Are you on the hunt for a user-friendly platform that can handle the often frantic pace of day trading?

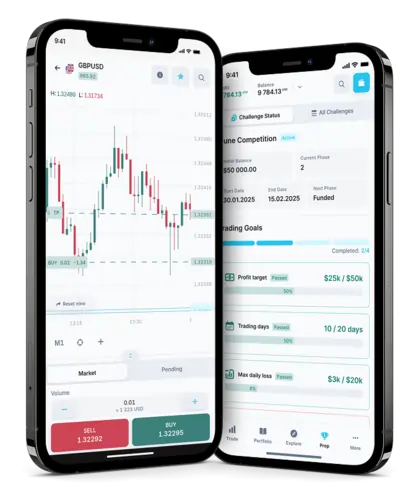

The match trader platform could be exactly what you need. It offers a seamless blend of speed and customization designed for traders who want reliable execution and detailed insight as they manage fast-moving positions.

In this guide, you’ll discover how to navigate its powerful interface, tweak the layout to your liking, and make the most of the many built-in features that can lead to a more efficient trading routine.

Understand Match Trader Features Basics

Before diving into specific features, it helps to understand the overall framework of this platform. Picture it like an all-inclusive workspace for day traders, neatly wrapping top-notch analytics, versatile charts, and trade execution tools into a single environment. You can open a position directly from a chart, view your order history instantly, and even follow economic news feeds inside the same dashboard.

The fundamentals revolve around these core pillars:

Because everything is located within a single system, you reduce the need to jump back and forth among different software tools. That simplicity can boost your focus. And when you’re focusing more on analyzing price trends or spotting emerging market opportunities, you stand a better chance of finding a solid edge.

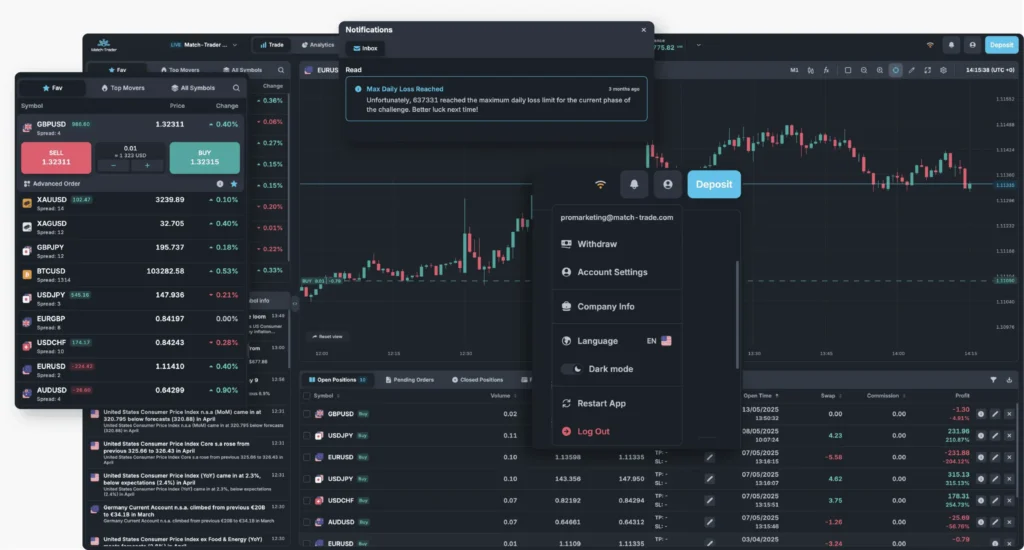

One highlight is how user-friendly the navigation feels. The layout is designed for clarity. Key tabs for charts, orders, and account management typically appear in a top or side panel, with easily recognizable icons. You can glance at your watchlist, open trades, or news feed all in a matter of clicks. This design also translates well to different screen sizes, so if you prefer trading on a laptop or large monitor, you’ll find you can adapt the main window in just seconds.

Even if you’re new to direct-access trading, the platform’s learning curve is surprisingly gentle. You can treat each tab like a step on your journey. First, identify the asset you want to trade, then load its chart. Next, mark any key support or resistance zones. Finally, execute your plan with the order buttons placed conveniently near the chart. It’s all about reducing friction and helping you concentrate on the crucial task: placing timely, informed trades.

Examine the Core Interface

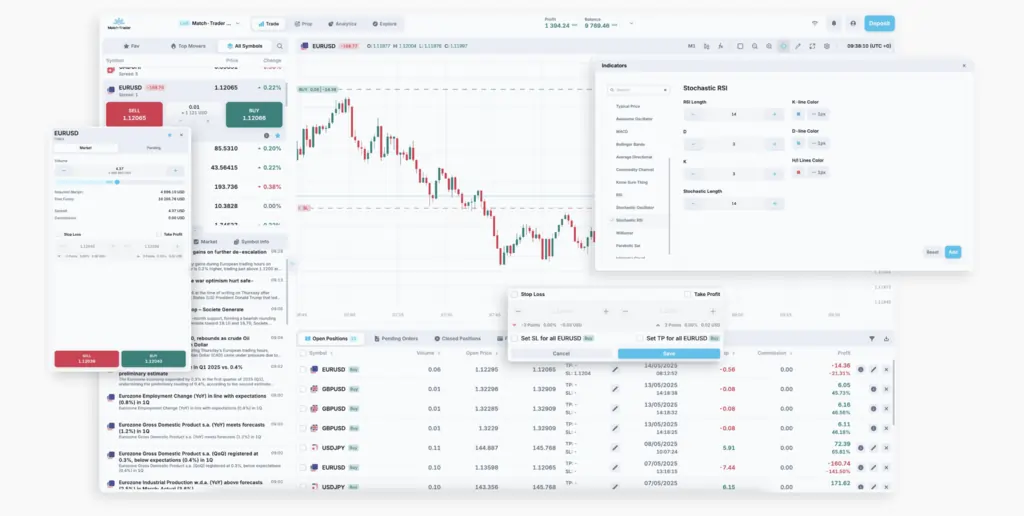

When you first open the main dashboard, you’ll see several panels that highlight what’s happening in the market and in your account. Think of this space as your command center, ready to supply the details you need to act quickly.

Key Interface Sections

- Displays the symbols you follow most often.

- Lets you sort by price, percentage change, or daily volume.

- Handy for picking the day’s top movers in one place.

- Provides a close-up look at your chosen symbol.

- Supports different time frames (like 1-minute or 15-minute intervals), which is incredibly helpful for day traders who need quick snapshots.

- Allows you to overlay indicators such as moving averages or Bollinger Bands for deeper analysis.

- Usually located to the side or below the chart.

- Includes drop-down menus for order type, quantity, and price.

- A color-coded buy/sell button so you can avoid confusion when you’re about to hit “buy” or “sell.”

- Reveals your current balance, available margin, and the amount of capital you have at risk.

- Offers a snapshot of open positions and any pending orders.

Each module has a straightforward look, so you spend less time searching for features and more time calling the shots on trades. For instance, if you’re watching four different currency pairs, you can arrange four smaller charts side by side, each with its respective watchlist and order module. It’s like customizing a cockpit that handles multiple instruments at once.

Navigation Tips

By taking some time to explore how each part of the interface works, you’ll reduce the chance of fumbling around during peak market hours. Day trading is all about timing, so comfortable navigation can be the difference between a successful scalp and a missed opportunity.

Customize your Workspace

Personalizing the layout is at the heart of getting the most out of the match trader platform. Nobody else trades exactly the way you do, so your workspace should reflect your preferences and highlight the tools you use most.

Layout personalization

Imagine you’re someone who follows 5-minute charts to catch momentum plays, but you also watch 1-hour charts to identify larger trends. In that scenario, two or three chart panels might be essential. If you specialize in currency trading, you could keep a watchlist for your favorite major pairs on the left side, while the main chart window and order entry module take center stage. Meanwhile, if you like to keep an eye on your active positions at all times, you might park the account summary panel at the bottom.

By default, the platform offers a few pre-configured workspace templates. These can act as a launchpad. Tweak them until you’re comfortable. Play around for a bit, add new widgets, remove those you rarely touch, and resize your chart windows to match your screen resolution.

Color Themes and Visual Cues

Visual clarity goes a long way toward preventing confusion. You can typically set chart backgrounds to darker tones if you trade at night or prefer to reduce screen glare. You might also color-code moving averages, so a short-term average (like the 9-day) is one color, and a long-term average (like the 50-day) is another. The same goes for volume bars: if red and green bars are more intuitive for you, stick with that. Or if you prefer a more neutral look, shift them to different shades of gray.

Under the preferences or settings menu, look for:

Minimizing Distractions

A cluttered screen can cause you to miss trade signals. To keep a clean look:

Ultimately, the best workspace is one that feels natural to your workflow. You want to glance at your screen and instantly know your profitability, how many trades are live, and whether your chosen setup is forming. Tweaking these settings might take a bit of initial effort, but it pays off in fewer mistakes and smoother trades over the long term.

Leverage Order Types

Order types are a key part of any trading platform, and the match trader platform handles them with a streamlined approach. Using the right order at the right time can help you control slippage, manage your maximum risk, and ensure you enter or exit precisely where you intend to.

Common Order Categories

To make it easier to see how each one fits your trading style, here’s a quick table outlining the popular types:

| Order type | Description | Best for |

|---|---|---|

| Market order | Executes immediately at the best available price. | Quick entries or exits |

| Limit order | Sets a target price. The trade only triggers if the market reaches that price or better. | Getting your desired price |

| Stop order | Activates once the market moves beyond a specific price level, then fills at the next available | Momentum-based entries or stop-losses |

| Stop-limit | Combines stop and limit logic, triggering at a stop price but capping the fill with a limit. | Reducing slippage on breakouts |

When placing orders, you’ll typically use a simple drop-down menu to choose from market, limit, or stop orders, then specify your entry or exit triggers. If you like to scalp, you might rely heavily on market orders for immediate fills. But if you’re a bit more patient and prefer precise entries, limit orders may be your go-to.

Partial Fills and Advanced Settings

The platform usually provides options for partial fills when there’s not enough volume to fill an entire order at once. You can also enable settings like “Good-till-Canceled” (GTC) or “Day Only.” That control is important if you don’t want your orders hanging around in the market for longer than needed.

Many traders also explore bracket orders, which allow you to set both a profit target and a stop-loss the moment you open a position. The advantage is automation. Once the initial trade executes, your exit points are already in place, so you don’t have to watch every tick. This is especially valuable for those times when you can’t stay glued to your screen.

Order Placement Workflow

Here’s a quick routine many day traders follow:

One small mistake in order type selection can lead to unintended consequences, like a fill at a terrible price or an unplanned hold if you forget to set a stop-loss. By carefully choosing the order that matches your plan, you reduce the risk of those surprises.

Explore Real-Time Charts

Charts serve as your window into how the market is moving. A quality charting system can help you spot trends, confirm signals, and figure out which price levels might be critical. The match trader platform stands out for offering real-time updates, so you’re never left trading on stale data.

Chart types and time frames

If you’re a day trader, one-minute or five-minute charts are often a staple. They give you a quick read on price action. But you can also expand to 15-minute or hourly views to see the bigger picture. When the platform offers you multiple choices (line, bar, candlestick, Heiken Ashi, etc.), experiment to see which one visualizes the market best for you. Many traders prefer candlesticks for clarity on open, close, high, and low prices.

Technical indicators

If you like to use technical analysis:

Most indicators have adjustable parameters—for instance, choosing a 9-period or 14-period RSI. It’s usually best to test a range of settings until you find a sweet spot that complements your trading strategy.

Drawing tools

Sometimes you need to mark up a chart to keep track of important price levels or potential patterns:

You can save these drawings on your chart, so each time you reopen the symbol, you’ll see the same markers. That continuity makes it easy to follow up on trades you considered the day before.

Multiple charts display

One of the biggest advantages of this platform is the ability to view several charts simultaneously:

In these side-by-side views, each chart can carry its own set of indicators. You could, for example, have a “momentum chart” loaded with MACD and RSI next to a separate “volume chart” focusing on how much trading activity is taking place in real-time. When you can see everything in one glance, you slash the risk of missing important signals.

Try automated trading features

If you’ve ever wished you could set up your strategy once and let the platform do the heavy lifting, automated trading might be your next step. This area is especially helpful for day traders who rely on repetitive rules-based tactics.

Algorithmic trading tools

In many modern platforms, you can code, or at least visually program, your trading logic. Depending on your comfort level:

The match trader platform often includes debugging or backtesting tools, so you can see how your logic would have performed on past market data. This is critical, because you don’t want to run a live algo based on untested assumptions.

Using Signals and Alerts

Even if you’re not entirely comfortable with fully automated trades, you can still harness partial automation:

This halfway approach helps you catch setups without jumping all-in on a self-running system. You still have the final say on whether to hit the buy or sell button.

Avoiding automation pitfalls

Automation is powerful, but it can also lead to issues, especially if you’re not monitoring your trades:

With a cautious approach and regular monitoring, automated features can streamline and speed up your trading decisions. If you harness them well, you might find that some of the stress disappears, leaving you free to focus on refining your strategy.

Manage risk effectively

No matter how you slice it, risk management is a huge deal for day traders. The match trader platform comes equipped with several tools to help you stay within your comfort zone and avoid letting a single trade torpedo your account balance.

Setting stop-losses

When opening a position, you can attach a stop-loss that automatically closes your trade if the price crosses a threshold. This is essential for capping potential losses:

Stopping out of a trade can sting, but it’s usually better than letting the market run away in the wrong direction.

Position sizing

A quick rule of thumb says you shouldn’t risk more than 1–2% of your total account on any single trade. In practice, you figure out how many shares or contracts correspond to that risk limit, factoring in the distance between your entry and your intended stop. The platform’s order ticket often shows how much margin you’re about to use, which helps you stay in tune with your risk profile.

Margin calls and leverage

If you’re using leverage, keep an eye on your margin level. If your account dips below a certain threshold, your broker can issue a margin call and automatically shut down some or all of your positions.

Most of the time, the platform’s account summary window displays:

Watch these figures. A sudden market movement can drain your account’s equity quickly if you’re overexposed.

Emotional discipline

You can have the best platform in the world, but if you can’t stick to your rules, you risk making impulsive trades. Every day trader faces emotional battles. Here’s how you can lean on the platform to help:

The objective is to stay consistent and prevent catastrophic mistakes. As you refine those habits, you’ll find yourself making more rational decisions that align with your overall plan.

Access market research

Executing trades quickly is important, but so is staying updated on broader market drivers. Even if you’re mostly a technical trader, unexpected events can rock the market. That’s where integrated research features come into play.

News feeds within the platform

You’ll often see a small window or sidebar that streams real-time news relevant to the symbols you trade. It might include economic releases, such as job reports or interest rate announcements, plus corporate earnings for specific stocks. Use these feeds to spot potential volatility catalysts. When crucial news hits, you can decide in seconds whether to trade that breakout or stand aside.

Fundamental data access

If you ever want to shift your focus from purely technical signals, the platform often provides basic fundamentals for stocks or other securities:

While day traders may not spend hours poring over these figures, they can still provide context. For instance, if a stock is heavily shorted, a positive earnings surprise might fuel a short squeeze, and that’s something you want to know early.

Economic calendar

In addition to breaking news, an economic calendar helps you plan your trades around scheduled events:

If your main markets are currencies, these events can drastically affect volatility. Knowing the release times and expected data points can make a big impact on how you place trades or position your stops.

Incorporating research into strategies

Sometimes, the best trading approach is blending technical and fundamental insights. For example:

This synergy can give you more conviction in your entry and exit decisions. The match trader platform’s integrated research tools mean you don’t need to open another browser tab or jump between multiple software packages, saving you a fair bit of hassle.

Final tips and next steps

Mastering the day trading game isn’t just about spotting the next trade. It’s about creating an environment where each click, chart view, and risk parameter aligns with your goals. The match trader platform puts a wealth of capabilities at your fingertips, from interface customization to robust order types, live charts, automation, and risk controls.

Keep these ideas in mind as you move forward:

Finally, remember that no platform can guarantee you’ll make winning trades every time. However, by smoothly integrating order execution, cutting-edge charting, useful research tools, and risk management features, this software can certainly narrow the gap between you and your best possible trading results. As you gain more familiarity, you’ll likely find ways to optimize your setup further and maybe even discover new strategies you hadn’t considered before.

Go ahead and start experimenting. Explore different time frames, try out the advanced order functions, and see how automation might help you save time. It’s all about taking that next step in your trading journey. If you stay open, remain disciplined, and capitalize on what the match trader platform brings to the table, you’ll put yourself in a position to trade smarter and more confidently every day.