Choosing the right trading platform is one of the most important decisions a forex trader can make. The platform you use shapes your trading experience, impacts your efficiency, and can even influence your profitability.

Two names that frequently come up in the forex trading world are DxTrade and MetaTrader (MT4/MT5). Both platforms have their own strengths, unique features, and loyal user bases.

In this article, we’ll take a deep dive into DxTrade vs MetaTrader, comparing them across all the parameters that matter to forex traders.

From a beginner looking for your first platform to an experienced trader considering a switch, this guide will help you make an informed decision.

DxTrade vs MetaTrader

What is DxTrade?

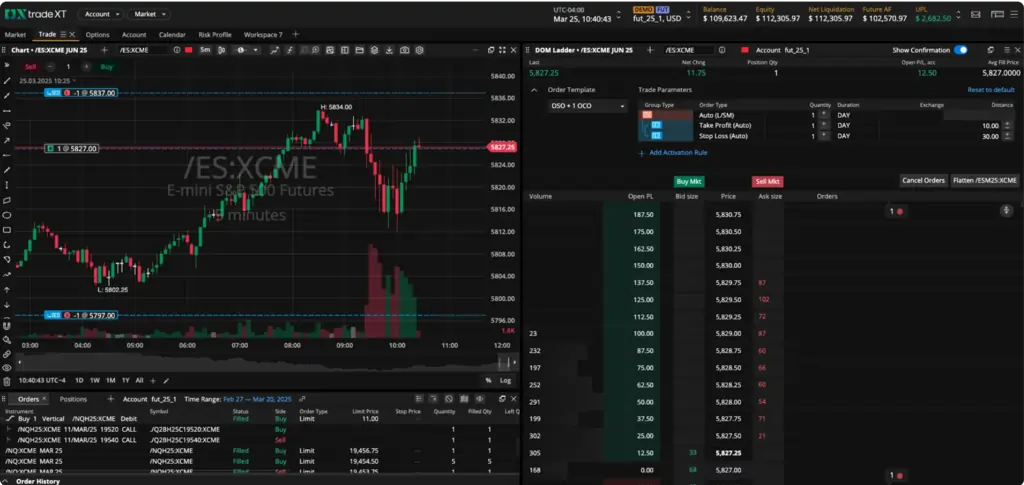

DxTrade is a modern, cloud-based trading platform designed for forex, CFD, and multi-asset trading. Developed by Devexperts, it’s tailored for both brokers and traders who want a customizable, intuitive, and accessible trading environment. DxTrade is especially popular among prop trading firms and brokers looking for a white-label solution with advanced risk management and performance analytics.

DXTrade Key Highlights

What is MetaTrader?

MetaTrader, available in two main versions (MT4 and MT5), is the industry standard for forex trading platforms. MT4 is renowned for its reliability and simplicity, while MT5 offers more advanced features and multi-asset support. MetaTrader is known for its vast ecosystem, automation capabilities, and near-universal broker compatibility.

MetaTrader Key Highlights

DxTrade vs MetaTrader: Comparison Table

| Parameter | DxTrade | MetaTrader (MT4/MT5) |

|---|---|---|

| User Interface | Modern, customizable, widget-based | Classic, detailed, less modern. |

| Charting Tools | 80+ indicators, advanced drawing, multi-view | 30+ (MT4), 80+ (MT5) indicators, multi-timeframes. |

| Order Types | Standard, efficient execution, risk tools | Multiple order types, advanced execution. |

| Automation | Limited EAs, basic automation | Extensive EA library, advanced automation. |

| Risk Management | Built-in, real-time exposure, dashboards | Basic (stop-loss, margin), add-ons needed. |

| Community & Support | Smaller, growing | Massive, global, active forums. |

| Device Compatibility | Cloud-based, web/mobile, no install needed | Desktop, web, mobile (MT4/MT5). |

| Broker Compatibility | Growing, especially with prop firms | Nearly universal among forex brokers. |

| Customization | Highly customizable layouts | Custom indicators, scripts, less UI flexibility. |

Detailed Comparison

1. User Interface & Experience

DxTrade:

DxTrade’s interface is modern, clean, and highly customizable. Traders can drag and drop widgets, create personalized layouts, and set up multiple watchlists.

The platform is designed to be intuitive, but some users mention a learning curve due to the depth of customization available. One-click trading and pre-configured stop loss/take profit settings make trade placement fast and convenient.

MetaTrader:

MetaTrader’s interface is more traditional. MT4 is familiar to most forex traders, but it can feel dated. MT5 offers a more polished look and additional features, but still lacks the modern feel of DxTrade.

The interface is functional and efficient, but not as visually appealing or customizable. However, many traders appreciate the no-nonsense, information-dense layout.

User Feedback:

DxTrade users praise the platform’s speed, browser-based access, and risk management features, but some find the interface complex at first.

MetaTrader users value its reliability and familiarity, though some wish for a more modern look and easier navigation, especially for beginners.

2. Charting & Analysis Tools

DxTrade:

DxTrade’s charting is a standout feature, offering flexibility and depth for technical analysis. The integration with TradingView is a major plus for traders who rely on advanced charting.

MetaTrader:

MetaTrader’s charting is robust, especially in MT5, and supports a wide range of custom indicators and scripts. The ability to backtest strategies and analyze historical data is a major advantage for systematic traders.

User Feedback:

DxTrade users highlight the advanced charting and ease of technical analysis. MetaTrader users appreciate the flexibility, but some find the mobile charting less intuitive.

3. Order Execution & Types

DxTrade:

DxTrade streamlines order placement, allowing traders to set risk parameters before executing trades. The platform is optimized for fast execution and offers real-time monitoring of orders and positions.

MetaTrader:

MetaTrader is known for its reliable and fast order execution. The platform’s flexibility in managing orders is a key reason for its popularity among active traders.

User Feedback:

DxTrade users like the one-click trading and pre-set risk controls. MetaTrader users value the ability to manage multiple accounts and the range of order types.

4. Automation & Algorithmic Trading

DxTrade:

The platform has a modern and easy-to-use design that works well for both beginners and experienced traders. It lets users set up some basic automatic trading, but there aren’t as many ready-made tools as on bigger platforms.

People can create their own trading tools, but the smaller community means there is less support and fewer shared resources. Because of this, the platform is better for traders who like to make their own decisions or use some automation, rather than relying on fully automatic trading.

DxTrade is not primarily designed for algorithmic trading, though it offers some automation capabilities. The platform is best suited for discretionary traders who want advanced analytics and risk tools.

MetaTrader:

MetaTrader is a popular trading platform known for its easy-to-use design. It helps traders test and improve their strategies before using them with real money. MetaTrader supports two main versions, MT4 and MT5, which let users create their own trading tools. The platform also offers many ready-made tools and indicators. This makes it easier for traders to manage risks and take part in trading challenges. Overall, MetaTrader is a helpful tool for anyone interested in trading.

MetaTrader’s automation capabilities are unmatched. Traders can automate virtually any strategy, backtest it, and deploy it across multiple accounts. The MQL marketplace offers a vast selection of ready-made EAs and indicators.

User Feedback:

DxTrade users note the limited automation but appreciate the focus on manual trading. MetaTrader users love the flexibility and power of EAs, though beginners may find the learning curve steep.

5. Risk Management Tools

DxTrade:

DxTrade excels in risk management, offering tools that help traders monitor and control their exposure in real time. The platform is designed to help traders stick to their risk parameters and analyze their performance.

MetaTrader:

MetaTrader provides essential risk management features, but advanced tools often require third-party plugins or custom scripts. The platform’s flexibility allows traders to implement their own risk controls.

User Feedback:

DxTrade users appreciate the built-in risk tools and analytics. MetaTrader users rely on stop loss and position sizing, but some wish for more integrated risk dashboards.

6. Community & Ecosystem

DxTrade:

DxTrade’s ecosystem is still developing, but it’s gaining traction, especially among prop trading firms and brokers looking for a modern solution.

MetaTrader:

MetaTrader’s community is one of its biggest strengths. Traders can find support, share strategies, and access a wealth of third-party tools.

User Feedback:

DxTrade users mention the smaller community but note that support is responsive. MetaTrader users benefit from the vast ecosystem and peer support.

7. Device & Broker Compatibility

DxTrade:

DxTrade’s cloud-based approach means traders can access their accounts from anywhere, with a consistent experience across devices.

MetaTrader:

MetaTrader’s compatibility is unmatched, making it the default choice for many traders who want flexibility and broker choice.

DxTrade users love the browser-based access and mobile apps.

MetaTrader users appreciate the multi-device support, though some find the mobile app less feature-rich.

User Feedback:

DxTrade users love the browser-based access and mobile apps. MetaTrader users appreciate the multi-device support, though some find the mobile app less feature-rich.

DxTrade Pros and Cons

Pros

Cons

MetaTrader (MT4/MT5) Pros and Cons

Pros

Cons

Which Trading Platform Should You Choose?

Choose DxTrade if:

You want a trading platform that is easy to use and works on any device, with no need to install anything. It should have tools to help you manage risk and track your trading results, so you can stay in control.

You also like having a workspace you can change to fit your needs and strong charting features, especially with TradingView. Whether you trade with a broker or take part in trading contests, these features help you trade better and reach your goals.

Choose MetaTrader if:

If you want a trading platform that is modern and easy to use, look for one that offers helpful tools and supports different trading styles. You will get access to a large community, many extra features, and plenty of learning materials to help you improve.

The platform should work with many brokers and let you choose how you want to trade. If you don’t mind using a more classic design and installing software, this option gives you the best of both worlds.

Answering Common Queries You Might Have

What are the main differences between DxTrade and MetaTrader?

DxTrade offers a modern, cloud-based, highly customizable interface, while MetaTrader is known for its reliability, automation features, and massive broker compatibility.

Which Platform is better for Algorithmic Trading and Automation?

MetaTrader excels in automation, offering thousands of Expert Advisors and advanced scripting, whereas DxTrade provides only basic automation and a smaller EA library.

How do Charting and Analysis Tools compare between DxTrade and MetaTrader?

DxTrade features advanced charting with TradingView integration and 80+ indicators. MetaTrader MT5 matches this in indicators and supports custom scripts for deeper analysis.

What Risk Management Features are available on each Patform?

DxTrade has built-in dashboards, real-time exposure monitoring, and analytics. MetaTrader offers basic risk tools, with advanced options available through third-party add-ons.

Who should choose DxTrade, and who should choose MetaTrader?

Choose DxTrade for a modern, cloud-based experience and advanced risk analytics. Opt for MetaTrader if you need automation, a large community, and maximum broker compatibility.

End Note

Both DxTrade and MetaTrader are powerful platforms, but they cater to different types of forex traders.

Ultimately, the best platform for you depends on your trading style, need for automation, and preference for interface and risk management tools. If possible, try both platforms with demo accounts to see which aligns best with your trading goals.

Happy Trading!