From FTMO to FunderPro, leading prop firms are making a strategic shift. The reason? A platform called cTrader.

The trading world is witnessing a significant shift as more prop trading firms embrace cTrader, offering traders like you enhanced flexibility and advanced features.

From a professional trader seeking funded accounts or a newcomer exploring prop trading opportunities, cTrader's growing popularity among prop firms signals a new era in the trading domain. With its user-friendly interface and sophisticated trading tools, cTrader is becoming the platform of choice for traders who demand more from their trading experience.

Let's explore why this platform is gaining momentum and how you can take advantage of its potential in the prop trading world.

Outlook Over cTrader Prop Firms

The outlook for cTrader prop firms appears remarkably promising as we move through 2025. A significant shift is occurring as major prop firms transition away from traditional platforms, with at least a dozen verified firms now offering cTrader as their platform of choice.

Recent integrations by industry leaders like FunderPro, The Funded Trader, and MyFundedFX demonstrate growing market confidence. With firms offering retail traders access to accounts up to $800,000 through cTrader, the platform's advanced features, including low latency execution and sophisticated risk management tools, are attracting both established and emerging prop firms.

Top cTrader Prop Firms Worth Considering

| Prop Trading Firm | cTrader | Funding Amounts | Evaluation |

|---|---|---|---|

| PipFarm | ✅ | $200,000 | 2-Phase |

| Alpha Capital Group | ✅ | $2,000,000 | 1-Phase |

| Funding Pips | ✅ | $2,000,000 | 2-Phase |

| FTUK | ✅ | $100,000 | 2-Phase |

| FundedNext | ✅ | $300,000 | 2-Phase |

| The Funded Trader | ✅ | $600,000 | 2-Phase |

| WSfunded | ✅ | $1,000,000 | 1-Phase |

| MyFundedFX | ✅ | $300,000 | 2-Phase |

| Goat Funded Trader | ✅ | $800,000 | 2-Phase |

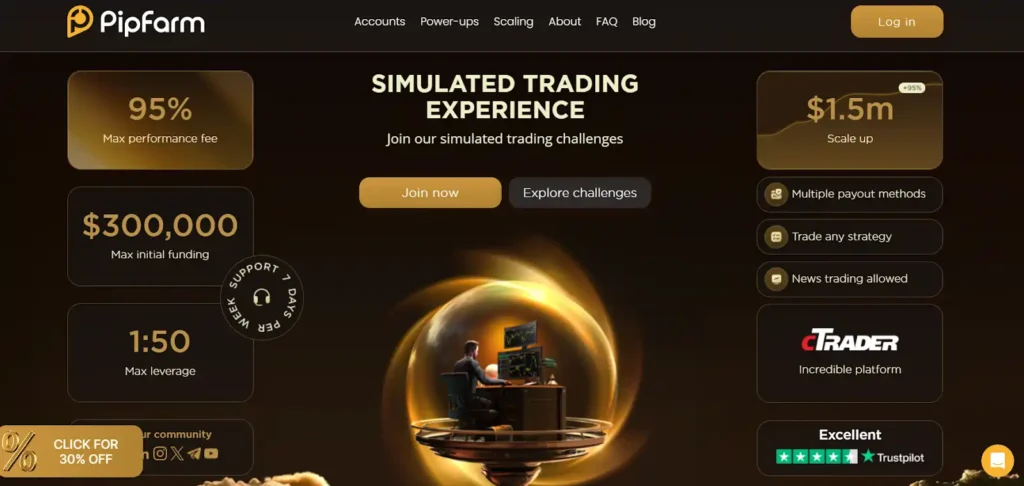

1. PipFarm

Established in June 2023, PipFarm has quickly gained recognition for its transparent approach to trader evaluation using the cTrader platform exclusively. The firm offers a structured evaluation process with simulated accounts, allowing traders to demonstrate their proficiency through specific profit targets and risk management guidelines.

Their approach includes both one-step and two-step evaluation programs, catering to different trader preferences and experience levels. With a focus on long-term sustainability, PipFarm implements static maximum loss rules and provides traders access to significant virtual capital ranging from $10,000 to $200,000.

Successful traders can earn up to 90% of their trading profits, making it an attractive option for skilled traders seeking funding without risking personal capital. The platform's unique XP ranking system rewards consistent performance and offers additional benefits as traders reach specific milestones in their trading journey.

2. Alpha Capital Group

Operating since November 2021, Alpha Capital Group has established itself as a reputable prop firm based in London. The firm recently partnered with cTrader through ACG Markets, offering traders access to advanced trading capabilities and comprehensive tools. Under the leadership of CEO George Kohler, the company has experienced remarkable growth with revenue increasing by 846% in its second year and another 180% in its third year.

With funding opportunities up to $2,000,000, the firm serves over 100,000 monthly active users and has paid out $80 million in performance fees to date. Their recent transition to cTrader marks a significant milestone, providing traders with both MetaTrader 5 and cTrader platform options.

The firm offers three unique funding programs with an attractive 80% profit share ratio, along with features like zero commission fees and balance-based drawdown management. Their commitment to trader success is evident through their comprehensive support system, which includes educational resources, market insights, and mentoring programs.

👉 Get High Value Discount Using Alpha Capital Group Coupons!

3. Funding Pips

Founded in 2022 and headquartered in Dubai, UAE, Funding Pips has established itself as an innovative prop trading firm under the leadership of CEO Khaled Ayesh. The firm recently expanded its platform offerings by introducing cTrader alongside Match-Trader and TradeLocker platforms to navigate regulatory challenges and enhance trader experience.

With account sizes ranging from $5,000 to $100,000 and potential scaling up to $2 million, traders can access various evaluation programs including one-step, two-step, and three-step challenges. The firm offers competitive trading conditions with leverage up to 1:100 for forex and instrument coverage including major/minor pairs, metals, indices, commodities, and cryptocurrencies.

Their commitment to trader success is demonstrated through their refundable fee structure after four successful withdrawals, flexible trading conditions that allow holding positions during news releases and weekends, and a profit-sharing model offering up to 100% profit split.

4. FTUK

Established in 2022, FTUK has emerged as a leading prop trading firm with a strong Trustpilot rating of 4.1. The firm offers funding opportunities up to $6.4 million through their innovative scaling system, with initial account sizes ranging from $10,000 to $100,000.

Their platform integration includes cTrader alongside DXTrade and Match-Trader, providing traders with advanced technological solutions for optimal trading performance. FTUK stands out with their flexible approach offering three distinct challenge types: instant funding, one-step, and two-step evaluations, each designed to accommodate different trading styles and experience levels.

The firm maintains transparent operations with clear rules and payout structures, offering up to 80% profit sharing and implementing various risk management protocols. Their commitment to trader success is demonstrated through competitive trading conditions, including flexible leverage options ranging from 1:10 to 1:100 depending on the account type, and access to diverse trading instruments including forex, cryptocurrencies, indices, and commodities.

👉 Claim Up to 40% Discount Using FTUK Coupons!

5. FundedNext

Based in the United Arab Emirates under CEO Abdullah Jayed, FundedNext has significantly expanded its platform offerings to include cTrader alongside MT4 and MT5. The firm has established itself as a leading prop trading company, serving over 51,000 traders from 195+ countries with more than $51 million in profit payouts.

Their integration of cTrader Prop Firms provides traders with a modern, intuitive interface and advanced capabilities, including sophisticated backtesting tools and extensive customization options. The platform supports account sizes ranging from $6,000 to $300,000 with the potential to scale up further.

FundedNext distinguishes itself by offering unique features such as a 15% profit share during the challenge phase, balance-based drawdown calculations, and news trading allowance. Their commitment to trader success is demonstrated through flexible trading conditions, including no time limits on challenges, competitive spreads, and fast execution speeds through their dedicated trading servers.

6. The Funded Trader

The Funded Trader, established in 2021, has emerged as a notable player in the proprietary trading space. This Texas-based firm offers traders the opportunity to manage accounts up to $600,000 after passing their evaluation program. What sets them apart is their flexible approach, with multiple challenge types designed to accommodate different trading styles and experience levels.

Whether you're a day trader or swing trader, you can access a variety of instruments including forex, indices, commodities, and gold, with profit splits ranging from 80% to 95%. While the firm has received mixed reviews, their innovative scaling plans and diverse account options have attracted thousands of traders worldwide.

7. WSFunded

Established in 2023 in Andorra, WSFunded has quickly emerged as an innovative prop trading firm with their state-of-the-art cTrader Prop Firms platform integration. The firm offers diverse trading challenges with account sizes ranging from $10,000 to $200,000, featuring both Express and Standard evaluation programs to accommodate different trading styles.

Their competitive offering includes an attractive 80% profit split, with the potential to increase through their scaling program. WSFunded distinguishes itself through its unique 120% refund policy on evaluation fees upon successful completion of challenges, demonstrating their commitment to trader success. WSFunded provides access to over 100 trading instruments across multiple asset classes, including forex, metals, indices, and cryptocurrencies.

Their sophisticated risk management system includes balance-based drawdown calculations, flexible leverage options up to 1:100, and the ability to hold positions over weekends. The firm maintains transparency in operations with clear trading objectives, no minimum trading days requirement, and a trader-friendly environment supported by 24/7 customer service.

8. MyFundedFX

Based in Dallas, Texas, MyFundedFX has established itself as a prominent player in the prop trading industry through its recent integration with cTrader Prop Firms via Purple Trading Seychelles. MyFundedFX offers funding opportunities ranging from $10,000 to $500,000, with the potential to scale up to $2 million through their progressive scaling program.

Their evaluation process includes both one-step and two-step challenges, featuring balance-based drawdown calculations and flexible trading parameters. MyFundedFX distinguishes itself through competitive trading conditions, including leverage up to 1:100, the ability to trade during news events, and weekend position holding capabilities.

MyFundedFX provides sophisticated risk management tools, real-time market analysis, and advanced charting capabilities. Their commitment to trader development is demonstrated through educational resources, daily market insights, and personalized coaching sessions. The firm maintains a high standard of transparency with clear trading objectives, regular profit distributions, and a dedicated support team available 24/7.

9. Goat Funded Trader

Established in Spain under CEO Edoardo Dalla Torre, Goat Funded Trader has recently expanded its platform lineup by adding cTrader alongside TradeLocker and MatchTrader, marking a significant transition away from MetaTrader platforms. The firm offers traders access to accounts ranging from $8,000 to $800,000, with the potential to scale up to $2 million through their progressive system.

With a strong Trustpilot rating of 4.1/5, GFT provides four distinct funding programs including two-step, one-step, instant, and GOAT challenges. Their trading conditions are notably flexible, allowing traders to hold positions over weekends and trade during news events.

Goat Funded Trader maintains competitive spreads across various instruments including forex, metals, indices, stocks, and cryptocurrencies. To celebrate their cTrader integration, the firm has introduced special promotional offers and maintains their commitment to trader success through support systems and educational resources.

👉 Get High Value Discount Using Goat Funded Trader Coupons!

Common Queries Related to cTrader Prop Firms

How Much Funding Can I Get with cTrader Prop Firms?

Funding ranges from $100,000 to $2,000,000, depending on the firm and evaluation process. Many firms offer scalable accounts for successful traders

What are the Main Advantages of cTrader Platform?

cTrader offers low latency execution, advanced charting tools, sophisticated risk management features, and support for both manual and automated trading.

Do cTrader Prop Firms Support Automated Trading?

Yes, cTrader supports algorithmic trading through cAlgo, allowing traders to create, test, and implement automated trading strategies.

Is cTrader Suitable for Beginners?

While intuitive, cTrader has a learning curve. It requires time to master all features, especially for those interested in algorithmic trading

Are there any Platform Limitations?

The main limitation is availability, as not all prop firms offer cTrader. However, the platform itself is feature-rich and technologically advanced.

Wrapping Up on cTrader Prop Firms

The emergence of cTrader Prop Firms represents a transformative moment in prop trading, signaling a new era of technological innovation and trader empowerment. These firms have collectively redefined the landscape by offering sophisticated trading environments that prioritize trader development, risk management, and financial opportunity.

The cTrader Prop Firms demonstrate a remarkable commitment to providing traders with advanced technological solutions, from institutional-grade execution platforms to comprehensive educational resources.

As the prop trading industry continues to evolve, cTrader Prop Firms stand at the forefront of this revolution, bridging the gap between talented traders and substantial trading capital. Their diverse evaluation programs, flexible trading conditions, and competitive profit-sharing models have created unprecedented opportunities for traders worldwide.

Looking ahead, cTrader Prop Firms are poised to drive further innovation, offering more sophisticated tools, expanded global access, and increasingly personalized trading experiences that adapt to the dynamic needs of modern traders.