Are you a day trader hunting for a new edge in your trading routine?

Chances are you’ve run into competing theories on market structure. Two of the most talked-about frameworks are (Smart Money Concepts) SMC vs Elliott Wave, each promising to help you catch better entries and exits.

In this comparison, you’ll discover what these approaches entail, their unique benefits, and how to decide if either is the right fit for your day trading style.

By the end, you’ll have a clearer map for choosing the framework that aligns with your goals, risk tolerance, and personal preferences.

Recognize the Basics: SMC vs Elliott Wave

Before you dive deeper, it helps to clarify why both Smart Money Concepts and Elliott Wave attract so much attention among day traders like you.

Even though these frameworks have different roots (SMC focuses extensively on what large institutional players might do, while Elliott Wave draws on wave-like patterns in market psychology), each can guide your daily decisions.

Think of them as two distinct roadmaps: both get you from point A to point B, but they use different landmarks and traffic signals. Understanding these landmarks is the first step in deciding whether you’ll enjoy the journey.

Explore Smart Money Concepts

Smart Money Concepts is built around the idea that major financial institutions and savvy market participants move the market more than retail traders. This approach tries to capture “big money” patterns so you can swim in the same direction as institutional capital.

Key SMC principles

Pros of Using SMC

Possible challenges

What is Elliott Wave Theory?

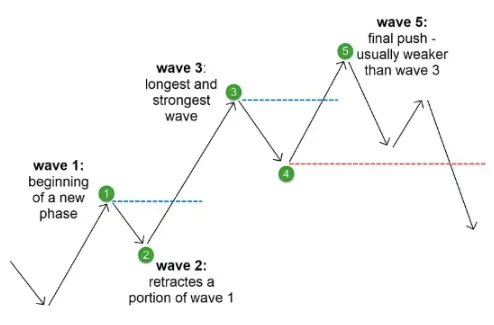

Elliott Wave theory goes back to observations by Ralph Nelson Elliott in the 1930s. This approach sees the market as a series of repeating wave patterns driven by collective human psychology. By identifying these waves, you aim to predict where price might head next.

Main Elliott Wave structure

Pros of Using Elliott Wave

Possible Challenges

Compare Key Differences

To see how SMC and Elliott Wave stack up side-by-side, check out the table below. It breaks down each framework according to some important factors you might weigh before making your choice.

| Factor | Smart Money Concepts (SMC) | Elliott Wave Theory |

|---|---|---|

| Core Principle | Tracks institutional moves based on liquidity and order blocks | Charts swings in five-wave impulse phases and three-wave corrections |

| Origin | Modern approach (roots in supply-demand analysis) | Developed in 1930s by Ralph Nelson Elliott |

| Market Focus | Institutional behavior, liquidity pools, break of structure | Crowd psychology, wave patterns, and fractal-like progression |

| Complexity | Moderate, with specialized terminology | High, especially in labeling waves and sub-waves |

| Data/History | Less historical data for back-testing | Long-standing theory with decades of application |

| Scalability | Shines on lower time frames for day traders | Usable on many timeframes, with wave fractals guiding multi-timeframe analysis |

| Strength in Day Trading | Pinpoint entry on liquidity grabs, order block retests | Potential to forecast next wave phase if you get the wave count right |

| Common Pitfalls | Overestimating institutional footprints, ignoring contradictory signals | Mislabeling wave counts, forcing patterns where they may not exist |

| Typical Users | Traders who want to align with “smart money” flows | Traders who favor chart pattern analysis and psychological cycles |

Pick the Right Framework

Now that you’ve seen each approach in detail, which should you pick? The answer hinges on how you interpret price data, how comfortable you are with chart analysis, and how much time you want to dedicate to understanding complex patterns.

Questions for Self-Assessment

These questions guide you in sensibly choosing between SMC vs Elliott Wave, or even combining key elements from both. In fast-paced markets, some traders adopt simplified versions of each. For instance, you might watch for a break of structure (SMC) but also confirm that price is due for an impulse wave (Elliott Wave).

Avoid Common Pitfalls

Traders sometimes fall into traps when learning either of these frameworks. Be on the lookout for these issues, and you’ll save yourself some headaches.

Mistakes with SMC

Mistakes with Elliott Wave

Make your Final Decision

If you still feel torn, keep these suggestions in mind:

- Start with a demo account.

Test either approach without risking real money. Take screenshots of your trades and label what you see. - Use a checklist.

Whether you pick SMC or Elliott Wave, write down the conditions that must be met before you enter a position. It might look like:- For SMC: Identify an order block, see a break of structure, wait for retest.

- For Elliott Wave: Identify a completed five-wave impulse, then confirm the corrective phase.

- Combine with risk management.

No matter how brilliant your analysis, day trading success boils down to consistent risk control. Keep your stop losses tight, and don’t over-leverage. - Stay flexible.

Markets evolve, and sometimes your chosen framework doesn’t produce a trade signal on a given day. Avoid forcing trades, and consider stepping back if neither SMC nor Elliott Wave lines up clearly.

Common Queries Relevant to SMC and Elliot Waves

What is the main difference between SMC and Elliott Wave Theory?

Elliott Wave is predictive, focusing on wave patterns and market cycles; SMC is reactive, tracking real-time institutional price action and liquidity zones.

Which theory is easier for beginners to learn?

SMC has a lower learning curve and simpler concepts like order blocks, while Elliott Wave requires complex wave counting and Fibonacci knowledge.

In what market conditions does Elliott Wave perform best?

Elliott Wave excels in trending markets, identifying impulsive and corrective wave patterns to forecast long-term trend direction.

When is SMC most effective?

SMC thrives in volatile and range-bound markets by focusing on liquidity grabs, order blocks, and break of structure signals.

How does Elliott Wave Theory explain market movement?

Markets move in 5-wave impulsive trends followed by 3-wave corrective phases, reflecting crowd psychology and fractal patterns.

Sum Up your Next Move

Smart Money Concepts zero in on institutional footprints and liquidity squeezes, while Elliott Wave theory revolves around repeating wave patterns shaped by collective psychology. Both can be powerful, but each demands dedicated study to master its nuances.

If you relish using supply-demand zones and riding big-money moves, you may find SMC more appealing. If you love discovering hidden patterns in charts and relying on human behavior cycles, opt for Elliott Wave. You might even decide to blend aspects of both for a more holistic perspective.

Try mapping out a couple of trades using each framework side by side. This practice quickly reveals which approach fits your personality and which yields more consistent results in your specific market. Whichever path you choose, keep practicing, stay patient, and refine your skills with discipline. A strategy tailored to your own style often leads to the best results over the long haul.