apps tailored for any skill level, Forex.com offers an all-around fantastic trading experience. As an industry veteran serving clients worldwide, Forex.com has earned a reputation for excellence – empowering traders with technology, education, and support.

Reasons to Choose Forex.com

| Feature | Details |

|---|---|

| Spreads | Competitive spreads with an average of 1.4 pips on the EUR/USD for the Standard account. |

| Execution Speed | High-speed execution with a 99.57% execution rate of less than a second. |

| Trading Platforms | Access to MetaTrader 4 and Forex.com's proprietary platforms. |

| Account Offerings | Offers a variety of accounts including Standard, Commission, and Direct Market Access (DMA) accounts. |

| Regulations | Regulated across major jurisdictions like FCA, ASIC, CFTC. |

9. Capital.com

Established in 2016, Capital.com is an award-winning trading platform that makes global markets accessible to everyone. With intuitive apps, and over 3,000 markets across stocks, crypto, forex, and more, Capital.com aims to give traders the confidence to make informed decisions through integrated analysis tools, risk management features, and dedicated support.

Regulated across top-tier jurisdictions like the UK's FCA and Australia's ASIC, traders can feel secure depositing funds. Whether you’re new to trading or a seasoned pro, Capital.com provides an ideal environment to discover opportunities with virtual portfolios, copy trading capabilities, and in-depth educational resources alongside competitive pricing.

Reasons to Choose Capital.com

| Feature | Details |

|---|---|

| Spreads | Competitive spreads with floating spreads from 0.6 pips. |

| Execution Speed | High-speed execution suitable for high-frequency trading. |

| Trading Platforms | Access to TradingView and Capital.com's proprietary platform. |

| Account Offerings | Commission-free trading with a wide range of instruments. |

| Regulations | Regulated by top-tier authorities. |

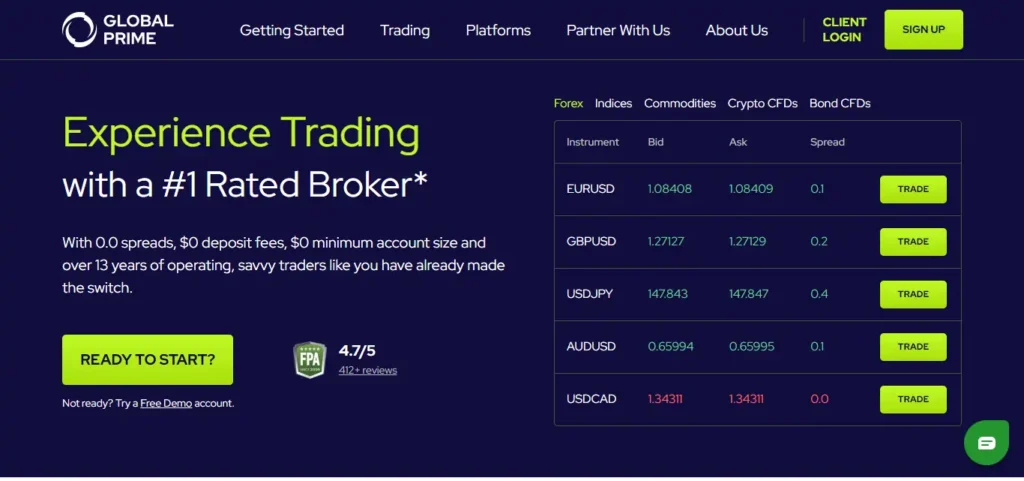

10. Global Prime

Established in 2010, Global Prime is an award-winning Australian forex and CFD broker known for competitive ECN pricing, fast execution speeds, and direct access to tier 1 liquidity providers. Regulated by ASIC and VFSC, Global Prime provides traders access to 150+ instruments across currencies, commodities, indices, and crypto.

For algorithmic traders, features like a Python API, VPS hosting, and colocation services aim to optimize performance. With a focus on transparency alongside powerful trading platforms, risk management tools, and multilingual 24/5 support, Global Prime creates a robust trading infrastructure for clients. As a trusted broker, Global Prime empowers traders to capitalize on market opportunities.

Reasons to Choose Global Prime

| Feature | Details |

|---|---|

| Spreads | Competitive ECN spreads from 0.1 pips. |

| Execution Speed | Fast execution speeds and direct access to tier 1 liquidity. |

| Trading Platforms | MT4, MT5, cTrader, and FIX API offered. |

| Account Offerings | Multiple account types for all trader requirements. |

| Regulations | Regulated by ASIC in Australia and VFSC. |

11. Fusion Markets

Established in 2010, Fusion Markets is an award-winning Australian forex and CFD broker known for providing traders access to institutional-grade liquidity. With raw ECN spreads from 0 pips and fast execution through top-tier banks, Fusion Markets offers pricing and technology tailored to both manual and high-frequency trading strategies.

Regulated by ASIC, client funds are held securely in segregated accounts at National Australia Bank. Alongside powerful trading platforms, integrated tools for market analysis, and multilingual support, Fusion Markets aims to give clients control, transparency, and flexibility – whether you are a novice trader or an experienced professional.

Reasons to Choose Fusion Markets

| Feature | Details |

|---|---|

| Spreads | Raw ECN spreads from 0.0 pips. |

| Execution Speed | Fast execution through top-tier banks. |

| Trading Platforms | MT4, MT5, and cTrader platforms offered. |

| Account Offerings | Multiple account types tailored to trade styles. |

| Regulations | Regulated by ASIC in Australia. |

12. Trade Nation

Established in 2019, Trade Nation is a fast-growing UK forex and CFD broker known for providing traders access to tight spreads from 0 pips, fast execution speeds, and direct access to top-tier liquidity providers. Regulated by the FCA, client funds are securely segregated at Barclays and Deutsche Bank.

Alongside powerful trading platforms optimized for any device, integrated market analysis tools, and multilingual 24/5 support, Trade Nation creates a robust trading infrastructure for clients. Whether you are new to trading or a seasoned professional, Trade Nation delivers transparency, flexibility, and control – empowering you to capitalize on opportunities across 50+ markets.

Reasons to Choose Trade Nation

| Feature | Details |

|---|---|

| Spreads | Tight spreads starting from 0.0 pips. |

| Execution Speed | Fast execution speeds and direct access to top-tier liquidity. |

| Trading Platforms | Intuitive proprietary and MT4 platforms offered. |

| Account Offerings | Multiple account types tailored to trader requirements. |

| Regulations | Regulated by the FCA in the UK. |

13. VT Markets

VT Markets offers an easy-to-use trading experience, perfect for people who want fast account setup and funding. It has offered many trading choices on popular platforms like MT4, MT5, and TradingView.

Spreads are usually good, and deposits are free, though there may be withdrawal fees. Regulators like ASIC oversee the broker, and client money is insured up to $1,000,000. Many customers praise the fast and helpful support, but some mention issues with trust. Flexible accounts and loyalty programs make it attractive to traders.

Reasons to Choose VT Markets

| Feature | Details |

|---|---|

| Spreads | Competitive, often below industry average. |

| Execution Speed | Fast execution, minimal slippage on major pairs. |

| Trading Platforms | MT4, MT5, TradingView, web and mobile apps. |

| Account Offerings | ECN, standard, demo, loyalty programs, diverse assets. |

| Regulations | Regulated by ASIC, moderate trust score, insured funds. |

14. MultiBank

MultiBank, founded in 2005, is one of the world’s largest brokers. It is regulated by 11 global authorities, including ASIC and CySEC. The broker offers more than 20,000 trading options, such as forex, indices, and cryptocurrencies. Spreads for some accounts start from 0.0 pips.

MultiBank’s trading platforms include MT4, MT5, and MultiBank-Plus. Both new and experienced traders get 24/7 support and educational help. Withdrawals are usually done within 24 hours, with no commissions. Some limits exist, such as no scalping and no micro accounts.

Reasons to Choose MultiBank

| Feature | Details |

|---|---|

| Spreads | From 0.0 pips on ECN, low standard spreads. |

| Execution Speed | Reliable, near-instant execution, institutional grade. |

| Trading Platforms | MT4, MT5, MultiBank-Plus, web, mobile compatible. |

| Account Offerings | Standard, Pro, ECN; 20,000+ instruments. |

| Regulations | Regulated by 11 authorities, top-tier licenses. |

15. Interactive Brokers

Interactive Brokers is known for its low fees and wide access to over 150 markets around the world. It is a good choice for experienced traders and institutional investors who want powerful trading tools and low-cost margin rates.

There is no minimum deposit, and trades of US stocks and ETFs have no commission. The trading platform offers many features, but beginners may need time to learn it. The company is regulated in the US, Europe, and Asia, and is recognized for strong customer support and safety.

Reasons to Choose Interactive Brokers

| Feature | Details |

|---|---|

| Spreads | Tight spreads; US stocks commission-free (Lite). |

| Execution Speed | Advanced smart routing, institutional-grade execution. |

| Trading Platforms | Trader Workstation, IBKR Mobile, IBKR Lite. |

| Account Offerings | Individual, joint, trusts, professional accounts. |

| Regulations | Top-tier global regulation; US, EU, Asia. |

Common Queries Related to Low Spread Forex Brokers

Why are Low Spreads Important in Forex Trading?

Low spreads reduce the cost of trading, increasing potential profits. They're especially beneficial for frequent traders and scalpers.

What is a Zero Spread Forex Account?

A zero spread forex account offers trades with no difference between the bid and ask price, often incorporating a commission.

DoLow Spread Forex Brokers Guarantee the Best Trading Experience?

Not necessarily. While low spread forex brokers reduce costs, other factors like platform usability, customer service, and regulation also matter.

Do Spreads change with Market Conditions?

Yes, spreads can fluctuate based on market conditions, trading account types, and currency pairs.

How can I choose the Best Low Spread Forex Brokers?

Consider factors like spreads, commissions, platform, customer service, and regulatory status when choosing a low spread forex brokers.

Wrapping Up on Low Spread Forex Brokers

Choosing a low spread forex brokers with competitive spreads and transparent pricing empowers you to maximize opportunities for trading currencies. Our rankings highlight top low spread forex brokers where active traders can access offers spreads as low as 0 pips alongside optimized trade execution.

While tempting deals exist, prioritizing stability and service ensures you have support managing volatility. Leading brokers highlighted also provide integrated tools for analysis alongside risk management features to inform decisions. As regulations differ globally, verifying oversight and security of funds with highly regulated brokers prevents avoidable risks too, as described in many popular forex guides.

We hope these recommendations give you confidence in finding an optimal forex partner aligned to your unique trading needs and style. Looking at the search results, interactive brokers stands out as a member of the National Stock Exchange and Bombay Stock Exchange, which could make it a reliable choice for forex traders in India. Stay tuned next year as we continue benchmarking brokers to keep you trading effectively.