I first heard about OFP Funding Review earlier this year while scrolling through a trading forum.

Someone mentioned them in a thread about prop firms that actually give traders a fair shot. What immediately caught my eye was their 100% profit share—no split, no hidden catches. On top of that, the idea of instant access without having to jump through endless evaluations sounded almost too good to be true.

Curiosity got the better of me, so I checked out their site. The process looked simple, and honestly, the thought of keeping all my profits was a huge draw. I’d been burned before by firms that take a big chunk or make you jump through hoops just to get started.

Seeing that OFP Funding skipped all that, I figured it was worth a shot.

Right before signing up, I noticed a promo code—FINAL15—for 15% off. That sealed the deal for me. Getting a discount on top of the already tempting offer made it feel like the right time to give them a try.

So, that’s how I ended up with OFP Funding. Let me break down what happened next and how the whole experience played out.

Save 15% on Any OFP Funding Plan

exclusive

Use code FINAL15 at checkout and enjoy 15% off your chosen OFP Funding plan today.

SAVE UP TO 15%

Get 20% Off Instantly Funded Accounts

exclusive

Apply code FAST20 to instantly funded accounts and receive an exclusive 20% discount on your purchase.

SAVE UP TO 20%

OFP Funding Review: Why OFP?

For anyone curious about what OFP Funding offers, here’s a quick rundown of their main features. This table breaks down the essential information you'll want to know before getting started.

| Feature | Details |

|---|---|

| Headquarters | United Kingdom |

| Year Established | 2022 |

| Trading Platforms | Other, MetaTrader 5 |

| Minimum Evaluation Fee | $35 |

| Profit Share | 100% |

| Daily Loss Limit | 2% to 5% |

| Maximum Trailing Drawdown | 10% |

| Funded Account Options | 7 |

| Minimum Funded Account | $5,000 |

| Maximum Funded Account | $300,000 |

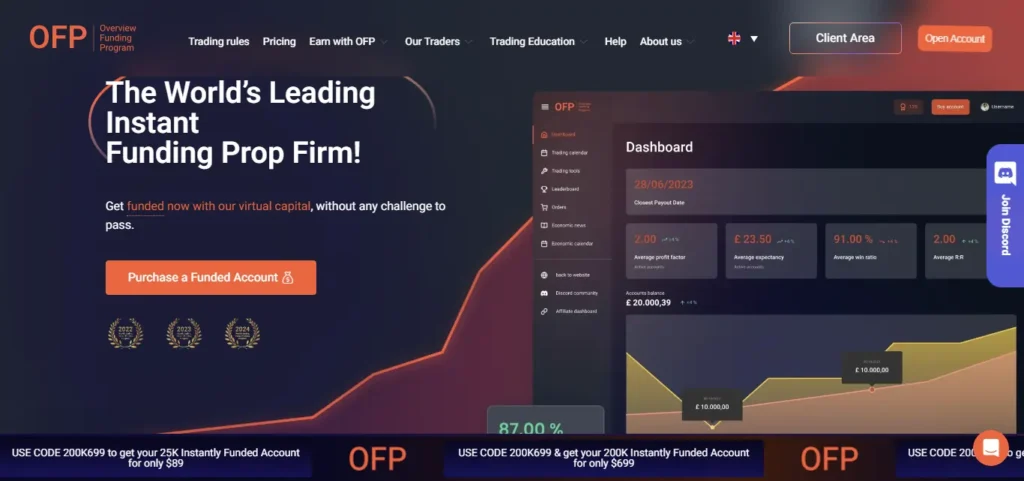

What is OFP Funding? The Orange Line to Fast-Track Trading

OFP Funding is a prop trading firm that’s made a name for itself by keeping things refreshingly straightforward and trader-friendly. Based in the UK and launched in 2022, OFP has already paid out over $18 million to its traders, with an impressive 34% of users qualifying for payouts—a stat that stands out in the prop firm world.

One of the first things you’ll notice about OFP is their commitment to speed and fairness. Their spreads start from 0.0 pips, which means you’re not losing out on tight trades due to hidden costs. Even more impressive, the average payout time is just 7 hours—so you’re not left waiting days (or weeks) to see your profits hit your account.

OFP Funding draws a bright orange line between itself and the usual prop firm experience. Here’s what sets them apart:

OFP Funding’s approach is all about giving traders a fair shot and keeping the process as clear as that signature orange line. If you’re looking for a prop firm that values your time and rewards your skills without unnecessary barriers, OFP is definitely worth a closer look.

How I Saved 15% on My Purchase? Code | FINAL15

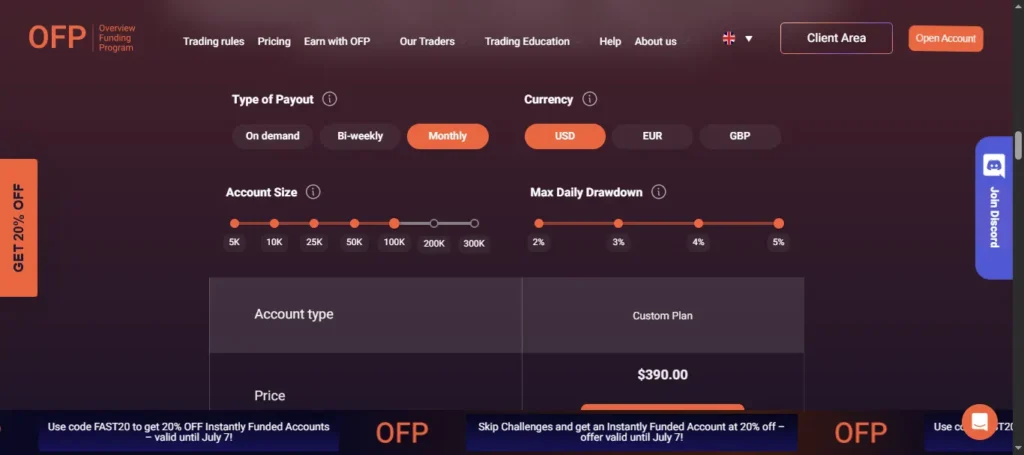

When I decided to get started, I went for the Custom Plan with a $100,000 account. The one-time fee was $390, which seemed fair for direct access to that level of capital.

Before finalizing, I remembered the promo code I'd seen floating around. I entered FINAL15 at checkout, and it instantly knocked 15% off the price.

That brought the cost down to $331.50, making an already good offer feel even better. It was the perfect start to my journey with them—saving a little extra cash made the decision feel right.

Here are the key features that came with my plan:

OFP Funding Payouts: Fast, Flexible, and Truly Trader-Friendly

One of the biggest perks I’ve found with OFP Funding is how straightforward and fair their payout system is. Here’s what stands out from my experience:

100% Profit Split Example

OFP’s Premium 100% profit split is a real game-changer. For example, if you earn €20,000 on a €100,000 account, you keep the entire €20,000. There’s no split with the firm, so every bit of your trading success goes straight to you.

Lifelong Accounts and No Renewal Fees

Another thing I really appreciate is that there are no renewal fees. Once you’re funded, your account is yours for life—unless you break the rules, which is pretty rare if you’re careful. This is something you don’t see often with other prop firms, and it adds a lot of value for traders who want stability and long-term potential.

OFP Funding’s payout structure is all about giving traders freedom, speed, and a fair shot at keeping what they earn. It’s a breath of fresh air compared to the usual hurdles found elsewhere.

My Path with OFP

Getting started with OFP Funding was refreshingly simple, and honestly, a bit exciting.

Here’s how my journey unfolded:

Trading with OFP has been a mix of excitement and responsibility. The instant access and fast payouts are a huge plus, but staying cautious and following the rules is just as important. That balance is what makes the experience both rewarding and sustainable.

A Look at OFP's Platforms and Spreads

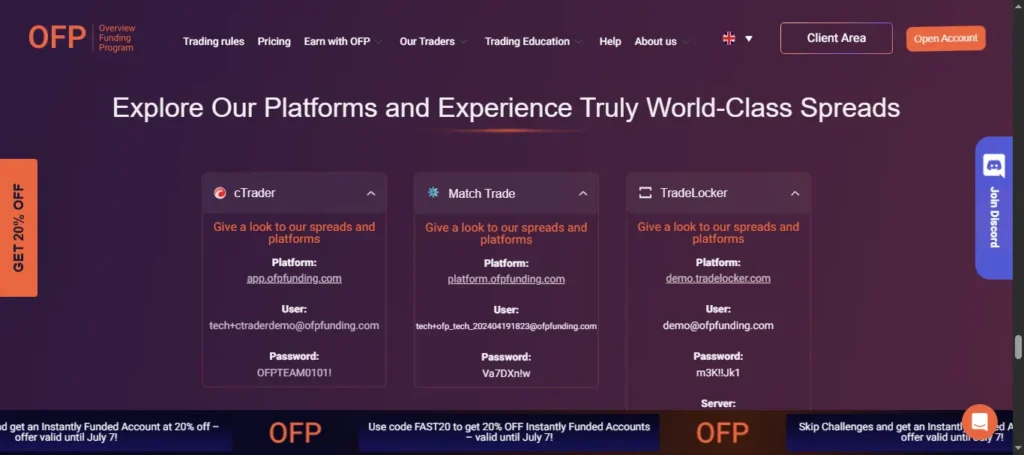

When it comes to the actual trading environment, OFP Funding gives you a few solid choices, including cTrader, Match Trade, and TradeLocker. I found the platform I used was straightforward to set up and get used to, which let me focus on my strategy instead of figuring out complicated software.

The execution quality was clean and fast, with no noticeable lag when placing trades. But what really stood out to me were the spreads. OFP advertises spreads starting from 0.0 pips, and they weren't kidding.

For my style of trading, which often involves quick entries and exits, these tight spreads are a huge plus. It makes scalping and day trading much more viable because you aren't fighting a wide spread on every position.

Overall, the combination of a user-friendly platform and highly competitive spreads made for a really positive trading experience.

Quick Answers for Curious Traders Regarding OFP Funding

Is OFP Funding Legit and Safe to use in 2025?

Yes, OFP Funding is a registered UK-based prop firm with a strong payout record and transparent rules.

What’s the Biggest Challenge Traders face with OFP?

Staying within the daily loss and inconsistency score limits can be tricky, especially for aggressive trading styles.

How quickly can I Withdraw Profits?

You can request a payout after your first trade, and withdrawals are typically processed within 24 hours.

What makes OFP different from other instant Funding Firms?

OFP offers instant funding, no evaluation phase, 100% profit share, and no profit targets—plus fast, transparent payouts.

Is there a Monthly Fee or Renewal Required?

No, there are no monthly or renewal fees. Once funded, your account is yours for life unless you break the rules.

My Honest Take on OFP Funding

Looking back on my time with OFP Funding, I can honestly say the experience was refreshingly straightforward. The instant funding and no evaluation challenges took away so much of the stress I’d felt with other firms. Being able to keep 100% of my profits was a huge motivator, and the fact that payouts were processed quickly made the whole process feel rewarding and efficient.

The transparent pricing and clear rules gave me confidence that I knew exactly what I was signing up for. I never felt like there were hidden fees or surprise requirements waiting around the corner.

That said, I do want to highlight the importance of understanding the inconsistency score and daily loss limits. These rules are there for a reason, and it’s easy to slip up if you’re not paying attention—so take the time to read through them before you start trading.

If you’re looking for a prop firm that values your time and effort, OFP Funding is definitely worth a try. My personal tip: use code FINAL15 at checkout to save 15% on your plan—it made a good deal even better for me. Just remember, as long as you trade realistically and stick to the rules, OFP can be a solid choice for your trading journey.