Forget the plastic in your wallet. The best Apple Pay crypto cards of 2025 are redefining what it means to carry cash.

As we step into 2025, the fusion of cryptocurrency and traditional payment methods continues to revamp how we transact.

Apple Pay, with its 744 million active users worldwide, has become a game-changer in this space. Crypto cards that seamlessly integrate with Apple Pay are now at the forefront, offering users the best of both worlds – the security of blockchain and the convenience of contactless payments.

These cards allow you to spend your digital assets at over 100 million merchants globally, bridging the gap between crypto investments and everyday purchases. With the crypto market running red hot and Bitcoin recently surpassing $100,000, the timing couldn't be better to explore the top Apple Pay-compatible crypto cards.

Let's a have a quick look over the top of the line Apple pay based crypto cards worth considering!

Get Started with the Best Apple Pay Based Crypto Cards

So, you’ve decided to join the cool kids and start using a Apple Pay Based Crypto Cards? Good choice.

Here’s how to get rolling with your new shiny payment toy – step by step:

1. Pick Your Perfect Crypto Card

First up, choose a card provider that fits your needs. Big names like UPay, Crypto.com, or Bista are solid options. Make sure they support Apple Pay integration so you can tap and pay with ease. Pro tip: Check the perks like cashback, low fees, or crypto rewards – not all cards are created equal.

2. Sign Up and Prove You’re You

Once you’ve chosen your provider, create an account. You’ll need to complete the good ol’ KYC (Know Your Customer) verification process. Yep, they’ll ask for your ID – nothing scary, just a quick identity check to keep things secure.

3. Load Up Your Crypto Wallet

Now it’s time to top up your wallet. Transfer some of your favourite cryptocurrencies – Bitcoin, Ethereum, or whatever you’re stacking – into the wallet. Don’t forget to make sure there’s enough for your planned spends and any little conversion fees that might pop up.

4. Apply for a Card That Works for You

Head to the card application section in your provider’s app or website. You’ll need to choose between a physical card (great for in-store shopping) or a virtual card (perfect for online transactions). Got your pick? Submit your application, pay any required fees, and you’re on your way. Virtual cards are usually instant, while physical cards will pop through your letterbox in a few days.

5. Activate and Link to Apple Pay

Once your card’s approved, activate it. For virtual cards, it’s often just a few taps in the app. For physical ones, you might need to scan the card or follow instructions from the provider. Next, open Apple Wallet on your iPhone, tap the “+” button, and add your new crypto card. Boom, you’re ready for action.

6. Tap, Pay, and Flex

Now comes the fun part – spending your crypto! Just hold your iPhone or Apple Watch near the payment terminal, confirm with Face ID, Touch ID, or your passcode, and you’re done. Whether you’re buying a coffee or splurging on a fancy dinner, your Apple crypto card has got you covered.

Top of the Line Apple Pay Based Crypto Cards

| Card Name | Key Features | Apple Pay |

|---|---|---|

| Coinbase Card | 4% crypto rewards, no fees | ✅ |

Crypto.com Visa | Up to 8% cashback, tiered perks | ✅ |

UPay Card | 168+ countries, instant conversion | ✅ |

KuCard | Multi-currency, real-time tracking | ✅ |

Bybit Card | 10% cashback, no annual fees | ✅ |

Nexo Card | Spend crypto, no selling required | ✅ |

Wirex Card | 1.5% Bitcoin rewards, no FX fees | ✅ |

Bista Card | 20+ cryptos, enhanced security | ✅ |

CoinJar Card | Free card, real-time conversions | ✅ |

1. Coinbase Card

The Coinbase Visa card is like the Swiss Army knife of crypto cards. It supports over 250 cryptocurrencies, which is perfect if your portfolio looks like a bag of Skittles. With no annual fees and smooth Apple Pay integration, this card makes spending your digital assets as easy as pie.

Plus, you can earn up to 4% back in crypto rewards on purchases – that’s like getting free money in Bitcoin or Ethereum! It auto-magically converts your crypto to fiat at checkout and works at over 40 million merchants worldwide. No credit checks, no staking, just swipe and go!

Coinbase Card Benefits

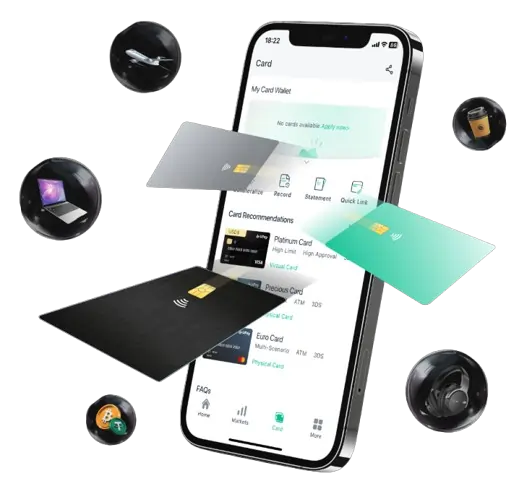

2. Crypto.com Visa Card

This one’s for the big spenders and CRO fans. The Crypto.com Visa card has a tiered system, so the more CRO tokens you stake, the bigger the perks. Cashback rewards? Up to 8%! Fancy airport lounges? Yep, if you’re rolling with the higher tiers.

It supports multiple cryptocurrencies, integrates seamlessly with Apple Pay, and has no monthly or annual fees. If you're buying groceries or booking first-class flights, this card has your back – and your balance could stretch up to $1,000,000 if you hit top tier.

Crypto.com Visa Card Benefits

3. UPay Card

The UPay card is like a world-traveling crypto sidekick. Available in over 168 countries, this card is all about flexibility.

You can choose between virtual or physical versions, load up with major cryptocurrencies, and enjoy instant crypto-to-fiat conversions. It even has crypto-collateralized options for extra versatility.

Security? Top-notch, with 256-bit SSL encryption. If you’re grabbing a pint or shopping online, UPay’s got you covered. Oh, and Apple Pay integration? That’s the cherry on top.

UPay Card Benefits

4. KuCard

KuCard by KuCoin is perfect for anyone who loves multi-currency options and high security.

This card supports a variety of cryptocurrencies and provides real-time conversions so you’re always getting the best rates.

Apple Pay integration means you can keep things simple and secure with biometric authentication. Plus, you can track your spending instantly – no need to wonder where your Bitcoin just went. If you want a card that’s all about ease, security, and global acceptance, KuCard’s ready to roll.

KuCard Benefits

5. Bybit Card

Bybit’s crypto card is a straight shooter – no staking, no annual fees, no hidden nonsense. You get up to 10% cashback on purchases, free ATM withdrawals (up to certain limits), and support for eight major cryptocurrencies. Apple Pay? Of course, it’s got that.

Bonus points for the Auto-Savings feature that lets you earn interest on your crypto while you spend it. This card is built for the spender who wants convenience, perks, and zero hassle.

Bybit Card Benefits

6. Nexo Card

The Nexo Card is like having your cake and eating it too. It lets you spend your crypto without actually selling it, thanks to its credit line feature. This dual debit-and-credit card has zero annual fees and offers up to 2% back in crypto rewards on every purchase.

Fancy a free cash withdrawal? You can do that too, up to monthly limits. Perfect for European users, it also supports multiple currencies. With the Nexo Card, you can keep your crypto while still living your best life.

Nexo Card Benefits

7. Wirex Card

Wirex keeps things simple and super useful, especially for globetrotters. It supports both crypto and fiat currencies, so you’re covered wherever you go.

The card’s unique Cryptoback™ rewards program gives you up to 1.5% back in Bitcoin on all purchases. Real-time exchange rates, global Mastercard acceptance, and instant currency conversion make this a solid pick for frequent travellers and everyday spenders alike.

Wirex Card Benefits

8. Bista Card

If you want a card that balances ease of use with solid rewards, Bista’s got your back. It supports over 20 cryptocurrencies and has Apple Pay built-in for that tap-and-go convenience.

Competitive exchange rates mean you’re not losing out when converting crypto to fiat, and its enhanced security features give you peace of mind. If you’re shopping online or paying in-store, this card works worldwide.

Bista Card Benefits

9. CoinJar Card

CoinJar makes crypto spending as straightforward as it gets. It offers a free physical card (yep, no issuance fees) and lets you spend your crypto directly with real-time conversions.

No annual fees, competitive reward rates, and instant notifications keep everything simple and transparent. If you’re just getting started with crypto cards or want something reliable, the CoinJar Card is a no-brainer.

CoinJar Card Benefits

Common Queries Related to Apple Pay Based Crypto Cards

Which Crypto Cards Support Apple Pay?

Coinbase Card, Crypto.com Visa, UPay Card, KuCard, Bybit Card, Nexo Card, Wirex Card, Bista Card, and CoinJar Card support Apple Pay.

What is a key Feature of the Coinbase Card?

The Coinbase Card offers up to 4% crypto rewards on purchases.

How does the Crypto.com Visa Card Reward Users?

Users can earn up to 8% cashback based on CRO token staking levels.

What makes the UPay Card Unique for Travelers?

The UPay Card is available in over 168 countries with instant conversion features.

What Security Feature does KuCard Provide?

KuCard includes biometric authentication for enhanced transaction security.

What Cashback Percentage does the Bybit Card Offer?

The Bybit Card provides up to 10% cashback on purchases.

How does the Nexo Card allow Spending Without Selling Crypto?

The Nexo Card features a credit line that lets users spend without liquidating assets.

What Reward does the Wirex Card Offer on Purchases?

Wirex offers up to 1.5% back in Bitcoin through its Cryptoback™ rewards program.

What is a Notable Benefit of the Bista Card?

The Bista Card supports over 20 cryptocurrencies and has easy Apple Pay integration.

What is a key Advantage of the CoinJar Card?

The CoinJar Card has no issuance fees and allows real-time cryptocurrency spending.

Ready to Give these Crypto Cards a Shot?

So, there you have it – the top 9 Apple Pay Based Crypto Cards, making your digital assets as spendable as cash. If you're a crypto pro or just starting out, these cards bring convenience, rewards, and a touch of futuristic flair to your everyday spending.

From cashback perks to instant conversions, they’re designed to make your life easier while keeping your crypto game strong.

The best part? You don’t need to be a tech wizard to use them. Just tap your phone, and you’re good to go. If you’re grabbing coffee, shopping online, or jet-setting across the globe, these cards let you spend your crypto effortlessly. So, pick your favorite, link it to Apple Pay, and start enjoying the perks of a cashless, crypto-powered future. Cheers to smarter spending! 🚀